An individual holding $100 U.S. currency notes. JoeLena

Looking for Alpha readers who have actually followed my work over the years have actually most likely discovered that I’m a person who consumes his cooking. I own over 100 stocks in my dividend development stock portfolio. That is why when I’m covering a business, it’s since I think in it and have a beneficial interest in its success as a long-lasting investor (or wish to ultimately own it).

The extra insurance company Aflac ( NYSE: AFL) is a business that I do not own a substantial stake in within my portfolio (0.4% of my dividend earnings). Nevertheless, I am positive in business and wants to up the weighting of it within my portfolio For the very first time considering that February 2022, let’s go into Aflac’s basics and dangers to comprehend why I would want to contribute to my position at the ideal rate.

Aflac’s Awesome Dividend Development Performance History Can’t Be Fabricated

Aflac’s 2.2% forward dividend yield isn’t specifically appealing compared to the monetary sector mean of 4%. That discusses why Aflac makes a D grade for dividend yield from Looking for Alpha’s Quant system.

However for financiers who can neglect this lower starting earnings, there are lots of factors to like the stock.

As numerous readers are most likely conscious, Aflac quickly satisfies the requirements essential to certify as a Dividend Aristocrat. The business is an S&P 500 element with 40 successive years of dividend development, which is well above the 25-year minimum. While business can massage revenues figures in a range of methods to their benefit, they can’t phony dividend development for 40 years: Either a business can’t pay a growing dividend years after years or it can do so. Suffice it to state, that Aflac is a business with exceptional dividend consistency.

Not to point out that the extra insurance company’s dividend has actually intensified at 9% each year over the previous ten years – – much better than the monetary sector mean of 7.9%. This is how Aflac makes a B+ grade for dividend development from Looking for Alpha’s Quant system.

Decent dividend development need to continue in the years ahead for 2 factors. Initially, the expert agreement for adjusted diluted EPS development is 6% each year over the medium term. Second, Aflac’s adjusted diluted EPS payment ratio is rather low: The business is slated to pay $ 1.68 in dividends per share in 2023. Versus the expert agreement of $ 6.04 in changed diluted EPS for 2023, this is a 27.8% changed diluted EPS payment ratio. That need to leave the business with the essential buffer to fulfill my yearly dividend development rate projection of 7.25% over the long run.

A Basically Intact Company

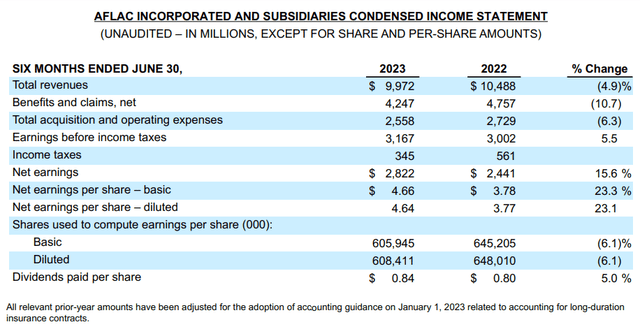

Aflac Q2 2023 Revenues News Release

Through the very first half of 2023, Aflac has actually provided good operating results to its investors. The business’s overall profits dipped 4.9% over the year-ago duration to $10 billion in the very first half. A drop in the topline might not appear all that motivating, however there is more to the story.

Back in 2019, news spread that Japan Post poorly offered numerous countless Aflac policies. This has actually pushed profits in Japan for a couple of years now. That discusses how Aflac Japan’s overall profits decreased by 13.8% year-over-year throughout the very first half of 2023. However with Japan Post Group just recently releasing the brand-new cancer insurance coverage item in April, Aflac Japan might become on its method to healing.

Aflac U.S. taped $3.3 billion in overall profits for the very first half, which was up 1.7% over the year-ago duration. In addition to greater business and other profits and net financial investment gains, this is how Aflac’s general profits just somewhat reduced in the very first half.

Aflac’s changed watered down EPS omitting undesirable foreign currency translation grew by 11.3% year over year to $3.24 throughout the very first half. Aflac’s increasing digital adoption of brand-new company applications and claims assisted its cost ratio to fall listed below 20% for the very first half. Paired with a considerably lower share count from share repurchases, these aspects are why currency-neutral adjusted diluted EPS development far surpassed profits development.

Besides its strong operating outcomes, Aflac is an economically robust company. Since June 30, the business had $4.7 billion in money and money equivalents. This was much higher than its minimum target quantity of $1.8 billion, which is why Aflac has actually been appointed A- and A3 credit rankings from S&P and Moody’s on steady outlooks (information in this area sourced from Aflac Q2 2023 revenues news release and Aflac Q2 2023 10-Q filing).

Threats To Think About

Aflac might be doing fairly well operationally, however there are dangers that financiers require to be comfy with prior to ending up being an investor.

First Of All, Aflac Japan made up 69% of its overall profits in 2022 and Aflac Japan held 80% of the business’s overall properties in 2022. This indicates that the business’s monetary potential customers associate with Japan’s general economy. If the nation’s financial fortunes are forced, Aflac might likewise be hurt as an outcome.

Another threat to the business is that while it is presenting innovation to make its company more digital, many policies are offered through in person interaction. In times of public health emergency situations like COVID-19, this hurt Aflac’s outcomes. If another pandemic were to strike, this might once again hold true (a total conversation of dangers can be discovered in the Threat Aspects area of Aflac’s latest 10-K filing).

The Assessment Looks A Bit Too Abundant

As holds true with any stock, it is essential to not pay excessive. This is because by preventing paying far more than reasonable worth, the chances of long-lasting financial investment success increase considerably. That is why I will utilize 2 evaluation designs to evaluate the reasonable worth of Aflac’s shares.

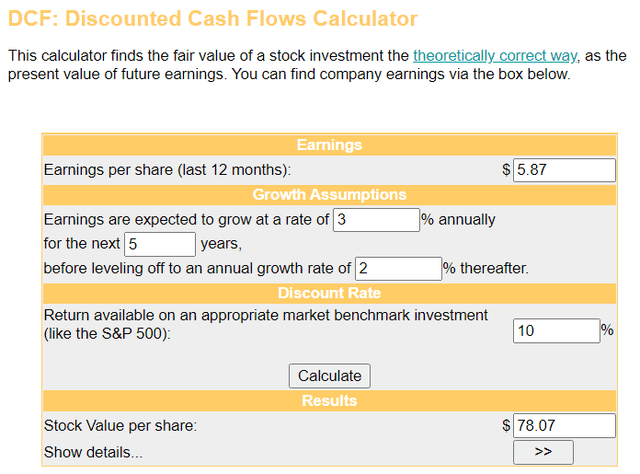

The very first evaluation design that I’ll make use of to worth shares of Aflac is the reduced capital or DCF design. This includes 3 inputs.

The very first input into the DCF design is the last 12 months of currency-neutral adjusted diluted EPS. That quantity is $5.87 for Aflac.

The next input for the DCF design is development forecasts. I’ll presume a 3% yearly development rate for 5 years, which has to do with half of the expert agreement. I will then consider a deceleration to 2% each year in the years afterwards.

The last input into the DCF design is the discount rate, which is the yearly overall return rate. This varies from one financier to another, however my individual choice is 10%.

Utilizing these inputs for the DCF design, I brought out a reasonable worth of $78.07 a share. That indicates Aflac’s shares are trading at a 2.9% discount rate to reasonable worth and use a 2.9% upside from the existing rate of $75.84 a share (since October 2, 2023).

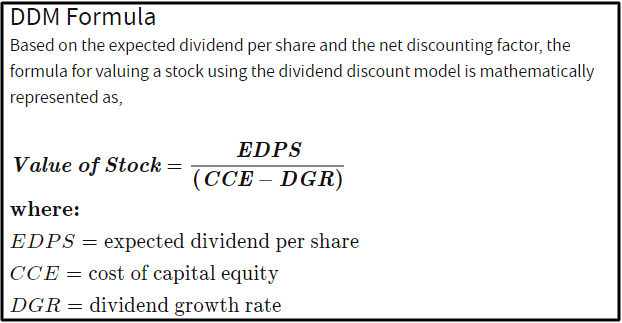

Investopedia

The other evaluation design that I will use to approximate the reasonable worth of shares of Aflac is the dividend discount rate design or DDM, which likewise has 3 inputs.

The very first input for the DDM is the annualized dividend per share, which is $1.68 for Aflac.

The 2nd input into the DDM is the expense of capital equity or yearly overall return rate. I will once again utilize 10% for this input.

The 3rd input for the DDM is the yearly dividend development rate. As I mentioned earlier, I’ll presume 7.25% for this input.

Plugging these inputs into the DDM, I get a reasonable worth of $61.09 a share. This indicates that Aflac’s shares are priced 24.1% above reasonable worth and might position 19.4% capital devaluation from the existing share rate.

When I balance these 2 reasonable worths together, I calculate a reasonable worth of $69.58 a share. That recommends shares of Aflac are trading at a 9% premium to reasonable worth and might have an 8.3% drawback from the existing share rate.

Summary: Aflac Is A Buy Below $70 A Share

Aflac is a dream stock for dividend financiers: The dividend has a recognized performance history of development, it is well-covered by revenues, and increasing revenues need to provide it more space to grow progressing.

However after rallying 17% considering that I last covered the stock as the S&P 500 has actually sunk 5%, Aflac isn’t the worth that it was not so long back. Up until the stock dips back listed below $70 a share, that is the only factor I rate it a hold for the time being.