yullz

Dear readers,

In this post, I’ll upgrade you on the benefits and capacity of buying concrete, particularly Holcim ( OTCPK: HCMLY). I’m a big-time financier in Concrete – or a minimum of I was till Heidelberg Products ( OTCPK: HDELY) breached the EUR75/share native rate target – which is where I offered the last of my stake in the business. You can see the existing share rate of that business there.

Heidelberg Products, Nordnet ( Nordnet)

The reason that I offered concrete, and Heidelberg, is not due to the fact that it’s a bad organization or I do not see more possible long-lasting benefit, however due to the fact that I invested at simply over EUR40/share typically, which implies that I handled to eke out an extremely remarkable RoR in an extremely brief time – and there are much better capacities on the marketplace than waiting on Heidelberg to recognize much more of its benefit.

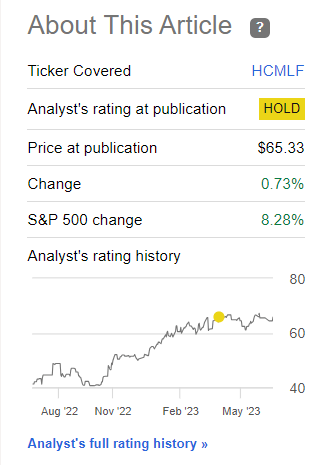

I state this, due to the fact that the very same, or much of the very same, takes place to be real for Holcim. Given that I discussed Holcim last and offered you my neutral “HOLD” score, the business has actually hardly recovered cost. The S&P is up practically 8.5% given that April – Holcim isn’t even up 1%.

Holcim RoR ( Looking For Alpha)

Similar To Heidelberg, due to the fact that we’re discussing an market here, Holcim has, I think, reached what it has the ability to grab the time being, and I see much better options somewhere else.

I wish to crystallize this viewpoint for you in this post, and ensure you comprehend where it is originating from.

Let’s start.

Holcim – It’s a great time for some earnings rotation

If you follow my work, you’ll understand that I are among the factors not shy about informing you when I’m purchasing, however likewise when I am turning. I have no worry of leaving a favorable financial investment “prematurely”, and whenever I enter into a financial investment, I have an “exit” target also, though in some cases those targets can be incredibly lofty.

I like buying Concrete/aggregates due to the fact that it’s an extremely ageless sort of financial investment, and I do not believe the section or the business in the section are going anywhere. Their organization designs are reasonably easy to comprehend. The business offer services and products that do refrain from doing well if they require to be carried cross countries, so it’s a reasonably easy cycle, offered you comprehend a few of the impacts.

Holcim has an extremely various asset/portfolio profile from Heidelberg. I would identify it as more “qualitative” than what we see in Heidelberg due to the fact that Heidelberg is affected by its purchase of ItalCementi. On the other hand, Holcim can not produce as inexpensively as Heidelberg, however what it produces comes at a less expensive CO2 tax.

Typically speaking however, Holcim and Heidelberg have relatively various profits and profits profiles. If one business increases in a quarter, it’s most likely the other will also.

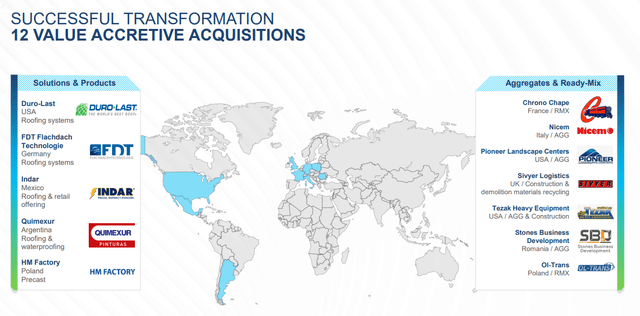

So too in 1Q23. In the trading upgrade, the business saw a strong start to the year with natural sales development of 8%, EBIT development of 12% and 12 appealing M&A’s. Holcim stays among the most climate-aligned concrete business in the sector, and they likewise updated their 2023E assistance.

Here are a few of the brand-new names that Holcim contributed to its portfolio.

Holcim IR ( Holcim IR)

In general, the business with the exception of its Argentina direct exposure, has a considerably various threat profile geographically than Heidelberg also, which has more direct exposure to APAC. The business is likewise a near-leader in worldwide net-zero carbon concrete.

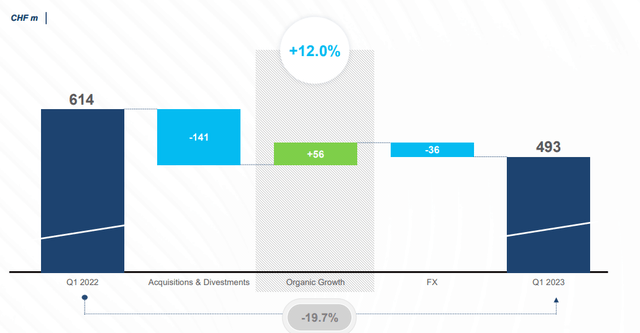

Regardless of the business’s natural development in regards to EBIT, the real EBIT itself was lower than in 1Q22 – however this is because of business divestments and acquisitions that have actually not yet begun to contribute to the business’s sales. YoY the real number is practically a 20% decrease, as seen listed below.

Holcim EBIT ( Holcim IR)

However, positives consist of exceptional local development in NA, LATAM, EU and Africa/ME. Need is constantly strong, with many effects originating from the roof section. The business’s orderbook however, is well-filled. LATAM saw its 11th successive quarter of success, driven by Mexico, Colombia and Argentina with excellent tasks and pipelines. Even anemic Europe saw strong efficiency, with margin growth driven by non-commoditized high-value services, the very same thing that Heidelberg is attempting to focus a growing number of on. Africa and Middle East were exceptional also though, seeing substantial margin growth, a considerable boost in alternative fuels, and a healing in China noticeable overall.

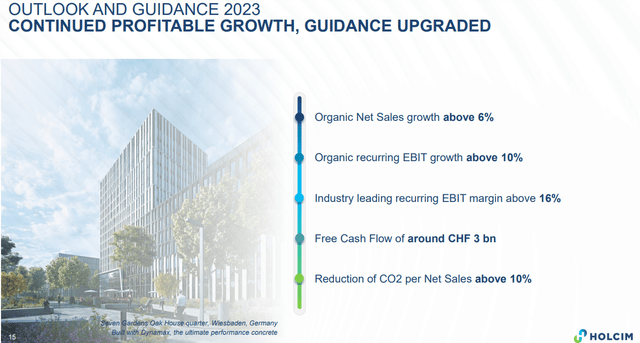

There wasn’t much unfavorable to be stated for Holcim for the quarter, and this is driving what is an excellent level and outlook for the business’s full-year assistance.

Holcim IR ( Holcim IR)

The problem for the business isn’t quality or results – the problem for Holcim is assessment, which we’ll enter in a bit here.

What I wish to state is that with a near-40% gross margin, Holcim is truly among the first-rate, highest-margin, and most affordable financial obligation (1.9 x to EBITDA on a net financial obligation basis) concrete services around. It’s likewise Swiss, which I view as another unique benefit. Its existing dividend yield of around 4.2% remains in no other way bad and is really at a 2-year high regardless of its assessment. The business’s only unfavorable patterns that I might see from a high level are the releasing of long-lasting financial obligation and an ROIC that’s still lower than the typical weighted expense of capital. however if you follow my short articles on concrete business, you’ll understand the computations for the replacement worth of existing properties, and why a few of these computations, offered the replacement worth, do not truly make good sense. It’s the factor Heidelberg and Holcim are obtaining, instead of developing brand-new properties (or part of them, a minimum of).

What we wish to take a look at when it concerns Holcim moving forward are truly macro-level patterns. The business, regardless of troubles in part of the United States markets, anticipates favorable lead to roof. It’s a complex market, due to the business over the previous couple of years seeing a lack in particular feedstock, specifically a plasticizer that’s caused interruptions in supply. This has actually caused overstocking at the specialist level, as many merely purchased what they could, understanding there was an interruption. This is now what’s stabilizing – still, outcomes are anticipated to stay in the favorable variety for the business.

1Q is constantly the tiniest quarter from the year – so the business’s assistance upgrade is really worth keeping in mind here, and take a look at whether it’s based upon volume or margins (i.e. rates). The business is on a favorable cost-over-price basis in each and every single area, with expenses peaking (similar to Heidelberg) at some point throughout 3Q in 2015 due to energy rates, to name a few things. The takeaway I draw from management commentary when it concerns this is that it is a mix of margin healing from highs, along with strong need throughout numerous locations.

The concern from the Ukraine war is absolutely nothing little – and there is inflation along with a continuing greater expense of energy, and the European green offer, which puts export volumes at threat (not simply for Holcim, however for all business affected by it).

CapEx is another thing we wish to keep our eyes on. The existing strategy is 2B CHF intended on a forward basis. In this context, the financial investments in sustainability really have really remarkable returns in Europe due to the political and tax landscape – which implies we can currently assist for how margins are going to increase in Europe once these are online. The EU has a substantial decarbonization system with Carbon credits, and when Holcim satisfies this, it’s a concern of how rapidly the margins will increase.

I have excellent expectations for the business’s bottom line moving forward, however at the very same time, here are the concerns I presently see for Holcim.

Assessment for Holcim – It’s not all that excellent, regrettably

You might like Holcim here, however regrettably, there is a good quantity of drawback to the stock. Considered that the business is set to grow profits no greater than 2-3% annually in the next couple of years, you’re wagering, if you invest, on a fast awareness of margin enhancements as an outcome of the business’s green financial investments. I think these will take more time. The business presently trades at about 11.3 x P/E. This is not “high” per se, however it’s likewise above where the business has actually been most times for a minimum of the previous 5 years. Yes, the profits profile is enhancing -however still.

The business is BBB+ ranked, and it there’s one concrete business in between Heidelberg and Holcim that I would enable a premium, it’s Holcim without a doubt. However Heidelberg is (or was) a lot less expensive.

And, to be frank, I do not think Holcim to be worth 16x Stabilized P/E, which is what you ‘d wish to take a look at to see outsized returns for the business here.

Experts and assessment designs for the business are relatively divided, however I can see and display a few of the unpredictability here. 20 experts follow Holcim based upon existing patterns and work rate targets beginning at 48 to 78.5 CHF with an average for the native HOLN ticker of 63.4 CHF. That’s likewise 13 CHF greater than just 6 months ago – which I do not consider as legitimate.

Sweating off forecasted FCF, P/S numbers in a sector context, graham number (square root of 22.5 times the increased worth of the business’s EPS and BVPS – an extremely conservative/defensive financial investment assessment approach) and Peter Lynch fair-value formula, you get averages indicating a PT of 50-53 CHF. Offered where the business presently trades today, that would really suggest a modest overvaluation. It’s not precise to me – there’s capacity for the business to go higher – however it might definitely go lower also, based merely on the headwinds and capacities here.

That’s most likely why 14 out of 20 experts are at “HOLD”, “OFFER” or comparable rankings and just 5 are at “BUY”. It’s because of that, blended with my own conservative view of the whole sector, that I state that anything above 55 CHF is excessive for business here.

I went “HOLD” prior to on Holcim with a conservative PT of 52 CHF – I’m not altering this at this time, and consider this business to be too costly here also.

Thesis

- Holcim is among the most qualitative and fascinating cement business in Europe – together with peers like Heidelberg, which I consider as practically similarly appealing. It has a, 4%+ yield, and an excellent set of basics, even if there is a threat to a few of its property profile.

- I no longer see Holcim as a “BUY” – and for this business, I’m stating it’s at 58 in regards to PT, making it a “HOLD”.

- Keep in mind the high level you need to be taking a look at here. Any Cement business such as this is a play on Urbanization. The essential patterns continuous all over the world speak in the long-lasting favor of business like Holcim – which’s why I buy them. A minimum of, at the best total level.

Keep In Mind, I’m everything about:

- Purchasing underestimated – even if that undervaluation is minor and not mind-numbingly huge – business at a discount rate, enabling them to stabilize with time and harvesting capital gains and dividends in the meantime.

- If the business works out beyond normalization and enters into overvaluation, I collect gains and turn my position into other underestimated stocks, duplicating # 1.

- If the business does not enter into overvaluation however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time permits.

- I reinvest profits from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them ( italicized).

- This business is total qualitative.

- This business is basically safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently inexpensive.

- This business has a reasonable benefit that is high enough, based upon profits development or numerous expansion/reversion.

I do not see Holcim as inexpensive or as appealing enough to consider it a ‘Purchase’ at over 58 CHF. It’s a “HOLD” here.

Editor’s Note: This post talks about several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.