Galeanu Mihai

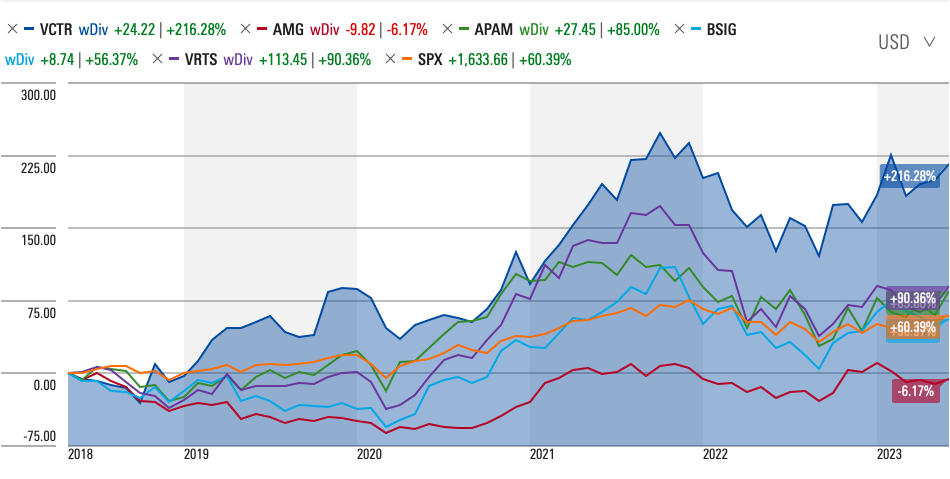

Diversified worldwide property supervisor, Triumph Capital Holdings, Inc. ( NASDAQ: VCTR), has actually grown overall investor return (TSR) by more than 216% compared to simply 61% for the S&P 500 ( SPX) and 30% for its peer group. With a performance history of methods beating their criteria, and the changing costs dealt with by financiers, there is a great basis to think that the property supervisor can continue to grow AUM. The company is trading at appealing P/E multiples and its complimentary capital (FCF) are offered at a yield of 10%, compared to 2.3% for the marketplace. In General, Triumph Capital looks set to be a strong entertainer in the years ahead.

A Success Lap on the Stock Exchange

In the last 5 years, Triumph Capital’s share rate has actually valued by over 189%, compared to almost 61% for the S&P 500, while the company’s peer group mean share rate increased by over 11%. Triumph Capital’s TSR increased by over 216%, while its peer group TSR increased by simply over 30%. The company’s peer group includes Affiliated Managers Group, Inc. ( AMG), Craftsmen Partners Possession Management, Inc. ( APAM), BrightSphere Financial Investment Group, Inc. ( BSIG), and Virtus Financial Investment Partners, Inc. ( VRTS).

Source: Morningstar

The concern for financiers is whether the company stays a great bet over the next couple of years, or whether it’s time to look in other places. Our thesis is that nonreligious patterns indicate the company’s ongoing stock exchange quality in the long-lasting.

Nonreligious Development of AUM

The bulk of Triumph Capital’s income is obtained through possessions under management (AUM). Organizations, intermediaries, retirement platforms and private financiers are brought in to the company’s conventional and alternative financial investment methods, and, the bigger AUM, the greater the charges that the company will make. This naturally presumes that these methods are, typically, able to beat their criteria. This is the easy reasoning that drives business. Grow AUM and carry out on the methods.

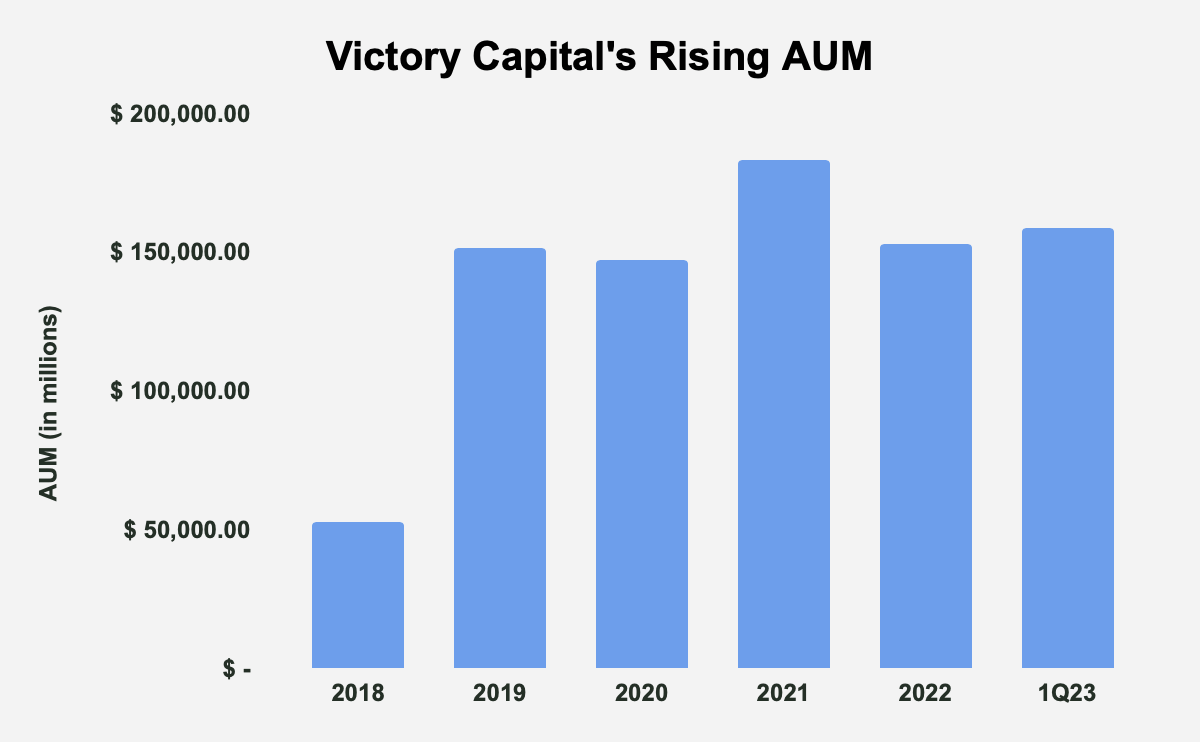

In Between 2018 and 2022, Triumph Capital grew AUM from $52.8 billion to $153 billion, intensifying at 23.7% a year. In 1Q23, AUM stood at $158.6 billion.

Source: Triumph Capital Holdings, Inc. Filings and Author Computations

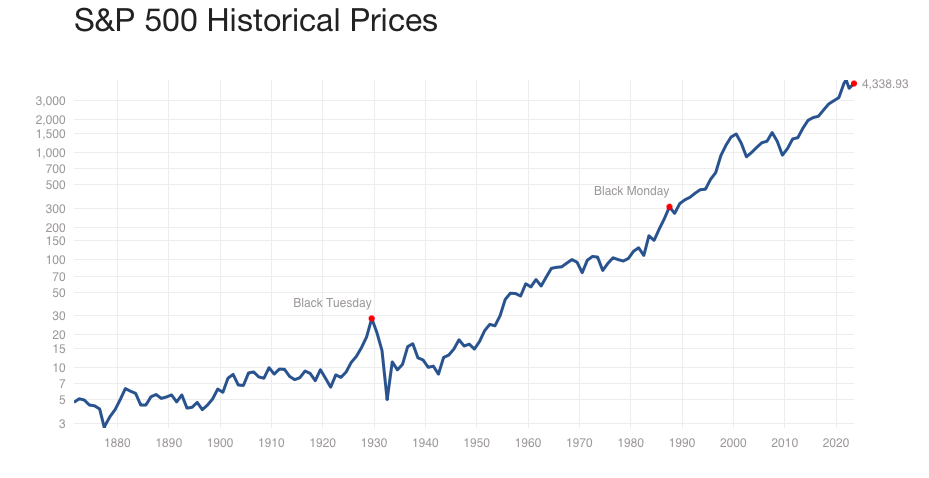

There are factors to think that AUM will continue to increase. Mostly, the march of industrialism is, essentially, about growing the quantity of capital within the financial system, with the rate of that capital decreasing with time. This has actually definitely held true for the last 8 centuries of worldwide history That capital needs to be invested, whether it remains in the conventional or alternative financial investments. When you take a look at the stock exchange, for instance, the result has actually been a nonreligious development in the S&P 500.

Although stock exchange undergo boom-and-bust cycles, as Jeremey Siegel’s work has actually revealed, over the long term, stock exchange tend to increase in worth. Naturally, this is presuming that a fund’s technique does not blow the fund up. This is clear from taking a look at a chart of the S&P 500.

Source: Robert Schiller

In the post-Great Economic crisis duration, this pattern has actually been offered extra assistance, with federal governments significantly loath to suffer high and lengthy stock exchange decreases. Even now, as analysts speak about completion of simple cash, that thesis has actually not actually been checked. Since financiers have this guarantee that essential markets will be bailed out, financiers are more going to trade, increasing liquidity and property worths, attracting a lot more financiers, financiers who can use still-historically low rate of interest. Considered that need for possessions is increasing, however the supply of those possessions is reasonably inelastic, rates have another factor to pattern upwards in the long run. So, while property rates might take a hit on any given year, in the long run, property supervisors have factor to think that they can grow AUM. In reality, even with zero-growth, AUM can still increase if property rates, on aggregate, increase. Favorable inflows are simply the icing on the cake.

Changing Expenses

Unless a possession supervisor blows up, they do not usually deal with outflows that are of an existential magnitude. This is since customers suffer huge changing expenses from moving from one property supervisor to another. Due diligence needs to be carried out, there are threats in altering horses mid-course, the brand-new property supervisor might show even worse than the present, and the present property supervisor might enhance returns after a customer has actually left. Inertia tends to specify how customers deal with property supervisors. All a possession supervisor requires to do is to get reputable outcomes, and they can keep their customers. They require not fear a huge exodus of customers just since another property supervisor is doing effectively, since the very same changing expenses use. Their task is more unfavorable: remain in the video game.

Triumph Capital’s History of Profitable Methods

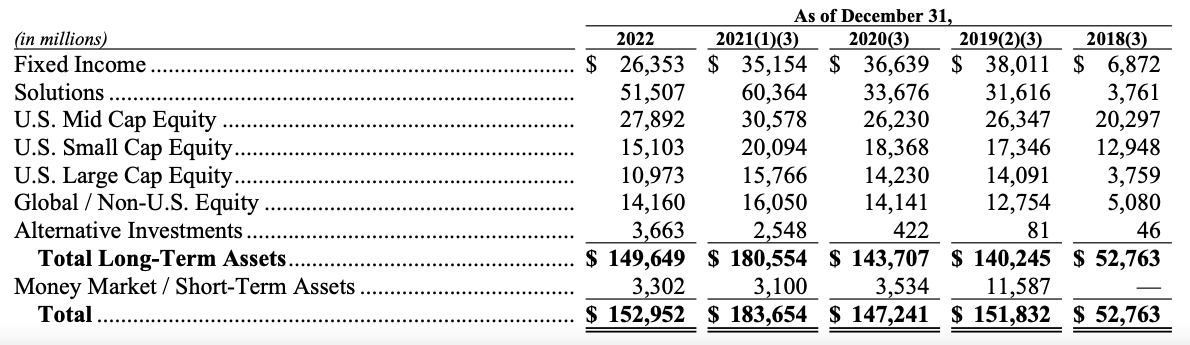

Triumph Capital uses 128 financial investment methods, assigning capital to set earnings, Solutions, U.S. mid cap equity, U.S. little cap equity, U.S. big cap equity, global/non-U. S. equity, alternative financial investments, and cash market/short-term possessions.

Source: Triumph Capital Holdings, Inc. 2022 Yearly Report

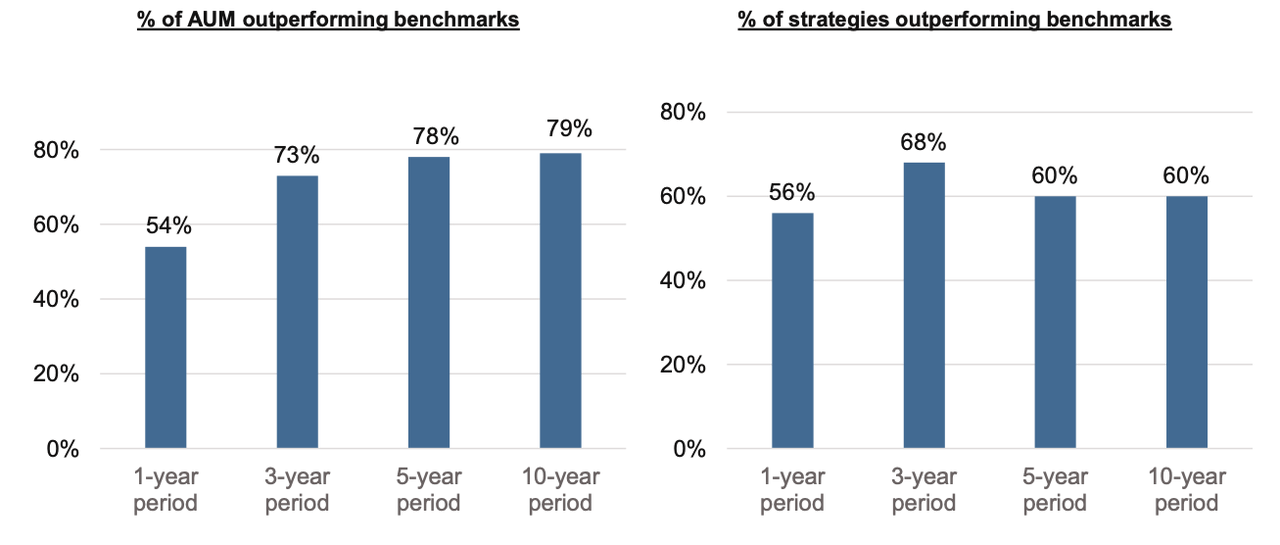

The company’s methods have actually been really effective. In 2022, the Triumph Funds complex was ranked 2nd amongst Barron’s Finest Fund Households for the 1 year duration, initially in the Mixed Possession classification, and 2nd in the U.S. equity classification, while its USAA Mutual Funds were ranked 26th for the 1 year duration. Since 1Q23, 44 of its overall shared funds and ETFs had 4 or 5 star general rankings from Morningstar, and 66% of its overall shared funds and ETFs AUM had 4 or 5 star general rankings. Most of the company’s AUM outshined its criteria over a 1 year to 10-year duration, and a bulk of its methods outshined their criteria over a 1 year to 10-year duration.

Source: Triumph Capital Holdings, Inc. 1Q23 Revenues Discussion

Triumph Capital is, just, doing enough to guarantee that AUM has a flooring, which customers need to reconsider prior to leaving the company. In result, a financier needs to question, “Is it worth it to leave Triumph Capital?”, and for the long-lasting financier, the response is, “No”.

Appraisal

Triumph Capital has a price/earnings multiple of 9.12, compared to 25.12 for the S&P 500, and 7.54 for its peer group. The business’s gross success, at 0.17, is not appealing, disappointing the 0.33 limit developed by proof, and which is the peer group average. Lastly, the company has a FCF yield (FCF/enterprise worth) of 10%, compared to a mean FCF yield of 2.3% for the 2000 biggest companies in the U.S., as determined by New Constructs So, the company seems trading at appealing multiples relative to the marketplace.

|

Business |

Ticker |

Market Cap (in billions) |

5-Year Share Cost Development |

5-Year TSR |

Gross Success |

ROIC |

P/E Ratio |

FCF Yield |

|

Triumph Capital Holdings, Inc. |

VCTR |

$ 2.17 |

189.11% |

216.28% |

0.17 |

30.70% |

9.12 |

14.77% |

|

Associated Managers Group, Inc. |

AMG |

$ 5.27 |

-8.36% |

-6.17% |

0.25 |

26.40% |

5.73 |

21.54% |

|

Craftsmen Partners Possession Management, Inc. |

APAM |

$ 2.52 |

14.02% |

85.00% |

0.71 |

18.20% |

13.34 |

8.86% |

|

BrightSphere Financial Investment Group, Inc. |

BSIG |

$ 0.93 |

44.17% |

56.37% |

0.73 |

19.50% |

10.75 |

8.66% |

|

Virtus Financial Investment Partners, Inc. |

VRTS |

$ 1.55 |

69.43% |

90.36% |

0.22 |

6.20% |

12.90 |

10.70% |

|

Peer Group Average (excl. Triumph Capital) |

$ 12.44 |

11.24% |

30.07% |

0.33 |

28.79% |

7.54 |

12.90% |

Source: Business Filings and Author Computations

Conclusion

Triumph Capital has a relatively easy company design, and relatively easy objectives: it needs to grow AUM and guarantee that most of its shared funds and ETFs beat their criteria. In this method, the property supervisor will avoid considerable outflows, grow incomes and success. The record reveals that the business has actually undoubtedly had the ability to make strong returns from its methods. Moreover, nonreligious, industry-wide aspects support a belief that a nonreligious development in AUM is quite supportable. Provided these aspects, Triumph Capital need to meet its easy objectives. In addition, the company is trading at really appealing multiples and its FCF are offered at a substantial discount rate to those of the marketplace. In other words, Triumph Capital stock appears like a great bet for the long-lasting.