Dilok Klaisataporn

Intro

I constantly like to begin my short articles, when I can, by evaluating any previous protection I have actually had of a stock. This can be beneficial since I tend to have a more quantitative investing method that concentrates on numbers in my short articles instead of a story method that concentrates on a story. I initially purchased Elevance Health ( NYSE: ELV) back when it was called Anthem, for my Investing Group on 12/20/20, almost 3 years back. I produced a bullish YouTube video on the stock a couple of weeks in the future 1/10/21, and it was a stock choice in a public Looking for Alpha post the next month on 2/11/21 entitled “ There Are Bubbles All Over, However Money Is Not The Location To Be, Here Are 10 Stocks To Purchase Now”

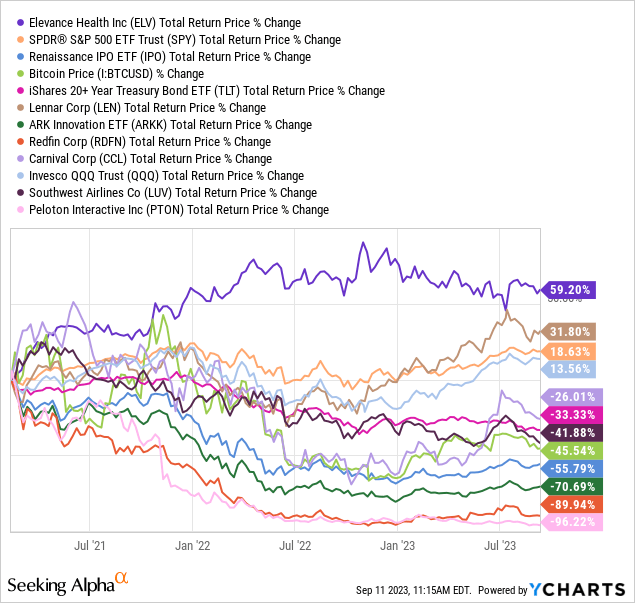

I headed out of my method to alert financiers about much of the popular market bubbles I saw at the time in early 2021.

There has actually been a great deal of discuss bubbles in the market recently, and bubbles definitely exist. Total assessments of the stock exchange, by lots of accounts, are as costly as they have actually ever been. Crypto-currencies like Bitcoin ( BTC-USD) have actually increased to uncharted area. The IPO and SPAC market is on fire. Residential realty set brand-new records in 2020. Bond yields are exceptionally low by many steps. I do not believe any of the above declarations are especially questionable. So, I expect we should not be amazed to see conversations of bubbles ending up being more regular in the monetary media. Let’s state, for the sake of argument that all of individuals declaring these markets are too costly to purchase today since they will produce extremely low or unfavorable medium-to-long-term returns (state, throughout 5-10 years) are ideal. (My good method of stating, they are bubbles.) What should financiers who want to get a prospective inflation-beating long-lasting CAGR from their financial investments do?

Possibly we ought to initially invert our thinking, and list what NOT to do if we wish to attain fairly great long-lasting returns. In order to do that, we can consider things we ought to do if our objective is to produce bad long-lasting returns. If you actually wish to guarantee you will produce bad returns over the next years you ought to 1) head out and purchase as lots of current IPOs and SPACs as you can, 2) purchase great deals of crypto-currency 3) put more than 20% of your portfolio in long-duration bonds 4) purchase stocks with low revenues yields 5) purchase stocks with PEG ratios over 3.0, 6) purchase stocks handling huge quantities of brand-new financial obligation simply to keep their companies alive, 7) purchase stocks who had a momentary 2-year lift from COVID and are now trading at high rates,

purchase a brand-new home that you do not require even if your stock portfolio has actually carried out well, 9) purchase the stocks of companies that have actually revealed proof they are being interrupted by brand-new innovation, 10) own index or shared funds that are greatly weighted with much of the above kinds of stocks, and last, however not least 11) hold great deals of money since you believe whatever remains in a bubble.

Below is a tasting of a few of the stocks and ETFs that suit the classifications I explained above. Just the homebuilders themselves have actually carried out decently as shown by Lennar ( LEN). Every other kind of stock and long-lasting bond has actually carried out inadequately ever since, and we have not even had an economic crisis, yet.

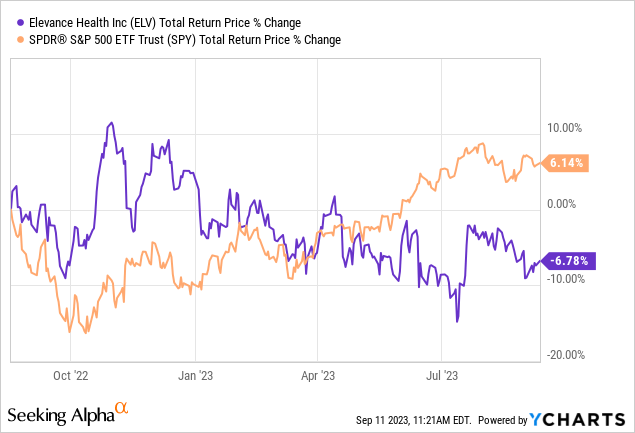

Elevance has actually carried out well, and I still own my position in spite of broader market weak point over the previous numerous years. I examined the stock as soon as in 2015 in the post “ Elevance Health: Finding Boring Stocks That Earn Money” and I ranked it a Hold at the time.

Now that the stock rate has actually revealed some weak point even while revenues have actually increased, I believed it was a great time for another evaluation where I share the rate I would want to purchase the stock if I didn’t own it currently. In this post, I will take you through my upgraded investing procedure.

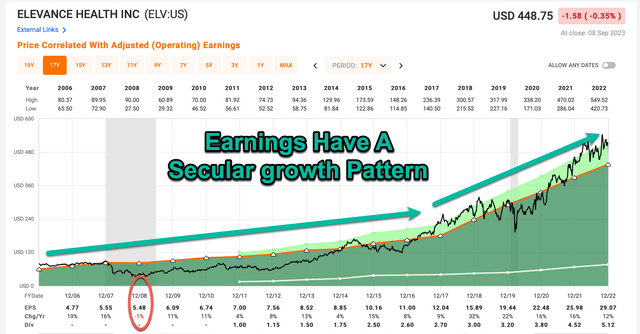

Elevance’s Historic Profits Pattern

The very first thing I constantly inspect when evaluating a stock is what the historic revenues pattern has actually been. Profits cyclicality is the main point I look for, however I likewise try to find other patterns like stagnancy, uncommon increases or decreases, or unpredictable variations that can’t be quickly discussed. If I figure out the historic revenues are cyclical, then I generally do not utilize revenues to value the stock since they can be too unforeseeable and can typically send out the incorrect signals relating to assessment. Likewise, if revenues are extremely unpredictable I in some cases instantly put the stock in the “too difficult stack” if I do not believe historic revenues are a fairly great guide for the future.

When it comes to Elevance, revenues development suffered a small -1% decrease throughout the Great Economic downturn of 2008 however has actually grown each and every single year aside from that a person for the previous twenty years. I would consider this a nonreligious development service based upon revenues, which is a quite uncommon classification. While nonreligious development never ever lasts permanently, generally a company is doing something right if it can progressively grow revenues at an excellent rate for 20 years without disruption. At any rate, there is essentially no revenues cyclicality here, so utilizing an earnings-based analysis is suitable for this service.

Elevance’s Present Assessment

This summertime I have actually been changing my assessment technique to represent 3 brand-new elements that have actually grown more appropriate in the previous number of years. Because I began utilizing this assessment technique in 2019, I have actually approximated about 1/3rd of the stock assessment by presuming the P/E of a steady-earning stock like Elevance would likely go back to its mean P/E with time. I have actually chosen to do away with that part of the analysis since I believe with greater rates of interest most likely not returning to no without a significant economic downturn, it’s not likely most stocks keep the typical P/E ratios they had when rates of interest were near 0%. So, I will no longer consist of a mean reversion part of my analysis and rather, I will just concentrate on business revenues from the viewpoint of an owner of business.

The other brand-new aspect connects to rates of interest too. In the past, I usually didn’t consist of a company’s financial obligation and other responsibilities as part of my assessment procedure since rates of interest were low so the expense of capital was low and didn’t seem most likely to alter throughout the last financial cycle. Now rates have actually increased, so as time goes on and companies require to re-finance their financial obligation with time, it’s most likely to be a drag on future revenues. On the other hand, companies with net money can in fact make a genuine rate on that money, so they ought to be better moving forward. In order to represent this, I now change the rate of the stock (for assessment functions) based upon the overall business worth of business instead of market cap.

The 3rd change I have actually made is that I a little modified the method I compute “Economic downturn Purchase Rates” for stocks in order to figure out the rates I intend to pay if I believe the threat of economic downturn is high, or if we are in fact in an economic crisis. I’ll discuss more about this later on in the post. In the meantime, let’s enter the fundamental analysis.

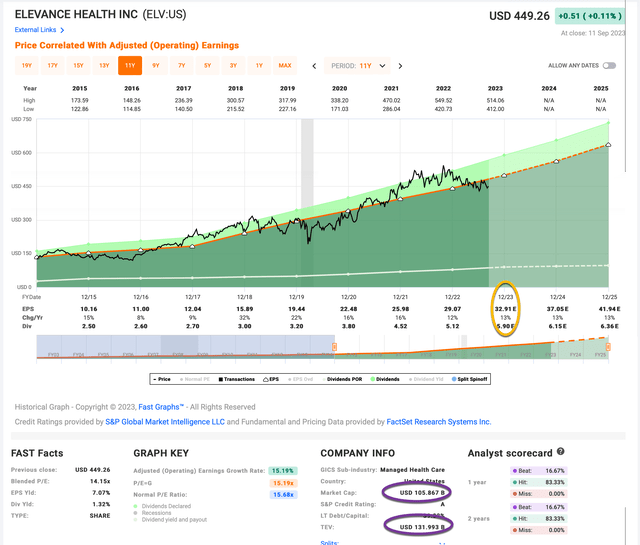

10-Year Profits CAGR Quote

One of the most fundamental method I carry out an appraisal for a steady-earning stock like ELV is to compute just how much in revenues I would likely gather over a 10-year duration if I owned business and kept all the revenues for myself. I transform that quantity of gathered revenues into a CAGR portion and utilize that portion to choose whether the assessment is appealing. I do this by utilizing a mix of revenues yield and revenues development expectations. I usually base my revenues development expectations on what the development rate has actually been over the previous cycle. In this case, I’m utilizing a period that ranges from 2015-2023.

The very first piece of info I require to approximate the 10-year service revenues CAGR is revenues, and usually I take a look at the existing year’s expert price quote since the marketplace tends to be positive. Today experts anticipate $32.91 per share this year (circled around in gold on the FAST Chart). The 2nd thing I wish to consider is financial obligation or any other responsibilities business may have, and change the stock rate utilized for the assessment appropriately. The method I do this is to divide the Overall Business Worth by the Market Cap (circled around in purple) and when we do that we see the Overall Business Worth has to do with 25% greater than the marketplace Cap. The method I change for this in my assessment procedure is to presume that the stock rate has to do with 25% greater than the rate it is in fact trading at. As I compose this ELV is trading at $447.65, so I will treat it as though the rate is actually $559.56 per share. (This most likely isn’t an ideal method to tackle doing this, however I track and cover a great deal of stocks so I attempt to have useful procedures that I can utilize rapidly while still being reasonably efficient in getting to an excellent ballpark assessment.)

When I do this, I get a debt-adjusted revenues yield of about +5.88%.

Next, I wish to approximate how quick those revenues are most likely to grow with time, and in order to do that I take a look at how quick those revenues have actually been growing, year-by-year given that 2015 while managing for buybacks (since buybacks will pump up revenues per share).

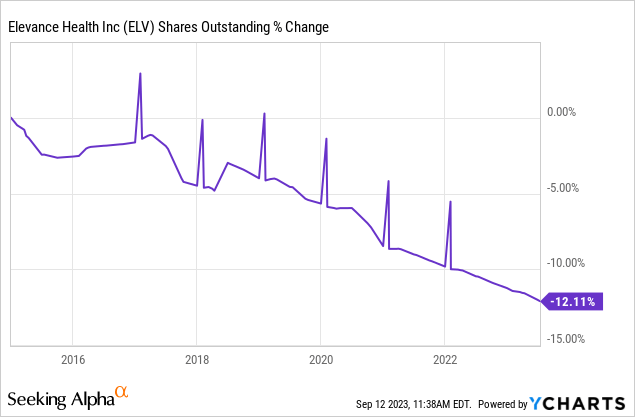

Elevance has actually redeemed about 12% of the business given that 2015. After making modifications for those I get a profits development rate of about +14.11%, which is a great revenues development rate (yet a bit more conservative than FAST Graphs’ +15.71% rate since I represented buybacks).

Next, I’ll use that development rate to existing revenues, looking forward ten years in order to get a last 10-year CAGR price quote. The method I consider this is, if I purchased ELV’s entire service for $100, it would pay me back $5.88 plus +14.11% development the very first year, which quantity would grow at +14.11% annually for ten years after that. I need to know just how much cash I would have in overall at the end of ten years on my $100 financial investment, which I compute to be about $230.53 (consisting of the initial $100). When I plug that development into a CAGR calculator, that equates to a +8.71% 10-year CAGR price quote for the anticipated service revenues returns after changing for financial obligation and other responsibilities.

10-Year, Full-Cycle CAGR Quote

Utilizing my old assessment technique, that included a mean reversion aspect and did not take financial obligation into account, I utilized a “Hold Variety” for the 10-Year CAGR in between 4% and 12%, and if it was listed below 4% the stock would generally be a “Offer”, and above 12% a “Buy”. Now that I have actually gotten rid of the P/E suggest reversion part of the price quote I have actually tightened up the “Hold” variety from 5% to 8% since there is usually a lot less change when it concerns typical service revenues than there is with the stock rate. The existing +8.71% 10-year approximated service CAGR would, under typical scenarios, make ELV a “Buy”. Nevertheless, I believe economic downturn threat in the near term is high today, so I have a more stringent requirement in location for the time being that takes economic downturn threat into account.

Economic Crisis P/E

Given That January of 2022, I have actually been changing my portfolio and getting ready for a stimulus boom/bust and a most likely economic downturn. While the majority of the stimulus cash bust has actually occurred which’s why the marketplace experienced a bearishness in 2015, due to great deals of excess cost savings, a hold-up in trainee loan payments, and lagged impacts of greater rates of interest, so far we have not had a financial recession. I study the next 6-9 months economic downturn threat in the United States stays high, though, so I am utilizing more stringent requirements for brand-new stock purchases. Among the methods I utilize to attempt to get lower rates and prevent paying excessive near financial peaks is what I call the Economic downturn P/E, a variation of which I utilized throughout the pandemic in 2020 with fantastic success. I have actually made a couple of modifications to the strategy ever since, and I’ll share those here.

For the record, I still own ELV from when I purchased it in late 2020, so what I’m sharing here is how I would identify my buy rate if I didn’t currently own it. It resembles what I’m utilizing with Humana ( HUM) today, which I do not presently own.

The believed procedure with the Economic downturn P/E is to search for the most cynical P/E the stock experienced in the past and to then be prepared to purchase the stock when it is within a specific variety of peak pessimism. For instance, if the most cynical P/E the stock experienced throughout a previous recession or economic downturn was, state a 10 P/E, then I may be ready to purchase a stock if the existing Economic downturn P/E was within 30% of a 10 P/E, or a 13 P/E. So, we aren’t attempting to select a precise bottom in the rate, mainly what we are attempting to do is utilize peak revenues to existing rate as a more steady guide to approximating how low a stock may succumb to a provided stock throughout an economic crisis when existing and forward revenues are changing a lot (and tend to go from extremely positive to extremely cynical). This is most beneficial for reasonably cyclical stocks, which ELV is not, however it can likewise work for stocks that go through unfavorable belief durations, which health insurance companies definitely do.

The method this works is I take a look at business’s history throughout a decline and I take the most affordable rate the stock was up to and develop a ratio utilizing the peak yearly revenues per share business experienced. That is the “Economic downturn P/E”. I utilize my judgment relating to which historic recession is more than likely to duplicate in the future. In ELV’s case, since lots of people believed the federal government may take control of the whole health care market in 2009, the Economic downturn P/E was unusually low, so I am utilizing 2020’s March decrease for this Economic downturn P/E price quote.

The low stock rate in March 2020 was $171.03 per share and EPS for 2019 was $19.44, which is an Economic downturn P/E of 8.80. (This tends to be a lot more beneficial for companies that have quickly falling revenues (like, state, Target ( TGT) just recently) than one where revenues are consistent, however we can see that the marketplace typically does not appreciate just the revenues and will get scared about other things too.) In ELV’s case, I would want to purchase if it got within 40% of an 8.80 economic downturn P/E, which is a P/E of 12.32, changed for financial obligation, about 9.88. I have their existing debt-adjusted P/E at about 13.53, so it is not rather to the rate it requires to be to purchase today if an individual believes an economic crisis is a high possibility. I presently have that buy rate at $324.36, which has to do with -27% lower than today’s rate. Financiers who purchase around that rate needs to have a high possibility of above-average long-lasting returns. And, notably, if there is an economic crisis, there is a great opportunity (much better than 50%) that rate hits.

Conclusion

Whether Elevance stock is a bargain today mainly depends upon just how much economic downturn threat there remains in the broader economy. I believe the economic downturn threat is quite high, so if I was searching for an entry point over the next couple of months, I believe under about $325 per share is where I would intend. If an individual does not believe an economic crisis within the next year or two is most likely, then Elevance is a bargain today. The average anticipated 10-year service revenues CAGR for the S&P 500 I approximate has to do with 5% to 5.5%, while Elevance at today’s rate is more like 8% to 9% if the revenues patterns given that 2015 continue. Possibly Elevance will not have the ability to grow at those sort of rates moving forward, I do not have a trusted method to understand that, however it has an excellent performance history and good margin of security compared to the broader market today.