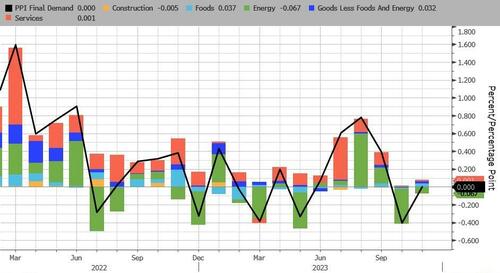

After collapsing 0.5% mother in October (the most because April 2020) on the back of plunge in fuel rates, experts anticipate Manufacturer Costs to be the same mother in November and they were area on (although October was modified as much as a 0.4% mother decrease).

Heading PPI YoY decreased to +0.9% – the most affordable because June.

Source: Bloomberg

Leaving out food and energy, the core PPI was cooler than anticipated, the same mother in November versus expectations of a 0.2% mother increase. That dragged the Core PPI YoY to 2.0% – its least expensive because January 2021 …

Source: Bloomberg

Energy was as soon as again a huge motorist of the decrease …

While Food and Solutions inched greater mother …

… thanks to as 58.8% rise in the cost of chicken eggs.

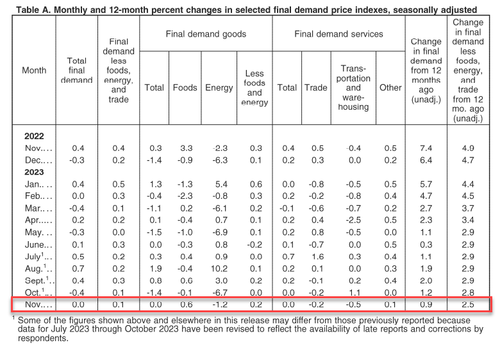

Last need products:

The index for last need products was the same in November after dropping 1.4 percent in October. In November, cost boosts of 0.6 percent for last need foods and 0.2 percent for last need products less foods and energy balance out a 1.2-percent decline in the index for last need energy.

Item information: Within last need products in November, rates for chicken eggs leapt 58.8 percent. The indexes for fresh fruits and melons, energy gas, electrical power, and carbon steel scrap likewise moved higher. On the other hand, rates for fuel fell 4.1 percent. The indexes for processed poultry, commercial chemicals, jet fuel, and melted petroleum gas likewise moved lower.

Last need services:

The index for last need services stayed the same in November, the like in October. In November, rates for last need services less trade, transport, and warehousing edged up 0.1 percent. Alternatively, the indexes for last need trade services and for last need transport and warehousing services decreased, 0.2 percent and 0.5 percent, respectively. (Trade indexes determine modifications in margins gotten by wholesalers and merchants.)

Item information: Within the index for last need services in November, rates for tourist lodging services increased 4.0 percent. The indexes for deposit services (partial); health, appeal, and optical products selling; food and alcohol wholesaling; and garments, shoes, and devices selling likewise advanced. On the other hand, margins for vehicle selling (partial) decreased 5.1 percent. The indexes for chemicals and allied items wholesaling, portfolio management, furnishings selling, and truck transport of freight likewise fell.

There was some more excellent news: intermediate PPI, commonly viewed as a leading indication to last PPI, stays securely in deflation …

Source: Bloomberg

This all appears like excellent news however we advise readers that the swing aspect continues to be product rates, which in turn depend upon just how much stimulus China picks, just how much oil OPEC+ will pump and just how much crude Biden will silently discard to keep gas rates low into the election year.

Filling …