AWSeebaran

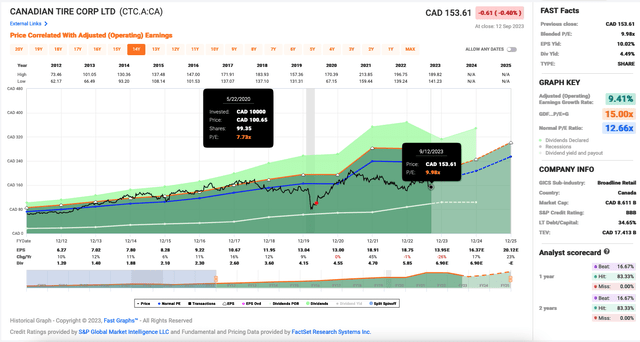

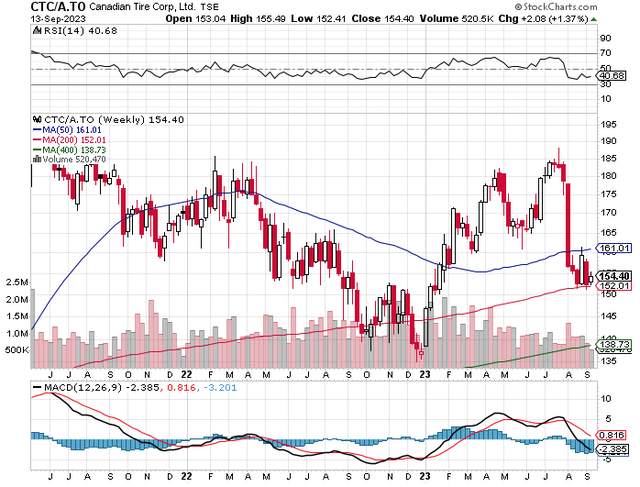

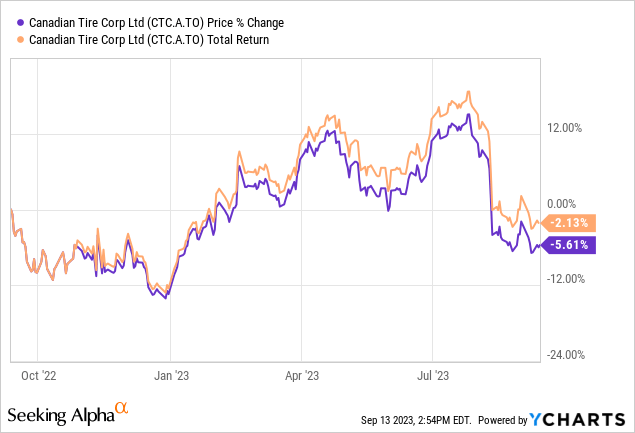

The investing neighborhood appears to be overlooking Canadian Tire ( OTCPK: CDNTF) ( TSX: CTC.A: CA) in the meantime as the last Looking for Alpha protection on it was more than 4 months earlier. The stock has actually simply pulled back north of 16% from a current high of about $185 embeded in July. In the last 12 months, the stock is down about 5% with overall returns being -2% thanks to the cushion from its dividend.

What’s Weighing on the Stock?

Expected Upcoming Economic Crisis

An upcoming economic crisis might be what’s weighing on the stock. With economic experts preparing for an economic downturn by 2024 in Canada, financiers are most likely proper to see meticulously on the sidelines, as the stock likely will not go much greater in the near term.

Due to the fact that it provides resilient items, the customer discretionary stock generally falls meaningfully in an economic downturn. When Canadians are strapped for money, they would concentrate on the fundamentals like groceries. In the Q2 report, even Greg Hicks, the Canadian Tire president and CEO, mentioned, “As inflation continued and rate walkings continued, customer need for discretionary items softened, especially in the latter half of the quarter, and Canadians moved to more fundamentals within our multi-category selection.”

In the last 2 economic downturns (throughout the worldwide monetary crisis of 2008-09 and the pandemic in 2020), from peak to trough, the stock fell more than 40%. What’s significant is that it did bottom eventually throughout the economic downturns and consequently picked up while paying safe dividends. So, it might be rewarding to target to purchase low and offer high while gathering the dividend in between.

For example, if you had actually considered the stock and purchased it meticulously after it has actually bounced and made a little a combination in throughout the 2020 pandemic crash, you would have made decent annualized returns of north of 17% holding it till now, as displayed in the buy and offer points in the above chart.

( The business reports in Canadian dollars, so the figures in this post remain in CAD$ unless otherwise kept in mind.)

Credit Score

Because 2022, the Bank of Canada has actually raised the benchmark rates of interest quickly to 5.0% to suppress the fairly high inflation. The stock’s credit ranking is not the very best in today’s greater rates of interest environment, which increases the expense of capital for the business and is a dampener on financial development. Particularly, Canadian Tire has a S&P credit ranking of BBB for its long-lasting financial obligation.

To get a sense of the rate of interest that Canadian Tire is exposed to, it simply pressed out $ 600 million worth of unsecured medium term notes, consisting of $400 million due September 2030 at a rate of 5.372% and $200 million at a drifting rate due September 2026.

Business

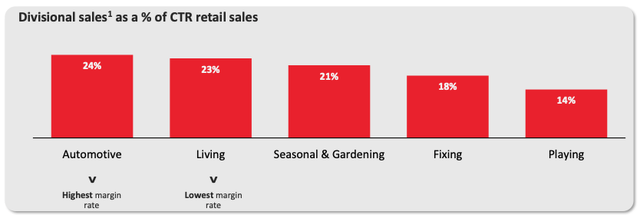

Canadian Tire is a renowned brand name that was established in 1922. It has actually gotten other retail brand names along the method. Besides Canadian Tire, its umbrella of brand names consist of Mark’s (for casual and commercial wear), Pro Hockey Life (a hockey specialized shop), SportChek, Hockey Specialists, Sports Specialists, and Environment, and so on. Particularly, its retail company has 5 departments with leading sales originating from its higher-margin Automotive department, as displayed in the chart listed below.

The omni-channel product seller has 1,700 retail and gas outlets that are supported by its Financial Solutions department. It likewise has a stake in CT REIT ( CRT.UN: CA). In 2022, Canadian Tire’s profits diversity was nearly 90% Retail, nearly 8% Financial Providers, and near 3% CT REIT.

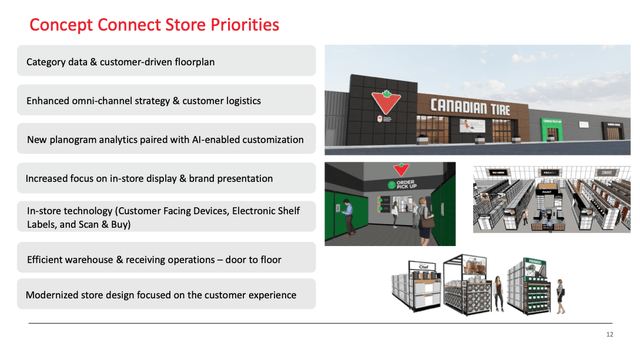

Because the statement in 2022, the seller has actually been revamping its Canadian Tire Retailer to make them more modern. Up until now, it has actually revitalized more than 10% of the shops to enhance client experience and aid drive incremental sales. Locations of enhancement are highlighted in the slide listed below.

Year to date, it has actually invested $238 million in running capital expense and finished 22 of these shop enhancement ideas.

Current Outcomes

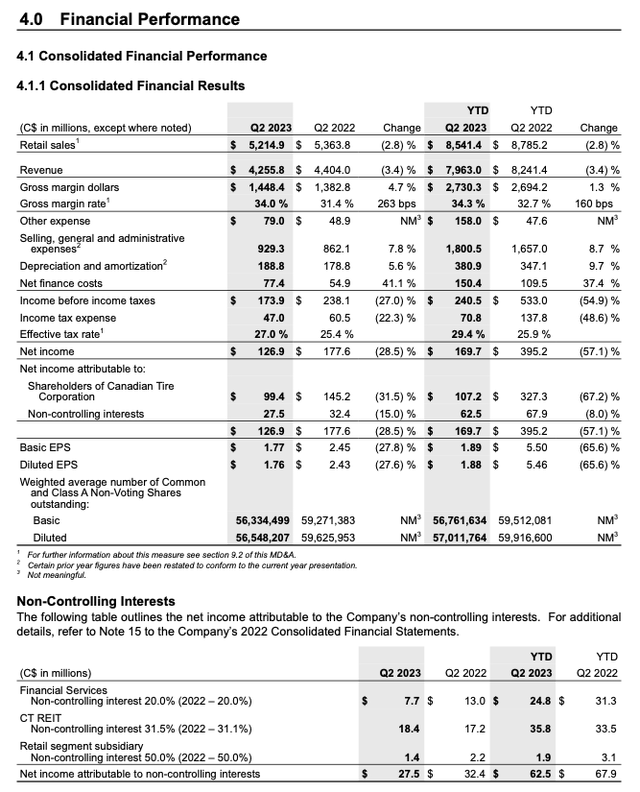

Its eCommerce sales struck $1.1 billion over the last 12 months. Year to date, its retail sales fell 2.8% to $8,541.4 million. The gross margin increased 1.3% to $2,730.3 million with the aid of the gross margin rate broadening 1.6% to 34.3%. Sales remained durable in today’s macro environment.

Regrettably, expenditures leapt. Offering, basic and administrative expenditures included $206 million to its expenses. Greater financing expenses included $40.9 million. The efficient tax rate of 29.4% was likewise 3.5% greater year over year. Eventually, the GAAP revenues dropped 57% to $169.7 million with the diluted revenues per share (” EPS”) falling nearly 66% to $1.88.

Threats

All financial investments include threat. Here are some dangers Canadian Tire are exposed to.

As discussed previously, with a credit ranking of BBB for its long-lasting financial obligation, Canadian Tire goes through rates of interest threat. Greater rate of interest increase its loaning expenses and make its financial obligation a higher concern and moistens its development capacity.

Because the start of the year, Canadian Tire has actually finished the multi-year rollout of its digital platform throughout all banners. This implies that, in a sense, it’s taking on other business that are offering comparable items online. According to Similarweb, a few of Canadian Tire’s leading online rivals consist of Walmart ( WMT), Rona that’s owned by Lowe’s ( LOW), and Amazon ( AMZN).

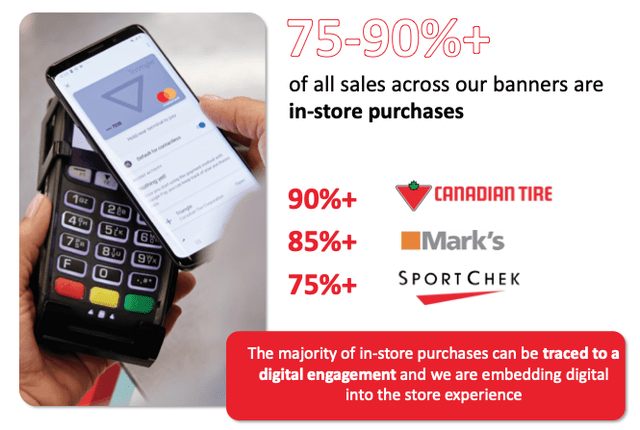

That stated, Canadian Tire did point out that about 75-90% of its sales are in-store purchases. As kept in mind in the slide listed below, its digital platform is indicated to boost or support sales for its brick-and-mortar shops. So, at the end of the day, anticipating client need and customer choices, and picking the best items to offer is crucial.

Due to the fact that Canadian Tire sources its items from various nations, it is exposed to foreign currency volatility. In 2022, China was its leading sourcing nation, followed by Canada, the United States, Bangladesh, Vietnam, Cambodia, Mexico, Malaysia, Taiwan, and Israel. When the Canadian dollar is weak versus these foreign currencies, especially, the Chinese Yuan and the U.S. dollar, it will be a hit on the seller’s bottom line.

Fairly high inflation is likewise another threat aspect. It’s more difficult to pass greater inflationary expenses to customers for resilient items that are discretionary purchases. It implies that oftentimes, Canadian Tire needs to consume that expense.

Development Drivers

Canadian Tire targets to revitalize 50% of the square video in its network, which might motivate foot traffic and the customer shopping experience. Because the majority of its sales are in-store purchases, this financial investment can possibly drive sales development.

Its company tends to do well post-recessions. Also, it tends to produce steady development in other financial conditions (aside from doing badly in economic downturns). So, presuming Canada does fall under an economic downturn by 2024, financiers can anticipate the stock to do much better at some point after that.

Furthermore, throughout economic downturns, the Bank of Canada tends to lower the policy rates of interest to motivate financial development. The decrease of rate of interest would be a development drivers for services, consisting of Canadian Tire.

Evaluation and Dividend Security

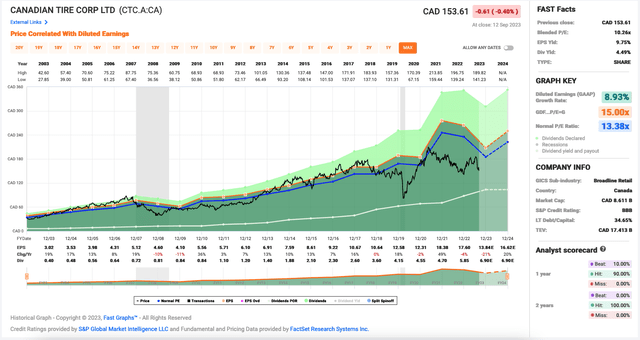

Regardless of it offers non-essential product, Canadian Tire’s revenues have actually remained in a development pattern and mainly steady, specifically if you overlook the enormous increase in revenues in 2021 post-pandemic.

In the last ten years, the stock provided annualized returns of about 8%, which is not excellent. Nevertheless, today, at $154.62 per share at composing, it trades at a forward P/E of about 11.1 based upon adjusted EPS. This is a good several to purchase shares presuming a subsequent financial growth. Nevertheless, financiers may require to wait on this to take place after an economic downturn.

In the meantime, Canadian Tire pays a safe dividend. It has actually kept or increased its dividend for a minimum of 20 successive years with 5-, 10-, 15-, and 20-year dividend development rates of 17.6%, 17.2%, 15.0%, and 14.4%, respectively. At composing, it provides a dividend yield of near 4.5%. Its sustainable trailing-12-month payment ratio was 44% of earnings.

Financier Takeaway

In the previous ten years, Canadian Tire increased its adjusted EPS by nearly 11.6% each year. Being more mindful, let’s presume Canadian Tire grows its revenues by about 8%. Then, based upon its affordable assessment today, it must have the ability to provide overall returns of basically 12%, presuming no assessment growth over the next 5 years.

That stated, in the close to medium term, if Canada does face a moderate economic crisis, the stock might be variety bound, which might make it a good prospect for trading on possible pops from any great news. The technical chart listed below programs a ceiling in the $180 variety.

Editor’s Note: This post talks about several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.