designer491

Co-produced by David Ksir.

When it pertains to buying property financial investment trusts, or REITs ( VNQ), comprehending utilize is exceptionally crucial.

All of us understand the stating that financial obligation is an excellent servant, however a horrible master. Well, this is particularly real in property. Financial obligation allows REITs to grow faster and enhances investor returns. However if utilized badly, it can quickly trigger dividend cuts and even result in personal bankruptcy.

With the Federal Reserve raising rates at an extraordinary rate over the previous year and a half in an effort to combat inflation, it is now as crucial as ever to be careful of high utilize.

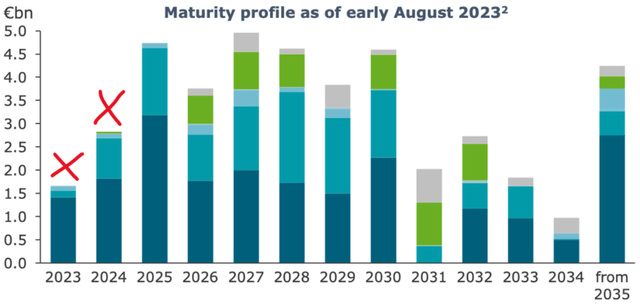

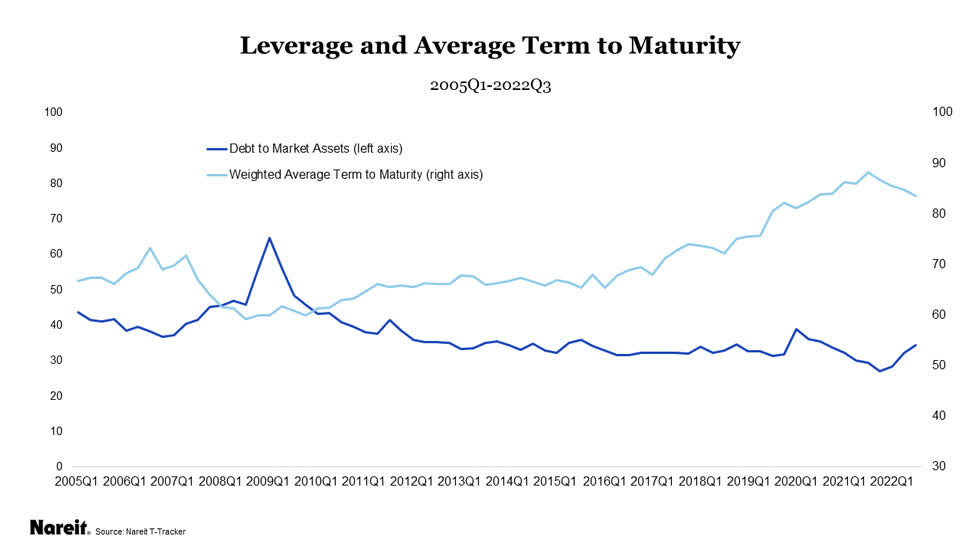

The advantage is that, typically, REITs today are far better placed to hold up against high rates of interest than they were throughout the 2008 crisis. Utilize is lower, the typical term to maturity is longer, and the share of fixed-rate financial obligation is up from 70% in 2005 to over 85% today.

NAREIT

The market has actually absolutely gained from the last significant crisis, however that does not indicate that every REIT is safe to purchase. While the increase in rates of interest has actually caused lots of quality REITs selling deal area, it has likewise substantially increased the threats for those who have actually not been on top of their video game. As financiers, our task is to separate the weak from the strong to alleviate threats.

Today, we highlight 5 REITs that are overleveraged:

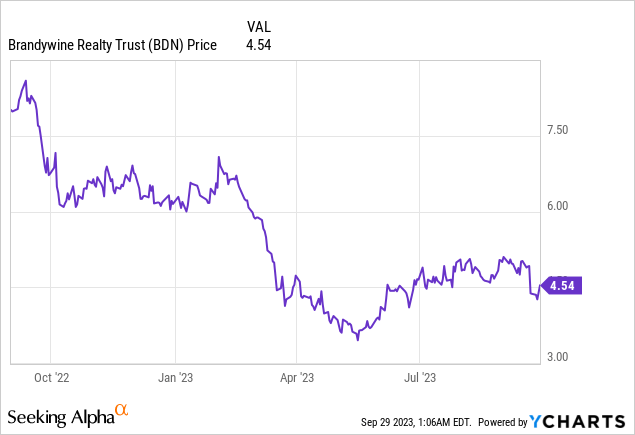

Brandywine Real Estate Trust ( BDN)

Brandywine is a workplace REIT with a heavy concentrate on the Philadelphia market where 80% of the business’s NOI is created. The staying 20% of NOI originates from the fast-growing Austin market, where management selected to broaden in an effort to diversify its portfolio.

The business’s stock has actually been struck particularly hard over the previous 18 months, since of 2 main factors:

# 1 – An occupant mix that’s not durable to work-from-home

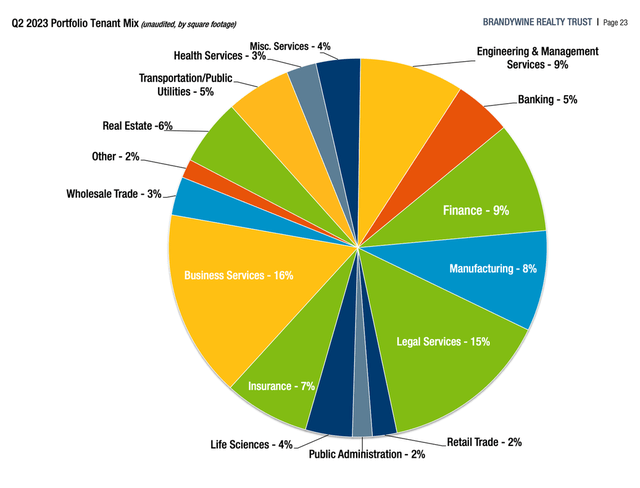

The issue is that BDN owns mainly standard workplace rented to renters in legal and company services, insurance coverage, financing, and banking. All of these are markets where staff members can do a big part of their work from another location, which increases the possibility that renters will wish to scale down when their leases end.

Management has actually been attempting to fight this by increasing the percentage of Life Science renters, which truly aren’t dealing with the exact same threat. However regardless of their best shot, the percentage stays low at simply 4% today, and although they presently have adequate Life Science area under building to double their direct exposure to 8%, I do not believe it will suffice to alter the nature of their portfolio.

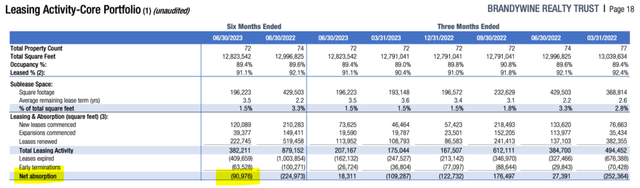

Current leasing activity validates this, as the business hasn’t had the ability to keep adequate renters, leading to unfavorable net absorption over the very first half of the year and gradually decreasing tenancy.

The important things is that in order to turn things around and draw in renters, BDN will likely need to decrease leas, provide greater rewards (longer rent-free durations or greater fit-out contributions), and/or invest substantial CAPEX to bring a few of their older structures as much as date. All of these will have a significant unfavorable effect on the business’s capital.

# 2 – Extremely leveraged balance sheet

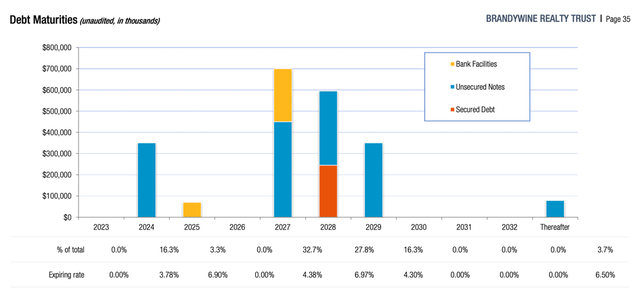

The marketplace hasn’t agreed with to workplace REITs for a while, and things got a lot even worse following the collapse of Silicon Valley Bank in March 2023. When SVB collapsed, it ended up being obvious that credit will tighten up substantially and some workplace REITs might have difficulty re-financing their financial obligation as it comes due, for the basic truth that local banks might not wish to keep direct exposure to workplaces.

Not surprisingly smaller sized workplace REITs concentrated on standard area were left most susceptible, particularly if extremely leveraged.

And honestly, Brandywine’s utilize is high at net financial obligation/ EBITDA of 7.6 x

The business will likewise need to handle a considerable financial obligation maturity of $350 million next year, which will at the minimum result in a boost in interest cost.

For contrast, we can take a look at Highwoods Characteristic ( HIW), which is a well-run workplace REIT with residential or commercial properties all throughout the Sunbelt. HIW has a more modest net financial obligation/ EBITDA of 6.0 x:

Up until now, things are reasonably steady and the business continues to pay its dividend which yields over 15%. Nevertheless, their high utilize and high payment ratio are most likely to impede their capability to invest substantially in their portfolio to reconstruct their occupant base, most likely resulting in additional losses in the future.

Workplace Characteristic Earnings Trust ( OPI)

OPI is another little workplace REIT with 155 residential or commercial properties situated all throughout the nation, and it deals with a great deal of the exact same issues as Brandywine.

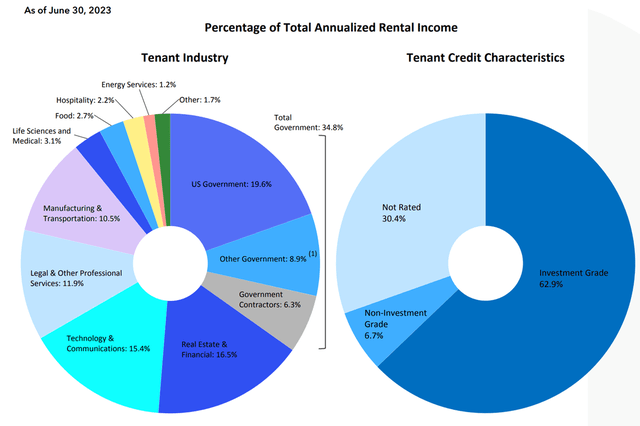

In regards to renters, about a 3rd of area is rented to the Federal government, followed by Realty and Financials (16%), Innovation & & Communications (15%), and other Expert Provider (12%).

Workplace Characteristic Earnings Trust

Leasing to the federal government features a variety of benefits, however there are likewise disadvantages. To start with, with the ever-increasing deficit spending, it is possible that when leases end, the federal government might pick to combine its operations into less structures to cut expenses. Additionally, the federal government normally has lower efficiency requirements for their staff members compared to personal corporations which suggests they might be less most likely to demand individuals returning to the workplace.

All things thought about, I believe the REIT’s tenancy will come under pressure over the next 24 months as about a 3rd of its leases end, and a big part of renters possibly pick to scale down, unless provided extremely beneficial terms from OPI.

Current leasing activity exposes that the REIT is certainly currently using affordable leas in order to keep renters and restore their leases.

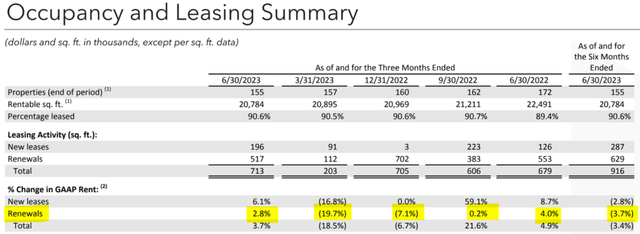

In specific, over the very first half of the year, lease spreads on renewals have actually balanced -3.7% on a GAAP basis, which suggests that on a money basis, the drop was even larger. And in Q1, the discount rate was as huge as 20%!

Workplace Characteristic Earnings Trust

However regardless of lower leas, the REIT has actually just rented 916,000 sqft of area throughout the very first half of the year, which is low compared to upcoming expirations over the 2nd half of 2023 of 1.5 Million sqft and practically 3 Million sqft in 2024.

I see just 2 possible methods moving forward. Either tenancy drops or the business uses a lot more aggressive lease discount rates. In either case, their capital will suffer.

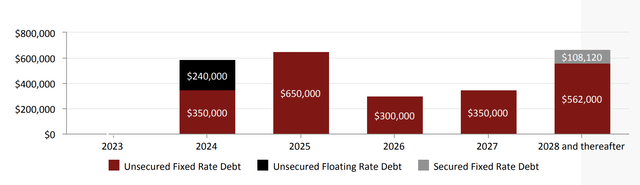

Not just will 2024 be a hard year for OPI from a leasing viewpoint, however they will likewise need to manage a big $590 million financial obligation maturity. I state big since it’s practically 3 times their annualized FFO, which suggests there’s no chance to pay back the financial obligation from kept capital and refinancing will not be simple nor low-cost offered their currently high utilize of 7.9 x EBITDA

Workplace Characteristic Earnings Trust

OPI is not well placed for the existing high rate of interest environment and has little hope of minimizing its high utilize considered that their capital is likely to agreement over the next 2 years.

You may be shocked to see Vonovia on the list. After all, we hold a considerable position in the German home property manager and have actually been promoting purchasing it for rather a long time.

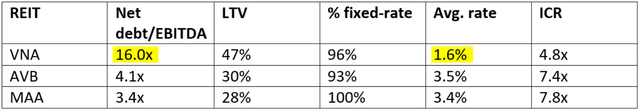

However regardless of our favorable outlook, the truth is that the business is substantially more leveraged than its U.S. peers, particularly on a net financial obligation/ EBITDA basis. Additionally, if rates of interest stay raised for an extended amount of time, Vonovia will need to take active actions to decrease its utilize.

The distinctions are big, however to make a significant contrast, we need to comprehend some structural distinctions in between the U.S. and German multifamily markets.

To start with, as obvious from the table above, Vonovia delights in an exceptionally low expense of capital of 1.6%. Such low interest on their financial obligation has actually traditionally truly incentivized the business to grow strongly through financial obligation issuance, which is precisely what management has actually done over the years. As an outcome, financial obligation LTV has actually balanced 45-50%, which is above the 30% mark frequently seen in quality U.S. property REITs.

Second Of All, as an outcome of high home worths in Germany and controlled leas, Vonovia makes extremely low yields of around 3-3% on their residential or commercial properties. This makes their EBITDA rather low in contrast to their book worth, which in turn leads to an extremely high net financial obligation/ EBITDA of 16x.

However it’s not all bad. Management has actually taken active actions to fix the circumstance and they have actually currently made great development. All bank loans developing up until completion of next year have actually been re-financed, and 2 current disposals have actually created enough liquidity to pay back all bonds developing this year and next year.

Vonovia isn’t totally out of the woods yet, and if rates of interest stay raised for a number of years, they will probably need to deal with more possessions to slowly pay back the maturing unsecured financial obligation and decrease utilize.

All things thought about, we see the opportunity of personal bankruptcy as incredibly low as banks are plainly available to dealing with Vonovia to renegotiate their financial obligation and current disposals near book worth are extremely motivating.

In the meantime, the stock trades at a significant discount rate to its net possession worth, supplying substantial upside possible.

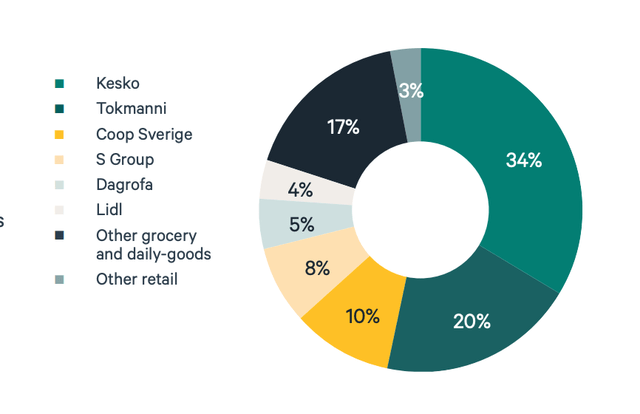

Cibus Nordic Realty (CIBUS/ CBUS)

Cibus, Inc. is a European business that owns practically 500 supermarket throughout Finland, Sweden, Denmark, and Norway. Their renters consist of significant regional supermarket chains such as Kesko or S-Group along with discount rate chains such as Tokmanni or Lidl.

Their concentrate on supermarket makes them extremely durable to economic downturn along with e-commerce. Additionally, supermarket are effectively placed to hold up against high inflation, since they can quickly increase costs and pass the inflation onto the last customer, making them the perfect occupant for a high inflation environment.

In general, we like Cibus since of the protective nature of its company and hold a little position in our worldwide portfolio.

However something to be conscious of here is utilize which the business has actually built up as an outcome of an aggressive development method in a low rate of interest environment.

Cibus has simply over EUR 1 billion of financial obligation at a typical rate of 4.6% (100% hedged), representing an LTV of 55%. On an adjusted EBITDA basis (leaving out latent portfolio revaluation P&L), net financial obligation/ EBITDA stands at 10.0 x That’s high by any procedure, particularly when we think about that Cibus has a weighted typical financial obligation maturity of just 2.5 years.

As A Result, if EUR rates of interest stay raised enough time, the business’s interest cost will increase. Fortunately, since rates of interest are just high since of high inflation, which straight benefits their renters, we believe it’s most likely that Cibus will have the ability to raise leas to (a minimum of rather) balance out the greater expense of capital.

We like the risk-reward here since its appraisal is greatly affordable however recommend care for more protective financiers since of the business’s higher-than-usual utilize.

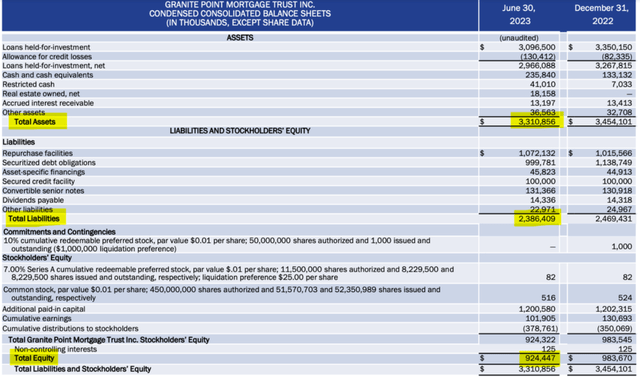

Granite Point Home Mortgage Trust Inc. ( GPMT)

Next on the list is GPMT, which is a home loan REIT (” mREIT”). Home mortgage REITs run a various company design than Equity REITs and normally utilize a lot more utilize.

Granite Point, in specific, owes about $2.4 billion on its $3.3 billion loan portfolio. That’s debt-to-assets of 73% and utilize of 3.7 x

Granite Point Home Mortgage Trust

Throughout the great times, utilize is fantastic as it amplifies returns, however throughout the hard times, it produces extra threats. When it comes to GPMT, the threat depends on a a great deal of workplace loans in their portfolio (42%). With workplace appraisals dropping dramatically over the previous 18 months, if a big adequate part of debtors default on their loan payments, the mREIT might need to default on its own financial obligation.

The important things is that there are currently some fractures forming as the REIT has actually currently taken a $15.5 million write-off as an outcome of a default on a $114 million workplace loan in Q4 2022 and ever since, management has actually been strongly increasing its credit loss reserve in anticipation of additional defaults on their 5-rated workplace loans which represent about 8% of the loan book.

Honestly speaking, at this time it appears not likely that GPMT would default on its financial obligation, as it would need about 30% of its loans to default. However, the REIT is extremely leveraged, which suggests investor losses will be amplified, and offered the grim outlook for workplaces, we do not like the risk-reward here.

Bottom line

Utilize is a double-edged sword and in this hard financial environment, we do not like the risk-reward of buying a lot of overleveraged REITs.

While there are lots of fantastic deals in the market today, it’s as crucial as ever to be selective.

In the words of Warren Buffett: “It’s far much better to purchase a fantastic business at a reasonable cost than a reasonable business at a fantastic cost.”

That’s why we attempt to keep away from distressed beaten-down REITs that are overleveraged.

Editor’s Note: This post talks about several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.