{“page”:0,” year”:2023,” monthnum”:9,” day”:5,” name”:” d-fence-investigating-commodity-performance-under-a-defensive-fed”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

D-FENCE! Examining Product Efficiency under a Protective Fed

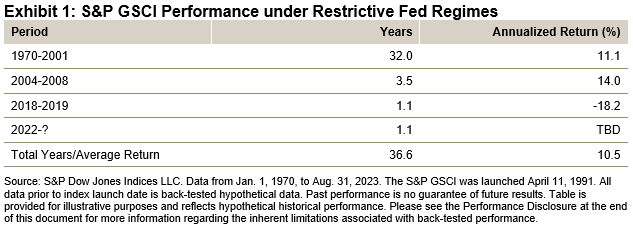

I enjoy this time of year. August trips are over, the kids are back in school and football season begins in the U.S. The Fed took its August “trip” at the Jackson Hole Seminar, where Jerome Powell’s remarks singularly concentrated on rate stability. Inflation has actually boiled down however “stays too expensive” and the Fed alerted it’s “prepared to raise rates even more.” As markets get ready for ongoing limiting financial policy, we returned to school to examine the efficiency of products under a limiting Fed. Considering that 1970, the S&P GSCI has actually attained typical annualized returns of 10.5% compared to simply under 1% throughout durations when the Fed kept a limiting policy position.

As part of its double required, the Fed sets a target inflation rate of 2%. While that step stays approximate, the Fed looks for to attain this through accommodative or limiting financial policy. Utilizing the main tool of the Fed, we compare the efficiency of the S&P GSCI when the Fed funds efficient rate stays above target inflation for a minimum of 12 months. The S&P GSCI is the leading product criteria, with back-tested history extending for over 50 years. Taking this renowned criteria, we assess index efficiency throughout this time. There have actually each been 3 durations where continual financial policy was either limiting or accommodative, covering 50 of the 53 years considering that 1970.[1]

In over two-thirds of the sample, typical annualized returns were over 10.5%. This covers the inflationary bouts of the 1970’s, the product incredibly cycle of the 2000’s and one especially brief and abysmal year in 2018/2019. Financiers of product ETFs missed out on these chances, with the development of the product ETF’s occurring throughout exceptionally loose financial policy routines. Inflation is now the focus of the Fed and product efficiency has actually gotten.

Charting the present Fed funds efficient rate advises me of Mr. Powell’s view of the Grand Tetons. These towering peaks pierce the Wyoming sky, with a rugged shape going for 40 miles. The greatest peak tops 13,775 feet, while the most affordable elevation is well over a mile high. Those peaks rest on leading the 3,000 mile long Rocky Mountains with elevations over one and approximately 3 miles high. Like the Tetons, inflation has actually stuck out up and fell from its current peak however stays raised. This would describe Mr. Powell’s focus on inflation, specifying “limiting financial policy will likely play a significantly crucial function.”

Taking a look at the history of the S&P GSCI, when the Fed gets protective, products have actually tended to be a great offense. In this present duration of limiting financial policy, products have actually produced strong however irregular returns. The S&P GSCI attained a 22% return in 2022, outmatching all possession classes. Year-to-date, the S&P GSCI has an overall return over 5%. Ought to the Fed stay limiting, historic product returns have actually shown to be a strong protective method.

[1] The 3 years consist of the present duration and times the efficient rate did not remain above or listed below for a minimum of twelve successive months.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

S&P 500 Low Volatility Index August 2023 Rebalance

The S&P 500 ®(* )carried out well from the last rebalance for the S&P 500 Low Volatility Index on May 19, 2023, through the most current rebalance on Aug. 18, 2023. As Display 1 reveals, the S&P 500 was up 4.7% throughout this duration versus a decrease of 1.5% for the S&P 500 Low Volatility Index. This divergence tends to occur particularly throughout durations of strong efficiency and low volatility for the S&P 500. Remarkably, the annualized day-to-day basic variance over this duration for the S&P 500 was a reasonably low 10.7%. As Display 2 programs, tracking 1 year volatility reduced for all 11 GICS ® sectors since July 31, 2023, versus April 28, 2023. Determined in outright terms, volatility reduced the most for the Customer Discretionary and Energy sectors, which fell 6.8% and 5.4%, respectively. Since July 31, 2023, Energy, Interaction Providers, Customer Discretionary, Infotech and Property were the leading 5 most unstable sectors in the S&P 500, with day-to-day recognized volatilities of around 29%, 27%, 26%, 26% and 23%, respectively.

In the middle of the general decline in volatility, the S&P 500 Low Volatility Index’s newest rebalance brought some modifications to sector weights. The most recent rebalance moved an extra 1.5% weight to the Customer Staples sector, which even more strengthened its position as the biggest sector by weight. Energies had the biggest decrease in weight, at around 2.9%, dropping it to the third-largest sector by weight. The Customer Staples, Utilities, Healthcare, Financials and Industrials sectors continued to have a combined weight of higher than 90%.

Energy and Products continued having no weight in the S&P 500 Low Volatility Index. The most recent rebalance worked after the marketplace close on Aug. 18, 2023.

The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers Why Multi-Factor Indices in South Africa?

Elizabeth Bebb

A Random Stroll Down Wall Street, asserted, “The realities recommend that effective market timing is extremely hard to attain.” 1 Multi-factor indices might be a method of guaranteeing you are “in the best location at the correct time,” getting involved throughout market cycles without jeopardizing timing or returns.

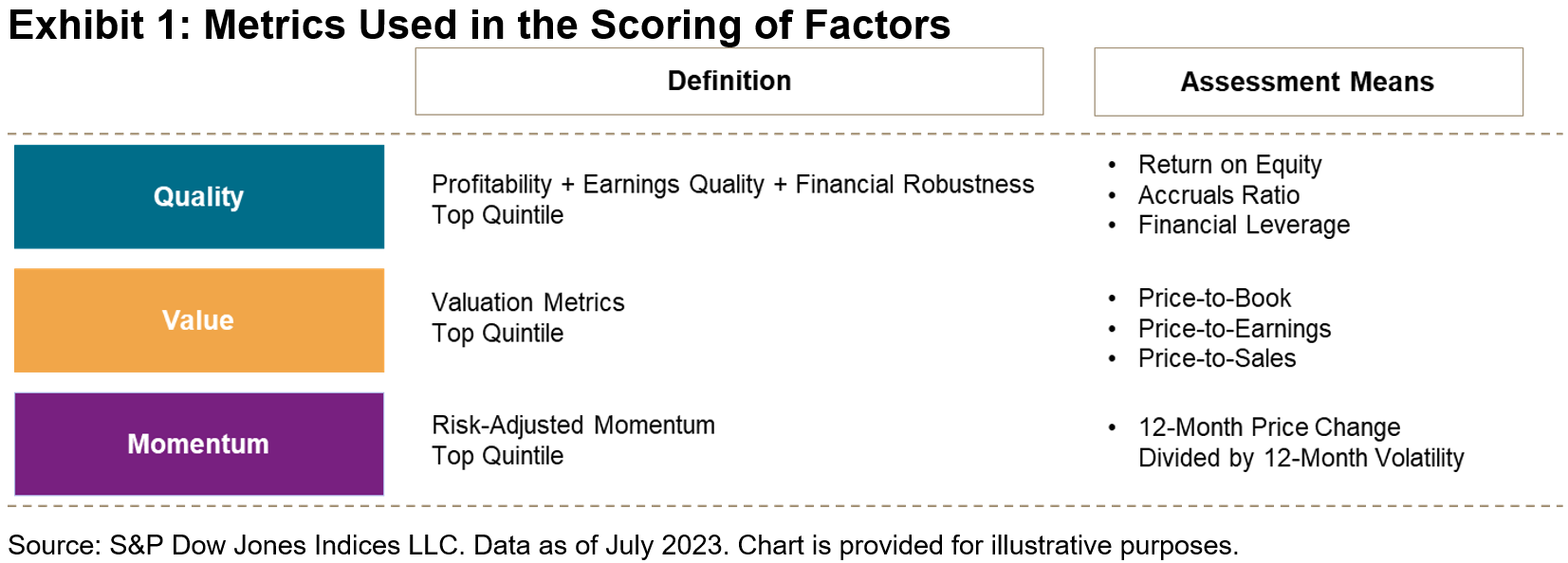

The S&P DJI Multi-Factor Indices are constructed on a bottom-up method. This implies the element ratings are integrated to pick “all-rounders” that score extremely throughout several elements. The

S&P South Africa Composite Quality, Worth & & Momentum (QVM) Multi-factor Index makes use of the Quality, Worth and Momentum elements. The illustration listed below programs the metrics utilized in the scoring for each private element. To be qualified for addition in the S&P South Africa Composite QVM Multi-factor Index, the constituents need to be members of the

S&P South Africa Composite and pass a trading liquidity screen. Multi-factor ratings are computed for each business based upon the average for each element. The leading 40 constituents with the greatest element rating are consisted of in the index. All constituents are market capitalization times element rating weighted, to an optimum weight of 10%. The method makes it possible for numerous advantages to be constructed into the index. Stocks are chosen within the context of the overall combined portfolio and general direct exposures to the preferred elements might be greater. Furthermore, back-tested outcomes reveal more powerful risk-adjusted returns than the index of indices method.

Multi-factor indices have actually traditionally tended to carry out more highly over the longer term on a risk-adjusted basis. This enhanced dynamic is shown by returns being closer to the leading left in Display 2. The S&P South Africa Composite QVM Multi-factor Index is nearer this point than other indices.

We reveal the S&P South Africa Composite QVM Multi-factor Index returns on an annual basis with the private element returns overlaid in Display 3. The S&P South Africa Composite QVM Multi-factor Index line shows how the private element returns are interacting over numerous years to provide the risk-adjusted return.

The connections throughout excess returns in between elements are low, which permits the prospective take advantage of integrating private elements within the S&P South Africa Composite QVM Multi-factor Index method.

Display 5 reveals the risk-adjusted returns gradually for each of the elements. The S&P South Africa QVM Multi-factor Index supplies excellent returns over the long-lasting with lower tracking mistake versus the S&P South Africa Composite. It likewise takes part well in increasing markets however prevents a few of the disadvantage in falling markets, showing the advantages of the multi-factor method.

The S&P South Africa Composite QVM Multi-factor Index supplies a fascinating chance to think about for multi-factor indexing in the South African market.

1

Malkiel, Burton. A Random Stroll Down Wall Street W. W. Norton & & Business, Inc. 1973. The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers Stabilizing Defense with Development: The S&P Quality Indices

Wenli Costs Hao

Senior Lead, Elements and Dividends Indices, Item Management and Advancement

S&P Dow Jones Indices

So far this year, about two-thirds of the

High quality is frequently related to a business’s

strong success, high incomes quality and robust monetary strength For this reason, the S&P Quality Indices make use of 3 popular metrics to catch a business’s quality attributes (see display 2): return-on-equity (ROE), balance sheet accruals ratio (BSA) and monetary utilize ratio (FLR). The choice for the S&P Quality Indices represents the leading 20% of qualified stocks within their particular universe, ranked by their general quality ratings. Index constituents are weighted by the item of their market capitalization and quality ratings, based on restraints.

1 Efficiency Contrast

Historically, the S&P Quality Indices exceeded their matching criteria in the brief and the long term with regard to

overall return and risk-adjusted return ( see Display 3). Year-to-date, the S&P MidCap 400 ® Quality Index and S&P SmallCap 600 ® Quality Index exceeded their criteria by 8.55% and 6.46%, respectively. Furthermore, these indices have actually tended to show protective qualities, as evidenced by lower volatility, lower beta and smaller sized drawdowns.

YTD Quality Index Efficiency Attribution

So far in 2023, the monetary utilize ratio (FLR) element has substantially exceeded the S&P 500 (see Display 4), recommending that markets might have rewarded lower leveraged business on the back of high rate of interest.

High Advantage Involvement and Protective Attributes

The historic capture ratios in Display 5 reveal that the S&P Quality Indices tend to take part one for one in up markets

2 while providing considerable outperformance throughout down markets. The protective nature of these indices makes good sense considering that the quality element tends to track business with resilient company designs and sustainable competitive benefits. For the

S&P 500 Quality Index, these capture ratios might be partly described by the choice of mega-cap development stocks, which tend to have strong financials and underlying company basics. The current constituents consist of 5 (Apple, Microsoft, Nvidia, Alphabet and Meta) of the Stunning 7. Display 6 reveals the leading 15 factors to the S&P 500 Quality Index’s efficiency YTD. Aspect Direct Exposure

Display 7 reveals the element direct exposure distinction in between quality indices and their criteria in regards to Axioma Threat Design Aspect Z-scores. The S&P Quality Indices showed a strong

quality tilt versus their particular criteria. Particularly, the quality indices had greater direct exposure to success and lower direct exposure to utilize ratio elements. Furthermore, the indices had comparable evaluation and development direct exposures to their criteria. Sector

Structure Display 8 reveals the historical sector direct exposure distinction in between the quality indices and their criteria. Historically, the quality indices were obese in Industrials and Innovation, while underweighting Interaction Providers, Energy, Financials, Property and Utilities.

1

For more info about the element meaning, element rating estimation and index style, please see the S&P Quality Indices Method 2

The marketplace is specified as the regular monthly efficiency of the underlying criteria from Dec. 31, 1994, to July 31, 2023. The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers 4 Ways to Compare Asian and U.S. Dividend Markets

Dividends are ending up being progressively crucial as financiers come to grips with greater U.S. Treasury yields that do not seem decreasing anytime quickly. Nevertheless, not all dividend markets are developed equivalent. Below are 4 charts that compare dividend index efficiency in Asia to the U.S.

The S&P Pan Asia Dividend Aristocrats Index brings S&P Dow Jones Indices’ noteworthy “Dividend Aristocrats

® “index method to Asia. The index chooses business in both emerging and industrialized Asian economies that have actually increased their dividends every year for a minimum of the previous 7 years. Please click here for the complete index method and here for more dividend-related research study from KraneShares. 1. Momentum

The S&P Pan Asia Dividend Aristocrats Index has actually exceeded the S&P 500

®(* )Dividend Aristocrats Index, which tracks dividend growers in the U.S., up until now this year, getting 8.09% versus 3.97% for its U.S. equivalent, since June 20, 2023. 2. Yield S&P Pan Asia Dividend Aristocrats Index constituents likewise presently provide a greater dividend yield, typically, than their U.S. equivalents.

3. Appraisal

S&P Pan Asia Dividend Aristocrats Index constituents are presently trading at almost one half of the price-to-earnings several of their U.S. equivalents, typically.

4. Connection

S&P Pan Asia Dividend Aristocrats constituents have actually likewise displayed reasonably low connections to the broad U.S. equity market and the S&P 500 Dividend Aristocrats Index constituents, which might provide extra portfolio advantages over the long term.

Meanings:

S&P 500 Dividend Aristocrats Index:

The S&P 500 Dividend Aristocrats Index determines the efficiency of S&P 500 business that have actually increased their dividends every year for the last 25 successive years. The index deals with each constituent as an unique financial investment chance without regard to its size by similarly weighting each business. The index was introduced on Might 2, 2005. See complete method

here S&P Pan Asia Dividend Aristocrats Index: The S&P Pan Asia Dividend Aristocrats Index determines the efficiency of constituents within the S&P Pan Asia Broad Market Index (BMI) that have actually followed a policy of regularly increasing dividends every year for a minimum of 7 years. The index was introduced on April 14, 2009.

S&P 500: The S&P 500 is commonly considered the very best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed possessions making up around USD 3.4 trillion of this overall. The index consists of 500 leading business and covers around 80% of readily available market capitalization. The index was introduced on March 4, 1957.

S&P Pan Asia Broad Market Index (BMI): The S&P Pan Asia BMI is a sub-index of the S&P Global BMI and an extensive criteria consisting of securities from established and emerging Asia. The index was introduced on Dec. 31, 1997.

Dividend Yield: The portion of a business’s share rate that stated business pays in dividends each year.

Price-to-Earnings Ratio (P/E): A procedure of whether a business is over or under-valued. P/E is computed as a business’s rate per share divided by its incomes per share.

Revenues Per Share (EPS): The overall earnings of a business divided by the variety of shares impressive.

Connection: Connection is a fact that determines the degree to which 2 securities relocation in relation to one another. Connections are revealed here as the connection coefficient, which is a worth that needs to fall in between -1 (inverted connection) to 1 (outright connection).

The S&P 500

®

,&S&P 500 Dividend Aristocrats Index, S&P Pan Asia Dividend Aristocrats Index and S&P Pan Asia Broad Market Index are items of S&P Dow Jones Indices LLC or its affiliates (” SPDJI”). S&P ®, S&P 500 ®, Dividend Aristocrats ® are hallmarks of S&P Global, Inc. or its affiliates (” S&P”); Dow Jones ® is a signed up hallmark of Dow Jones Hallmark Holdings LLC (” Dow Jones”). Kraneshares ETFs based upon SPDJI’s indices are not sponsored, backed, offered or promoted by SPDJI, Dow Jones, S&P, their particular affiliates or licensors and none of such celebrations make any representation relating to the advisability of purchasing such item( s) nor do they have any liability for any mistakes, omissions or disturbances of the Indices. The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers