The pioneering iBuyer intends to bring its share cost back above the New York Stock Exchange’s $1 minimum limit.

In these times, double down– on your abilities, on your understanding, on you. Join us August 8-10 at Inman Link Las Vegas to lean into the shift and gain from the very best. Get your ticket now for the very best cost

With the approval of investors, having a hard time iBuyer Offerpad will carry out a reverse stock split Monday in a quote to conserve the business from being delisted from the New York Stock Exchange.

Offerpad got a noncompliance notification from the exchange on Nov. 15 after the closing cost of the business’s shares fell listed below the needed $1 average over a successive 30-day trading duration.

Shares in Offerpad had briefly rose above $1 in February after the business revealed a strategy to raise $90 million from existing financiers, consisting of CEO Brian Bair, Roberto Sella and First American Financial Corp. However shares in the pioneering iBuyer stopped working to preserve the minimum $1 average over 30 trading days.

Offerpad’s board of directors revealed the 1-for-15 reverse stock split on June 8, the very same day financiers authorized the relocation at the business’s yearly investor conference. After markets close Monday night, every 15 shares of exceptional Offerpad typical stock will be immediately transformed into one share.

The stock split impacts all investors evenly and does not modify any investor’s portion interest in the business. So in theory, a minimum of, each share in Offerpad will deserve about 15 times as much when the New York Stock Exchange opens on Tuesday.

Shares in Offerpad, which over the in 2015 have actually traded for as low as 37 cents and as much as $3.80, closed at 52 cents Monday, down 19 percent from Friday’s close of 64 cents.

There’s no warranty that Offerpad’s share cost will get an increase from the reverse split that’s precisely proportional to the decrease in exceptional shares. However Monday’s closing cost suggests that each share in Offerpad must deserve more than $7 on Wednesday– well above the New York Stock Exchange’s $1 minimum limit.

Offerpad’s board of directors suggested the reverse stock split in an April 24 proxy declaration, stating it “might be” an efficient methods of gaining back compliance with the exchange’s minimum share cost requirements.

” The board thinks that continued listing on the [New York Stock Exchange] offers total trustworthiness to a financial investment in our stock, offered the strict listing and disclosure requirements of the NYSE,” financiers were informed. “Significantly, some trading companies prevent financiers from buying lower-priced stocks that are sold the over the counter market due to the fact that they are not held to the very same strict requirements.”

In addition, a greater stock cost “might assist create financier interest in the business and aid draw in, keep, and inspire workers,” the board encouraged financiers. Some prospective workers “are less most likely to work for the business if we have a low stock cost or are no longer noted on the [New York Stock Exchange], despite the size of our total market capitalization.”

Valued at $2.7 billion when the business went public in a September 2021 SPAC merger with Spencer Rascoff-led Supernova Partners Acquisition Business Inc., Offerpad’s market capitalization is better to $200 million today.

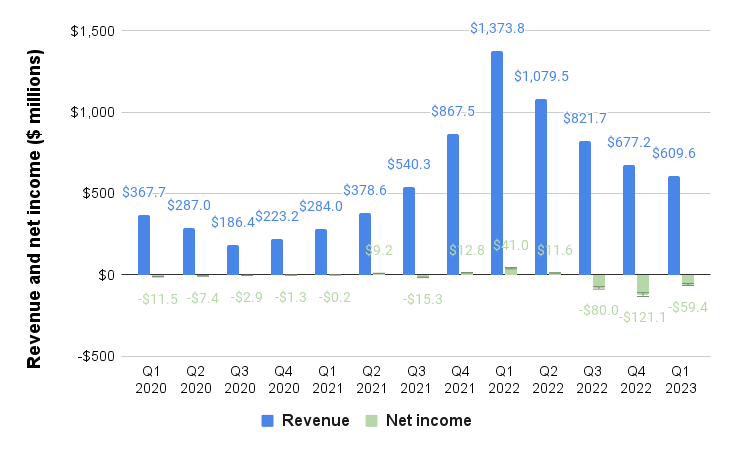

Offerpad stems losses

Source: Offerpad regulative filings

After generating record profits ($ 1.37 billion) and earnings ($ 41 million) throughout the very first quarter of 2022, Offerpad has actually published 4 successive quarters of decreasing profits and hasn’t paid because the 2nd quarter of 2022.

Other iBuyers likewise had a hard time in 2015 as increasing home mortgage rates and house rates took a toll on house sales. However Offerpad handled to cut its Q1 2023 bottom line to $59.4 million, about half of the $121.1 million bottom line it acquired in the previous quarter.

To weather the recession, Offerpad has laid off half its labor force and offered 99 percent of its “tradition” stock throughout Q1 2023, obtaining simply 364 houses.

In the meantime, Offerpad has actually rotated to mainly offering “property light” services that enhance deals and help with sales straight to purchasers, instead of purchasing and offering homes itself.

Offerpad’s Direct Plus service links institutional purchasers with sellers, and the business is likewise offering restoration as a service. The business likewise sees chances to develop its bottom line by bundling secondary services, such as home mortgage, title and restorations.

In reporting first-quarter incomes, Offerpad stated it anticipates to offer 400 to 550 houses throughout Q2 2023, with anticipated profits of $140 million to $200 million and an adjusted loss of in between $25 million to $40 million.

While the $90 million personal positioning revealed in February watered down existing financiers’ stake in Offerpad by 65 percent, it extended the business’s money burn runway by 6 months to a year, according to experts at Keefe, Bruyette & & Woods (KBW) led by Ryan Tomasello.

” Closing a $90 million personal positioning when the macro environment postured considerable obstacles to accessing capital was a considerable achievement,” Offerpad Chairman and CEO Brian Bair stated in a letter to investors prefacing the business’s 2022 yearly report. “In addition, involvement by existing and brand-new investors showed continued self-confidence in our technique and our capability to drive long-lasting worth for our clients and investors.”

Bair stated Offerpad is “now all set to move on and profit from future chances with a 2023 tactical strategy that integrates things we have actually gained from previous experience and looks for to broaden upon our existing strengths.”

Get Inman’s Home Mortgage Quick Newsletter provided right to your inbox. A weekly roundup of all the most significant news worldwide of home loans and closings provided every Wednesday. Click on this link to subscribe.