Stephan Behnes

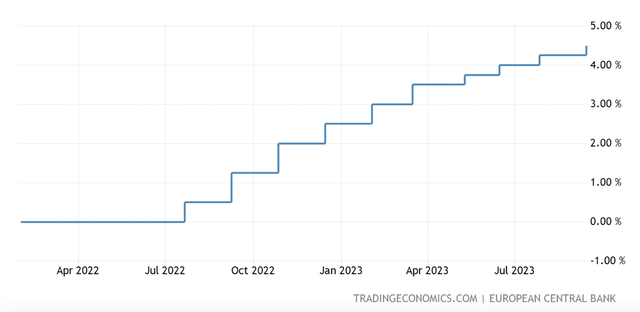

In a continued quote to eliminate inflation, the European Reserve Bank [ECB] raised crucial rates of interest for the tenth successive time previously today, stating that inflation is “still anticipated to remain too expensive for too long”. Inflation in the eurozone is at 5.3% year-on-year (YoY) based on the most recent reading.

The current 25 basis points increase, now suggests that the rate for the primary refinancing operations is at 4.5% and those for its minimal loaning and deposit center are at 4.75% and 4%, respectively. Substantial as financial tightening up is to keep cost stability, it comes at an expense.

Increasing Rate Of Interest ( Source: Trading Economics)

The expense of greater rates of interest

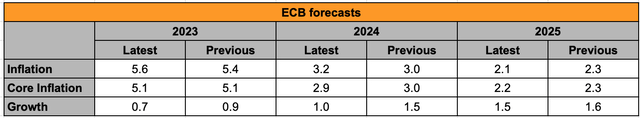

The expense, naturally, is development. Here’s why. Together with the rates of interest choice, the bank likewise upgraded its projections for both inflation and development for approximately 2025 (see table listed below).

The most significant modification remains in development expectations for 2024, which have actually been slashed to 1% from 1.5% earlier. This suggests, that the economy will now touch pattern development of 1.2%, the typical development over the previous 5 years, just in 2025. This is likewise the time when inflation will lastly come up to the ECB’s target rate.

Source: ECB

The silver lining

Remarkably, however, crucial European stock exchange revealed no unfavorable response, with the German DAX and the French CAC 40 in fact up by 1% and 1.2%. This may have something to do with the possibility of a time out in rates, based upon the following declaration:

Based upon its existing evaluation, the Governing Council thinks about that the crucial ECB rates of interest have actually reached levels that, kept for an adequately long period of time, will make a considerable contribution to the prompt return of inflation to the target.

Whichever method we take a look at it, however, the truth stays that rates of interest are not at a record high and are anticipated to remain there for the foreseeable future.

The investing difficulty

With the ECB most not likely to action in if development drops, it suggests we are now taking a look at over a year of macroeconomic patterns that are both advantageous and difficult. Beneficial due to the fact that of the softening in inflation and difficult due to the fact that of a decreasing of development. This is a possibly predicament from a stock investing point of view.

A come-off in inflation is a favorable indication for margins. As I discussed when it comes to iShares Core High Dividend ETF ( HDV), 5 of its leading 10 holdings had actually reported a growth in running margin in the most recent quarter. Energy business were the ones that didn’t participate on this pattern, for the factor of a decrease in energy costs.

On the other hand, the development downturn is likewise noticeable in a come-off in sales development throughout business. A case in point is the French high-end business LVMH ( OTCPK: LVMUY), which has actually sustained development just recently partially due to the fact that of its European market, besides the return of development from China. With softening in the United States market currently noticeable, a drop in European sales can impact it moving forward.

Where to invest now

Instead of selecting single stocks at this time, an excellent financial investment might be in an ETF like the SPDR Euro Stoxx 50 ETF ( NYSEARCA: FEZ) rather. As the name recommends, it tracks the efficiency of the Euro Stoxx 50 index ( SX5E), which represents the efficiency of the most significant 50 stocks in the eurozone by market capitalisation [MCap].

Top quality and varied

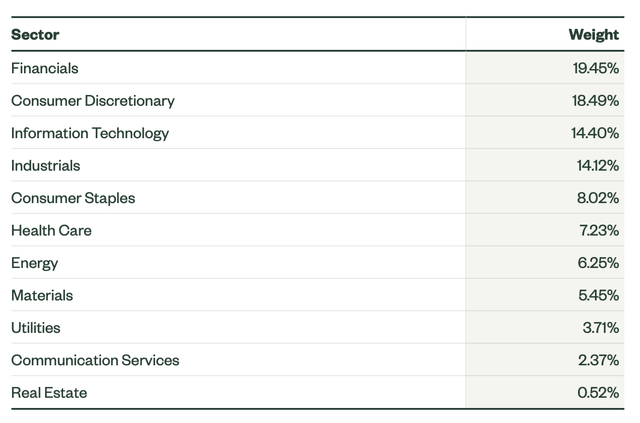

While it’s totally possible that the index itself might damage if the financial conditions begin looking more unsure than anticipated, it does have its benefits. The very first is that a financial investment in blue chip stocks is a more secure bet at this time than others. Next, it’s distributed throughout sectors, with financials, customer discretionary, infotech and industrials all of which have an over 10% weight in the fund (see table listed below).

Source: SPDR Euro Stoxx 50 ETF

Motivating returns

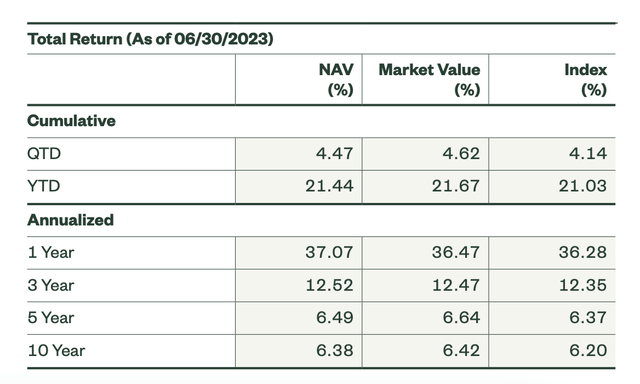

Its efficiency over the previous year is significant with a 27.4% increase, and it was strong even up until the very first half of this year (see table listed below), though it has actually decreased considering that with year-to-date [YTD] cost returns at 11.4%. The annualised three-year returns at the end of the last quarter likewise look rather good (see table listed below).

Source: SPDR Euro Stoxx 50 ETF

Dividend consistency

FEZ’s dividend yield at 3.3% is good too and there’s something to state for the truth that it has actually regularly paid dividends for the previous 15 years. Likewise, while its dividend quantities have actually changed from year to year, over the previous 5 years, they have actually seen a compounded yearly development rate of 2.6%. In truth, the number has actually leapt to 32.4% over the previous 3 years.

The danger

It’s not without its threats, however, with financials offseting 19.5% of its holdings. As a cyclical sector, it might be susceptible to a downturn. Likewise, its most significant holdings like the Dutch semiconductor devices service provider ASML Holdings ( ASML), the French high-end business LVMH and TotalEnergies ( TTE) all have substantial direct exposure to the United States market too. While the United States economy has actually defied the economic downturn up until now, there are still threats ahead.

General though, the fund appears like an excellent financial investment to make good returns and with its direct exposure to sectors like healthcare and energies, can likewise offer stability.

What next?

The crucial takeaway from the ECB’s financial policy declaration from the investing point of view, is that rates of interest walkings may strike a time out, however they will remain raised. This is excellent news on the inflation front however development is anticipated to suffer this year and the next.

There is both an investing chance and a difficulty for financiers in this circumstance. While decreasing inflation can show much better margins, a weak economy can decrease sales development. Considering that it can be an unpredictable time, an excellent concept might be to buy a broad-based ETF rather of single stocks.

FEZ is one alternative, which tracks the Euro Stoxx 50 index, offers stability from purchasing the most significant business and is likewise diversified throughout sectors. It’s efficiency YTD is excellent too, and has a good dividend yield too. While it has its own threats, consisting of direct exposure to cyclical sectors in addition to the United States economy, which might face its own difficulties later on this year or the next, general, it still appears like an excellent alternative.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the threats connected with these stocks.