The financial obligation bubble is currently breaking, and it’s impacting numerous sections, consisting of the triple BBB, the most affordable investment-grade level. Why should you be worried? Due to the fact that it will lead to less tasks, lowered earnings, and increased monetary pressure on customers. In reality, some are turning to buy-now-pay-later prepare for standard needs like food, which is not a sustainable technique.

CHAPTERS:

0:00 Financial Obligation Bubble Bursting

1:05 Is This Where it Starts?

5:03 Household Scenario

5:42 Customers

7:45 Costco Gold

12:24 Get Your Technique

SLIDES FROM VIDEO:

RECORDS FROM VIDEO:

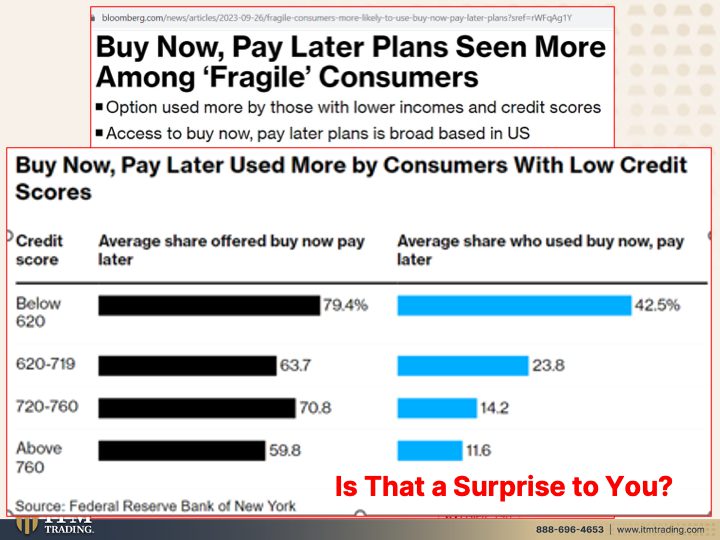

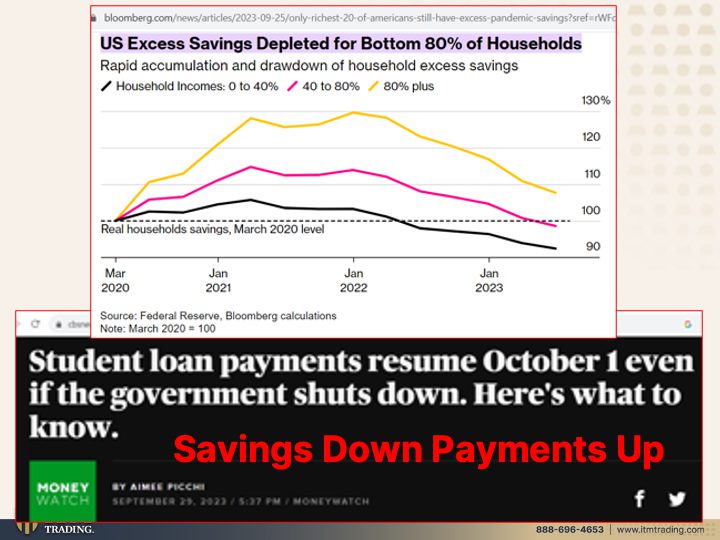

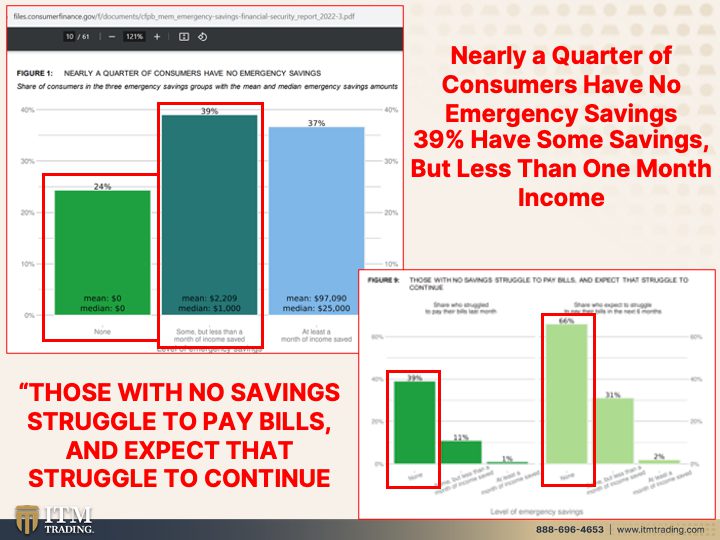

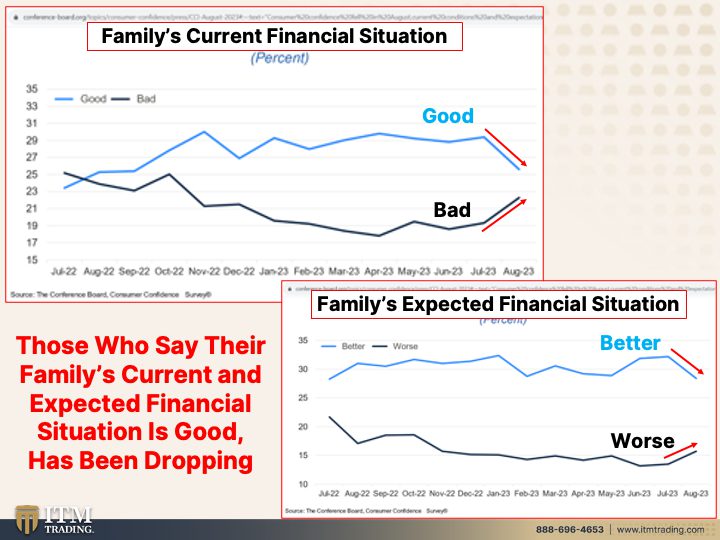

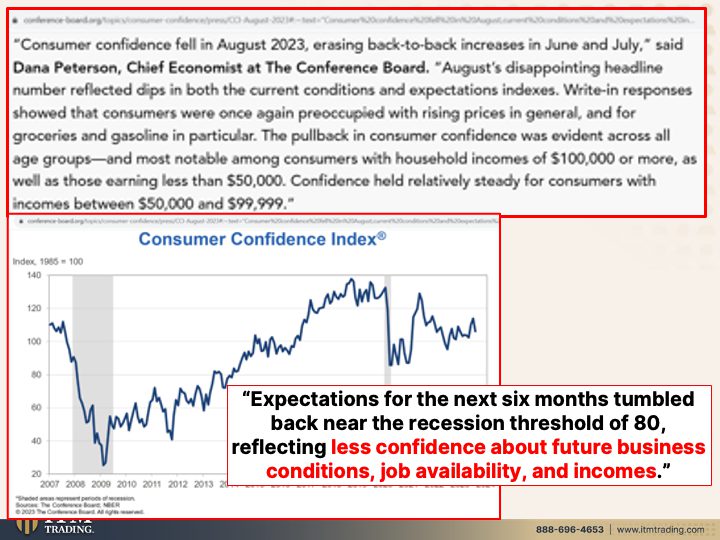

Financial obligation bubble is breaking. Corporations are drowning in financial obligation, and your next-door neighbors are now rushing to purchase gold bars from Costco. Why did you state? Costco is now offering one ounce gold bars and they’re currently offering out quite quick here throughout the nation. Yes, you heard that right. We are on the edge and your monetary future is hanging in the balance. How did we get here and what can you do to protect your household from the approaching storm? Showing up, I’m Lynette Zang primary market expert here at ITM Trading, a complete physical gold and silver dealership focusing on customized techniques. And you require one if you do not have it. Click that calendly link listed below. Speak with among our specialists and get your technique in location and performed. Due to the fact that honestly, the financial obligation bubble is currently breaking. Are you all set for this? It’s beginning in the lower locations, however likewise the triple B, which is the minimum level thought about investing grade. So what does that mean for you? Why should you truly appreciate that? Well, there are a great deal of reasons that you must appreciate that. However mainly this will cause less tasks and less earnings and more earnings losses. Which incorporate to what is expected to be helpful of the whole United States economy, which is the customer. However you have these by now and pay later strategies. And we have actually seen where individuals are in fact utilizing these strategies to purchase food, for goodness sakes. So individuals are needing to go into financial obligation and break down their payments for food. How do you believe that’s going to end up? However the alternative is utilized more by those with lower earnings and credit report. Access to purchase now pay later on strategies is broad based in the U.S. And as I stated, we have actually seen some individuals even needing to utilize it to purchase food. However you can see the credit report listed below 620, 42.5% is the typical share who utilized the buy now pay later on from that offering. And clearly, as you have higher earnings, and so on, you will utilize it less and less. However still you can see that there is tension to spend for things today, even in the greater level of credit history, which might likewise likely cause the greater level of earnings. Is that a surprise to you? It’s not to me, truthfully. You might see that coming so quickly. Obviously, as inflation has actually raved through, earnings have actually not equaled it. And, you understand, you have actually got to feed your household. You have actually got to do these things. And the excess cost savings from all of that complimentary cash printing that was going on throughout the pandemic, it is diminished for the bottom 80% of homes. At the very same time that you had trainee loan payments coming on board, it’s not going to matter, no matter what occurs. These individuals had 3 years where they were not needing to pay that. And think what other things showed up in its location. So what we see is their cost savings are down and payments are up, which spells problem in the financial obligation markets. I believed this was truly fascinating is most likely a stat that you have actually currently heard, however almost a quarter of customers have no no for emergency situation cost savings and a complete 39% in addition. So what is that, 63% of all customers? Well, those men have less than one month’s worth of cost savings. Possibly they just have 2 or 300 dollars. Wow. So that’s 63% have less than a month down to no in cost savings in case of emergency situation. Can you see the issue developing? Not just that, however those without cost savings are having a hard time to pay their costs today and they anticipate that to grow to 66% tomorrow, that they’re having problem today. However they 66% expect it’s going to be an even larger issue in the future next month and on and on and on. We’re a customer driven economy. If the customer can take in Houston, we got an issue. Those who state their household’s present and anticipated monetary circumstance is great has actually been dropping. Let’s see what that appears like, since this is the household’s present monetary circumstance there. It’s great, the bottom, it’s bad. Therefore as the great is dropping the present monetary system for households is increasing. It’s not a great formula. And their anticipated monetary circumstance, as you can see, that’s moving too. So the great the much better is disappearing and the even worse is increasing. This is a dish for catastrophe. When you are counting on these weak customers to keep this video game going. Obviously, I do not truly believe that they’re intending on keeping this going. Let’s discuss customer self-confidence, since it fell in August 2023, removing back to back increases in June and July. August frustrating heading number showed dips in both the present conditions and expectation indexes. Right. In action has actually revealed that customers are as soon as again preoccupied with increasing rates in basic. However wait. Inflation is disappearing, isn’t it? No. The speed in specific locations is cutting down, however not in all locations. So, yes, rates have actually not decreased and they’re returning up once again. The pullback in customer self-confidence appeared throughout any age groups and many significant amongst customers with family earnings of $100,000 or more. In addition to those making less than 50,000. Self-confidence held reasonably constant for customers with earnings in between 50,000 and and nearly 100,000. However it’s revealing you on the lower end in addition to the upper end, that self-confidence, which is what we require to keep this entire thing going, is decreasing and not in an excellent way. Expectations for the next 6 months toppled back near the economic crisis limit of 80, showing less self-confidence about future service conditions, task schedule and earnings. Therefore when you are less positive, then you understand you invest less. Which’s an issue. You handle less financial obligation, you invest less, you’re going to invest your cash on outright needs, not frivolities for sure. Costco, I enjoy this. I enjoy this for many factors that I’m going to inform you. All of them. Costco is offering gold bars and they’re offering out within a couple of hours. They’re offering the one ounce gold palm Swiss woman fortune bars. And their primary monetary officer stated the bars remain in hot need and do not last long in stock. Now, let’s think of what this suggests, since Costco is absolutely traditional and you have ideal throughout the board a great deal of individuals of all socioeconomic levels that go to Costco. Now, they have actually restricted the amount that you can purchase 2 to 2 ounces. However what this informs me is that the mainstream, the general public is beginning to end up being more mindful. I have actually had a demand to do a video on the stages of a pattern, so remain tuned. I will most likely either have that for next week. I will have that showing up. However this would be an awareness piece that would prepare for. Well, could it prepare for greater rates on the area market? Since that’s such a simple market to control. You can develop as much gold and silver for that matter as you desire. That does not exist and never ever will exist in the physical markets. We’re currently seeing premiums increase. We’re seeing rates increase more considerably. You discover more reality in a market that is just physical. However I understand that they have actually delayed this unavoidable timing for a long period of time now. I suggest, 2020, we remain in 2023. Hey, didn’t they simply pertain to a conference of the minds to delay another federal government shutdown? Does that suggest whatever is hunky dory? You understand, here you hear absolutely nothing about what occurred in March and April with the local banks as the B, and so on. Definitely that need to be all repaired. Well, no, none of that is repaired. None of it. There is a crisis that is developing and they are depending on weak point to support the strong or those that have the wealth. I must state the 1%. We’re heading into an issue. However Rose kept in mind that the business appears to have actually accelerated its offering of dried food and other survivalist items at a time when stress over the future are running high. In addition, they have actually done their marketing research. I believe it’s an extremely creative method to get their name in the news and have some fantastic promotion. There is absolutely a crossover of individuals living off the land, being self-dependent, thinking in your own currency. That’s the attract gold as a safe house as individuals who despair in the United States dollar. The general public fidgets about the future too they must be. Neighborhood can assist those that do not have cash to purchase gold and silver. Possibly they have great deals of abilities. Possibly they can plant a garden or develop a home or repair the electrical or repair the pipes. If you can’t place yourself into the physical metal, enter into a neighborhood since someone in there can. We simply are broadening our little neighborhood that’s increasing the hill. If we require to bug out, that’s a level of convenience for me. And the concern is, what abilities do you give the table? I’m bringing all of this. What are you bringing? So what are you bringing? That’s what I’m asking you. And look in your area initially for your neighborhood. Go internationally. Due to the fact that we are all in this together and we need to come together internationally and be supported to fulfill individuals where they are and see how you can come together to be truly a lot more powerful. Due to the fact that as soon as the general public ends up being mindful of what’s truly occurring to the currency, self-confidence disappears totally. You have devaluation. Are you gotten ready for that? I hope so. I truly do. And if you have not done it, I’m going to be repeated. Click that afraid link listed below. Have a discussion with among our experts. Get your individual technique in location and get it performed a.s.a.p. Possibly I can’t even call this the calm prior to the storm since there’s absolutely nothing truly calm that’s occurring out there. However I can see individuals going, Oh, take a look at that 10 years treasury. Yeah. Do you believe that’s safe? No. As the Bank for International Settlements informs us, gold is the only monetary property that runs no counterparty danger. Take a look at some current videos that I have actually likewise done. Ruled by the IMF, where we discuss a warm world currency since that’s where they wish to take us. It’s a lot easier to manage if whatever is one location. And who are you going to grumble to? Right. You have no no choices. Taylor Kenny did a magnificent video video on economic crisis signals. So simply you require to be able to watch out there and see what’s occurring and truly comprehend it. They desire you to believe that this is simply a soft landing or, hello, possibly we have actually currently gone through it. That’s what they truly desire you to believe. However that’s simply setting yourself up for catastrophe since, honestly, this bubble has actually popped. We simply have not seen completion of it yet. And ensure you subscribe. Leave us a remark. Provide us a thumbs up and share. Share, share. Due to the fact that we need to establish that neighborhood. We need to. For ourselves. I suggest, I’m old. I do not care, you understand? However my kids, my grandchildren, your kids, your grandchildren, your fantastic, fantastic. That’s what I appreciate. That’s what I’m doing this for. That’s who you must be. Well, I can’t inform you what to do. You got to do whatever you’re comfy with, what you understand, this is a lot larger than simply us. Till next, we fulfill. I desire you to recognize your monetary guard is physical gold. Physical silver in your ownership. And happy. Till next week. Me? Please take care out there. Bye. Bye.

SOURCES:

https://www.cbsnews.com/news/student-loan-government-shutdown-resume-start-date-october/