Impressive costs describe those costs which connect to the present accounting duration however have actually not been paid up until now. These costs cause a boost in liability for a company. A few of the kinds of these costs are Impressive incomes, Impressive incomes, Impressive Interest on loan, and so on. All these costs need to be taken into consideration for calculating the present Profit/Loss of a company. These are debited to Revenue and Loss A/c under their particular accounts.

Change:

A. If Impressive Expenditure is offered outside the trial balance: In such case, 2 entries will be passed:

- Will be included the worried product (cost) at the Dr. side of Trading A/c or Revenue & & Loss A/c.

- Will be revealed on the liabilities side of the balance sheet.

B. If Impressive Expenditure is offered inside the trial balance: It will be just revealed on the liabilities side of the Balance Sheet. (Since it is an Agent Personal A/c, which has a Cr. balance)

Illustration:

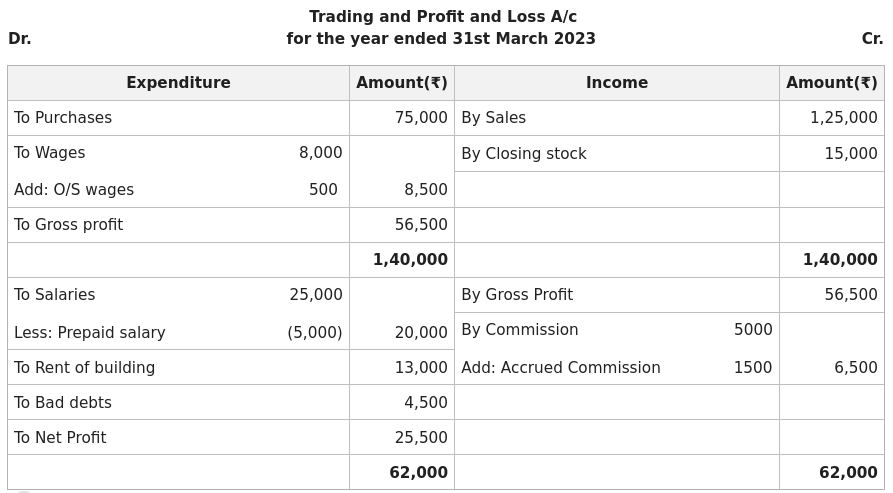

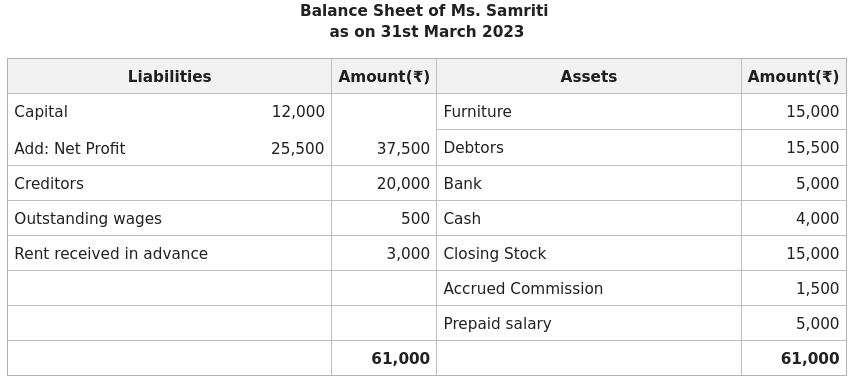

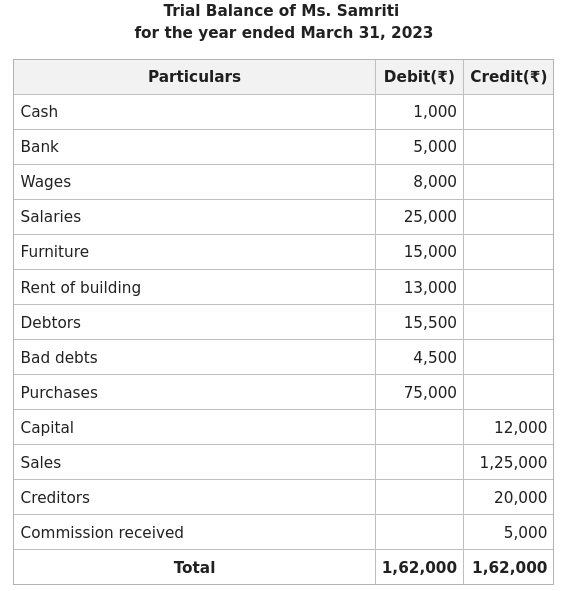

The Trial Balance of Ms. Samriti for the year ended March 31 2023, looks like follows:

The following modifications were kept in mind on that date:

1. Impressive incomes totaling up to 500.

2. Quantity of Closing stock on 31st March 2022 was 15,000.

3. Wage paid ahead of time amounting to 5,000.

4. Commission totaling up to 1,500 is still to be gotten.

5. Lease got ahead of time total up to 3,000.

Prepare Trading and Revenue and Loss A/c and balance sheet after taking the following modifications into factor to consider.

Service: