PeopleImages/iStock through Getty Images

Intro

Established in October 2020, Centessa Pharmaceuticals ( NASDAQ: CNTA) is a clinical-stage company dedicated to producing transformative medications. Making use of an “asset-centric” technique, the business got 11 pre-revenue biotech companies in January 2021 and went public in June 2021. It has considering that reorganized its management and subsidiaries, concentrating on a varied pipeline that covers early to late-stage advancements in high-value, underserved medical locations. The business goes for regulative approval to interrupt existing treatment paradigms and use multi-billion dollar markets.

The following short article evaluates Centessa’s monetary position, drug pipeline, and financial investment capacity. It highlights the business’s liquidity, varied pipeline, and appealing drug prospect ORX750 for Narcolepsy Type 1.

Q2 Profits Report

Taking a look at Centessa’s latest revenues report, the business had $303.6 M in money and equivalents since June 2023, boosted by $15M from ATM sales in August. They predict this will fund operations into 2026. R&D expenditures reduced to $33.7 M, compared to $53.7 M in Q2 2022. G&An expenditures were a little down at $13.3 M. Bottom line narrowed to $24.9 M, assisted by a $24.1 M tax advantage.

Money Runway & & Liquidity

Relying on Centessa’s balance sheet, the business has present properties of $145.2 M in money and money equivalents and $158.4 M in short-term financial investments, amounting to $303.6 M in liquid properties. From the Consolidated Statements of Money Flows, the net money utilized in running activities over the last 6 months is $91.9 M, equating to a month-to-month money burn rate of around $15.3 M. With this rate, the projected money runway has to do with 19.8 months. It is very important to keep in mind that these figures are based upon previous information and ought to not be entirely trusted for anticipating future efficiency.

Centessa seems in a relatively liquid position, however its high rate of money burn might require extra funding. The business has long-lasting financial obligation of $73.3 M, suggesting some utilize however not a frustrating problem relative to its properties. Based upon these elements, it appears possible that the business might protect extra funding, although the beneficial regards to such funding would be contingent on future functional turning points and market conditions. These are my individual observations, and other experts may translate the information in a different way.

Capital Structure, Development, & & Momentum

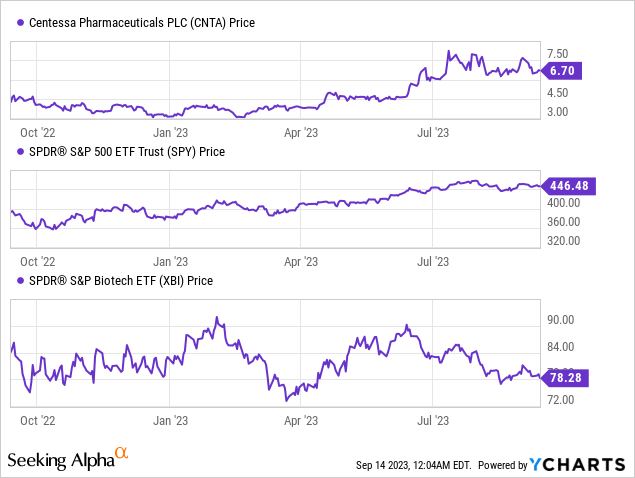

According to Looking for Alpha information, Centessa has a moderate debt-to-market cap ratio, balanced out by a considerable money cushion for monetary stability. The company’s business worth is $433.87 M. Currently in the medical phase, earnings generation appears a couple of years off. Current stock patterns reveal robust momentum, especially exceeding the S&P 500 over numerous durations.

With a diverse pipeline and a targeted technique, Centessa uses development capacity, contingent on conquering medical and regulative difficulties.

Centessa Targets High-Value Medical Niches

Centessa’s pipeline targets high-value medical specific niches with ingenious methods.

-

SerpinPC for Hemophilia: A subcutaneously administered prospect in Stage 2a trials, it intends to minimize bleeds with an unique system and has actually protected FDA Fast lane and Orphan Drug classifications.

-

LB101 and LB206 in Oncology: Making use of LockBody innovation, these prospects provide targeted growth treatments while restricting systemic toxicity. LB101 remains in Stage 1/2a trials, while LB206 reveals preclinical guarantee.

-

ORX750 for Sleep Disorders: This orally-administered OX2R agonist remains in preclinical advancement and targets Narcolepsy Type 1 (NT1), with capacity for more comprehensive applications in sleep conditions.

Each prospect intends to supply a separated service in their particular markets. For a much deeper check out how Centessa prepares to affect the sleep condition market, let’s look into the details of ORX750.

Centessa’s ORX750 Targets Orexin for Lasting Wakefulness

ORX750 is taking its own specific niche in the field of narcolepsy treatments. With essential information to be showcased at the upcoming World Sleep Congress, this orally readily available OX2R selective agonist intends to attend to the source of NT1 by concentrating on orexin neurotransmission.

Points of Distinction:

-

System of Action: Unlike Belsomra, Dayvigo, and Quviviq, which generally work by causing sleep, ORX750 promotes wakefulness by targeting the orexin receptor. The drug was created utilizing a style rooted in high-definition protein crystallography, along with a supported OX2R receptor protein.

-

Strength and Selectivity: ORX750 has showed amazing selectivity over human OX1R, 9,800-fold in vitro tests, and showed complete agonist abilities at human OX2R with an EC50 of 0.11 nM, compared to orexin A’s EC50 of 0.035 nM.

-

In vivo Effectiveness: Arise from PiezoSleep assays and EEG/EMG/video evaluations show ORX750 substantially raises wakefulness, reduces cataplexy episodes, and extends the time prior to sleep and cataplexy occasions in Atax mice, an accepted design for human NT1.

-

Security Metrics: While TAK-994, another orexin receptor agonist, revealed excellent effectiveness in enhancing wakefulness and lowering cataplexy, it failed due to hepatotoxic adverse effects. ORX750’s security profile will for that reason be a vital focus, possibly separating it from TAK-994.

-

Effectiveness and Security Balance: The approaching information discussion at the World Sleep Congress is excitedly waited for, as it’s anticipated to provide thorough insights into both the effectiveness and security of ORX750. Offered the effectiveness and effectiveness that TAK-994 showed, ORX750 stands to take advantage of equivalent efficiency, supplied it shows a beneficial security profile.

ORX750 is poised to possibly change NT1 treatment by straight dealing with the underlying shortage in orexin. For both financiers and clinicians, the information to be exposed at the World Sleep Congress ought to supply indispensable insights into this appealing prospect’s effectiveness and security.

My Analysis & & Suggestion

In concluding my dive into Centessa Pharmaceuticals, numerous bottom lines stick out. Initially, the business’s varied pipeline, assisted in by its asset-centric design, uses numerous opportunities for prospective success. This diversity works as a risk-mitigating technique, guaranteeing the business has numerous “shots on objective.”

Economically, Centessa is fairly well-positioned. With $303.6 M in liquid properties, the business has a monetary buffer that might last up until 2026. Although future funding might be needed due to a high money burn rate, a moderate long-lasting financial obligation of $73.3 M makes the possibility of protecting extra funds possible.

Of specific interest is ORX750, a preclinical prospect targeting NT1. Its special system and appealing preclinical information make it a possession worth seeing. Nevertheless, it’s essential to keep in mind that the drug remains in its nascent phases. Financiers ought to eagerly anticipate the World Sleep Congress for more thorough information that might verify ORX750’s guarantee.

While the drug’s security profile stays a topic of upcoming information, the requirement for such a profile that attends to formerly observed imperfections in options like TAK-994 can not be overemphasized. In a field filled with problems, the capability to show both effectiveness and security will be essential.

Offered Centessa’s monetary health and varied drug portfolio, I tend to suggest a speculative “Purchase.” ORX750 includes an interesting and surprise layer of capacity, however keep in mind, the biotech sector is naturally unstable. Financiers ought to continue to keep an eye on upcoming medical trials and information discussions, consisting of the World Sleep Congress, as part of their due diligence.

In essence, keep Centessa on your radar as it might provide a mix of threat and benefit that smart biotech financiers like.

Threats to Thesis

While I have actually suggested a “Buy” for Centessa Pharmaceuticals, numerous threats might possibly weaken this position:

-

Medical Failure: Regardless of guaranteeing early outcomes, any prospect like ORX750 might stop working in later medical phases.

-

Regulative Difficulties: Fast Lane and Orphan Drug classifications do not ensure FDA approval.

-

Money Burn: Even with over $300M in liquid properties, their high money burn rate might need dilutive funding.

-

Competitors: Other companies might produce more reliable or more secure drugs for targeted medical locations.

-

Management Execution: The business is young, and handling a varied portfolio of 11 companies postures a functional threat.

-

Evaluation: Without any present earnings and a clinical-stage pipeline, market cap might be over-optimistic.

-

Financial Conditions: More comprehensive financial declines can impact biotech financing and market belief.