Weekly highlights

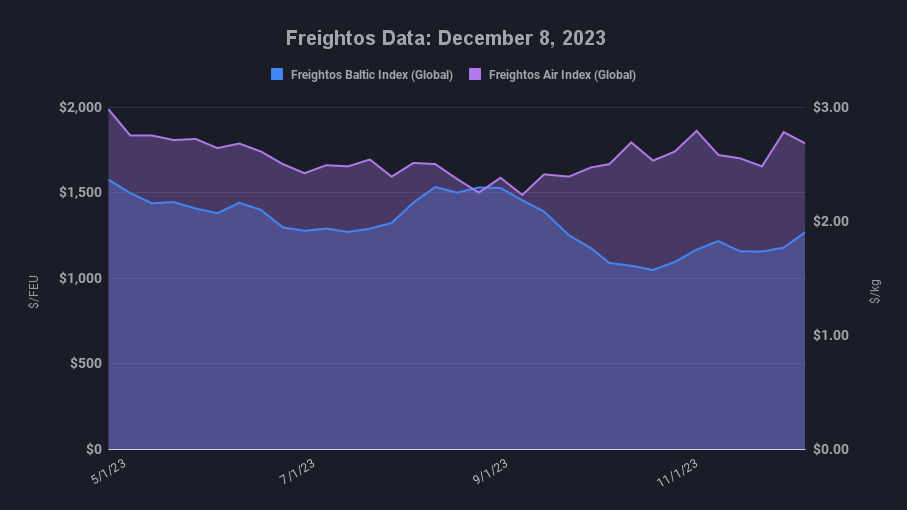

- Asia-US West Coast rates (FBX01 Weekly) fell 1% to $ 1,603/ FEU

- Asia-US East Coast rates ( FBX03 Weekly) climbed up 5% to $ 2,497/ FEU

- Asia-N. Europe rates ( FBX11 Weekly) climbed up 18% to $ 1,466/ FEU

- Asia-Mediterranean rates ( FBX13 Weekly) increased 29% to $ 2,161/ FEU

- China– N. America weekly rates reduced 7% to $ 5.88/ kg

- China– N. Europe weekly rates fell 13% to $ 3.69/ kg

- N. Europe– N. America weekly rates climbed up 1% to $ 2.16/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with immediate freight information reporting

Analysis

Asia– N. Europe and Mediterranean ocean rates increased considerably on early-month GRIs recently, with Mediterranean rates continuing to climb up up until now today. With these boosts, rates to N. Europe stay 8% listed below 2019 levels, however the sharper reach the Mediterranean has rates 32% greater than pre-pandemic.

Extra GRIs are prepared by some providers mid-month, with some revealing January GRIs also, intending to press rates past the $3k/FEU mark. Rates preserving or surpassing their current gains would likely be a function of more stringent capability decreases targeted at getting rates up throughout long-lasting agreement settlements, though there are likewise indications that need will begin to enhance ahead of Lunar New Year.

On the transpacific, rates to the West Coast have actually had to do with level given that mid-November, while East Coast rates have actually ticked up 5% though some providers will pursue West Coast rates of $1,800/ FEU and $3k/FEU to the East Coast in the 2nd half of December. Reports of more providers preventing the Panama Canal in favor of the longer path around Africa’s southern idea will cause more additional charges in the coming weeks.

In regards to need, the National Retail Federation reported that peak season really extended through October with volumes 9% greater than in 2019, before dipping in November. Forecasts through February for volumes above 2019 levels might indicate ongoing customer strength and expectations for stock restocking for after the vacations.

Houthis broadened their danger to Red Sea traffic to consist of all Israel-bound– not simply Israeli-owned– vessels today, and assaulted a tanker it declared was bound for Israel on Tuesday. A French Navy vessel helped the tanker and shot down a drone headed the tanker’s method. Extra current global actions to resolve the danger consist of more British Navy ships being released to the area, and United States sanctions targeted at interrupting Houthi funds.

The increased danger to ships in the area has actually led Maersk to sign up with providers charging a war danger premium for containers to and from Israeli ports, and ZIM will increase rates for its Asia– Mediterranean service that will prevent the Red Sea in favor of the longer path around Africa.

And throughout lanes, as providers battle with volume decreases and lower rates, some reports reveal they are looking for to boost or present other kinds of charges to increase profits in other methods, even as service levels are most likely to suffer due to growing overcapacity.

Freightos Air Index information reveal that ex-China air freight rates continued to cool today, perhaps showing that the e-commerce-driven boost in need over the last couple months might be beginning to decrease as the holiday nears. Some boost in transatlantic need has actually pressed rates as much as $2.16/ kg since recently– a 30% boost given that early October– however volumes have actually been soft compared to regular peak season levels.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.