SimonSkafar

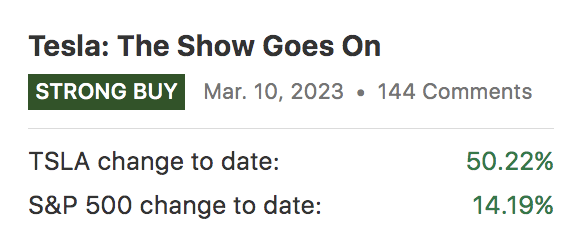

As Tesla, Inc. ( TSLA) stock has actually gotten more than 50% considering that our previous post, we believed it would be sensible to supply our readers with an upgrade on our outlook on the stock.

Today’s post, entitled: “Riding the Wave,” changes our previous thesis, “The Program Goes On,” which echoes our belief that Tesla is now well and really a momentum play. A couple of months back, we still considered the stock a contrarian choice; nevertheless, in today’s post, we argue that the structural modifications required to increase the stock have actually been recognized and will likely sustain in the coming quarters.

Looking For Alpha

Without additional hold-up, let’s look into a much deeper conversation about our newest findings on Tesla’s stock.

Functional Update

Present Worth Chauffeurs

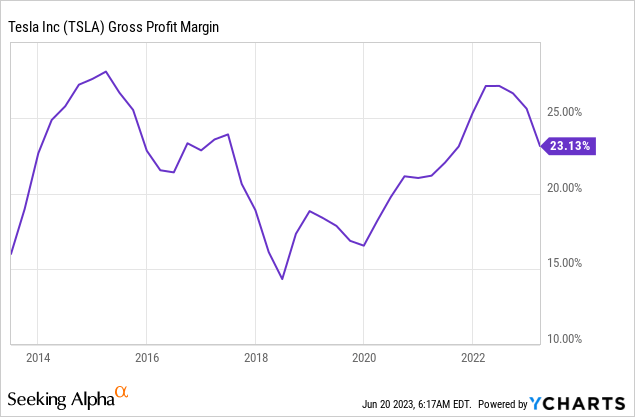

Based upon anecdotes, the majority of experts and market analysts appear concentrated on Tesla’s item cost cuts, recommending that it may thwart the business’s earnings margins. Nevertheless, a couple of aspects are ignored.

To start with, yes, elements like more strict electrical car (” EV”) tax credits and subsiding need has actually asserted pressure on the business to decrease its rates. Nonetheless, everybody appears to be neglecting variables such as lower product expenses, a softer labor market, a possible market share boost (due to cost cutting), and need flexibility.

Furthermore, lots of experts are looking backwards rather of analyzing the potential customers for future need. For example, will not customer self-confidence be renewed with a rate of interest pivot most likely to recognize in 2024? The theory of customer energy definitely recommends so.

I am not suggesting that softer item rates will not lessen success. Rather, we argue that it is extremely simple to follow suit of a shared story rather of taking a look at an opposing argument.

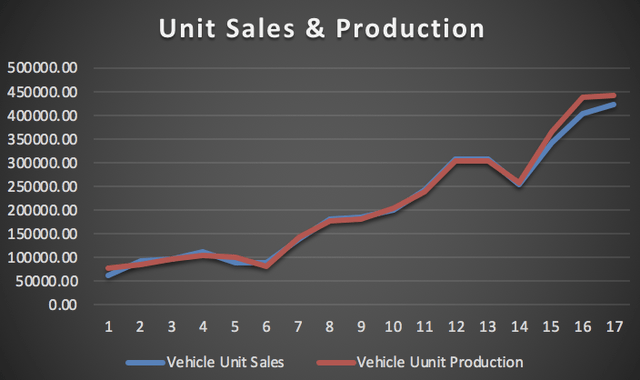

Figure 1 ( Author’s Deal with Information from Gurufocus)

Illustrated in Figure 1 are Tesla’s broad-based car production and sales numbers, beginning in March 2019 and ending in March 2023. According to its newest reporting quarter, Tesla experienced another rise in vehicle sales, as the section’s profits increased by around 21.68% year-over-year. In our view, thinking about exogenous and endogenous aspects, Tesla’s profits development will likely keep broadening over the coming quarters in the middle of a nearing rates of interest pivot and the company’s history of effectively carrying out item distinction techniques.

Last but not least, a crucial factor to consider for Tesla’s main section is the pending launch of its brand-new Design S This may supply structural assistance. And in addition, this when again reveals that Tesla continuously revitalizes and updates its line of product, constantly keeping complacency from going into the structure.

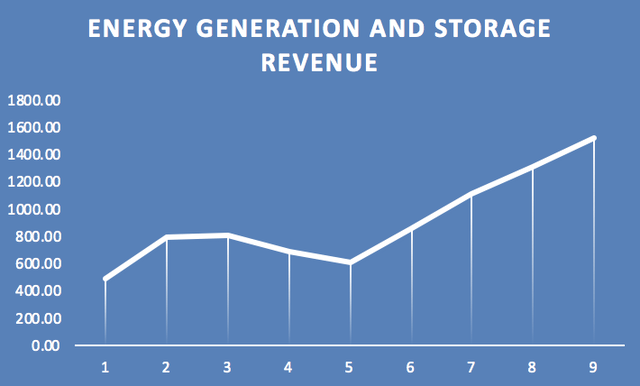

Author’s Deal with Data From Gurufocus

Another affecting variable is the development of Tesla’s energy generation and storage section In our view, the worth include here comes from Tesla’s endeavor into brand-new markets that still supply synergies to its primary company. In essence, the section stages out the threat of focused profits while still offering cross-sales chances to Tesla’s primary company.

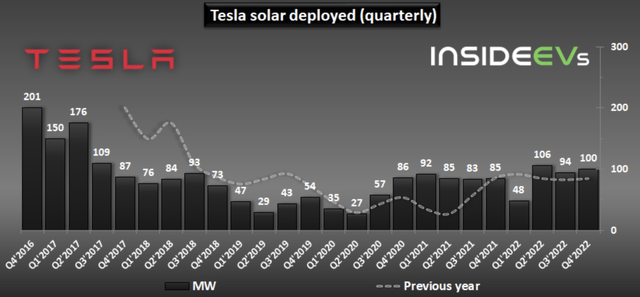

Although the section’s solar implementation undertakings stay at an early phase, an 18% CAGR is anticipated for the solar market up until 2030, which supports the department extremely well. Furthermore, Tesla is a cash-rich company, enabling it to go into the marketplace as a major rival rather than an individual confronted with strenuous barriers to entry. For that reason, we see this element of Tesla’s company as a possible surprise property that might yield product gains in the coming years.

Solar Implementation ( Inside EVs)

Effectiveness Remeasured

As discussed previously, a compromise exists in between Tesla’s item cost cuts and its input expenses. In our viewpoint, the commercial product cost index’s 7.71% year-over-year downturn reveals that product expenses are on a down trajectory, which might permit Tesla to suppress its variable expenses and sustain decent earnings margins up until demand-side aspects begin straightening within the long lasting items area.

Naturally, it needs to be yielded that the threat of diminished rates implemented to sustain federal government credits will stay a threat element for the foreseeable future.

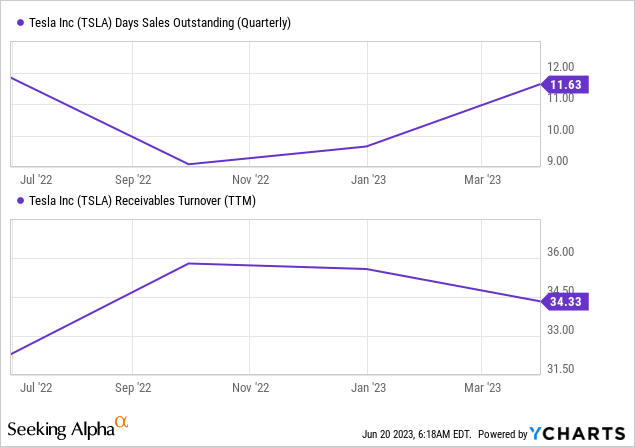

Tesla’s days sales impressive ratio has actually ticked up a little bit considering that our newest engagement. The business’s 10-Q declares that its payments schedule depends upon bank settlements and month-to-month sales dispersion. Nevertheless, in our view, any prolonged payment schedule must be thought about a threat in today’s economy, as exogenous aspects like bank liquidity and an uptick in vehicle delinquencies recommend that settlements may be less sure than previously.

Additionally, Tesla’s just recently compromised receivables turnover ratio plays into our DSO argument. Business frequently increase receivables as credit sales subside in attempting financial scenarios.

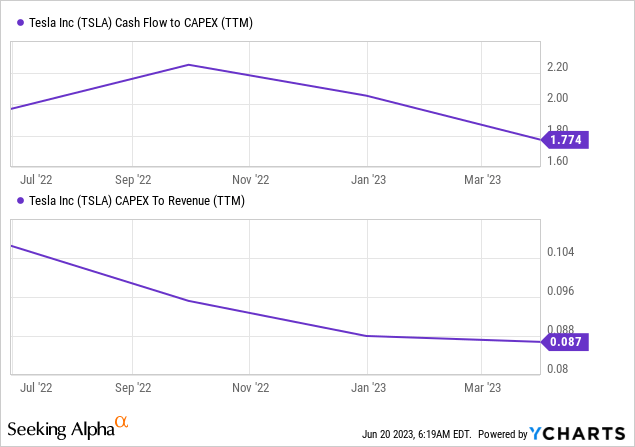

Capital and profits to CapEx ratios are a sound method of evaluating a company’s development trajectory and how sustainable its development trajectory is.

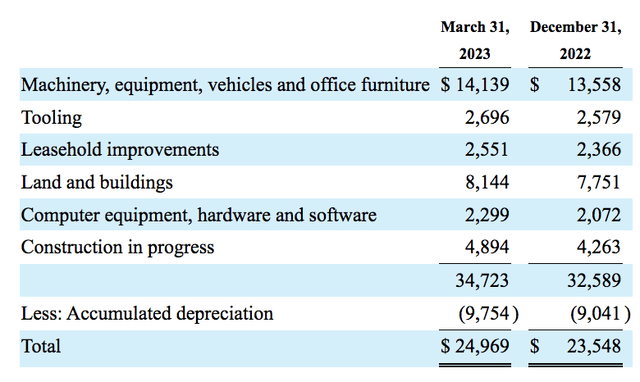

To start with, it should be stressed that Tesla’s upkeep CapEx may settle lower in being successful quarters as inflation has actually begun tapering, which we think about a favorable for the company. On the other hand, as the monetary markets have actually found renewed assistance and a rate of interest pivot nears, M&A activity, re-investment rates, and acquisition conclusions will likely multiply, leading to greater expansionary CapEx for Tesla.

Although there is a compromise within Tesla’s CapEx sphere, we consider it a healthy circumstance as lower upkeep CapEx needs less of a drag on liquidity, and greater expansionary CapEx is not excessive of an inconvenience.

Tesla’s high item turnover and growth into other domains like energy storage and generation reveal that the business is looking for to inhabit its whole worth chain, which indicates its CapEx will likely stay high for many years to come. Nevertheless, crucial ratios show that its capital and profits permit heavy costs, making continual internal development possible.

Beta Level Of Sensitivity Analysis and Appraisal

Comprehending a stock’s beta assistance is important for any monetary market individual. In a nutshell, a stock’s beta level of sensitivity determines how it carries out relative to various sections of the marketplace, i.e., particular stocks exceed the marketplace when worth stocks are chosen by financiers, and vice versa.

Additionally, due to the level of sensitivity associated with rates Tesla’s threat, we chose to keep our assessment analysis easy and stock with a relative assessment.

Let’s look into a few of our findings about Tesla stock’s assessment.

Smart Beta

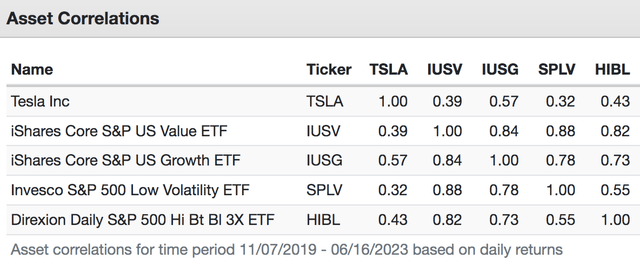

A regression analysis reveals that Tesla’s recognized returns are extremely associated with the iShares Core S&P U.S. Development ETF ( IUSG) and the Direxion Daily S&P 500 ® High Beta Bull 3X Shares ETF ( HIBL), showing the stock’s predisposition to exceed the marketplace when financiers are risk-seeking.

TSLA connection with financial investment designs ( Author in Portfolio Visualizer)

The concern now ends up being: will growth and high-risk stocks continue to increase, and will that lead to assistance for Tesla’s stock?

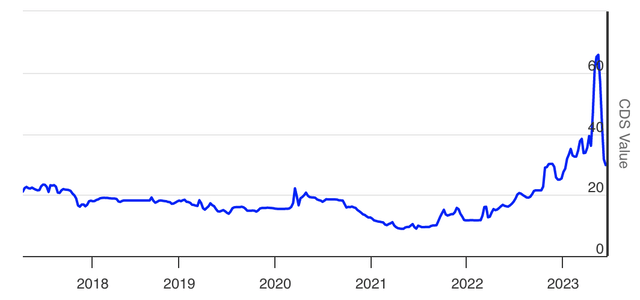

In our view, development and high-beta stocks may continue to increase in the coming quarters. We base our property on aspects such as lessening CDS worths (credit threat), leveling in inflation volatility, and more clearness from the Federal Reserve on rates of interest policy. For that reason, we believe the outlook is intense for higher-risk properties such as high-beta development plays like Tesla.

U.S. CDS Worths ( worldgovernmentbonds.com)

Relative Appraisal and Technical Rate Level

The truth is that Tesla has raised cost multiples, leaving it exposed must a development stock reversion take place. Nevertheless, on the other end of the playing field, an inward appearance recommends the stock is most likely not misestimated.

Yes, Tesla’s prominent cost multiples are at sector-relative premiums, however we argue that it is warranted due to the business’s robust market position. In addition, the majority of Tesla’s heading multiples are at stabilized discount rates, interacting the possibility that the stock is at a cyclical discount rate.

| Metric | Worth | 5y Discount Rate |

| price-sales (forward) | 8.24 | -0.80% |

| price-earnings (forward) | 74.17 | -39.66% |

| EV/EBITDA | 48.61 | -3.76% |

| price-book (forward) | 15.42 | -12.44% |

Source: Looking For Alpha.

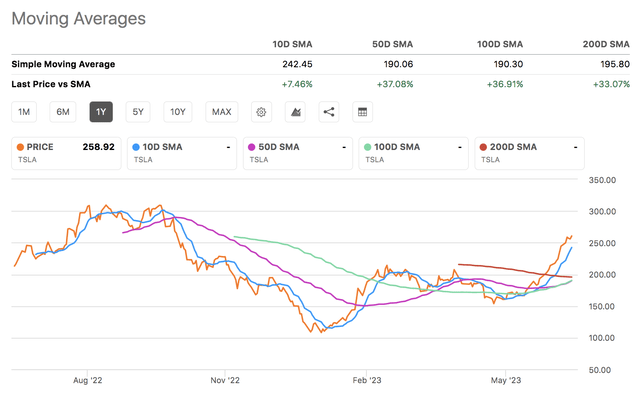

Last but not least, based upon its moving averages, Tesla’s stock is at chances to take advantage of the momentum abnormality, which is a theory specifying that in an up-market, previous winners are most likely to exceed previous losers. In our view, the momentum abnormality might enter into play, as no current structural breaks have actually taken place within the marketplace that recommends a modification in trajectory remains in shop (determined year-to-date).

Extra Dangers To Think About

Although numerous dangers were discussed throughout the post, extra threat aspects need to be represented prior to thinking about a financial investment in Tesla’s stock.

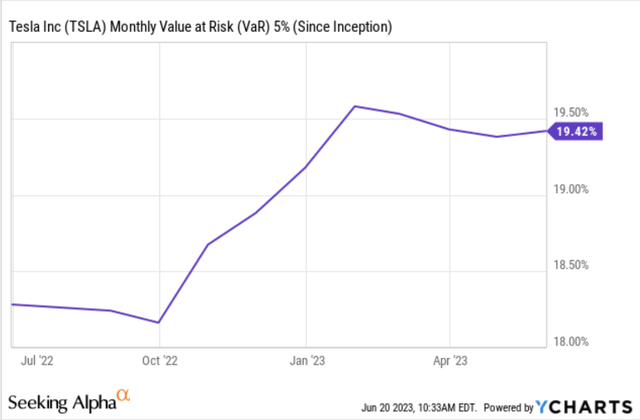

To start with, Tesla’s stock has a great deal of cost threat, highlighted by its VaR, indicating that financiers risk of losing a substantial quantity of their invested capital if the stock gets in another dip.

Additionally, financiers need to comprehend that the electronic cars market is warming up, and although Tesla was early-to-market, a more fragmented landscape is most likely to take place in the coming years. If market fragmentation recognizes, Tesla will likely require to invest a substantial quantity of its money to sustain its market position, raising the threat of lessening investor worth.

Another element that financiers must think about is Tesla’s considerable operating property base driven by ownership of numerous Gigafactories. We detail this as a threat due to possible year-end problems on the company’s long-lived properties driven by greater rate of interest and lower market capital development in the middle of an attempting financial duration. Disability threat is consistent throughout the majority of markets at the minute, and Tesla is no exception in our view.

Last Word

Our outlook on Tesla, Inc. stock stays favorable. Sure, numerous difficulties, such as cost cuts and market fragmentation, must not be ignored. Nevertheless, the business’s focus on item distinction and its growth into brand-new markets supply compound to a bullish argument. Furthermore, couple of have actually thought about the advantages that may accumulate from lower product expenses and a softened upkeep CapEx landscape.

Last but not least, a stock market-based analysis shows that high-beta stocks like Tesla are at great chances to attain additional gains. Therefore, we verify our strong buy ranking.