Jeff J Mitchell

After our last upgrade on TotalEnergies, it is time to return to evaluate Shell plc (NYSE: SHEL, OTCPK: RYDAF). Here at the Laboratory, we do have a great grip on the oil sector, and our company believe that the existing environment might provide a fascinating entry point. TotalEnergies has actually constantly been Our Favourite Oil Choose In The Renewable Resource Shift, and now we see some resemblances in Shell’s technique. In our last upgrade, we highlighted how Saudi Arabia is the only OPEC+ nation to have enough extra and storage capability to quickly minimize and increase production. Considering that YTD, petroleum costs are falling and OPEC+ suddenly revealed a supply decrease of about 1.6 million barrels daily. This newest cut appears a caution signal to prevent oil rate speculation. For that reason, our company believe that OPEC+’s choice will assist to restrict production and is a clear favorable reading for oil costs in the near term, although issues over China’s slow financial healing will likely continue to function as headwinds. Here at the Laboratory, we are anticipating an oil rate of around $80/bbl; nevertheless, “ even if this rate per barrel will not be attained, at least, we see OPEC+’s message supplying assistance to oil business, even in a recessionary environment. For that reason, here at the Laboratory, we are positive that this news is favorable for oil E&P and incorporated business, which will straight gain from the anticipated rate boost”. The Saudi cut revealed on 4 June 2023 is currently having a couple of impacts, with oil storage costs decreasing. Furthermore, in a less congested market, just jobs including a lower expense will be made use of.

Dividend and Green financial investments

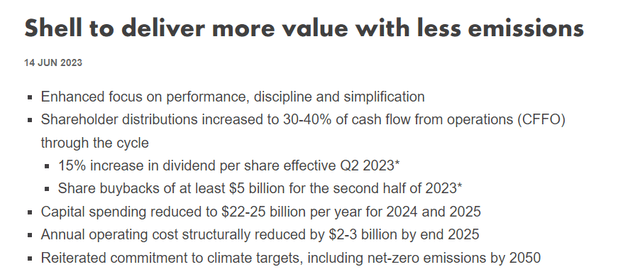

Prior to deep-diving into Shell analysis, it is essential to report the current business news. The other day, Shell interacted that it will increase its dividend per share by 15% in Q2 (this is still based on board approval). In 2023 Q1, the circulation was EUR0.2678 per share, while for the 2nd it needs to be EUR0.3079 per share. The CEO likewise pointed out that Shell will be more discipline and streamlined. The group now wishes to disperse 30% to 40% of its capital from operations to financiers. Returning to the DPS quotes, we are now anticipating a DPS of EUR1.232 per share, which indicated a present yield of 4.43%. As a pointer, in the previous operating cycle, Shell dispersed 15-20% of the liquidity acquired from the operation activities. The business likewise prepares to invest an extra $5 billion for the purchase of treasury shares in the 2nd half of 2023. Our company believe that this statement will be reported in Q2.

In addition, Shell validated its dedication to the melted gas market with a prepare for extraction activities that will continue till 2030. From an energy shift perspective, Shell means to place itself as a leader in low-carbon fuels and in the charging of electrical cars. The oil group is active in other sectors of the energy shift, such as direct carbon capture and making use of hydrogen as a sustainable fuel. Undoubtedly, the business securely developed its dedication to end up being a carbon-neutral emitter by 2050, with an objective to minimize emissions from its existing operations. This maneuver is seen with hesitation by ecological groups; nevertheless, we favorably report Shell’s dedication to invest $10-15 billion in between 2023 and 2025 in green developments. As currently pointed out, we understand that oil financial investments have a greater IRR than renewable resource jobs; nevertheless, the business’s objective to purchase green jobs is most likely the best one. We likewise acknowledged that “ the existing market dislikes these financial investments however are most likely going to be the business’s clear competitive benefit in the future”.

Here at the Laboratory, we now think that the business has among the most progressive energy shift methods within the oil sector, thanks likewise to an asset-lighter technique. Our group thinks that Wall Street is ignoring the business’s capability to create capital while compensating investors and assisting the World energy system to quickly decarbonize. Our buy score target is supported by: 1) a concentrate on CAPEX allotment to attain a balance in between decarbonization and return, 2) greater expense conserving, having currently executed numerous methods to enhance success, and 3) emissions decrease with a greater allotment towards green financial investments.

Source: Shell CMD news release

Modifications in Price Quotes and Appraisal

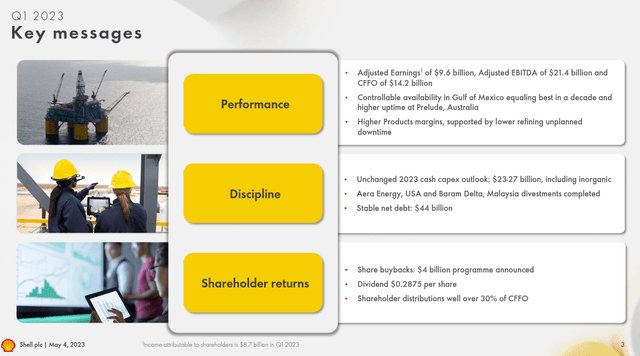

Really quickly, Shell Q1 adjusted incomes were a bear compared to agreement by practically 21% ($ 9.65 billion vs $8.5 billion). This efficiency was because of integrated gas results thanks to trading activities and much better numbers in the Chemicals area. This was supported by oil and items trading. For this factor, Shell revealed a $4 billion buyback and is well on track to our share bought quotes ($ 10 billion in 2023). In our quotes, on a rolling quarterly basis, the business’s circulation is now at >> 35% of CFFO. This well supports investor compensation. Going to the Q2 quotes, Shell guides for an incorporated gas output in between 920 and 980kboed, and liquified nat gas volumes in between 6.8 and 7.4 mt. While we anticipate an upstream production at a greater point of 1.916 kboed (lower than Q1 provided seasonality changes). Here at the Laboratory, we chose to make small changes to the Chemicals department with much better trading, and in the Marketing sector, we are anticipating a lower OPEX. In the Business, the CEO flagged one-off tax charges and as an effect, the business expenditures will likely be greater ($ 1 billion compared to a typical expense of $0.5 billion).

Source: Shell Q1 results discussion

After this June Capital Market Day, the CEO amazed Wall Street by rising the CFFO payment ratio to practically 40%. Following the strong start of the year, we chose to increase FY23E/FY24 incomes per share by 5% and 10% respectively to include the better-than-expected outcomes. In addition, thanks to lower losses from the Chemicals sector and a greater buyback, our company believe that experts must re-price Shell. The business is presently trading at a 20% P/E discount rate compared to its peers (5.59 x vs. 7x). To support our assessment, we must report that Shell is likewise trading at a greater discount rate compared to its historic information. In Q2, we are anticipating a $7.8 billion earnings with a CFFO pre-WC at $14.6 billion. For that reason, with a resistant EPS, at an $80 Brent rate and EUR55 EU gas, our Shell target rate is set at 2.900 cent ($ 75 in ADR). Drawback dangers consist of 1) oil and gas rate volatility (OPEC+ choice associated to Russian oil circulation in APAC nations), 2) still associated to point 1) we may suffer increasing stress in between Europe and Russia on gas rate and supply, 3) value-destructive M&A that might cause one-off expense, 4) execution threat on CAPEX (particularly due to unsteady nations where significant oil business typically run), 5) possible lower return on green financial investments, 6) regulative dangers on worldwide decarbonization target, and 7) supply chain inflation.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.