PM Images

Avantax ( NASDAQ: AVTA) anticipates profits development in 2023, and just recently enacted aggressive actions to boost the present evaluation, consisting of a Dutch tender deal and a stock redeemed program. In my view, the business has enough money to employ brand-new monetary experts, and more sale of properties might make AVTA much more appealing. Besides, I would anticipate more attention from financiers as persistent profits keeps increasing. There are dangers from a decrease in the stock exchange and underperformance of financial investments proposed to customers, nevertheless, the present stock rate appears too low.

Avantax

Integrated in Delaware, Avantax, which was formerly called Blucora, Inc., provides tax-focused wealth management services and platforms. Customers are normally customers, small company owners, tax experts, and licensed public accounting companies. The business runs one reportable section.

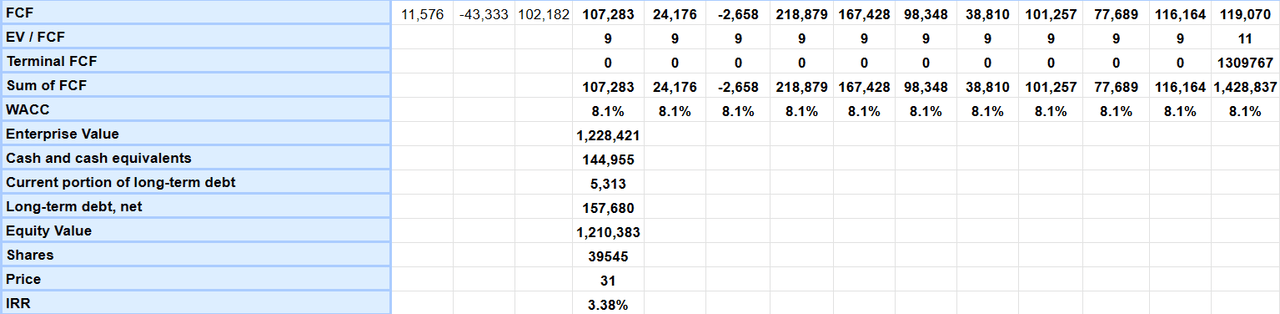

Avantax ranks 10th in the IBD classification in Cerulli’s Leading 25 B/D Networks by Assets Under Management. Thinking about such kind of figures, I think that we can anticipate a considerable quantity of charges from advisory, wealth management, and brokerage charges.

Source: Business Site

Avantax Anticipates More Sales Development And EBITDA Margin Development

Avantax, Inc. provides incorporated tax-focused wealth management services and platforms, helping people, small company owners, tax expert companies, monetary experts, and certified public accountant companies.

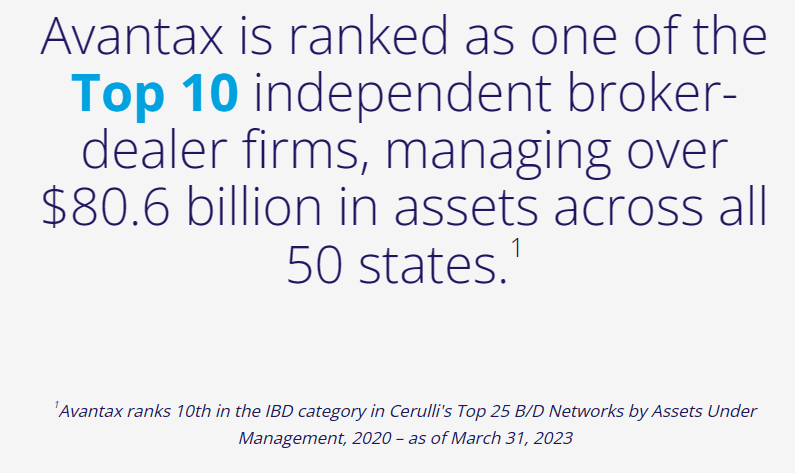

Source: Discussion To Financiers

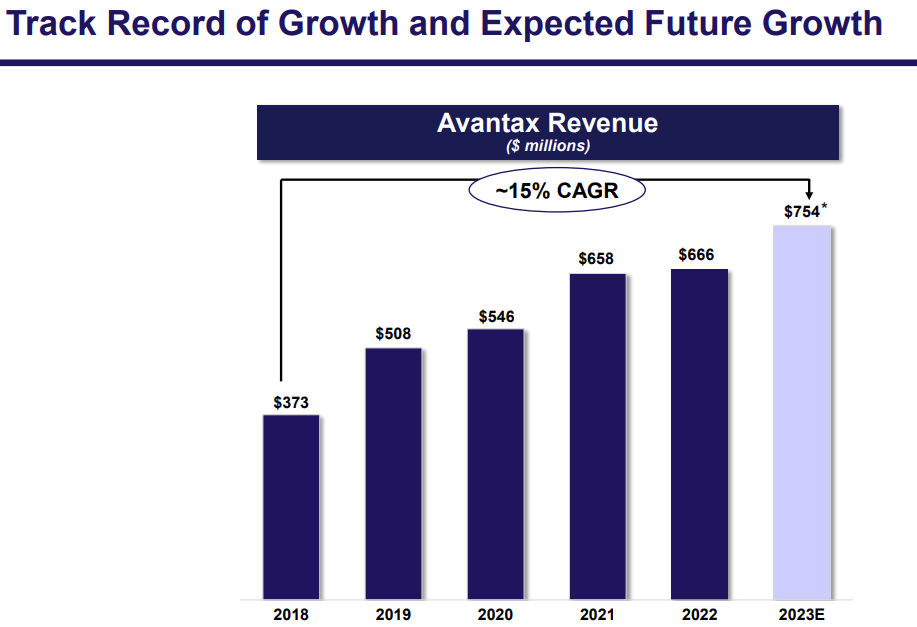

I think that just considering the performance history development and anticipated future development of Avantax suffices factor to perform research study about the stock. From 2018 to 2023, the business kept in mind profits development of near to 15% CAGR.

Source: Discussion To Financiers

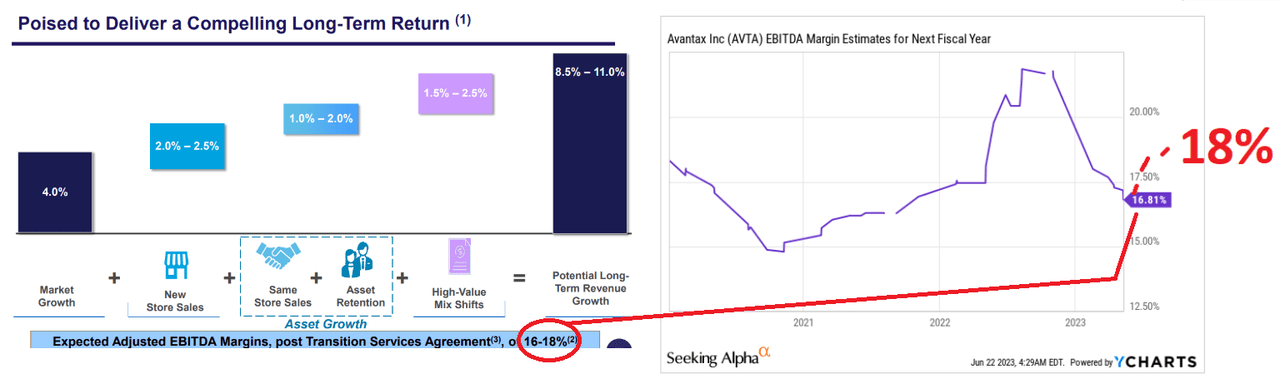

Besides, Avantax kept in mind that market development integrated with brand-new shop sales, possession retention, and high-value mix shifts might bring considerable prospective long-lasting development. The business likewise anticipates to provide EBITDA margin of around 16% to 18%. Thinking about the current decrease in EBITDA margins from 21% in 2022 to around 16% in 2023, a boost to 18% might bring need for the stock and stock rate gratitude.

Source: Discussion To Financiers

Market Expectations And Assistance

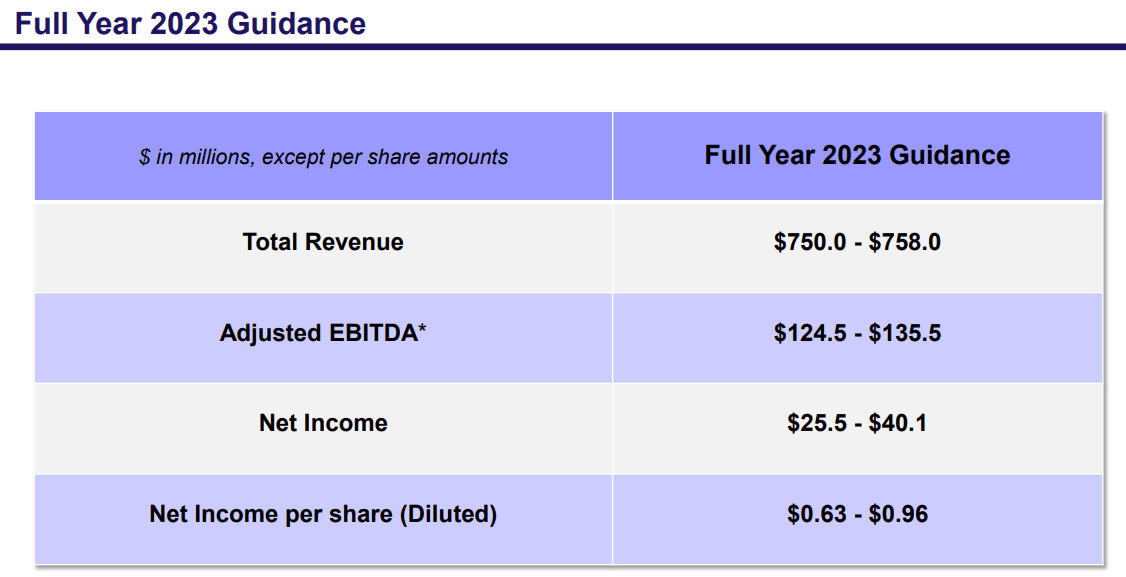

The business reported 2023 assistance near to $750-$ 758 million, changed EBITDA of about $124.5-$ 135.5 million, and earnings of $25.5-$ 40.4 million. Thinking about the present macroeconomic environment, I think that the numbers are rather positive. There are lots of experts out there anticipating a harmful financial situation in 2023 Nevertheless, management anticipates favorable 2023 earnings.

Source: Discussion To Financiers

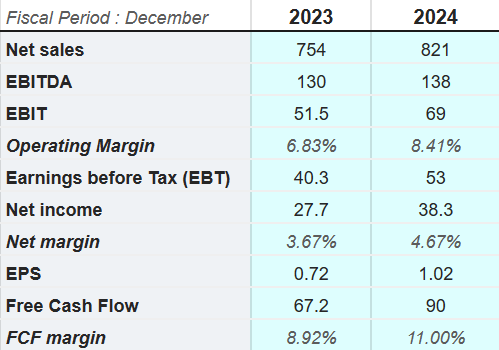

Other experts likewise reported 2024 net sales near to $821 million, 2024 EBITDA near to $138 million, 2024 EBIT of $69 million, and running margin near to 8.41%. Besides, experts are likewise anticipating 2024 earnings of about $38.3 million, with an EPS of $1.02 per share and 2024 FCF of $90 million. I think that the expectations of these market individuals are useful as the business anticipates running margin development, earnings development, and FCF margin development.

Source: Marketscreener.com

The Last Balance Sheet Consisted Of Reduces In Money And Properties

With concerns to the balance sheet, I think that the last quarterly report was not that useful. The business reported less cash, less present properties, a decrease in home and devices, and less overall properties. It is likewise worth keeping in mind that the overall quantity of liabilities increased, so the asset/liability ratio did not enhance. In my view, the brand-new balance sheet might belong to the factor to describe the decrease in the stock rate in Q1 2023.

Source: SA

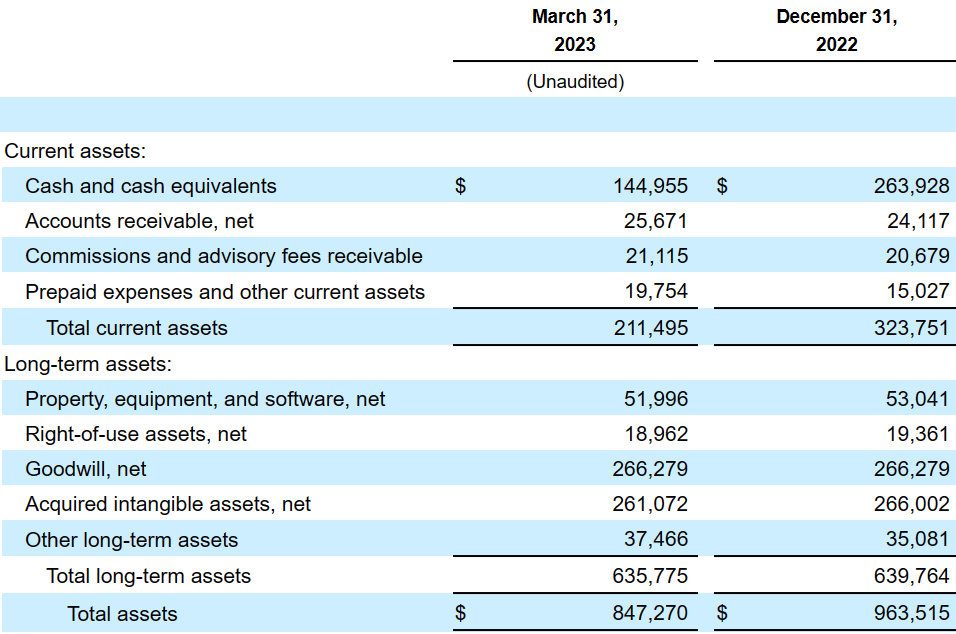

More in specific, the business reported money worth $144 million, with balance dues of $25 million, commissions and advisory charges receivable worth $21 million, and pre-paid expenditures and other present properties near to $19 million. Overall present properties stood at $211 million.

Likewise, with home, devices, and software application worth $51 million, right-of-use properties of $18 million, goodwill of $266 million, and got intangible properties of $261 million, overall properties amounted to $847 million. The asset/liability ratio stood at near to 2x, so I think that the balance sheet does look steady. With that, I hope that the management would effectively stop the reduction in properties that we saw in 2023.

Source: 10-Q

With concerns to the list of liabilities, the business kept in mind accounts payable worth $4 million, commissions and advisory charges payable of $13 million, and accumulated expenditures and other present liabilities of near to $111 million. Long-lasting financial obligation stands at about $157 million, with long-lasting lease liabilities of $29 million, postponed tax liabilities of about $21 million, and overall liabilities of $379 million.

Source: 10-Q

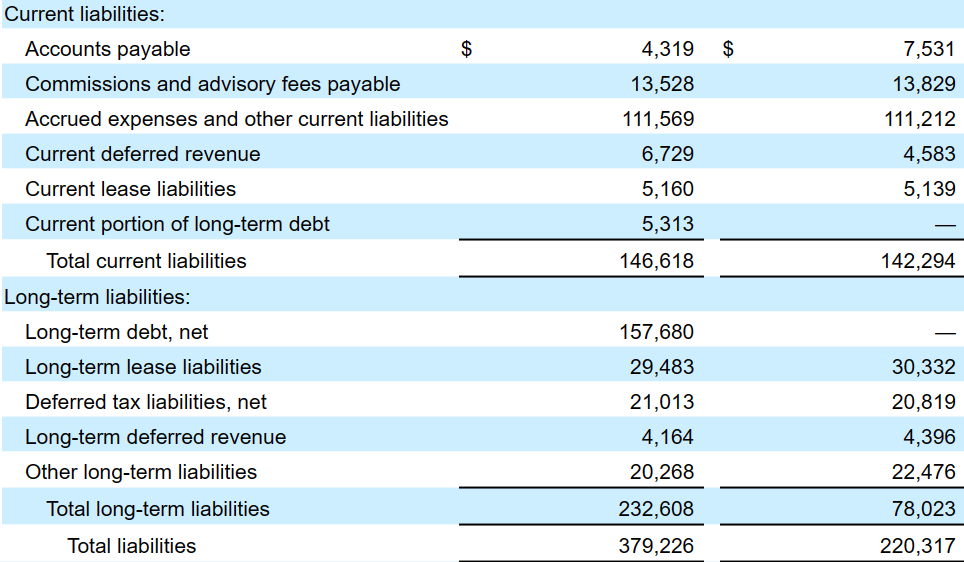

The business carried out a Dutch Auction tender deal to obtain near to 8.3 million shares at near to $30 per share. I think that the decrease in money might be discussed by this deal.

On January 27, 2023, we started a customized “Dutch Auction” tender deal to buy shares of our typical stock for an aggregate purchase rate of as much as $250.0 million at a rate per share not less than $27.00 and not higher than $31.00. Upon the conclusion of the Tender Deal, we redeemed and consequently retired around 8.3 million shares of our typical stock at the purchase rate of $30.00 per share, for aggregate money factor to consider of $250.0 million. Source: 10-Q

In theory, a decrease in the share count might cause greater stock evaluation. It was kept in mind when it comes to Avantax as seen in the stock rate listed below. Right after the decrease in the share count from around 48 million to near to 38 million, the stock rate decreased from near $30 per share to around $20-$ 23 per share.

Source: YCharts

My Capital Design And The Conclusions Of Engine Capital

In my view, Avantax will probably continue to get attention from customers as the technique carried out seems various from that provided by rivals. In my view, more info about how the business assists rich people pay a bit less taxes might bring the attention of financiers. In amount, under my DCF design, the technique would succeed.

Our development technique starts with our function to make it possible for customers to attain their objectives by supplying holistic monetary services through a distinctively tax-focused lens. Historically, the wealth management market has actually mostly stopped working to concentrate on the effects of taxes, or just carried out tax-advantaged methods for the most affluent section of customers, disregarding the tax implications for a broad variety of customers. We look for to perform holistic, long-lasting tax reduction methods for our customers’ tax scenarios, while broadening access to those methods to a wider group. Source: 10-Q

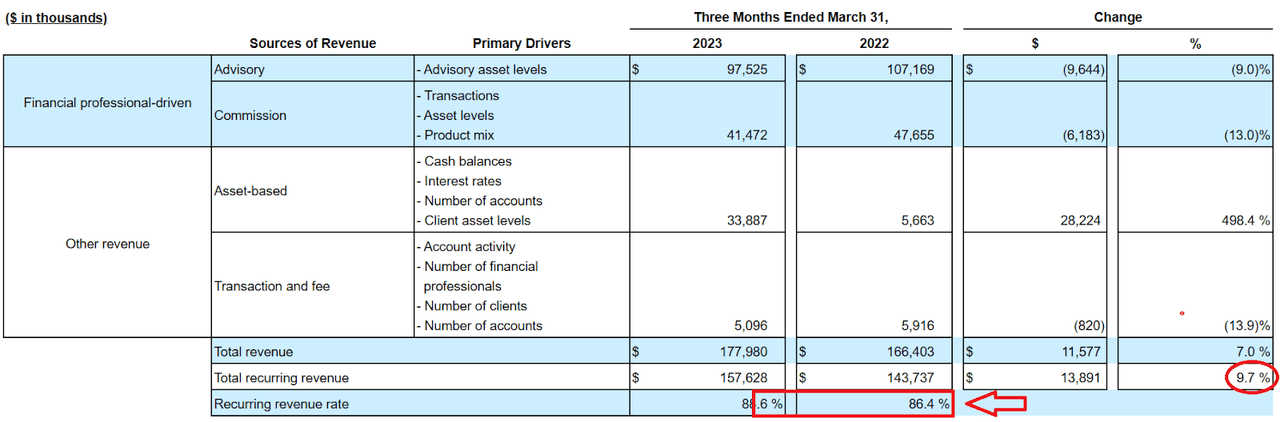

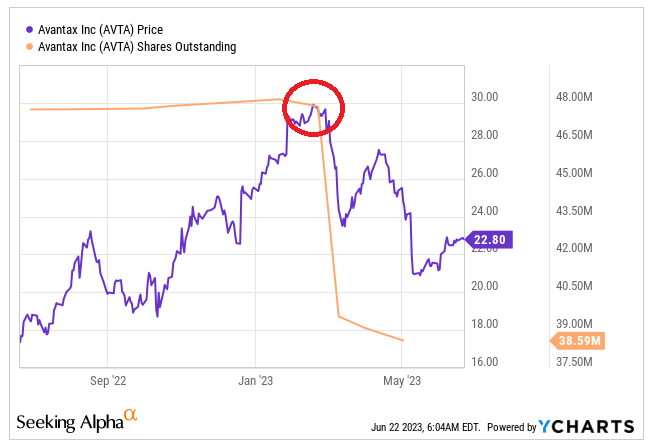

I likewise presumed that the overall quantity of persistent profits would continue to trend greater as we saw in the most current quarter. The quarterly repeating profits increased by near to 9.7%. In my view, market individuals will probably value repeating profits as it is much easier to forecast, and might have an advantageous effect on the stock evaluation.

Repeating profits includes advisory charges, routing commissions, charges from money sweep programs, and particular deal and cost profits, all as explained even more under the headings “Advisory profits,” “Commission profits,” “Asset-based profits,” and “Deal and cost profits,” respectively. Source: 10-Q

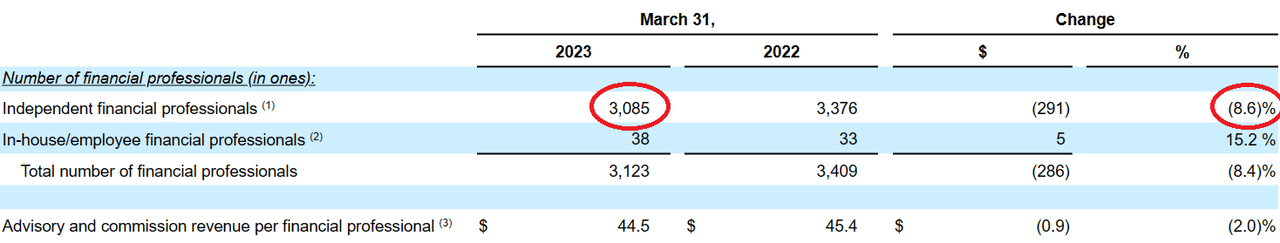

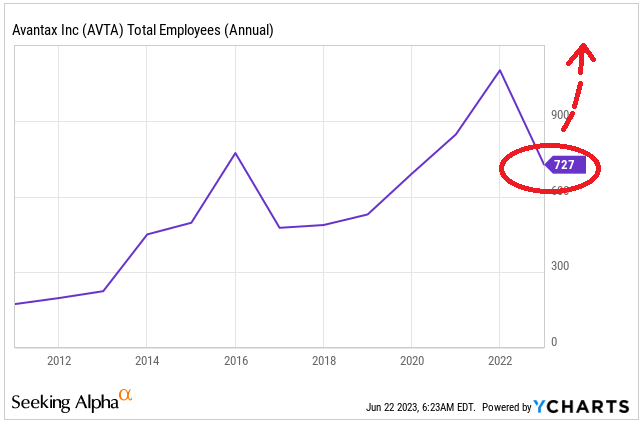

In the last quarter, Avantax reported a decrease of near to 8.6% in the overall variety of independent experts. I presumed that the business will, in the future, effectively maintain more independent monetary experts. It deserves pointing out that the variety of staff members, according to YCharts, increased from less than 300 in 2014 to more than 900. Thinking about the cash of $144 million, in my view, management might employ more in the coming years. As an outcome, more staff members might provide more monetary suggestions, and more customers might be called, which might be a driver for future net sales development.

In addition, in my view, more sale of properties might bring cash, which might boost the evaluation of Avantax. Offering little departments to repurchase stock appears more smart than offering the entire business. Minority financiers might not have the ability to get stock returns if the business is offered completely at the present stock rate of $20-$ 22 or lower. If the business attempts to offer itself, and there are no bidders, the stock rate might decrease, and a deal might be carried out at an inexpensive rate.

On October 31, 2022, we participated in the Purchase Contract with the Purchaser to offer our previous tax software application organization for an aggregate purchase rate of $720.0 million in money, based on traditional purchase rate changes stated in the Purchase Contract. The TaxAct Sale consequently closed on December 19, 2022. This divestiture was thought about part of our tactical shift to end up being a pure-play wealth management business and was figured out to fulfill discontinued operations accounting requirements under ASC 205. Source: 10-Q

Lastly, I believe that enough interactions about the present efforts to boost the stock rate and the evaluation of the stock might bring interest from financiers. As an outcome, need for the stock might cause lower stock volatility and lower expense of capital, which might boost the reasonable rate. I actually do not believe that the service is a sale of the business, due to the fact that the business is making a great deal of actions to reward investors. We need to be client.

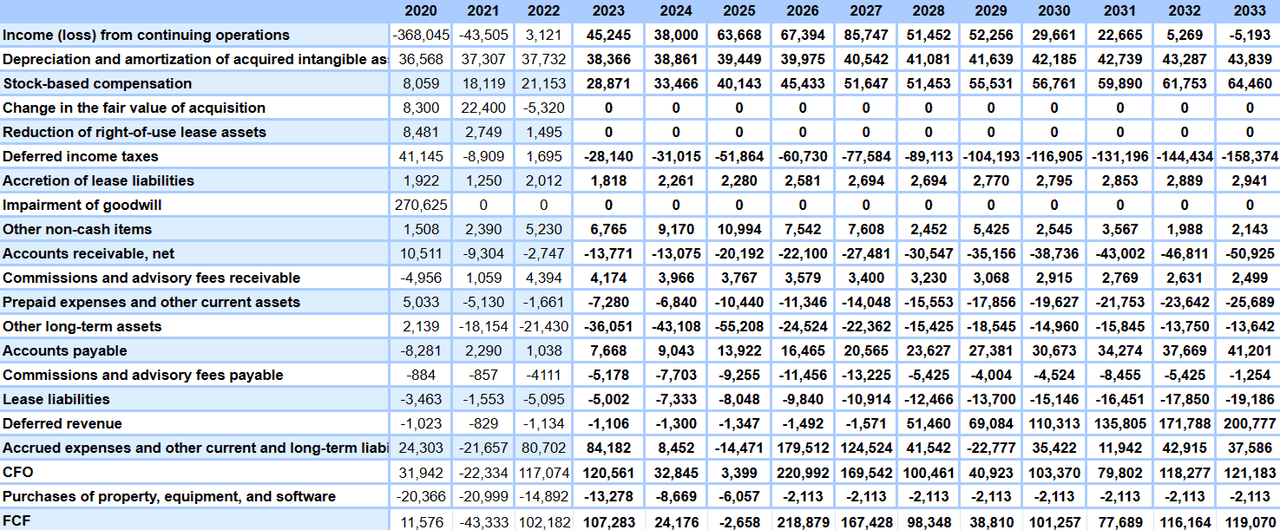

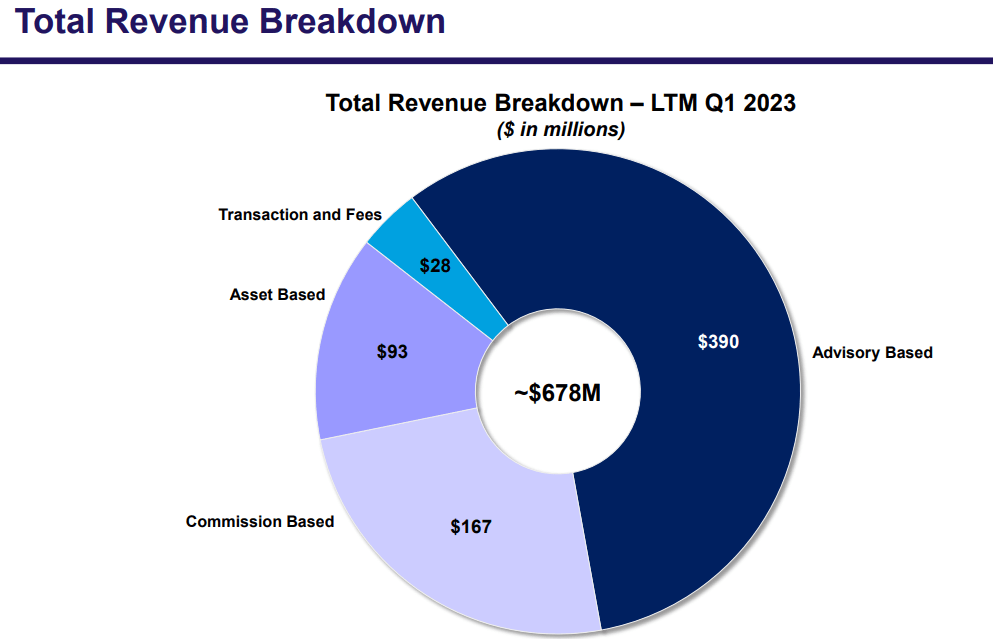

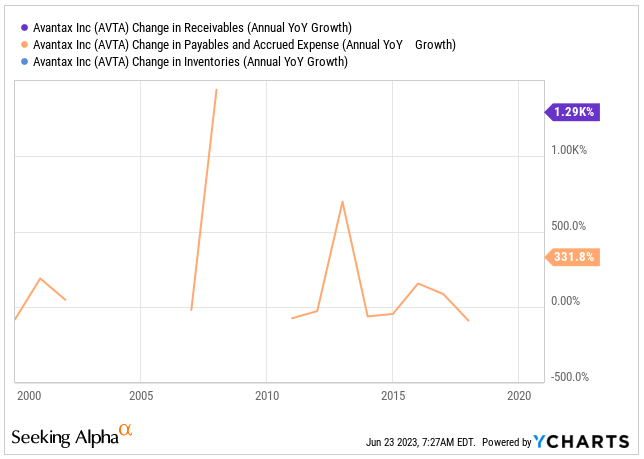

For the evaluation of future complimentary capital, I presumed decreasing modifications in balance dues, growing modifications in accounts payable, and growing D&A. I think that my figures are close to the figures observed in the past, and they are general conservative.

Source: YCharts Source: YCharts

For the earnings development and FCF development, I observed that the wealth management platform market is anticipated to grow at near to 12.85% from now to 2030. In my view, Avantax is a little rival, so we might anticipate a bit bigger development than other big rivals. Anticipating bigger development than the marketplace would make good sense.

The marketplace is prepared for to obtain an appraisal of around USD 7.55 Billion by the end of 2030. The reports even more forecast the marketplace to thrive at a robust CAGR of over 12.85% throughout the evaluation timeframe. Source: Wealth Management Platform Market is Forecasted to Strike USD

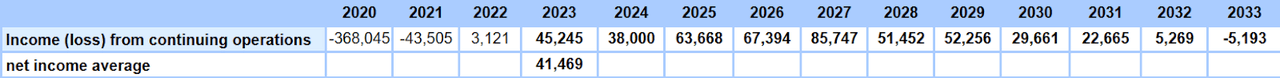

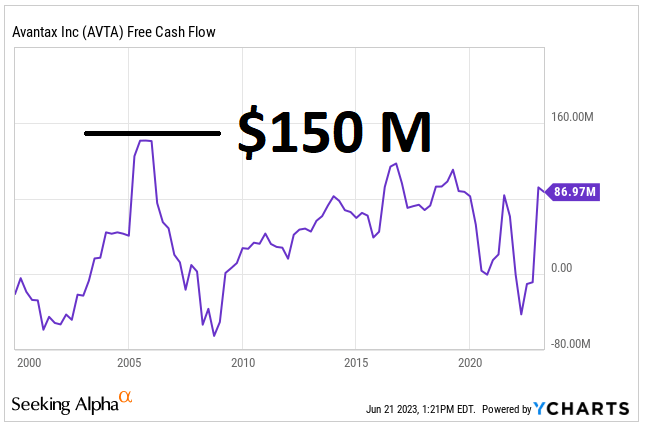

I likewise consisted of an earnings average of near to $41 million in between 2023 and 2033, with around steady FCF, and FCF average of near to $100 million. Keep in mind that I likewise presumed a decrease in capital investment like other monetary consultants. Capex would vary from around $13 million to $2 million.

Source: My DCF Design Source: My DCF Design

My monetary design consisted of 2033 earnings from continuing operations near to -$ 6 million, with devaluation and amortization of obtained intangible properties of $43 million, 2033 stock-based payment worth $64 million, and 2033 modifications in deferred earnings taxes of -$ 159 million.

My monetary design likewise consisted of 2033 accretion of lease liabilities worth $2 million, modifications in balance dues of -$ 51 million, commissions and advisory charges receivable worth $2 million, and pre-paid expenditures and other present properties of -$ 26 million. Besides, I presumed 2033 accounts payable of about $41 million, commissions and advisory charges payable near to -$ 2 million, modifications in lease liabilities of -$ 20 million, and modifications in deferred profits worth $200 million. Lastly, I got 2033 CFO of $121 million.

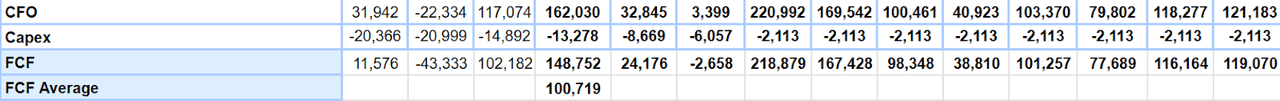

In the past, Avantax reported FCF near to $150 million and about $44 million. My numbers consist of an optimum FCF of $218 million and a minimum of $38 million. I think that my numbers are conservative.

Source: YCharts

With an EV/FCF ratio of 9x and a WACC of 8.1%, the suggested business worth would be close to $1.228 billion. If we likewise include money and money equivalents of $144 million, and deduct the present part of long-lasting financial obligation of about $5 million and long-lasting financial obligation of $157 million, the equity worth would be close to $1.210 billion. In amount, the reasonable rate would be $30 per share.

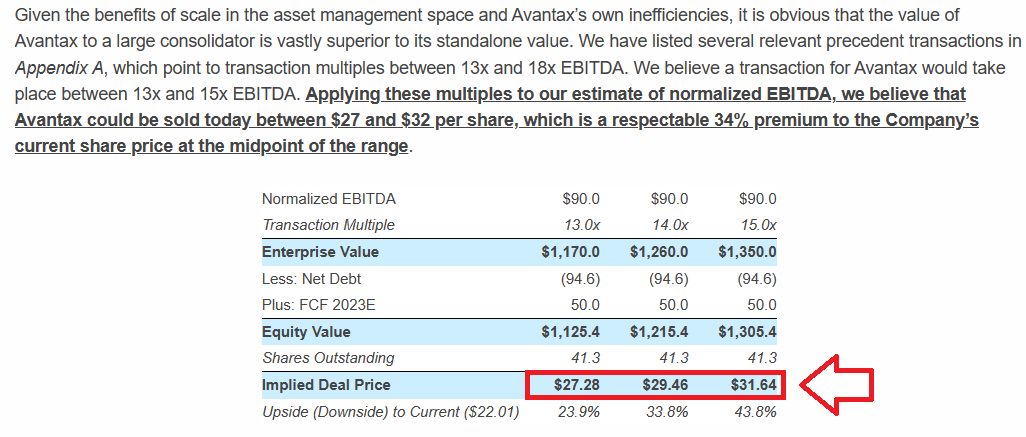

My DCF design suggested a reasonable rate near to $31 per share, which is close to the reasonable rate gotten by another financier, Engine Capital. It got a reasonable evaluation near to $27-$ 31 per share through a monetary design based upon deal multiples. With a deal several near to 15x, the suggested equity would be close to $1.3 billion, and the suggested offer rate would be $31 per share. The activist financier thinks that a sale of Avantax would be extremely fascinating thinking about the advantages of acquiring economies of scale in the possession management area.

Source: Engine Capital Issues Letter to the Board of Directors of Avantax

I welcome readers to take a look at the letter provided by Engine Capital, that includes clever suggestions about the future actions of Avantax. The activist thinks that Avantax would do excellent by performing a deal with a big company. According to Engine Capital, Avantax can not actually take on big companies, and the market remains in a procedure of combination.

Avantax obtains its benefit from 2 various sources– the services it renders to its monetary consultants and the money sweep. The Business has actually restricted control over the earnings originating from the money sweep along with the earnings showing its monetary consultants. For that reason, when benchmarking Avantax’s margins to its peers, our company believe it is essential to separate the profits and benefit from the service side of business, omitting the money sweep along with the payments to its monetary consultants. Source: Engine Capital Issues Letter to the Board of Directors of Avantax Relating To the Urgent Requirement to Check Out Strategic Alternatives|Service Wire

Avantax is just subscale and can not complete on equivalent footing with bigger companies. Considering that size matters in the possession management area, Avantax deserves significantly more to a big consolidator than as a standalone entity. Source: Engine Capital Issues Letter to the Board of Directors of Avantax Relating To the Urgent Requirement to Check Out Strategic Alternatives|Service Wire

In my view, Avantax is a buy. If the activities lastly press the business to sale for $27-$ 32, we would make dollars. On the contrary, if the business does not offer itself, I think that natural development and more hiring of staff members might likewise bring the stock rate up.

Dangers

I think that a decrease in the stock exchange is among the biggest dangers for Avantax. If customers view that their financial investments with Avantax do not provide good outcomes, they might close their accounts. As an outcome, charges from advisory would reduce, net sales might reduce, and the FCF margins would decrease due to the fact that of lower economies of scale. In this regard, management provided the following description.

Customer service and efficiency are necessary consider the success of our organization. Strong customer service and item efficiency aid increase customer retention and create sales of services and products. A decrease or viewed decrease in efficiency, on an outright or relative basis, might trigger a decrease in sales of shared funds and other financial investment items, a boost in redemptions, and the termination of possession management relationships. Such actions might lower our aggregate quantity of advisory properties and lower management charges. Source: 10-k

I likewise believe that a lower variety of monetary experts would probably lower the charges gotten from shared funds and other partners. Besides, if lots of financing experts view that Avantax does not provide what they require, or it provides poor quality items, the image of Avantax would weaken, which might bring lower complimentary capital than anticipated.

We obtain a big part of our earnings from commissions and charges produced by our monetary experts, including our internal monetary experts. Our capability to draw in and maintain efficient independent specialist and internal monetary experts has actually contributed substantially to our development and success. If we stop working to draw in brand-new monetary experts or to maintain and encourage our monetary experts, our organization might suffer. Source: 10-k

Lastly, in my view, if Avantax chooses to offer itself, and there are no enough bidders, the Board of Directors might choose to offer the business for a lower rate than the present market value. If there is no offer, reports might have a destructive effect on business design. Excellent staff members might choose to work for other rivals, which might reduce future efficiency.

Conclusion

Avantax continues to provide useful assistance, repurchases its own stock, and obtains a considerable variety of shares from the marketplace. In my view, if the EBITDA margin patterns greater as anticipated, more independent monetary experts sign up with the company, and efficiency provided to customers is appealing, future complimentary capital would trend greater. I likewise believe that offering particular properties to repurchase stock is a much better concept than putting the business for sale. Plainly, the business is rather underestimated, however we need to be client. Management seems taking the best actions.