Nickel skyrocketed to its greatest cost ever in 2022, breaking through US$ 100,000 per metric load (MT).

2023 was a various story. As federal governments worked to fight inflation and financiers dealt with substantial unpredictability, products saw a good deal of volatility. Nickel was no exception, particularly in the very first half of the year.

Eventually the base metal could not keep 2022’s momentum and has actually invested the last 12 months trending downward. Continue reading to discover what patterns affected the nickel sector in 2023, moving supply, need and rates.

How did nickel carry out in 2023?

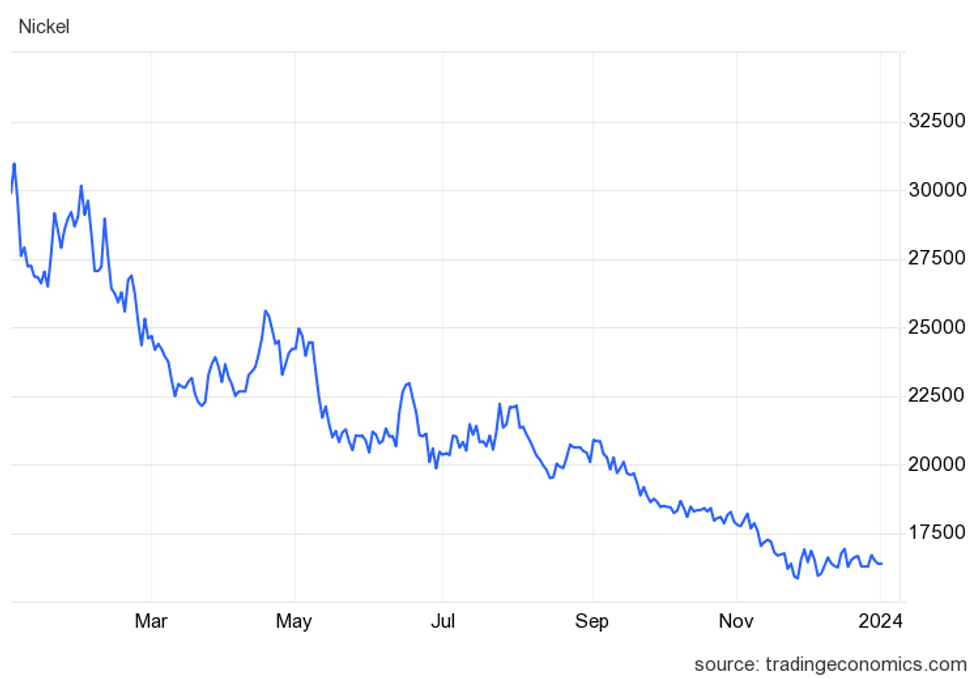

Nickel cost from January 2, 2023, to December 29, 2023.

Chart by means of Trading Economics

Nickel opened 2023 at US$ 31,238.53 on January 2, riding on the back of momentum that began in Q4 2022, and flirted with the US$ 31,000 mark once again on January 30. As January closed, the metal started to pull back, and by March 22 nickel had actually reached a quarterly low of US$ 22,499.53. It made small gains in April and Might, however invested the remainder of the year in decrease, reaching an annual low of US$ 15,843 on November 26. In the last month of the year, the nickel cost mostly changed in between US$ 16,000 and US$ 17,000 before closing the year at US$ 16,375, much lower than where it began.

Regardless of nickel’s go back to regular cost levels, 2022’s increase to more than US$ 100,000 made more headings this previous year. The considerable boost followed a brief capture, and the London Metal Exchange (LME) was slammed by some market individuals for stopping trading and canceling US$ 12 billion in agreements.

In June 2023, Jane Street Global Trading and hedge fund Elliott Associates submitted a claim for US$ 472 million in settlement for the canceled trades, specifying that the LME acted unlawfully. Nevertheless, judgment boiled down in favor of the LME on November 29 Elliott Associates has actually been given authorization to appeal the choice, which it means to do.

Indonesian supply development weighs on nickel cost.

At the end of 2022, experts were anticipating that nickel would get in oversupply area due to increased production, mostly from Indonesia and China. Talking to the Investing News Network (INN) at the time, Ewa Manthy of ING commented, “Our company believe increasing output in Indonesia will press nickel rates next year.”

This forecast became a reality– production surpluses continued to be a style in 2023, weighing on rates.

Indonesia continued its aggressive boost in nickel production, more than doubling the 771,000 MT it produced in 2020. A projection from an Indonesian federal government authorities in early December suggests the nation is on track to reach production in the 1.65 million to 1.75 million MT variety, more contributing to a growing supply excess.

In an e-mail too INN, Jason Sappor of S&P Global Market Intelligence stated nickel was the worst-performing metal in 2023 due to broadening supply. “We as a result anticipate the worldwide main nickel market surplus to broaden to 221,000 MT in 2023. This would be the biggest worldwide main nickel market surplus in ten years, according to our quotes,” he stated.

The factor for Indonesia’s greater output in the last few years is that the nation has actually been working to get higher worth through the production chain, and in 2020 strictly managed export of raw nickel ore. This choice required refining and smelting efforts in the nation to increase quickly and generated foreign financial investment.

In H2, Indonesia’s efforts to fight prohibited mining caused hold-ups in its mining output quota application system. While the nation initially stated it would start to procedure applications once again in 2024, absence of supply required steel manufacturers to acquire nickel ore from the Philippines to fulfill need, and Indonesia eventually released short-term quotas for Q4.

Nickel need obstructed by weak Chinese healing.

Supply is just part of the issue for nickel. Entering into 2023, Manthy recommended need would be affected by China’s zero-COVID policy, which had actually been impacting the nation’s realty sector. “China’s relaxation of its COVID policy would have a substantial result on the steel market, and by extension on the nickel market,” she stated.

This concept was echoed by experts at FocusEconomics, who kept in mind, “The durability of the Chinese economy and the nation’s handling of brand-new COVID-19 break outs are crucial elements to see.”

While China ended its zero-COVID policy in December 2022, the year that followed was less than perfect for the nation, with sharp decreases in realty sales and 2 significant designers seeing ongoing problems. In August, China Evergrande Group (HKEX: 3333) applied for insolvency in the United States, and at the end of October, Nation Garden Holdings (OTC Pink: CTRYF, HKEX:2007) defaulted on its financial obligation. Due to the fact that the Chinese realty sector is a significant chauffeur of steel need, this has had a remarkable influence on nickel and is among the main causes for its cost retreat.

There have actually likewise been larger ramifications for the Chinese economy. Deflation has actually been activated in the nation as its outsized home sector implodes, with downstream results for the more than 50 million individuals used in the building and construction market. Some, consisting of the International Monetary Fund and Japanese authorities, have compared the circumstance in China to Japan in the 1990s, when that nation’s real estate bubble burst and developed financial chaos.

With unpredictability swarming, China’s reserve bank still isn’t prepared to start cuts on its secret 5 year loan prime rate, however it has actually been working to enhance market liquidity to promote realty sector development. In help of that, it cut the reserve requirement ratio by 25 basis points two times in 2023, decreasing the quantity of money reserves banks need to keep on hand.

Up until now, these stimulus efforts have not had much result on the realty market, and its ongoing battles have actually guaranteed that products connected to the sector, consisting of nickel, are still trading at depressed rates. China has actually pledged to continue to deal with its financial policy by getting rid of buying limitations on home purchasing and offering much better access to financing genuine estate designers.

EVs not improving nickel cost right now.

Nickel is among numerous metals that has actually been identified as important to the shift to a low-carbon future. It’s vital as a cathode in the production of electrical lorry (EV) batteries, and when INN talked to Rodney Hooper of RK Equity at the end of 2022, he kept in mind that individuals were at first rather conservative on their quotes of EV sales.

Nevertheless, that’s now started to alter. “That’s all switched on its head now. EVs represent a huge portion of nickel need, and they will continue to increase moving forward,” Hooper discussed at the time.

While the EV outlook stays intense, the sector hasn’t grown quickly enough to offset decreasing steel sector need for nickel. And with restricted charging facilities, variety issues and the results of higher-for-longer rate of interest, EV sales slowed in 2023. The downturn is welcome news for battery makers as it will enable them time to develop out factories and more establish innovation, however it’s bad for financiers and manufacturers of nickel searching for rates gains

Financier takeaway.

2023 wasn’t a fantastic year for nickel. It dealt with increasing supply versus reduced need from both the Chinese realty sector and slower EV sales. The rebound in the Chinese economy that was expected after COVID-19 limitations were eliminated never ever took place, and rather it has actually fallen back even more, pressing into deflationary area.

Nickel financiers might feel a little stung at the close of the year, particularly as unpredictability in the market continues.

Do not forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct financial investment interest in any business discussed in this post.

Editorial Disclosure: The Investing News Network does not ensure the precision or thoroughness of the info reported in the interviews it carries out. The viewpoints revealed in these interviews do not show the viewpoints of the Investing News Network and do not make up financial investment suggestions. All readers are motivated to perform their own due diligence.

From Your Website Articles

Associated Articles Around the Web