valentinrussanov/E+ by means of Getty Images

Thesis

As the dust decides on Culp, Inc.’s ( NYSE: CULP) newest revenues report, the rare state of the business’s efficiency emerges. Reporting an EPS of -$ 0.37, beating expectations by $0.10, and income of $61.43 M, exceeding by $5.91 M, Culp, a global operator in the production and marketing of products for bed mattress and upholstered furnishings, has actually revealed strength in the middle of the monetary tumult. In spite of challenging market needs and a bleak sales outlook, Culp’s financials paint an image of possible turn-around anchored on sensible expense management, tactical restructuring, and functional performance. Nevertheless, my much deeper dive into its efficiency exposes a more disquieting truth, necessitating a “sell” ranking for its stock.

Business Introduction

Culp, Inc., headquartered in Peak, North Carolina, runs worldwide and is renowned for crafting and marketing products for bed mattress, sewed covers, and assembly packages. Their operations are mainly divided into 2 areas: the Bed mattress Fabrics department, committed to the development of materials for bed linen components such as bed mattress and box springs, and the Upholstery Fabrics department, providing a variety of material options for both domestic and business upholstered furnishings. Furthermore, they supply services incorporating window dressing setup and workplace seating options, mainly serving the hospitality and business sectors

Efficiency

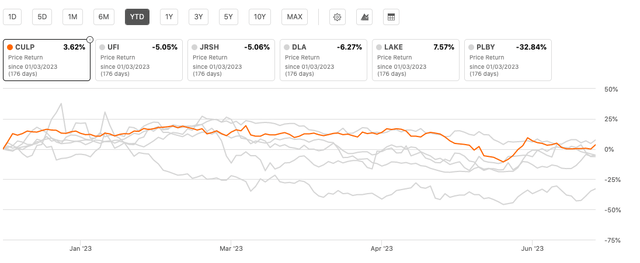

Relative to its peers in the Customer Discretionary (Textiles) sector, Culp, Inc. has actually handled to keep its head above water YTD with an extremely modest return.

Looking For Alpha

Culp’s Bullish Q4 2023 Revenues Takeaways

Culp, Inc.’s monetary outcomes for the 4th quarter show motivating indications of enhancement. Net sales showed strength, climbing up by 7.9% compared to the previous year duration. The favorable trajectory was mainly driven by greater sales in both the Bed Mattress Fabrics and Upholstery Fabrics sections, in addition to improved margins on brand-new items and functional performances. Especially, the Bed mattress Fabrics section saw a good sales boost of 3.1% year-on-year and an exceptional 24.3% sequentially, boosted by the intro of brand-new client programs.

In Spite Of a tough market need environmen t, the business’s concentrate on expense management settled, leading to lower overhead expenses. This beneficial advancement can be credited to the tactical restructuring and justification efforts executed in these locations. Furthermore, the Upholstery Fabrics section got a non-recurring client payment and saw strong need in its hospitality agreement company, representing around 32% of overall sales in the section.

While net sales for the complete experienced a decrease of 20.3% compared to the previous year, this decrease was eclipsed by the business’s significant accomplishments in boosting functional efficiency. In spite of reporting a loss from operations for the year, Culp showcased development in driving favorable results. By successfully handling working capital and reducing stock levels, the business created capital from operations and complimentary capital of $7.8 million and $6.9 million respectively, an amazing turn-around from unfavorable figures seen throughout previous .

In addition, capital costs was firmly managed, with a concentrate on necessary tasks, leading to lowered capital investment compared to the previous year. Looking ahead, the business expects capital costs for financial 2024 to vary in between $4 million and $6 million, focusing on upkeep tasks and efforts to improve quality and performance within the Bed mattress Fabrics company.

Lastly, Culp Corporation concluded the with $47.8 million, integrating money reserves of $21 million and obtaining accessibility of $26.8 million under the asset-based domestic credit center.

Evaluation

Nevertheless, the information provided listed below paints an uneasy photo for CULP.

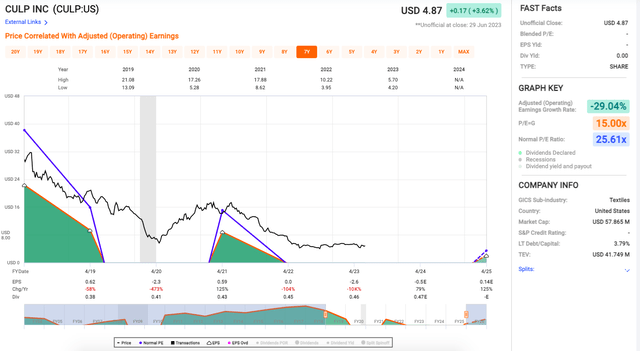

Quick Graphs/Author Photo

The essential figure here, one that leaves me significantly bearish on this stock, is the Adjusted (Operating) Revenues Development Rate of -29.04%. This down pattern reveals that the company is having a hard time to create earnings, a primary warning for any financier.

Now, let’s discuss the elephant in the space: the absence of a Mixed P/E and an EPS Yield. To put it candidly, the metrics recommend that Culp, Inc. remains in a precarious monetary circumstance. The remarkable decrease in running revenues, paired with the lack of essential success signs and dividends, signals problem.

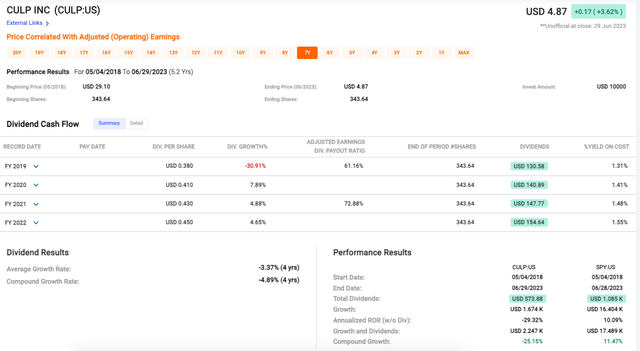

Quick Charts: 7 Year Efficiency/ Author Photo

Another figure (see above) that right away sticks out is the remarkable fall in the business’s share cost over a 5.2-year duration from USD 29.10 to USD 4.87. This sharp decrease suggests the stock has actually been underperforming and reveals the business’s decreasing worth gradually.

The Dividend Capital area supplies extra insight, revealing an erratic dividend development rate throughout the years. Despite the fact that dividends have actually somewhat increased from USD 0.38 per share in 2019 to USD 0.45 per share in 2022, the development has actually been irregular and minimal. The typical dividend development rate over 4 years stands at a worrying -3.37%, suggesting a general reduction, not development.

Furthermore, the contrast to the SPDR S&P 500 ETF Trust ( SPY) paints a plain photo. While Culp handled to create an overall dividend payment of USD 573.88 over the exact same duration, SPY offered almost double that quantity. Furthermore, the development of SPY eclipses Culp showcasing a substance development of 11.47% versus Culp’s -25.15%. The relative efficiency makes it clear that a financial investment in CULP might’ve been much better positioned somewhere else.

Sector Evaluation

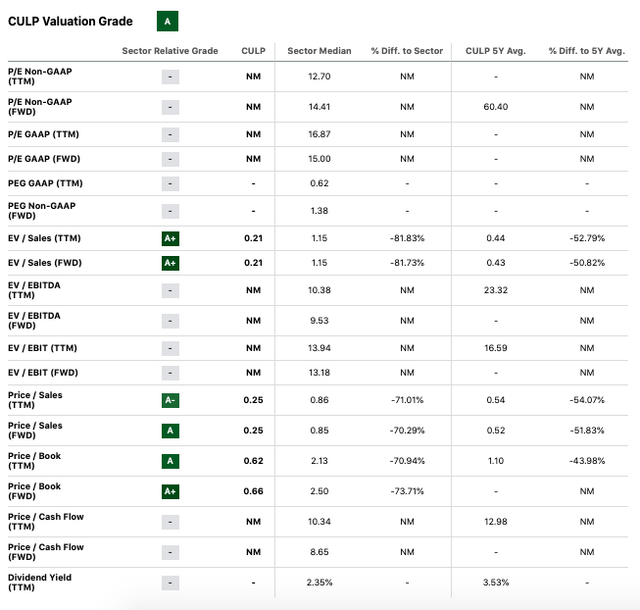

Alternatively, Culp, Inc.’s Business Worth (EV) to Sales ratios, both tracking twelve months (TTM) and forward, are complimentary. They have actually gotten an A+ assessment grade, which is excellent. It’s trading at a substantial discount rate to the sector typical– over 80% more affordable on an EV/Sales basis. That’s a motivating indication and informs me the marketplace may be undervaluing the business’s income generation possible.

Looking For Alpha

The Rate to Sales (P/S) ratios likewise indicate a comparable story. Culp, Inc. is significantly more affordable than the sector typical, and likewise cheaper compared to its five-year average. This low assessment based upon sales might show a possibly underestimated stock, presuming the business can preserve or grow its sales figures.

According to Rate to Reserve (P/B) ratios, the outlook appears favorable. The business trades at a substantial discount rate from both sector typical and five-year typical worths suggesting that market value does not precisely represent net property worth.

Threats & & Headwinds

In spite of a motivating uptick in sales throughout the 4th quarter, the business’s net sales have actually contracted by a significant 20.3% in contrast to the preceding year. This disparity points towards possible underlying troubles, ones that may leave a long lasting imprint on the business’s efficiency in upcoming financial durations.

Furthermore, a more detailed evaluation of CULP’s functional efficiency paints a rather bleak photo. The business has actually divulged functional losses for not just the last quarter however likewise the whole . Although there are tips of this unfavorable trajectory lessening with losses incrementally diminishing, the concern stays– when will the business break devoid of the shackles of these functional problems and resurface into the world of constant success? The response to this is yet uncertain.

According to management, undesirable patterns in the Residential Furnishings market, where CULP keeps a substantial grip, seem a pushing problem. The existing dull need might possibly cast a pall over CULP’s future sales and development trajectories.

Contributing to the business’s issues is the stop in dividends and the lack of any share buybacks throughout the , which raises warnings about the management’s capability to browse liquidity obstacles.

Turning our attention to the Upholstery Fabrics section, there’s an obvious uptick in SG&An expenditures that might possibly weigh on future success.

Lastly, an evaluation of the bottom lines highlights the plain truth of CULP’s financial health, that is, the bottom line for the stands at a worrying $31.5 million, a significant escalation from the previous year’s $3.2 million. This symbolizes a heightened monetary stress that might impede the business’s capability to rebound in the near term.

Last Takeaway

In Spite Of Culp, Inc.’s good efforts to simplify operations, improve item margins, and handle expenses, the overarching problems can not be ignored. Its net sales continue to agreement, functional losses continue, dividends have actually been stopped, and the company deals with obstacles within its essential market. A lot of worrying is the extreme -29.04% Changed Revenues Development Rate, which, paired with the disconcerting boost in bottom line from $3.2 million to $31.5 million, suggests significant monetary stress. Although some assessment ratios recommend undervaluation, the business’s existing health and bleak efficiency outlook necessitate me to provide a sell suggestion on the stock.

Editor’s Note: This short article covers several microcap stocks. Please understand the threats related to these stocks.