Debalina Ghosh

Browsing Today’s Environment It’s Simply Mathematics

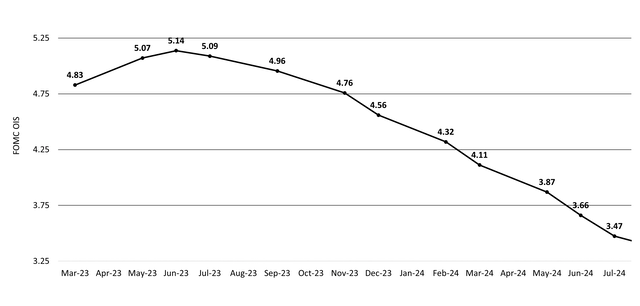

Starting in March 2022, the Federal Reserve (Fed) raised rate of interest at the fastest speed considering that the 1980. Monetary markets are now pricing in for the reserve bank to be near completion of its hiking cycle (Figure 1).

Figure 1: The Fed might be stopping briefly quickly

Source: Bloomberg, BlackRock since April 24, 2023. FOMC OIS represents Federal Free market Committee Overnight Indexed Swap.

With yields at present levels, mutual fund can secure longer-term yields, provide cost gratitude capacity, and general act as a hedge versus a possible difficult landing. Though raised money balances worked throughout the Fed’s treking cycle, our company believe now is a chance for customers to think about including period offered the capacity for a Fed time out.

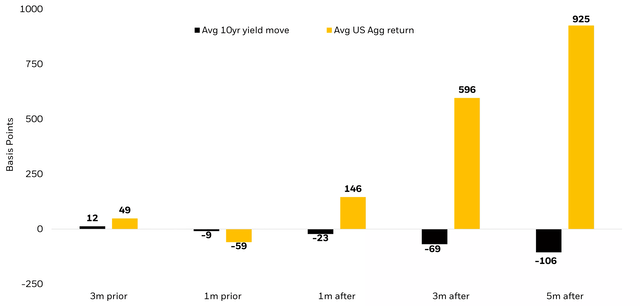

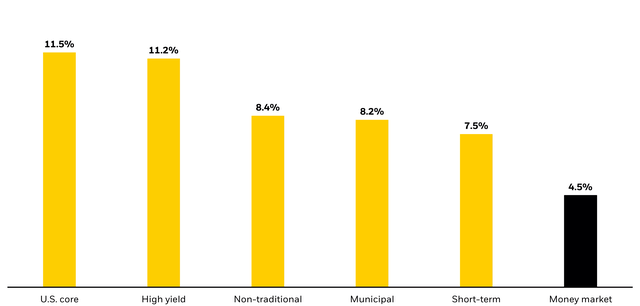

While financiers are not punished for being early to including period, there is a prospective expense to being late (Figure 2). Historically, money underperforms when the Fed stops hiking (Figure 3).

Figure 2: Act rapidly – there’s a chance expense to being late. Core bond yields have actually fallen rapidly when the Fed stops treking.

Typical modification in 10-year yield in months around the last Fed rate walking cycle (%).

Source: Bloomberg, BlackRock since March 30, 2023. Period since 1979-2019. Previous efficiency is no warranty of future outcomes. Index efficiency is revealed for illustrative functions just. It is not possible to invest straight in an index

Figure 3: Prospective Fed rates of interest walking time out and historic bond efficiency

Typical 12 months following the last Fed walking (2/4/94 – 4/30/23).

Source: Morningstar since April 30, 2023. Property class returns represented by particular Morningstar classification. Previous efficiency does not ensure or suggest future outcomes.

Period as a Hedge

In today’s environment of slowing development and inflation volatility, period might provide a hedge versus prospective market volatility and be utilized as a portfolio ballast. In the middle of the Fed getting near to stopping briefly, this bodes well for core mutual fund, like the BlackRock Overall Return Fund ( MAHQX) and the BlackRock Core Mutual Fund ( BFMCX), that might have the ability to provide defense in times of market tension in the type of earnings. For instance, throughout durations when the Fed is treking rate of interest, the connection of United States Treasuries to equities is favorable (+27%), nevertheless when the Fed is on hold or cutting rates the connection drops (-16%) 1

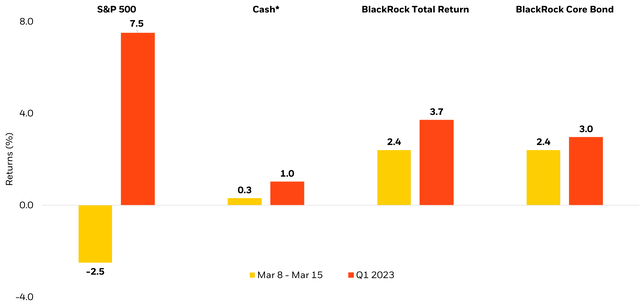

In addition, as markets were rattled by the United States local banking crisis in March of this year, Overall Return and Core Bond saw favorable returns as equities sold (Figure 4).

Figure 4: When stocks sold, bonds offered ballast

Returns throughout United States Regional Banking Crisis (March 8, 2023 – March 15, 2023)

Source: Bloomberg, BlackRock since March 30, 2023. Institutional shares class is utilized for both BLK Overall Return and BLK Core Bond. * Money is specified as United States Treasury Short Bond Index. Previous efficiency is no warranty of future outcomes. Index efficiency is revealed for illustrative functions just. It is not possible to invest straight in an index

Case Research Study: Placing the 60/40 Portfolio

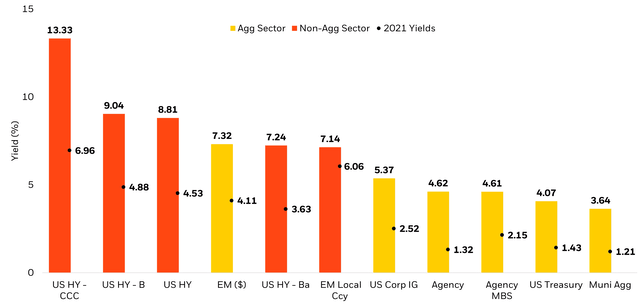

Since September 30, 2022, the typical consultant’s portfolio was underweight set earnings by 9% 2 In a market program with over half of set earnings yielding over 4%, consultants need to think about bringing bonds back to the benchmark level or to an obese as greater yields might supply drawback defense for bonds, possibly reducing your possibility of loss (Figure 5). In durations of slowing development, stocks might experience greater volatility, while top quality bonds might provide a steady source of returns.

Figure 5: Yields are back

With increasing yields, active sector rotation stays type in browsing this unpredictable market environment.

Source: Bloomberg, since Might 31, 2023. 2021 yield is since January 7, 2021. Previous efficiency is no warranty of future outcomes. Index efficiency is revealed for illustrative functions just. It is not possible to invest straight in an index.

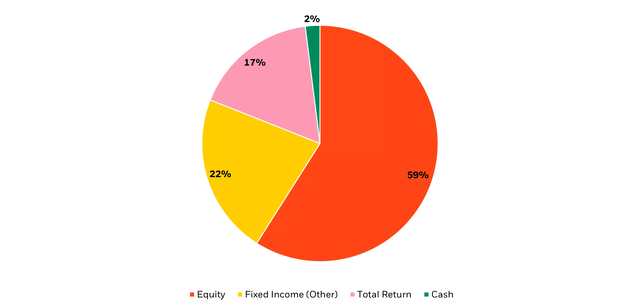

Since the most recent rebalance in March 2023, BlackRock’s Target Allotment Hybrid 60/40 Design most current rebalance presently holds 59% and 39% of its portfolio in equities and set earnings, respectively – with the rest remaining in money. In this rebalance, the Design wanted to boost the general quality of the portfolio and preserve its obese to period.

To increase equity diversity, dynamically browse today’s bond market, and source active returns, the Design now holds a 17% allowance to BlackRock’s Overall Return Fund, making it the Design’s biggest set earnings allowance (Figure 6).

Figure 6: Placing BlackRock’s Overall Return in a Whole Portfolio Option

Listed below programs BlackRock’s Target Allotment Hybrid 60/40 Design since the most recent rebalance, March 17, 2023

Note: Since March 17, 2023, the overall quantity of set earnings allowance in the BlackRock Target Allotment Hybrid 60/40 Design is 39%, with BlackRock Overall Return comprising 17%.

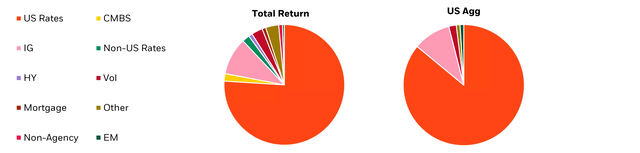

The Overall Return Fund is an actively handled set earnings method which looks for to recognize an overall return surpassing that of the standard, Bloomberg United States Aggregate Index. The Fund profile might have the ability to supply financiers with core-bond like defense with core-plus like efficiency. The fund uses a varied multi-sector technique developed to browse various market environments (Figure 7).

Figure 7: Overall Return is more varied than the Bloomberg United States Aggregate Bond Index

Contribution to run the risk of by method

Source: BlackRock, since Might 31, 2023.

Summary

As the Federal Reserve nears completion of its treking cycle, our company believe now is a chance for financiers to think about including period back to their portfolios. Period might supply defense versus prospective market volatility and be utilized as a portfolio ballast throughout durations of slowing development and inflation volatility. History reveals that core bonds serve as a diversifier when equity markets sold.

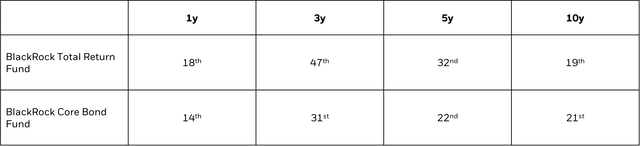

The BlackRock Overall Return Fund, uses a varied technique with adequate versatility in order to browse durations of market volatility, while supplying a cushion in the type of earnings, and broad portfolio diversity. This has actually led to producing Core Plus-like returns with Core-like threat. Since Might 31, 2023, the fund has a Yield to Worst (YTW) of 5.49% vs. 4.58%, Bloomberg United States Aggregate.

In addition, BlackRock Core Bond supplies financiers with a varied, core-bond direct exposure that looks for to produce appealing risk-adjusted returns that surpass the fund’s standard, Bloomberg United States Aggregate Index. The fund has a YTW of 5.08% since May 31, 2023.

Figure 8: Fund Efficiency

Source: Morningstar since April 30, 2023. The above lists out the percentile ranking for the fund’s particular Morningstar classifications. BlackRock Overall Return Fund remains in the Morningstar Intermediate Core Plus Bond Classification, and BlackRock Core Mutual Fund remains in the Morningstar Intermediate Core Bond Classification. Overall Return Fund was ranked 1yr, 109/618; 3yr, 258/567; 5yr, 161/544; 10yr, 82/469. Core Mutual fund was ranked 1yr, 104/467; 3yr, 115/438; 5yr, 92/422; 10yr, 86/374. Rankings are based upon overall return leaving out sales charges, separately determined and not integrated to produce a total ranking.

1 Source: Bloomberg since March 31, 2023.

2 Source: BlackRock, Aladdin. Information since September 30, 2022, based upon 5,417 portfolios.

3 The BlackRock Target Allotment Hybrid 60/40 Design buys both BlackRock Exchange Traded-Funds and Mutual Funds.

This post initially appeared on the iShares Market Insights.