ipopba

Composed by Nick Ackerman, co-produced by Stanford Chemist. This short article was initially released to members of the CEF/ETF Earnings Lab on June 7th, 2023.

The John Hancock Hedged Equity & & Earnings Fund ( NYSE: HEQ) is developed, as its name indicates, as a method to hedge one’s portfolio. The fund buys a varied portfolio, preferring more of the value-oriented sectors such as financials and health care. In addition to a broad mix of financial investments, the fund will use an alternatives composing method and use futures agreements to hedge. In addition, the fund likewise hedges with forward foreign currency agreements.

This method exercised well in 2022 when the majority of the equity and fixed-income market was down; this fund was flat. Nevertheless, hedging constantly features an expense, which generally limits upside possible in booming market. Throughout the majority of the last years, when equities were delighting in strong returns, this fund didn’t actually do much, as anticipated.

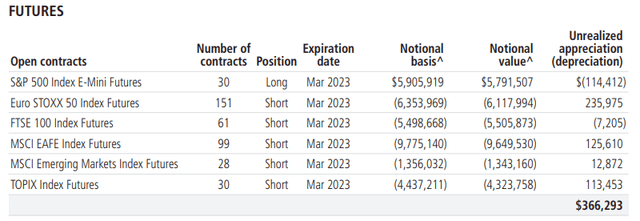

The fund utilizing the alternatives method is relatively basic, as other closed-end funds do the exact same. The futures agreements are where they appear to get a bit more aggressive.

The fund’s deep discount rate offers a prospective entry point for one wanting to diversify and hedge their portfolio if their outlook is for a prospective huge drop in the marketplace. Because our previous upgrade, the fund did supply some favorable overall returns, however it has actually been rather a long time because that upgrade. The last time I took a look at HEQ CEF remained in March of 2021

HEQ Efficiency Because Previous Update ( Looking For Alpha)

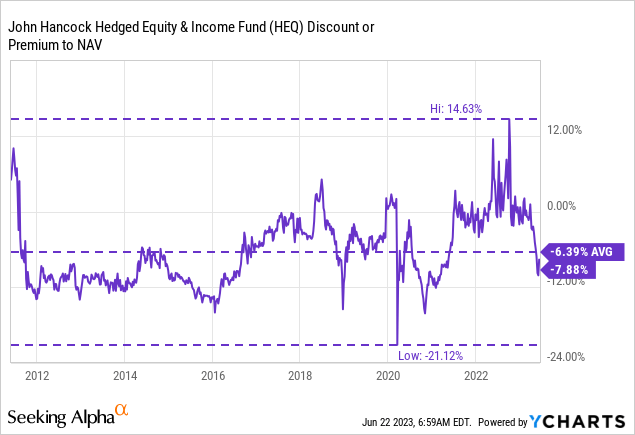

Throughout this time, the fund likewise increased to a big premium. That was relatively brief as the fund came crashing pull back to a sharp discount rate. Nevertheless, the fund has actually relatively regularly been flirting with a premium for the majority of the last 2 years. Returning even more, the fund has actually had a number of durations of where it has actually touched premium levels.

The Fundamentals

- 1-Year Z-score: -1.79

- Discount Rate: -7.88%

- Circulation Yield: 11.03%

- Cost Ratio: 1.16%

- Utilize: N/A

- Handled Possessions: $143.59 million

- Structure: Continuous

HEQ’s financial investment goal is to “look for overall return including both earnings and capital gains.” To accomplish this, the fund will invest “a minimum of 80% of the portfolio in a varied choice of equities throughout market capitalization.” TO handle the disadvantage dangers, the fund uses “alternatives methods to reduce capital losses in durations when equity markets decrease.”

Surprisingly enough, the fund really didn’t note any alternatives gains/losses or perhaps impressive alternatives positions in the last yearly report Rather, it was just futures agreements and currency agreements.

HEQ Futures Agreements ( John Hancock)

As you may anticipate, a fund concentrating on hedging isn’t making use of take advantage of. Nevertheless, with futures agreements, you can get outsized gains or losses. In addition, with composing alternatives versus indexes, there is in theory no limitation to those losses either. So while the fund does not use loanings, it can still experience outsized gains or losses based upon how excellent they are at utilizing these acquired “hedging” tools.

The fund is likewise rather little, which can cause restricted trading volume. That produces a danger of having a big spread in between the bid/ask rates. While that can be fixed with limitation orders, the restricted volume likewise implies financiers will have a tough time attempting to take bigger positions or exit those bigger positions if they are developed in time.

Efficiency – Discount Rate Opening

This fund has a history of touching premium levels, so the most recent discount rate might be a possibly strong argument for beginning a position. This discount rate has actually come quickly too. The drop can appear even steeper due to coming off of the fund’s all-time high premium that it was costing in 2015.

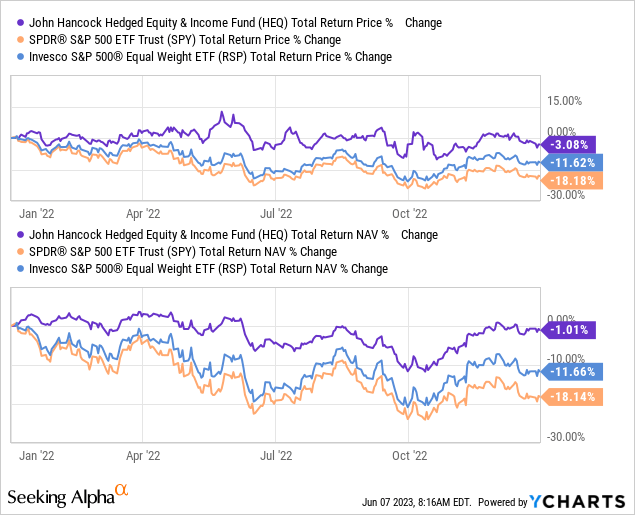

As a hedge, 2022 would appear like it achieved its objective. The overall NAV return for the year was basically flat when the equity market was down, as shown by the S&P 500 ETF ( SPY) and its equivalent, the Invesco S&P 500 Equal Weight ETF ( RSP).

YCharts

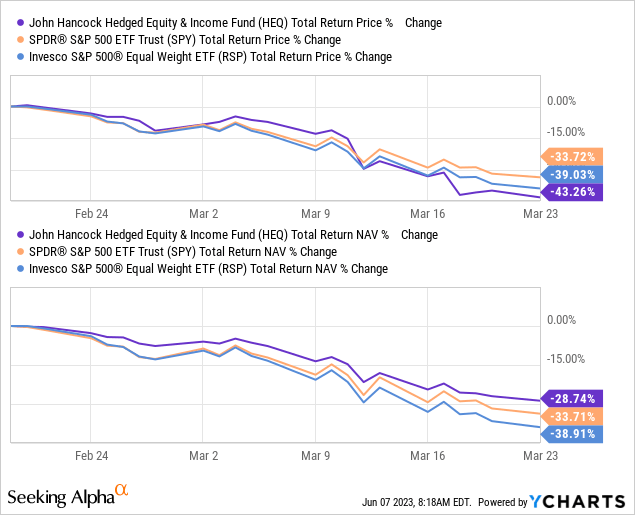

To review another duration, we can return to the pandemic crash. This is determining the overall return arises from February 19th, 2020, to March 23rd, 2020. As held true with many funds that would usually be protective, the drop came so promptly that the disadvantage security wasn’t able to operate, possibly as many would anticipate. That, and essentially whatever, sold tough – which is natural for black swan occasions.

Still, HEQ primarily achieved its objective of being a hedge in regards to its overall NAV results seeing a meaningfully lower drop. It was the overall share rate results with the CEF’s discount rate dropping significantly to all-time large discount rates that saw financiers not take part in the disadvantage security. This really highlights the threat of attempting to utilize a CEF as a hedge throughout market stresses; they can frequently be bad hedging tools because their discount rates broaden so dramatically throughout these black swans.

YCharts

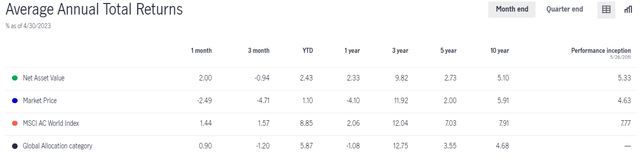

Over the longer term, the outcomes are relatively bad if you were holding this fund throughout the years rather of tactically. A minimum of if your objective was to anticipate competitive outcomes relative to equity-based peers such as the S&P 500.

Nevertheless, versus among their criteria, the International Allotment classification, it’s done reasonably well. Versus the MSCI Air Conditioner World Index is where it actually appears like they have actually offered uninspired outcomes. Once again, this isn’t unforeseen, as hedging features the threat of very little outcomes throughout strong durations for the marketplace. If one has a more ugly outlook moving forward, the outcomes of this fund might be viewed as more appealing.

HEQ Annualized Efficiency ( John Hancock)

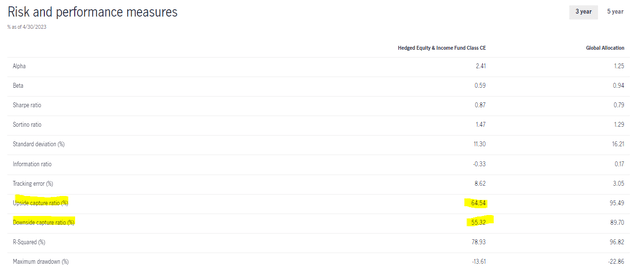

To take a look at this another method, the fund offers the advantage capture ratio and the disadvantage capture ratio. Keep in mind that this protests the international allowance criteria, not their very first noted criteria, which they appoint to MSCI air conditioner World Index. What this informs us is that the fund in the last 3 years caught around 65% of the advantage of its criteria – plainly why it would have lagged in efficiency in the last 3 years. Nevertheless, the hedging likewise suggested the disadvantage was more restricted too, at around 55%. The fund’s beta is likewise lower at 0.59.

HEQ Risk/Performance Procedures ( John Hancock)

HEQ’s Double-Digit Circulation

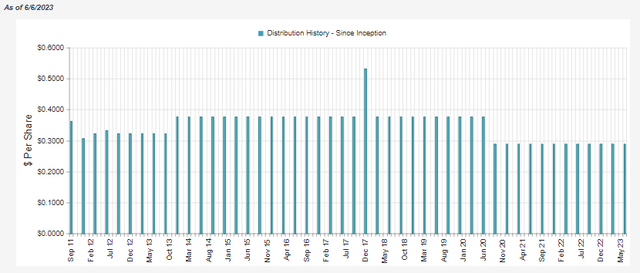

The fund presently sports a circulation yield of 11.03%. That’s rather appealing, and thanks to the fund’s substantial discount rate, this is greater than the 10.03% the fund needs to make to cover it. Obviously, history reveals us that because the fund’s launch, it hasn’t had the ability to make this circulation. The fund likewise cut its payment in 2020.

HEQ Circulation History ( CEFConnect)

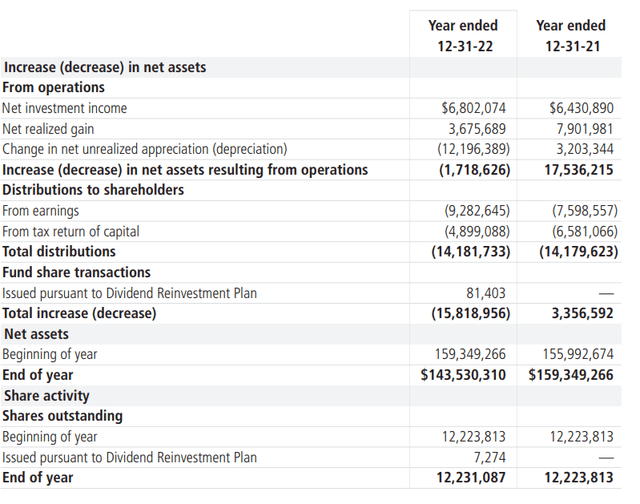

The fund’s net financial investment earnings isn’t sufficient to cover the circulation. As typical, with a fund that invests greatly in equities, this isn’t uncommon. The majority of equity-heavy funds will need capital gains to money their payments to financiers.

HEQ Yearly Report ( John Hancock)

The NII protection in the previous year pertained to almost 48%. That’s relatively strong compared to what we see out of some other equity funds. The fund was likewise able to recognize some capital gains in 2015 to assist money the payment too. Nevertheless, we likewise see a significant quantity of latent gratitude on the underlying portfolio too.

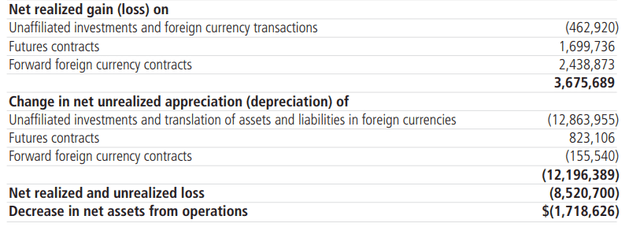

A few of the gains they had the ability to recognize originated from their acquired methods. In truth, it was all of their understood gains as they understood losses rather of their underlying portfolio. The biggest of these gains originated from the currency agreements.

HEQ Unrealized/Realized Gains/Losses ( John Hancock)

Once Again, I ‘d explain that they didn’t note any alternative positions in the last yearly report, and the report does not reveal any gains or losses from composed alternatives. This is uncommon, as it had actually appeared in previous years. I searched for out if they got rid of the alternatives method, however it’s still published on their site of their alternatives composing method and within their yearly report, they noted the alternatives method too.

It would appear they just merely didn’t use alternatives in the totality of 2022. As an actively handled fund, they have the versatility to choose when a method is utilized or not, so they need to have identified it was finest not to compose any alternatives in 2015.

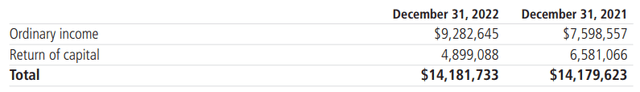

For tax functions, the fund notes a relatively considerable part of the circulation being categorized as common earnings. Although they likewise note a significant allowance to return of capital. These 2 categories make it less clear what kind of account might be the most proper. Common earnings is going to be taxed greatly, while ROC circulations postpone tax commitments up until a position is offered, as it lowers a financier’s expense basis. At that time, it gets taxed at a more beneficial capital gains rate.

HEQ Circulation Tax Category ( John Hancock)

HEQ’s Portfolio

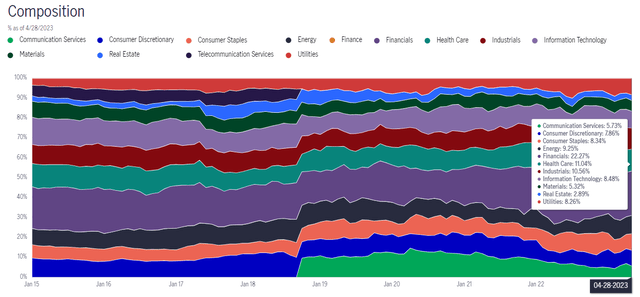

The fund notes 479 overall holdings, which offers a lot of diversity. The fund is likewise rather active, as the portfolio turnover in the previous year pertained to 163%. The fund has actually preferred weightings to financials, health care and commercial, all thought about value-oriented sectors. The monetary allowance this year was captured up in the banking crisis volatility. That being stated, the majority of their bigger banking positions are to the large-cap names that experienced more restricted pressure, such as JPMorgan ( JPM) and Bank of America ( BAC).

HEQ Sector Allotment ( John Hancock)

They have actually restricted their direct exposure to tech, however it still represents a relatively significant weighting due to the fact that the majority of the fund is relatively diversified. Mainly, the financials get the outsized weighting relative to the other allotments.

The portfolio can alter a bit, however even returning to our 2021 short article where we took a look at the weightings since January 29th, 2021, the greatest weighting was to the monetary sector.

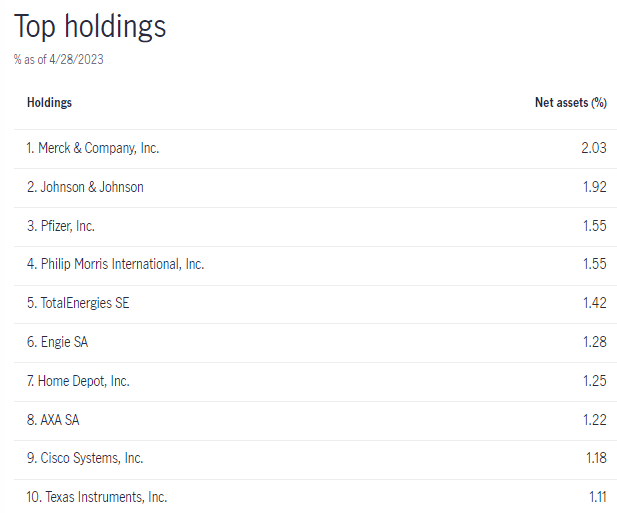

The leading holdings consist of a lot of familiar large-cap names that financiers and customers will acknowledge.

HEQ Leading 10 Holdings ( John Hancock)

That being stated, there is an absence of monetary names for having financials as the biggest weighting in the fund. AXA SA ( OTCQX: AXAHY) is an exception, an insurer based in France. Rather, we are met 3 health care names that represent the leading 3 positions. Those consist of Merck ( MRK), Johnson & & Johnson ( JNJ) and Pfizer ( PFE). Those are the leading 3 weightings, however they do not represent a considerable obese or anything. Rather, comparable to the fund’s allowance of being relatively varied in sectors, the weighting of each private position is likewise relatively even.

Conclusion

HEQ has actually primarily achieved what it was developed to do, hedge the disadvantage relocations. Hedging features an expense, which expense is more soft returns when times are excellent. Provided the unsure outlook presently and the fund’s appealing discount rate, it is most likely to have some attract financiers at this time. That would be whether to play it as a hedge ought to they anticipate the marketplace to stay forced or as a method to play the mean reversion back to its more historic ~ 6% discount rate level. A lot more optimistically, financiers might possibly see HEQ return back to a premium. That stated, I do not see HEQ as a long-lasting buy-and-hold position however one that ought to be traded tactically.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.