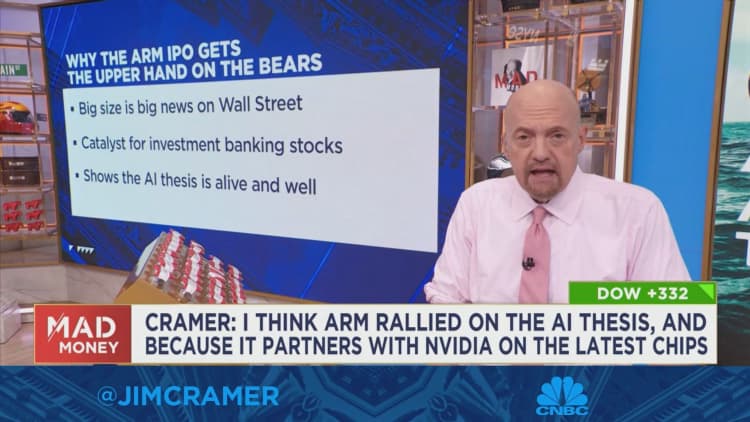

CNBC’s Jim Cramer on Thursday offered his handle Arm Holdings‘ going public, stating the semiconductor designer’s market launching went as well as might be anticipated.

” I believe this offer was quite darn close, truly, to a Goldilocks result and a great indication of things to come for the IPO market,” he stated. “Arm increased enough to get individuals delighted about brand-new offerings once again, however not a lot that the entire thing ended up being a travesty of a mockery of a sham.”

Valued at nearly $60 billion at the open, Arm is the biggest business to go public because electrical vehicle producer Rivian in 2021

Arm itself is not a producer. Rather, it produces semiconductor styles and accredits them to huge market names like Apple and Nvidia, gathering royalty costs for every single semiconductor used its innovation. About half of Arm’s royalty income originates from items launched in between 1990 and 2012, CNBC reported

Cramer stated he’s delighted about the business’s capacity due to the fact that of its strong royalty-based service strategy, focus on creating energy-efficient items that produce less heat, in addition to its monopoly on mobile phone main processing systems.

Nevertheless, he included that he watches out for circumstances where personal equity companies manage an openly traded business, stating that can cause public financiers “getting the brief end of the stick.” After the going public, Japanese investment firm SoftBank manages about 90% of Arm

Share s leapt almost 25% throughout their very first day of trading, beginning Thursday priced at $51 however reaching $63.59 by the close. In spite of the rise, Cramer recommended financiers purchase a little position in the stock.

” Listen, I want that Arm’s stock had actually remained in the low-to-mid 50s– it would be so simple for me to inform you to purchase it– however even at $63, all right, I want to validate placing on a little position here,” he stated. “Either Arm continues to climb up greater, in which case you have actually got a great little winner, or it falls back down, at which point you can purchase more on weak point at the cost we had actually choose.”