JHVEPhoto/iStock Editorial through Getty Images

Back in late January, I called Veeva Systems ( NYSE: VEEV) among the most appealing SaaS names out there, with an appealing assessment and among the most economic crisis resistant client bases out there. Ever since the stock is up about 17%, although it has actually returned some gain more just recently. When I reviewed the stock in June, I still hung on to my bullish belief. Let’s capture up on the name.

Business Profile

As a refresher, VEEV uses SaaS service for the life sciences market. Its Industrial Solutions is a CRM service that was initially constructed on top of Salesforce.com’s ( CRM) platform to assist life science business advertise their items. Nevertheless, the business revealed it would not restore its arrangement with Salesforce when it ends in September 2025 which it will move consumers over to its Veeva Vault Platform.

The business’s R&D Solutions items, on the other hand, assist life science business throughout the advancement stage of drugs and medical gadgets. It is constructed on VEEV’s exclusive cloud business material management system called Vault.

Strong Q2 Outcomes

Shares of VEEV published a great rally following its Q2 outcomes, with the stock increasing over 8% the next session and continuing to march greater the over the next week or two. Nevertheless, the stock has actually returned a few of its gains ever since.

For the quarter ended July, VEEV saw profits boost 10% to $590.2 million. Membership profits climbed up 10% greater to $470.6 million. Service profits increased 13% to $119.6 million. Experts were trying to find profits of $582.1 million.

The business saw an $18 million profits effect from the standardization of termination for benefit rights, which is an accounting modification that affects multi-year agreements. Leaving out the TFC effect, profits increased 14%.

Industrial Solutions membership profits increased 3% to $243.4 million, while service profits for the section increased 7% to $47.3 million. Management stated it included 8 brand-new SMB consumers in the quarter for its core CRM item.

The business stated that it likewise registered its very first client for its CRM item powered by its Vault Platform. While Vault CRM will end up being usually readily available in April, this early adopter will go reside in Q4.

The business likewise kept in mind that in China the nation passed brand-new policies that need approval for cross-country transfer of individual information. VEEV states it has a service that will satisfy these requirements, which consumers might change to it or assess other options. About 3% of its profits originates from China.

R&D Solutions profits leapt 18% to $227.2 million. Service profits for the section likewise increased 18%, being available in at $72.3 million.

Changed EPS was available in at $1.21, quickly exceeding the expert agreement of $1.13.

Stabilized billings were up 16% year over year to $553 million. This came ahead of business assistance due to deal timing.

The business produced $212 million in adjusted operating capital. It ended the quarter with more than $3.9 billion in money and short-term financial investments and absolutely no financial obligation.

While the TFC change as soon as again moistened its outcomes, VEEV, nevertheless, as soon as again set up strong outcomes. Its CRM service has actually grown and is no longer the development chauffeur it as soon as was, however R&D Solutions continues to shine, with brand-new items continuing to get traction.

With almost $4 billion in money, it will be intriguing to see what VEEV chooses to do with it. Today, it is getting some good interest earnings, however it stated its primary focus will be M&A. Discovering a strong 3rd leg of development, even if it’s through acquisition, would be huge for the business.

Outlook

Looking ahead, VEEV projection financial Q3 profits to come in between $614-616 million. That consists of a $12 million TFC standardization effect headwind. The expert agreement at the time was for Q3 profits of $617.2 million. Membership profits is forecasted to be around $493 million.

Changed running earnings is forecasted to be in between $223-225 million, while changed EPS is forecasted to be in between $1.26-1.27. The expert agreement at the time was for Q3 EPS of $1.25.

It is trying to find stabilized billions to be about $436 million for the quarter.

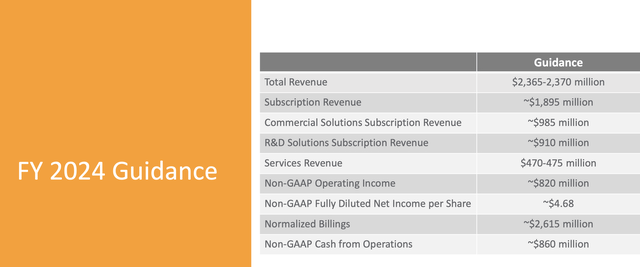

For the complete year, VEEV assisted for profits of in between $2.365-2.37 billion, a boost of $5 million on the low-end from its previous assistance. The projection consists of a $95 million effect from TFC standardization and $12 million in currency headwinds.

Membership profits is forecasted to be in between about $1.895 billion, up $5 million from its previous projection. Industrial Service profits is anticipated to come in around $985 million, while R&D Solutions profits is anticipated to be around $910 million.

VEEV is forecasting changed running earnings to be $820 million, with changed EPS of around $4.68. The business formerly assisted for full-year EPS of $4.59 and the agreement was for EPS of $4.32.

VEEV repeated its financial 2025 assistance projection of a minimum of $2.8 billion in profits and a minimum of $1.0 billion in adjusted operating earnings.

VEEV a little changed its assistance upwards, with that originating from the Industrial Service section. While the business has actually stated that there is some softness in little biotechs due to the macro environment and their financing scientific trials, general it has a really resistant client base. On the other hand, its winning some good handle locations such as EDC, which ought to assist see profits ramp with time. And with these ramping offers, down the roadway the TFC changes will move from a headwind to more of a tailwind.

Citi Global Tech Conference

Last month, VEEV EVP of Technique Paul Shawah was at a Citi financial investment conference speaking about the business. Some subjects he covered were the macro environment, keeping in mind that the business has actually seen an effect from the decrease in little biotech financing, along with the effect it has actually had on its Crossix marketing organization. Nevertheless, VEEV sees Crossix being a huge chance over the long term.

Shawah likewise went over generative AI. VEEV has actually revealed a CRM Bot, and it desires its information and applications to be AI-enabled. Nevertheless, the SVP kept in mind that the business does not wish to overemphasize its AI capabilities to its consumers. He stated precision is the most crucial thing in the life sciences market.

Shawah likewise concentrated on 2 huge item locations of possible development in Link and Compass. At the conference, he stated:

So Link and Compass are considerable and huge services for us, in many cases, bigger than a few of our recognized software that we have. So these are huge market chances and growing chances. Link is a fine example where we have not completely sized the chance since it continues to broaden. You can think of it as a platform where we began with one item, and now we have lots of items and there will be likely more items that we broaden on that exact same Link platform. So it’s a growing and broadening chance that we’re still extremely early days. And the method to think of it is, I have actually discussed previously, it’s a platform for real-time intelligence. We have innovation, however likewise people, individuals that source this real-time information about things like clinical specialists and believed leaders in the life sciences market, who are they, what are they speaking about? What occasions are they speaking at, did they go to ASCO, the huge oncology occasions? What are they providing on, what scientific trials are they taking part in? So we have this truly deep and abundant exposure, which’s all since of the Link platform. And after that we’re pointing that platform at other entities like crucial accounts, so who are the healthcare systems and the decision-makers in those health systems. That’s an example of another information set. And we’re continuing to do that at various information sets, which’s how we have actually begun with a single item, and now we have lots of items, and you can see that chance broadening. So and after that Compass, simply to double-click a bit more into that. That’s likewise a really considerable chance. Link is worldwide, our Compass item is concentrated on the U.S. market. And our very first information item there is around patient information, longitudinal client information, which are the important things like what are the treatments and the medical diagnoses and the prescriptions that all take place around the client. It’s truly important info for a life sciences business to section their consumers, choose who they target. And after that eventually, the information sets we supply will aid with things like reward settlement. So these are mission-critical information sets that the majority of every business purchases. And now they have a really practical option in the market with Veeva.”

Today, it appears like VEEV has some good opportunities when it concerns development chances. With its core CRM item now grow, VEEV is broadening into other locations, are options like Link and Compass might go along method to be future development motorists for the business. Something VEEV has actually done an excellent task of it having actually had the ability to broaden beyond its initial support CRM item.

Evaluation

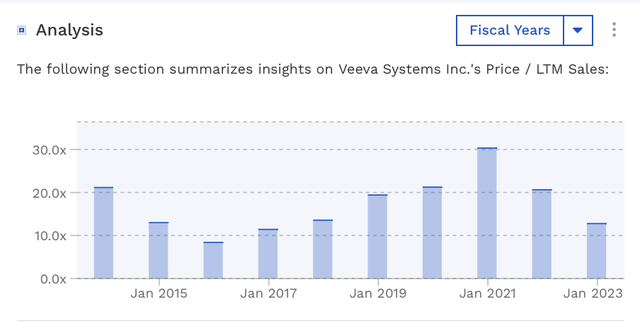

VEEV presently trades at 12x 2024 (ending in January) profits of $2.37 billion (EV/S), while its EBITDA multiple is 33x based upon the agreement of $856.7 million.

For fiscal-year 2025, it trades at 10x profits price quotes of $2.82 billion and under 27x the adjusted EBITDA agreement of $1.06 billion.

VEEV has actually traditionally traded at a high P/S ratio, with a P/S ratio of over 19x for 4 of the previous 5 years. You ‘d need to go back to 2016 to see a ratio under 10x.

Conclusion

With strong development, a sticky service, and a mostly economic crisis resistant client base, VEEV continues to be well placed to be a strong entertainer. The business has a great deal of emerging development chances, and with almost $4 billion in money, it will be intriguing to see if it can discover an acquisition to move development a lot more.

The stock’s assessment stays the greatest sticking point, as at 10x next ‘s profits it is not low-cost, although leading SaaS names can command multiples of over 12x, and the business has actually frequently commanded a P/S ratio of over 12x in the past also.

Today, I ‘d choose to be a purchaser of VEEV on a little a rate dip, however it’s not to the point where I ‘d reduce my score rather yet. As such, I will continue to rank the stock a “Buy.”