zhaojiankang/iStock by means of Getty Images

After a data-filled week (United States CPI, FOMC), we can now take stock on the technical photo of the marketplaces. In general, regardless of looking a little prolonged, the uptrends in numerous sectors continue to look healthy.

Emerging markets and products establishing for relocation higher

I am interested by the strength in emerging markets (consisting of China) and products. The USD concluded the week on a weak note; this is crucial as the USD traditionally has actually had an unfavorable connection versus emerging markets and products (weaker USD = more powerful EM, more powerful products).

From the everyday chart of the Dollar Index listed below, we can see that the USD is now trading listed below its crucial moving averages (10, 20, 50, 200 day). It searches course to check the 100– 101 assistances, and if those break, the USD might start its next leg lower.

Daily Chart: Dollar Index

Risk-on currencies are likewise looking useful versus the USD, which offer a healthy background for emerging markets and products to advance. Here is the Australian Dollar, which has actually broken out greater from a multi-month base versus the USD. The Australian Dollar has favorable connections with copper costs, iron ore costs, and China stocks

Daily Chart: AUD/USD

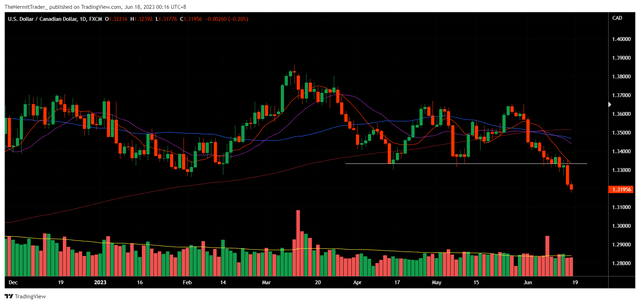

The Canadian Dollar, which has a high favorable connection with oil costs, considered that Canada is a big oil exporter, has actually broken out versus the USD.

Daily Chart: USD/CAD

Within the product equity area, I am viewing copper miners ( COPX) carefully. I believe copper miners look much better than their product peers – steel miners ( SLX), in addition to oil & & gas stocks ( XOP) ( XLE) ( XOP) ( OIH) ( FCG). I like that copper miners have actually been constructing a base for 2 years, and rate has actually increased above the crucial weekly moving averages.

Weekly Chart: COPX

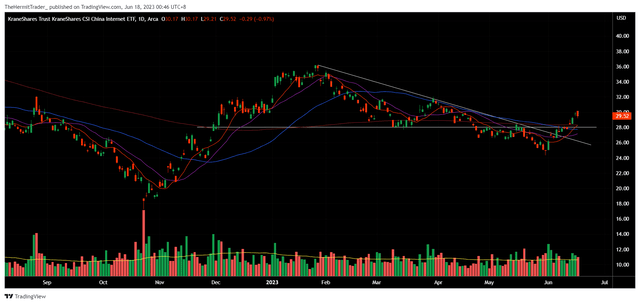

China innovation ( KWEB) has actually broken out above drop resistance that has actually included costs given that January. I am viewing to see how the sector holds up throughout its next pullback.

Daily Chart: KWEB

Pinduoduo ( PDD) is among the stocks I keep in this area. The stock broke out greater from a tiny base after beating profits. I went long at 76.91 (green line), with a stop at 70.90 (red line), and have actually given that cut a 3rd of my position.

Daily Chart: PDD

Here is NetEase ( NTES), another leader within the China innovation sector. The stock has actually broken out greater from a multi-month base.

Daily Chart: NTES

Li Car ( LI) is not an innovation stock, however is another leader within the China area. It broke out from a multi-month base after its current profits repelled in May. Ever since, the stock has actually been trending greater, and has actually gained from another driver today, which revealed brand-new highs on its weekly sales numbers. I went long at 29.41 (green line), and have actually given that moved my stop to breakeven. I have actually lowered my position by a quarter.

Daily Chart: LI

Vipshop ( VIPS) is another leader within the China innovation area. Notification how the stock was going sideways when the sector was selling, and after that breaking out greater from this variety ahead of its peers. I took a long position at 17.99 (green line), after Powell’s speech today.

Daily Chart: VIPS

Far From China, other emerging markets are likewise seeing strong momentum. Argentina ( ARGT) (surprise, surprise …) has actually been a strong outperformer this year, and just recently broke out from a big base.

Daily Chart: ARGT

Latin America ( ILF) has actually broken out from a big multi-month base.

Daily Chart: ILF

Total, today’s huge financial occasions have actually resulted in a pullback in the USD, which is now susceptible to another 1.5% drop prior to it consults with assistances.

While the marketplace’s attention has actually been on the renewal in AI, semiconductor, and innovation stocks, the current weakening in the USD has actually accompanied strength in product and emerging market stocks. Perhaps, this has actually gone under the radar.

Product stocks have actually gone sideways for months, and China stocks are on the cusp of coming out from among its most unpleasant bearish market. I think that if the USD breaks listed below its assistances, it would lead the way for its next leg lower. Simultaneously, product and emerging markets might shift into effective uptrends.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.