StockByM

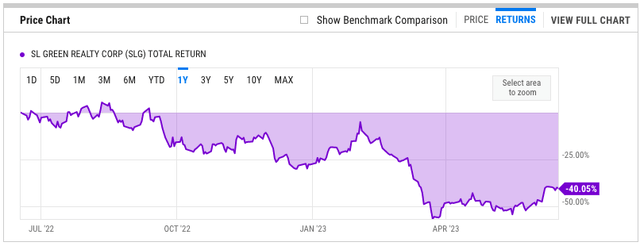

SL Green ( NYSE: SLG) has actually seen its share cost fall like a rock over the previous 5 years. The stock was trading around $100 per share pre-Covid, however never ever handled to reach those highs once the pandemic begun. Presently, the shares trade at simply $26 on 2 unique worries:

- High rates of interest– increasing expense of capital and reducing assessments

- Work from house– threatening tenancy and the extremely presence of workplaces

In this post, I wish to resolve both of these worries and conclude whether they are warranted or overblown.

Market Landscape

Unless you have actually been living under the rock, you have actually most likely observed an uptick in bearish headings concerning business property and workplace in specific. The belief is now as bearish as ever, with many individuals arguing that workplaces are doomed. The bearish thesis is primarily asserted on the reality that work from house will continue to be a substantial risk to tenancy which offered the tight credit market, workplace REITs will have a hard time to re-finance their financial obligation maturities as they come due.

SL Green Summary

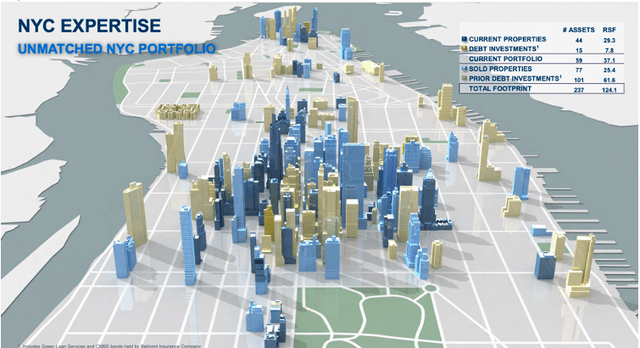

SLG is a recognized New york city City workplace property owner with a long history who owns a few of the most acknowledged and popular high-rise buildings in Manhattan, consisting of the similarity One Vanderbilt. In overall, the REIT owns 44 residential or commercial properties and has financial obligation financial investments in 15 residential or commercial properties. As currently pointed out, the portfolio is primarily workplace with a little, irrelevant direct exposure to domestic. The business likewise has an extremely strong management group, which has actually handled to get through the 2008/2009 monetary crisis.

Current cost action has actually definitely been frightening, however current functional efficiency hasn’t been that bad as tenancy stays over 90% and the REIT has actually had the ability to re-finance a few of its near-term financial obligation maturities. It’s truly the long-lasting practicality of workplaces that has actually terrified financiers away, so let’s begin with that.

By now, everybody recognizes with the work-from-home pattern, and there are 2 camps of financiers. The very first one argues that work from house is here to remain and workplaces are doomed. This certainly is what the status quo looks like. The 2nd camp believes that work from house is a short-term phenomenon which business will ultimately need individuals to go back to the workplace, particularly if the financial circumstance worsens and business have more bargaining power. My viewpoint is that workplaces will continue to exist in some kind as individuals will continue to have in-person in conferences in huge cities, however it will likely be the greatest quality ones that endure. The ones that remain in the very best areas and supply the greatest requirement. That’s why my workplace REITs are Boston Residence ( BXP) and Kilroy Real Estate Corporation ( KRC), both of which have a few of the youngest portfolios of all REITs.

This is regrettably where SLG and honestly the huge bulk of office in Manhattan fails. Sure, their most recent structures such as One Vanderbilt are most likely to carry out effectively, however the bulk of their portfolio includes much older structures, comparable to the Empire State Structure, for instance. That’s B-quality at finest by today’s requirements, and the important things is that conversions (whether to A-class workplace or domestic) are exceptionally costly and tough as those structures are extremely built with totally various designs.

As an outcome, it’s most likely that a big part of SLG’s structures will have a hard time to restore leases as they end and as an outcome, funding organizations will be extremely reluctant to re-finance any financial obligation ties to those structures. Just recently, SLG has actually handled to sign a substantial variety of leases, however it needs to be kept in mind that those were for area in a few of its finest structures. It’s truly the not so excellent structures that will, in my viewpoint, battle. This is where the 2nd worry originates from. High rates of interest and a tight credit market, integrated with extremely unfavorable belief towards business property at the minute, have actually produced a scenario in which any near-term financial obligation maturity is possibly dangerous.

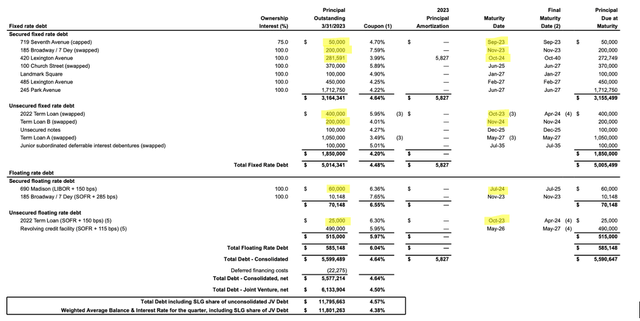

When once again, near-term financial obligation maturities is where SLG disappoints its peers. I went through all of their financial obligation and highlighted all centers that develop this year ($ 685 Million) and next year ($ 540 Million). With $150 Million in money and quarterly NOI of simply over $100 Million, the business will not produce adequate capital to pay back these maturities as they come due. This suggests that they will either need to offer some residential or commercial properties, which will be exceptionally tough, or re-finance these loans. On disposals, it deserves keeping in mind that they have actually been attempting to offer a few of their non-core properties, however just handled to offer a little stake in 121 Greene Street for $14 Million in Q1. On refinancing, it will be extremely tough to discover a lending institution happy to re-finance loans backed by office in Manhattan, and it will be extremely expensive.

There’s a genuine danger that SLG will not have the ability to re-finance, in which case it would need to state personal bankruptcy. I do not believe it’s most likely, however the danger exists. Additionally, from a long-lasting viewpoint, I’m not positive that their portfolio of old office will suffice to preserve high tenancy.

In regards to assessment, SLG appears low-cost. Trading at simply 3.6 x last 12-months FFO and a forward FFO of 4.31 x. This is considerably listed below the market average, in addition to SLG’s historic average, however as I have actually currently recommended, the stock is low-cost for a factor.

I see market worries as mainly warranted and am for that reason not happy to invest, no matter an apparently big discount rate to NAV and a 13% dividend, which has actually been validated just recently I stress that the NAV will be completely impaired as tenancy slowly reduces. Since of this, I will not touch SLG here and rate as a HOLD. You might ask, why not a sell? The factor is that SLG has the greatest brief interest of any workplace REIT, that makes it rather prone to a brief capture. Additionally, shorting from such depressed levels is seldom a great concept. The time to brief was a year back, now it’s finest to view from the sidelines.