Dragon Claws/iStock through Getty Images

By William J. Luther

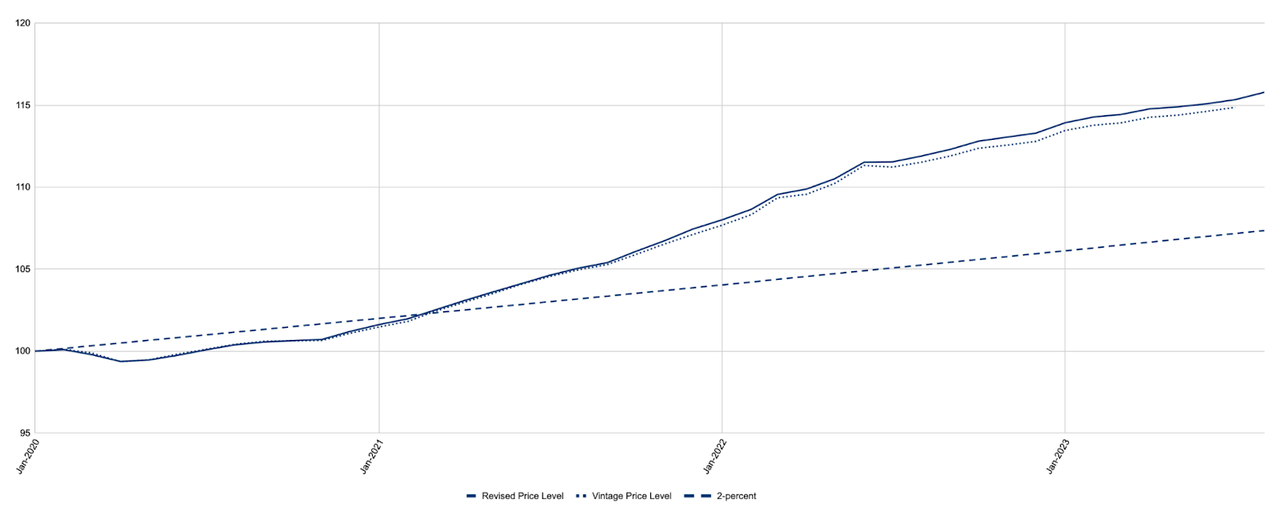

The Bureau of Economic Analysis has actually modified its quotes of inflation. The problem: rates have actually increased much faster than was formerly believed. The Individual Intake Expenses Cost Index (PCEPI), which is the Federal Reserve’s favored procedure of inflation, grew at a constantly intensified yearly rate of 4.1 percent from January 2020 to July 2023. The BEA’s previous efforts put inflation at 4.0 percent. In July 2023, rates were 8.2 portion points greater than they would have been had the Fed struck its 2-percent inflation target over the duration, compared to the previous quote of 7.7 portion points.

Figure 1. Modified and Vintage Personal Intake Expenditures Cost Index, January 2020 – August 2023

More problem: inflation chose back up in August 2023. The PCEPI grew at a constantly intensified yearly rate of 4.7 percent in August, compared to 2.6 percent in the previous month. The PCEPI grew 3.4 percent over the 12-month duration ending August 2023. Rates today are 15.8 percent greater than they remained in January 2020, and 8.4 portion points greater than they would have been had inflation balanced simply 2 percent over the duration.

The current uptick in inflation was mostly due to a rise in energy rates. The rate of energy items and services grew at a constantly intensified yearly rate of 70.7 percent in August.

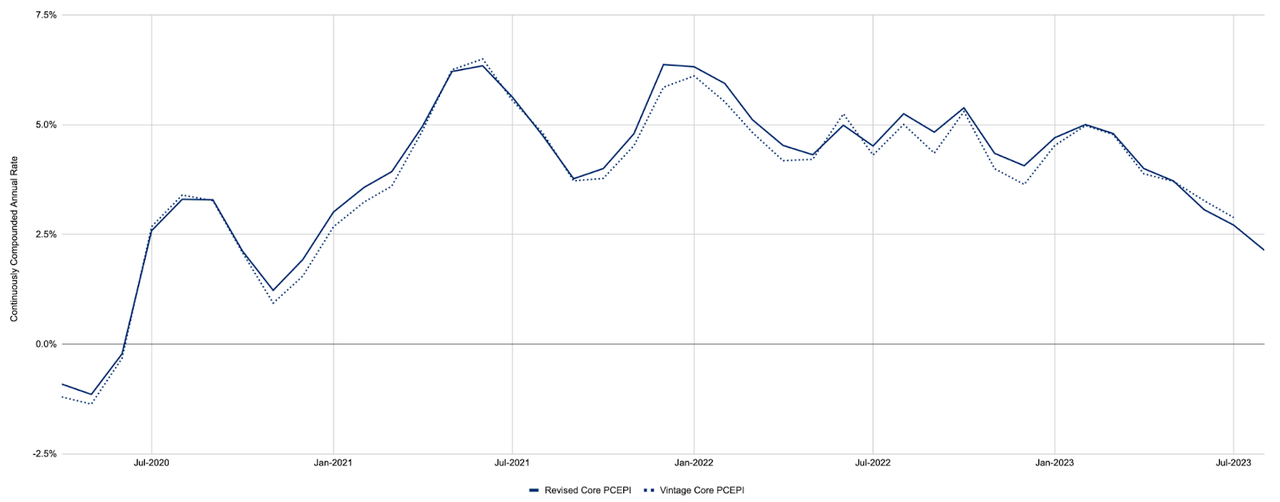

Thankfully, the most current release was not all problem. Core PCEPI inflation, which omits unstable food and energy rates, has actually continued to decrease. Core PCEPI grew at a constantly intensified yearly rate of simply 1.7 percent in August 2023, compared to 2.6 percent in the previous month. Core PCEPI has actually grown at a constantly intensified yearly rate of 3.8 percent over the last twelve months, and 3.8 percent annually given that January 2020.

More great news: the BEA’s current modification reveals that core PCEPI inflation has actually decreased more than formerly studied the last 6 months. Prior to the modification, the BEA stated core PCEPI inflation had actually grown at a constantly intensified yearly rate of 3.7 percent over the three-month duration ending in Might, 3.3 percent over the three-month duration ending in June, and 2.9 percent over the three-month duration ending in July. Now, it states core PCEPI inflation balanced 3.7 percent, 3.1 percent, and 2.7 percent over those durations – and simply 2.1 percent over the three-month duration ending in August 2023.

Figure 2. Modified and Vintage Core Personal Intake Expenditures Cost Index Inflation, Continually Intensified Yearly Rate Over Last 3 Months, April 2020 – August 2023

Although Fed authorities were late to tighten up financial policy, their efforts over the in 2015 appear to have actually worked. The danger today is that financial policy is too tight – and will stay so for too long.

The small federal funds rate target variety stands at 5.25 to 5.50 percent. Presuming energy rates will not continue to increase as quickly as they carried out in August, the previous month’s core inflation rate acts as a sensible quote of anticipated inflation over the existing month. That recommends the genuine federal funds rate target variety is approximately 3.55 to 3.80 percent. For contrast, the greatest quote of the natural rate used by the New York City Fed is simply 1.14 percent. Even if one were to utilize the typical core PCEPI inflation rate over the last 3 months, the resulting quote of the genuine federal funds rate target variety at 3.15 to 3.35 percent would still recommend financial policy is extremely tight.

Inflation has actually been expensive over the last couple of years. And the BEA’s current modification exposes it was even greater than we believed. Thankfully, high inflation now seems behind us. Sadly, Fed authorities do not appear to have actually recognized that yet – and might overtighten financial policy as a repercussion.

Editor’s Note: The summary bullets for this short article were selected by Looking for Alpha editors.