Gold’s newest pullback in May short-circuiting strong seasonals disappointed a lot of traders. It was driven by heavy gold-futures offering in action to a sharp US-dollar rally, which in turn was partly sustained by hawkish remarks from leading Fed authorities. When they promote for more rate walkings, the dollar captures a quote generating gold-futures offering. However traders weight Fedspeak method too extremely offered its miserable performance history.

In my kind of work as an expert speculator and financial-newsletter man, I carefully see the marketplaces all the time every day. For a quarter century now I have actually studied real-time cost action and newsflow, concentrating on what is moving markets and why. As each trading day unfolds, I in fact type up notes consisting of links to pertinent short articles and charts. Adding to a couple pages a day, these are later on utilized to compose newsletters.

This play-by-play understanding is vital for effective trading, as cost patterns are constructed on causal chains of newsflow. Comprehending their cause-and-effect development is essential for video gaming whatever is most likely following. It’s inadequate to understand that gold or the benchmark United States Dollar Index moved substantially on any offered trading day, why they moved is more crucial. Fedspeak has actually played an increasing function recently.

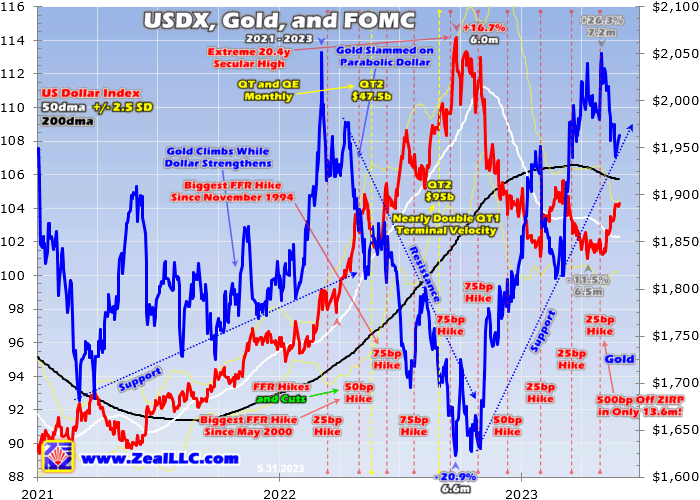

Gold’s present upleg was truly reinforcing in early Might, powering up 26.3% in 7.2 months to $2,050 on the fourth! That was within spitting range of the yellow metal’s small all-time-record closing high of $2,062 in early August 2020. Gold’s newest high-water mark came the day after the Fed’s Federal Free market Committee treked its federal-funds rate by another 25 basis indicate a variety midpoint of 5.13%.

Gold’s short-term cost action is controlled by speculators’ gold-futures trading, since of the severe utilize intrinsic in that world. They want to the United States dollar for their main trading hints. As gold rose in early Might into and after that newest FOMC conference, the USDX was wandering along near current lows. In a bearishness after shooting parabolic in 2015 on the Fed’s severe rate walkings, it struck an 11.7-month low in mid-April.

Hawkish Fedspeak sure wasn’t the only factor gold and the dollar reversed hard given that. Gold was truly overbought then, extended method approximately 1.132 x its 200-day moving average. Although that stayed well under upleg-slaying extremes above 1.160 x, severe overboughtness significantly ramps chances for healthy pullbacks to rebalance belief. And the USDX was oversold at 0.956 x its own 200dma, arguing for a bounce.

FOMC monetary-policy conferences are held about every 6 weeks, with choices launched Wednesdays at 2:00 pm. Surprisingly leading into those, leading Fed authorities undergo official blackout durations where they can’t speak openly or approve interviews. Those run from the 2nd Saturdays prior to conferences to the Thursdays instantly after. So from April 22nd to Might fourth, there was no Fedspeak throughout the current blackout.

Gold’s counter-seasonal Might pullback fired up on Jobs Friday the 5th with a 1.6% loss. That was primarily driven by another huge benefit surprise in April’s regular monthly United States tasks report, with 253k tasks apparently included compared to +180 k anticipated. However a late-day gold rebound was scuttled by remarks from the St. Louis Fed’s president. The Federal Reserve is in fact a central-bank system consisted of twelve local banks

That afternoon he informed press reporters, “the aggressive policy we pursued in the last 15 months has actually stemmed the increase in inflation, however it is not so clear we are on” a course to the Fed’s 2% inflation target. He stated he would require to see “significant decreases in inflation” to persuade him more rate walkings weren’t essential. Traders thoroughly listen when leading Fed authorities speak, moving futures-implies rate-hike chances appropriately.

The USDX’s technical bounce truly sped up a week later on, rising a huge 1.2% throughout the 11th and 12th which pressed gold a proportional 1.0% lower. That was generally due to installing worries Congress would stop working to reach a US-debt-ceiling handle time to avoid a technical default, Fedspeak wasn’t an aspect. Those concerns flared once again on the 16th, driving safe-haven dollar purchasing slamming gold 1.3% lower to $1,989.

That was its very first close listed below the psychologically-heavy $2,000 line in a couple weeks, truly speeding up the pullback-fueled bearish belief shift. Then the USDX’s most significant everyday rise in Might up 0.7% fired up a couple days in the future the 18th. The resulting big gold-futures offering knocked gold another 1.3% lower to $1,957. More hawkish Fedspeak was accountable, extending gold’s overall pullback to 4.5% in a couple weeks.

In addition to the lots regional-Fed presidents, the FOMC likewise consists of the Federal Reserve Board of Governors. It has actually 7 members designated by United States presidents and authorized by the senate for 14-year staggered terms The Fed chair and vice chair are constantly 2 of these 7. That day there was a phalanx of hawkish remarks from a guv and 2 local Fed heads, which truly moved markets.

The brand-new Dallas Fed president spoke in San Antonio, alerting “The information in coming weeks might yet reveal that it is suitable to avoid a conference. Since today however, we aren’t there yet. We have not yet made the development we require to make. And it’s a long method from here to 2% inflation.” Right after a Fed guv at a various location included “Inflation is expensive, and we have actually not yet made enough development on lowering it.”

” Beyond energy and food, the development on inflation stays an obstacle.” Then later on that St. Louis Fed president, who is the most flamboyant and attention-craving leading Fed authorities, chimed in once again stating “it might require securing some insurance coverage by raising rates rather more to ensure that we truly do get inflation under control”. Futures-implied rate-hike chances at the FOMC’s mid-June conference rose on all that.

After gold began bouncing, more hawkish Fedspeak turned it south once again on the 22nd. Relating to treking the FFR once again at the FOMC’s next conferences, the Minneapolis Fed leader stated “What is necessary to me is not signifying that we’re done … it might be that we require to go north of 6%”. That would need 4 more 25bp walkings this year, even after the Fed’s blistering 500bp of treking off no in simply 13.6 months into early Might!

Never ever one to be upstaged for long, that extravagant St. Louis man believed “I believe we’re going to need to grind greater with the policy rate in order to put adequate down pressure on inflation and to return inflation to target in a prompt way … I’m believing 2 more relocations this year … I have actually typically promoted quicker instead of later on.” That uber-hawkish Fedspeak assisted drive the dollar greater and gold lower for a couple of days.

By the 25th, gold’s overall mid-May pullback degraded to 5.4% over numerous weeks. That substantial selloff was sustained by increasingly-big gold-futures offering generated by the United States Dollar Index’s parallel 2.8% rise because very same period. Both relocations showed huge turnarounds, as evident in this chart. It superimposes Fed rate walkings over both the USDX and gold, which have actually been extremely inversely associated over the previous year approximately.

Once again it is necessary to understand that Fedspeak wasn’t the only motorist of the dollar bouncing and gold selling off in Might. Lots of other newsflow contributed, especially significant United States economic-data releases consisting of regular monthly United States tasks, customer inflation, wholesale inflation, and retail sales. However futures-implied rate-hike chances truly rose on the above and other hawkish remarks from leading Fed authorities, driving gold-futures trading.

The good news is this newest Fedspeak stretch is unwinding, with the official blackout duration leading into the FOMC’s June 14th conference beginning this Saturday the 3rd! So for the majority of the next couple weeks, federal-funds futures, the United States dollar, and gold are going to be trading without hawkish spewings from leading Fed authorities bullying them around. That need to either slow or reverse the dollar’s bounce and gold’s pullback.

After extremely studying the marketplaces for years, I’m truly shocked traders take Fedspeak so seriously. The large bulk of Fedspeak moving markets originates from those twelve regional-Fed presidents, which are a varied and vibrant lot fast to suggest on Fed monetary-policy instructions. The political-appointee guvs in Washington are typically much quieter, speaking method less typically and more hesitant to move markets.

The excellent paradox of all this is those local Fed heads driving Fedspeak newsflow are simply tokens without any genuine power! The Federal Free Market Committee has twelve ballot members who choose Fed financial policy at each conference. Those 7 guvs consisting of the chair and vice chair constantly have 7 of those twelve votes. They have an ironclad managing bulk by style, and constantly vote together.

So the staying 5 FOMC votes held by local Fed presidents are useless, constantly outgunned. The New york city Fed president has a long-term vote due to its nearness with stock exchange. That leaves an irrelevant 4 staying votes to be divided amongst the eleven other local Fed heads! Those are turned amongst those people on a yearly basis with Chicago, Dallas, Minneapolis, and Philadelphia in for 2023.

With all the monetary-policy power focused in the hands of the guvs, why do traders even care what the local Fed presidents are stating? Yes they all concern all monetary-policy conferences, sitting at the table taking part in conversations. However with just a 3rd of the FOMC votes, their viewpoints truly do not matter By all accounts the Fed chair persuasively manages the conferences, and the guvs vote with him.

So when he speaks, traders truly do require to listen! If he states something indicating a diverging monetary-policy course from what traders anticipate, markets require to transfer to get used to that. However local Fed heads talking are simply sound. Those tokens are helpless to sway the FOMC. Even even worse, they have a disappointing performance history in anticipating Fed rate choices that need to damage their reliability as forecasters.

With every-other FOMC conference, the Fed releases a Summary of Economic Projections detailing where leading Fed authorities anticipate essential metrics to head in the future. Private projections from all FOMC members consisting of both guvs and local Fed presidents are aggregated and anonymized. Those people all task where they anticipate United States GDP, core PCE inflation, and the federal-funds rate to enter coming years.

The latter is summed up in the well-known dot plots, which traders mistakenly take as gospel despite the fact that the Fed chair himself occasionally refutes putting excessive stock in them! Much like traders wagering with fully grown cost patterns, Fed authorities’ projections are usually incorrect near significant turning points in rates. The FOMC’s first rate trek in today’s beast treking cycle got here nearly 15 months back in mid-March 2022.

Ever Since the FOMC treked that impressive 500 basis indicate that midpoint target-range FFR level of 5.13%. Yet at that really conference when the Fed birthed this rate-hike cycle, those very same leading Fed authorities who did all that treking forecasted the FFR leaving 2022 at simply 1.88%. However the real FFR midpoint at the end of in 2015 was significantly greater at 4.38%! These are simple mortals without any crystal balls, and typically alter their minds.

The current dot plot was launched at the FOMC’s 2nd conference ago in late March 2023. Then these leading Fed authorities anticipated the FFR to stay at its present 5.13% at year-end 2023. After seeing the dot plot come a cropper to forecast future FFR levels for many years, it would be stunning if this newest one shows appropriate. Traders now believe the Fed will need to begin cutting quickly, to fight an economic crisis sustained by its aggressive walkings.

There are numerous examples of leading Fed authorities’ FFR outlooks in those quarterly dot plots showing hugely incorrect compared to what in fact took place. I have actually composed thoroughly about them in our newsletters throughout the years, as dot plots can truly move the dollar and gold. Provided the Fed people’ horrible performance history for in fact anticipating future FFR levels, traders truly should not care much about what they’re stating.

Gold’s substantial 5.4% Might pullback was driven by heavy gold-futures offering in the face of a parallel huge 2.8% rise in the United States Dollar Index. All that was primarily sustained by increasing futures-implied Fed-rate-hike chances at coming FOMC conferences. Hawkish Fedspeak played a huge function in driving traders’ moving expectations like typical. And the majority of that originated from the local Fed presidents who are a long-term minority on the FOMC.

Jointly they have no power to set or modify the Fed’s financial policy unless the managing guvs wish to. Which phalanx of aggressive Fedspeak is ending as the next blackout duration ahead of the FOMC’s upcoming mid-June conference begins Saturday. So there’s a great chance May’s gold pullback and USDX bounce both driven by that Fedspeak will stall or reverse in coming weeks, which is bullish for gold.

While gold’s substantial pullback last month did ramp bearish belief, it truly wasn’t a huge offer in the grand plan. Back in February, gold suffered a larger 7.2% pullback activated by a legendary upside surprise in regular monthly United States tasks. However that didn’t last long, and gold quickly reversed difficult to power 13.2% greater into early Might nearly accomplishing that brand-new small record close! However regrettably gold-stock traders still went crazy.

Throughout Might’s numerous weeks when gold fell 5.4%, the leading criteria GDX gold-stock ETF plunged 15.2%! That produced 2.8 x disadvantage utilize to gold, on the high side of the significant gold miners’ typical 2x-to-3x variety. That exaggerated gold-stock discarding is leaving some excellent deals in its wake, even in fundamentally-superior smaller sized mid-tier and junior gold miners. So gold-stock traders need to be preparing to purchase

This effective gold upleg is because of resume quickly with the Fed lacking space to keep treking. That will decrease the effectiveness of Fedspeak jawboning to move markets. With June being the peak summer-doldrums month for both gold and its miners’ stocks, the timing of gold’s turnaround might drag out a bit. However traders require to be all set with a great-gold-stocks wish list. When gold-futures purchasing returns, it ought to increase quick.

Effective trading needs constantly remaining notified on markets, to comprehend chances as they develop. We can assist! For years we have actually released popular weekly and regular monthly newsletters concentrated on contrarian speculation and financial investment. They make use of my large experience, understanding, knowledge, and continuous research study to discuss what’s going on in the markets, why, and how to trade them with particular stocks.

Our holistic incorporated contrarian technique has actually shown really effective, and you can profit for just $12 a concern. We thoroughly research study gold and silver miners to discover inexpensive fundamentally-superior mid-tiers and juniors with outsized upside capacity. Register totally free e-mail notices when we release brand-new material. Even much better, subscribe today to our well-known newsletters and begin growing smarter and richer!

The bottom line is gold’s hawkish-Fedspeak-driven Might pullback has likely primarily run its course. Leading Fed authorities have actually been talking difficult on future rate walkings, today they need to give up with the next FOMC conference nearing. That need to assist reverse current heavy gold-futures offering into purchasing, reigniting gold’s cut off upleg. Damaged gold stocks will fly greater with gold, making quick gains for clever contrarians.

Futures traders truly should stop stressing over Fedspeak anyhow. Leading Fed authorities have a disappointing performance history of anticipating rate patterns, specifically near turning points. And the local Fed presidents who are accountable for a lot of market-moving Fedspeak jointly have no genuine ballot power in the FOMC. As traders figure this out and the Fed lacks space to keep treking, Fedspeak’s effect on gold need to diminish.

Adam Hamilton, CERTIFIED PUBLIC ACCOUNTANT

June 2, 2023

Copyright 2000 – 2023 Passion LLC ( www.ZealLLC.com)