earleliason/iStock by means of Getty Images

How difficult is it to moderate my market declarations to have a little bit of healthy obscurity?

I do not like obscurity, almost everybody who discusses the marketplace is so wishy-washy. Though, I confess that I might quickly state “I anticipate a turn in about 2 weeks.” In my case, it almost constantly has to do with 2 to 3 weeks out of my very first observation, that a turn takes place. Did I understand that Powell would threaten 2 more rate walkings in advance, after all that’s what triggered the selling?

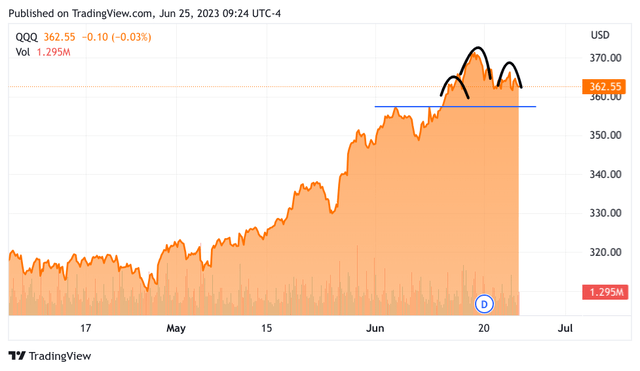

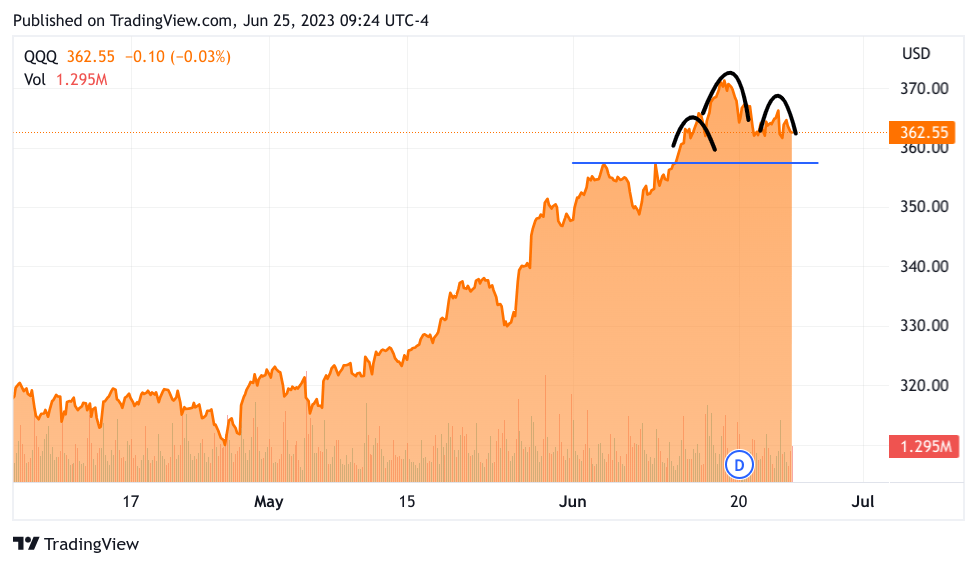

TradingView

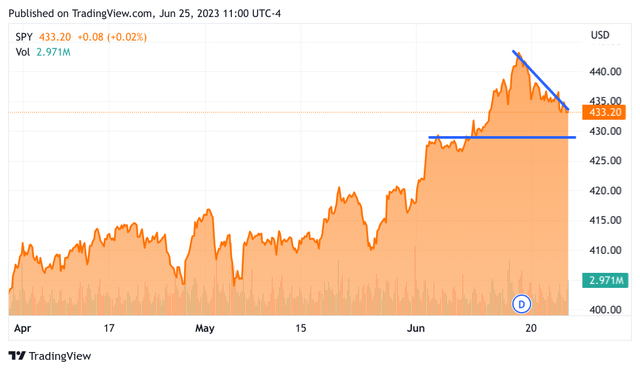

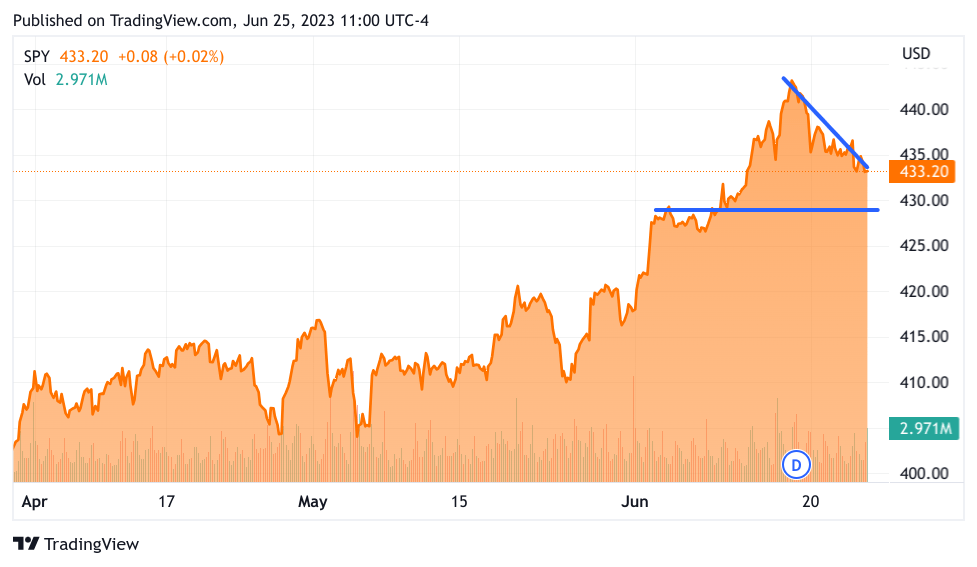

TradingView

No, It truly might have been anything or almost anything. If the marketplace wasn’t as overbought it might have quickly moved right past the Powell commentary. What do I suggest by overbought, there is a real measurement for being “overbought”, typically individuals discuss the RSI – the Relative Strength Index. It’s an excellent sign and for everybody who wishes to comprehend the market or specific stock “state of mind,” RSI is a great location to begin. I am a seat-of-the-pants person, This indicates I enjoy the charts and check out or enjoy all the appropriate media I can. So when the bulls begin to be dominant and the chart begins to like a geyser or space rocket going directly up, that is when I begin letting individuals understand that the marketplace will turn (with a 2-week head-start). Okay now that we are selling, how far can we go? I stated it was possible to lose 8% to 9%, which would injure, even if you were hedged. I do not like to hedge over the weekend, though Monday early morning it may end up being needed. Specifically because we do have actually a “Understood, Unidentified” showing up. More on that later on. So let’s have a look at the S&P 500 ETF ( SPY), and the Nasdaq-100 ETF ( QQQ). I am beginning with the QQQs for a modification listed below is a 3-Month chart

TradingView

We see a head and shoulders leading and after that some assistance at 357, the thin blue line. The QQQ ended at 362ish. So that is 5 QQQ points. I will likewise share what that indicates in the real Nasdaq 100 ended Friday at 14,891 points and assistance comes at 14,546. So that is another 350ish Nasdaq points. This does not suggest that Monday opens with the Nasdaq down by 350 points. Monday may simply begin down however be up decently by mid-afternoon. If we do get that reprieve you may wish to cut positions to have money prepared for a possible (being wishy-washy) sell-off Thursday, specifically into the close. The “Understood Unidentified” takes place on Friday. We might be remedied enough that even if the Core PCE is flat or perhaps a tick greater the selling may be perfunctory. I think that the Core PCE will reveal down development. If we have not remedied enough then we had actually much better made visible development or Friday may simply offer more difficult than I would like. Let’s take a look at the SPY now …

TradingView

This is once again the 3-month chart. I am not going to draw the “head-and-shoulders” though it’s really evident. Simply take a look at that downward-sloping line and the clear assistance level revealed by the horizontal line. SPY is a little simpler to relate to the real S&P 500 simply move the decimal point. Though there is still a little bit of an inconsistency the spy closed at 433.20 and this (horizontal) assistance line is at 429.02 obviously the assistance line will not be that precise however for the spy, this concerns 4.18, or if you move the decimal point 42 S&P 500 points. That might be covered without excessive discomfort in a week. I think that indicates the S&P 500 has more drawback resistance. This makes overall sense because tech is more susceptible to greater rates (a fundamentalist may state). I would provide more weight to the “technical” description that the techs delighted in the majority of the over-exuberance, or being overbought. How to make the most of this insight? Well maybe expanded your trading to development stocks that aren’t tech-forward. Likewise, if timed properly purchasing choose tech names that have actually been unduly penalized might create some good alpha. I would concentrate on tech that is currently successful, and not simply from the “Stunning 7”. Now how does this equate to the real S&P 500? This is really intriguing, the S&P 500 closed at 4,348, the 52-week high is 4.448! One hundred S&P 500 points nearly to the cent. Not that that indicates anything to a chartist, still it’s significant. The assistance line is at about 4,293 so like 50ish points, considered that the selling will be over numerous days it too can be reached without triggering panic. Most likely the bulk of the losses will be Wednesday at the close through Thursday. The expose is at 8:30 am, there remains in my mind a really good opportunity that we really rally Friday early morning. For something, we will mostly have actually marked down the negativeness with 150 S&P 500 points gotten rid of. Likewise, fingers crossed, however the PCE may simply respect us this time.

I am still bullish, though it is never ever fantastic to see the marketplace head lower rapidly

Why do I believe the Core PCE – Personal Usage Expense will bear excellent news? It holds true that Core PCE is what Jay Powell chooses to follow as an inflation sign. Nevertheless, Fed President Powell drills down into services expenses which are everything about experiences. Likewise, real estate comparable lease is another location he is really interested in. Fortunately is that the rate of climb for leas is falling difficult according to numerous posts in the Wall Street Journal previously this month “Apartment or condo lease development is decreasing quickly, moving the rental market to the occupant’s favor for the very first time in years. The average of 6 nationwide rental-price procedures from rental-listing and residential or commercial property information business reveals new-lease asking leas increased simply under 2% over the 12 months ending in May.” Will all this program up in the PCE? Federal government numbers are infamously backwards looking so it may not record all this friendly news however April no doubt had cooling leas too. So I provide the chances to less terrifying financial information. If that is so, we must bounce up rather well and maybe get to 4500+ in July even with the.25% raise. I have another factor for optimism …

Does anybody stop to consider what “long and variable lags” suggest when it concerns raising rates?

It indicates “we have no concept when the greater rates will strike the economy”. So whenever a Fed President speaks and wishes to toss a damp blanket on market interest, they begin talking raising “long and variable lags.” Could it be that the increasing market is responding “Rubbish” to this admonition? Similar to they have actually been requiring an economic downturn that has actually never ever come, the long and variable lags that were expected to sicken our economy with greater rates will never ever come too. I understand this will delight the wags will chime in with “This time it’s various” as sardonically as possible. Let’s take a minute to think about, in the olden days of the last fantastic economic downturn you got your loans from your banks, which was it. Even if you wanted to take a usurious rate as much as one’s keister (whatever that is, most likely near the lumbago). Those banks were not providing any credit, and there was no credit to be had. Now everybody and their sibling wishes to provide small companies cash. Block ( SQ) made a big offer that they were extending credit, costs Holdings ( COSTS) used me credit, and there are a lots of fintech names wanting to provide. Even hedge funds remain in the biz. So yeah it is various this time, possibly the couple of bank failures that we had, and possibly a couple of little ones are up ahead, which is the degree of the rate of interest unexpected effects. In truth, I think I have actually stated this previously, I believe the rate raises really made the economy more powerful by offering credit a genuine worth. That indicates that credit went to practical companies that revealed capital and not malinvestment like Virgin Orbit, in my viewpoint, for instance. So now Chairman Powell wishes to raise another meager 1/4 point? I do not believe it will do anything, to somebody with a hammer whatever is a nail. Raising rates gradually now will eliminate its shock worth and may be validated by the resurgent economy by reducing the rate of inflation moving forward.

So what about my trades?

I began a brand-new Call with Boeing ( BACHELOR’S DEGREE), and I want to contribute to it if it falls listed below 200 once again. The stock responded to the news that Spirit AeroSystems ( SPR) machinists went on strike. Listed below 205 is my very first buy point for bachelor’s degree and I think I will be rewarded. First of all, bachelor’s degree has a great deal of fuselages in stock, this was because of bachelor’s degree accepting and spending for them throughout the pandemic to keep the lights on at SPR. Second of all, the union has them over a barrel, and as long as they do not get greedy, SPR and bachelor’s degree will likely sweeten the offer. They require to raise wages to attract employees to this profession, this is much like the Railway Strike. They will take yes for a response, though I believe that if they do not reveal something this weekend bachelor’s degree will be up to like 197ish and I will happily include more calls. This time I will ride a few of them to 220, and not be so timorous.

My next trade is returning into Oracle ( ORCL) having actually constructed out so well the last time. ORCL is now a brand name well related to AI, and its cloud service is growing like Kudzu in Georgia. Albeit their cloud service is rather little they are taking share from somebody, most likely International Service Machines ( IBM). They pay and getting re-rated with a greater P/E. So I currently have numerous calls at the 120 strike and wanting to include more as soon as ORCL breaks under 117 to 115.

I likewise when long another old-timer which is Cisco ( CSCO), they simply launched a networking chip tailored towards network interaction in an IA-centric cloud. This will take on Marvell ( MRVL) and Broadcom ( AVGO). I like this feistiness; networking might be an essential location in development for AI.

I likewise began Call Options in Green Brick ( GRBK) I believe they are on the relocation. I have it as a long-lasting financial investment, and I am seeing fly. It lastly struck me, why not get involved on the trading side, so I have a lot at the 60 strike.

That oughtta hold you. Do I believe these names can fall even more today? The response is yes, I am depending on it. I wish to purchase more entering into Friday. I may likewise place on some hedges which I will talk about with the Group Mind Members tomorrow early morning. Maybe simply arrange a neighborhood trade at 8 am to purchase the sell-off at its inmost right prior to the expose.

Have an excellent everybody, let’s not get too distressed. In the end, it will all be great.