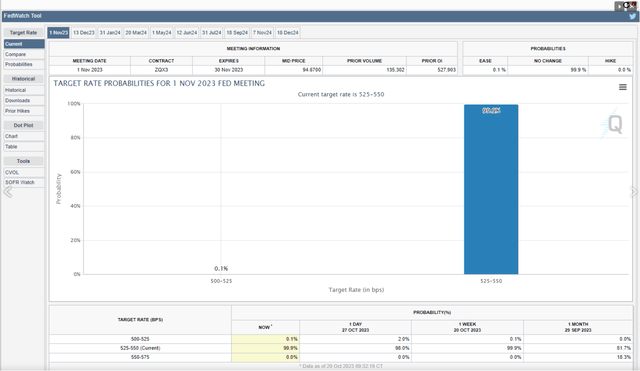

The very first bar chart is the fed funds possibility for Wednesday’s 11/1/23 FOMC conference and what it’s informing readers is that there is a 99% possibility that the FOMC will preserve the existing fed funds rate of 5.25%– 5.50% for the next 6 weeks.

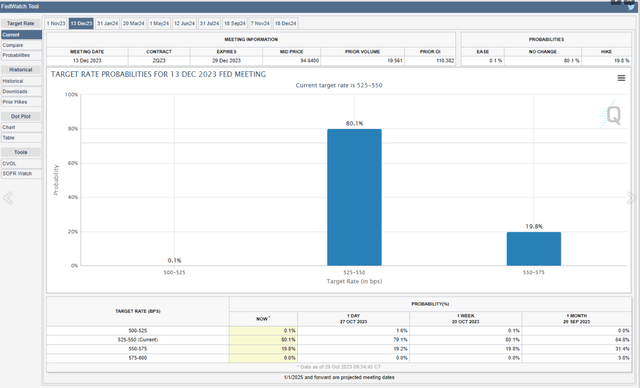

The 2nd bar chart reveals the possibility for keeping the fed funds at 5.25%– 5.5% at about 80% (since Friday, October 27th) with a greater possibility of about 20% of a 25 bps increase on December 13, 2023, or the next FOMC conference after Wednesday’s.

Taking a look at the fed funds possibility photo, it’s clear the Fed/ FOMC is on hold in the meantime. Let’s see if the FOMC declaration, on 11/1/23, creates an increasing possibility of a 25-bp increase for the 12/13/23 conference. (It’s still quite most likely that the Fed/FOMC or Powell would stay hawkish with this week’s declaration. The bully pulpit and terrifying the brief end of the Treasury yield curve is still the most convenient and most affordable type of financial policy). Nevertheless, I likewise believe financiers need to take a look at yields at the longer end of the curve, as there are some indications of the United States economy weakening.

Let’s see if the possibility modifications for the 12/13/23 FOMC conference for a possible rate walking, after Wednesday, 11/1/23’s conference.

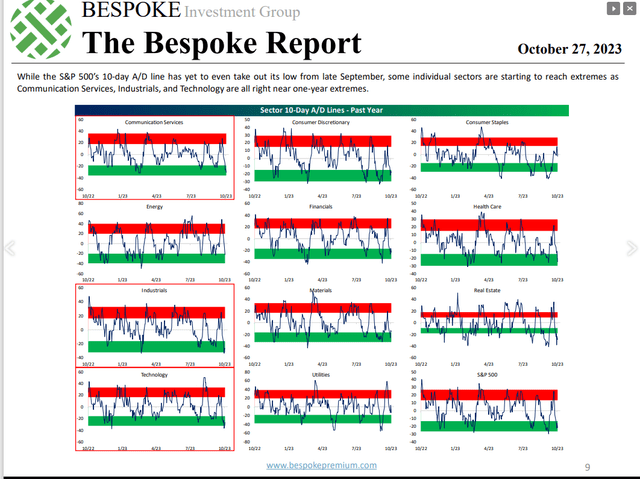

Oversold stock exchange:

What’s a Fundamentalis post without a Bespoke chart?

Every sector above is trading in “severe oversold” levels other than customer staples.

Petroleum is deteriorating, however the dollar is still too strong.

This isn’t a simple market to browse.

Apple ( AAPL) Profits, Thursday night, November second, after the closing bell:

Apple reports after the bell Thursday night and they have actually experienced the normal year in regards to pre brand-new item launch of the brand-new Apple iPhone 15.

The September quarter is the 4th quarter of financial ’23, and it does not appear like the vacation quarter (financial Q1 ’24) will be any less robust than is normal for the iPhone giant, unless we see the beginning of a nasty economic downturn in Q4. Nevertheless, in the calendar 4th quarter, 2018, when Jay Powell was raising the fed funds rate and the stock exchange was taking gas, Apple handled to simply fulfill EPS and income agreement. The business did not handle their normal healthy “upside surprise” for the vacation quarter in Q4 ’18.

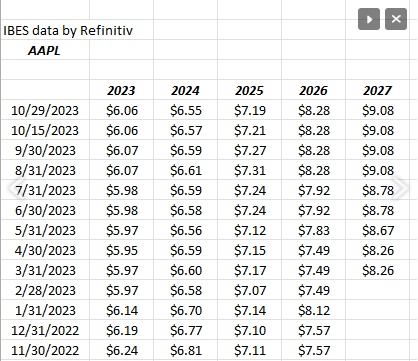

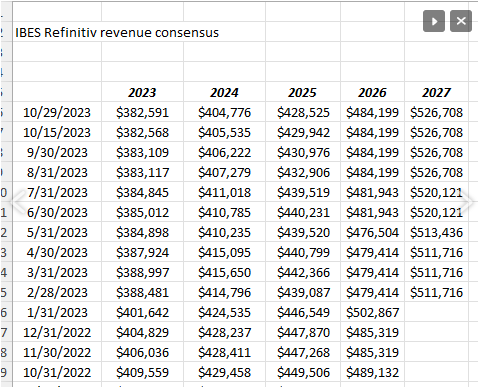

A take a look at Apple’s EPS and income modifications over the in 2015:

These modifications are sourced from IBES information by Refinitiv and reveal a progressive softening in EPS and income quotes over the last 12 months, not truly that uncommon for the second year of an iPhone launch.

The essential truly is how well will the brand-new iPhone and other Apple items offer in the vacation/ Christmas quarter that has actually currently begun.

Apple is anticipating -1% income development and 8% EPS development for the financial Q4 ’23 that will be reported Thursday night, however for the December quarter, income is anticipated to be up 5% and EPS is anticipated to grow 12% for the vacation quarter.

Here’s a history of Apple’s income for the essential December quarter for the last 5 years:

- Dec ’23: $123.23 billion (quote)

- Dec ’22: $117.154 billion (real)

- Dec ’21: $123.9 billion (real)

- Dec ’20: $111.4 billion (real)

- Dec ’19: $ 91.8 billion (real)

As readers can see, if Apple does not raise assistance for the December quarter on Thursday night, there is an opportunity that amount to income development for the last 2 years stays approximately flat with ’21, presuming the existing agreement stays near its existing level.

Apple is trading at approximately 26x EPS for a hardware business that is anticipated to produce simply 6% typical EPS development for the last quarter of ’23 and after that the next 2 . The services organization of Apple is now 26% of overall income– however the kicker is the services organization loads a 70% gross margin, versus the iPhone and item section, which has a 35% gross margin.

Several growth is anticipated with Apple as services grows as a portion of income. It’s most likely why Morningstar kept a weak or no moat score on Apple for a lot of years, i.e., awaiting services to grow as a portion of overall income.

Summary/ conclusion: As Soon As once again, a Bespoke chart leapt out at me this weekend and revealed the 11 sectors of the S&P 500 practically consistently deeply oversold. Apple’s income has actually slowed (depending upon where and how the December financial Q1 ’24 quarter ends up) however that is worthy of a longer look.

Take whatever on this blog site with significant hesitation as it represents simply someone’s viewpoint and previous efficiency is no warranty of future outcomes. All the EPS and income information is sourced from IBES information by Refinitiv. Capital markets alter rapidly for both the great and bad. Readers must determine their own convenience level with their portfolio volatility and change appropriately.

Thanks for reading.

Editor’s Note: The summary bullets for this post were selected by Looking for Alpha editors.