imaginima

Financial Investment Thesis

Plains GP Holdings ( NASDAQ: PAGP) owns and handles midstream energy facilities in Canada and the United States. The business has a long history of strong dividend payments. In this report, I will analyze sustainability of dividend payments by examining the business’s monetary efficiency. I will likewise be examining the assessment of the business with the aid of relative P/E assessment technique.

About PAGP

PAGP primarily concentrates on owning and running midstream energy facilities in Canada & & the United States. The business carries out organization in 2 sectors: Petroleum and Gas Liquids (NGLs). The petroleum sector handle event and carrying petroleum with aid of pipelines, trucks, barges, railcars, and event systems. It likewise provides storage, terminalling, and other services utilizing its integrated possessions throughout Canada and United States. The petroleum sector produces 95.57% of the business’s profits. It primarily produces its profits through pipeline capability contracts, tariffs, and other transport costs. It owns possessions in Permian Basin, South Texas, the Mid-continent, the Gulf Coast, Rocky Mountain, Western, and Canada. The NGL sector consists of gas processing, and NGL storage fractionation, terminalling, and transport. This sector contributed roughly 4.43% to yearly profits.

Financials

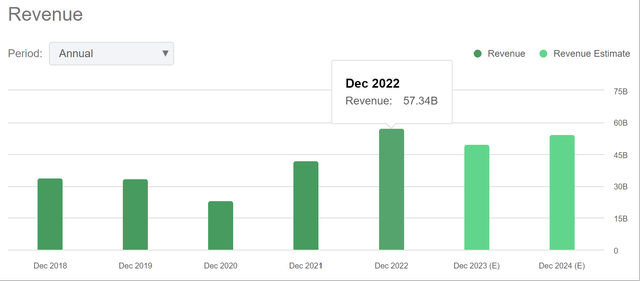

Earnings Pattern of PAGP (Looking For Alpha)

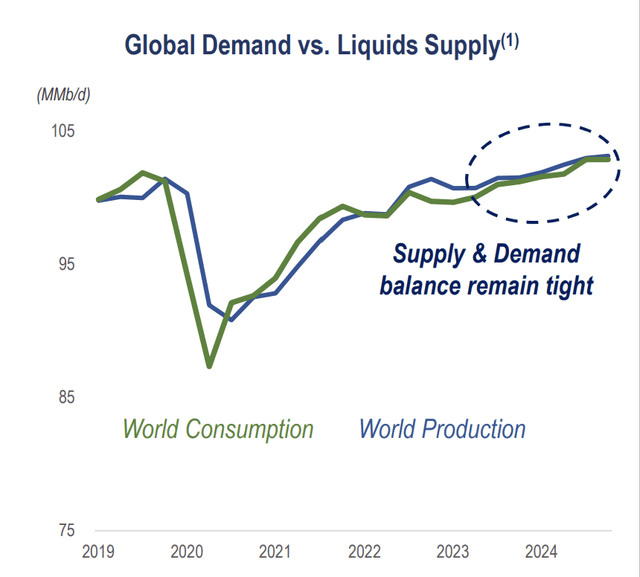

The geopolitical effects and macroeconomic aspects such as increasing product expenses, high rate of interest, and progressing policies and policies impacted the need & & supply characteristics. Regardless of these situations, the international oil need has actually not been affected and has actually increased by 2.3 mbpd in 2023. The market is anticipated to increase even more at the start of 2024 as an outcome of high oil rates and enhancing macroeconomic conditions.

PAGP has actually been experiencing considerable income development for last 3 years. The business’s income in FY2021 increased from $23.29 billion (FY2020’s income) to $42.08 billion which is 80.68% YoY development. The main factors behind this enormous development are 5% YoY increased need and 50% YoY rose international oil rates (Brent Rate was roughly $90 per barrel). PAGP’s operating earnings in FY2021 increased considerably YoY from an operating loss of $2.38 billion (FY2020’s operating loss) to an operating earnings of $851 million. The operating earnings development was driven by strong income development. Its income development continued in FY2022. The business’s FY2022 income of $ 57.34 billion was a YoY gain of 36.26% versus FY2021 income. This income development was sustained by rose Petroleum pipeline tariff volumes and continued Permian production. The business reported running earnings of $1.2 billion margin in FY2022 which is 51.8% YoY development compared to running earnings of FY2021.

The business has actually likewise produced considerable totally free capital (FCF) in the last 3 years. At the end of FY2021, the business’s FCF was $ 2.37 billion It dispersed $200 million (8.44% of FCF) to chosen unitholders and $515 million (21.73% of FCF) to typical unitholders. After the circulation to chosen and typical unitholders, its FCF was $1.65 billion in FY2021. The business handled to create this considerable FCF in FY2021 with the aid of property sales at premium rates and capital discipline with minimized capital investment. The business ended its FY2022 with an FCF of $1.6 billion. PAGP dispersed $206 million (12.9% of FCF) to chosen unitholders and $576 million (36% of FCF) to typical unitholders. In FY2022, its FCF was $828 million after circulations to favored and typical unitholders.

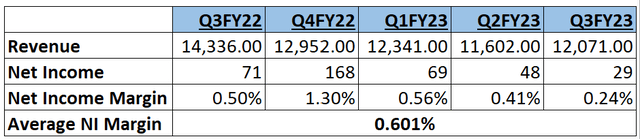

The business has actually reported its quarterly outcomes. It reported an income of $12.07 billion, down 13.65% compared to $14.33 billion in Q3FY22. This development was primarily withstood due to lower Permian volumes arising from unfavorable weather condition influence on gas processing capability. Earnings decreased by 59.15% YoY from $71.0 million to $29.0 million. It reported a diluted EPS of $0.15. The Petroleum and NGL sector profits were $11.93 billion, and $0.242 billion respectively. PAGP reported $262.0 million in liquidity and changed EBITDA stood at $662.0 million. The company has actually just recently finished the Rattler Permian Deal. Under this offer, Permian JV got the staying interest of 43% in OMOGJV Holdings LLC. I think with the aid of its possessions the Permian JV can be much better placed to grow its client base by increasing its product and services offerings and can even more broaden its earnings margins. This can likewise substantially assist to increase its capital and more boost its circulations.

International Need vs Supply of Petroleum (Q1FY23 Financier Discussion: Slide No. 10)

The outcomes were affected by serious weather in the Permian Basin which minimized the gas processing capability. Nevertheless, the management likewise thinks that the tariff volumes and tariff may stay at a raised level in the coming duration. The company is likewise extremely positive about the development and raised its adjusted EBITDA assistance to the series of $2.6 billion to $2.65 billion, which is an advantage of $50 million to $100 million from the leading end of its previous price quote variety. The business likewise approximates to attain FCF of $1.45 billion. Presently, need for petroleum is still high. The high petroleum rates verify that need for oil and gas has actually exceeded its supply. The oil rates are not as high as they utilized to be in 2022, however still, it is substantially greater than rates in 2021. For that reason, I believe we can presume that need for oil and gas in 2023 and 2024 may be lower than need in 2022 however greater than need in 2021. Thinking about need for oil and gas, I believe it is safe to state that the business can go beyond income of FY2021 in FY2023 & & FY2024 however stop working to go beyond the income of FY2022. That is why, I am presuming the business’s income for FY2024 may be $55 billion.

Brent Rate History (Looking For Alpha)

To compute the approximated earnings margin of FY2024, I am taking approximately the net earnings margin of last 5 quarters as the financial circumstance in FY2024 may be as like the last 5 quarters. For that reason, I am presuming net earnings margin for FY2024 to be 3%. The income price quote of $55 billion and net earnings margin of 3% offers EPS of $1.69.

Estimation of Typical Earnings Margin (Worth Mission)

Dividend Yield

The business has an outstanding history of constant dividend payment which suggests its well-positioning. In FY2022, it paid a money dividend of $0.18 in very first quarter. It dispersed steady money dividends of $0.2175 in each of the next quarters, which led to an overall yearly payment of $0.8325 and represented a yield of 5.31% compared to the existing share cost. In FY2023, it paid 4 quarterly a dividend of $0.2675, that makes the yearly dividend $1.07, making up a dividend yield of 6.83%. Just recently the company revealed a 19% increase in yearly dividend from $1.07 to $1.27 which is an effect of its current acquisition and robust need in market. The dividend payment of $1.27 makes a yield of 8.10% compared to existing share cost. The business approximates that it would have an FCF per share of $7.39 which indicates that the business’s dividend payments are safe. Even with my EPS price quote of $1.69, we can state that the dividend payment may be safe in the coming time. The business’s dividend yield of 8.10% is substantially greater than sector typical dividend yield of 3.58%. PAGP’s 4-year typical dividend yield is 8.69% which reveals that the business has a history of strong dividend yields.

What is the Main Danger Dealt With by PAGP?

The business’s organization operations require steel and other products to construct and preserve existing and brand-new pipelines and centers. If the supply of these products gets interfered with or if the business stops working to get adequate amounts, it can adversely affect its capability to preserve its existing possessions and construct brand-new facilities which may even more contract its earnings margins. Its operations likewise depend upon having access to big quantities of electrical energy and other products. If it stops working to get adequate electrical energy, it can impact its functional activities by more lowering its success.

Appraisal

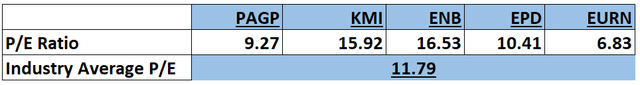

The business presently experiencing a robust tariff volume and raised tariffs due to strong need for oil and gas. The business has actually gotten staying interest of 43% in OMOGJV Holdings which can grow its client base by increasing its product and services offerings. After thinking about all these aspects and EPS computation in monetary area of this short article, I am approximating an EPS of $1.69 for FY2024 which offers the forward P/E ratio of 9.27 x (share cost: $15.66). After comparing the forward P/E ratio of 9.27 x with the sector typical of 9.97 x, we can conclude that the business is relatively valued. The business’s main rivals are Kinder Morgan ( KMI), Enbridge ( ENB), Business Products Partners ( EPD), and Euronav ( EURN).

Estimation of Market Typical P/E (Worth Mission)

If we compare PAGP’s forward P/E ratio of 9.27 x with the market typical P/E ratio of 11.79 x, we discover that PAGP is underestimated at its existing assessment. After thinking about a robust need in the market, raised tariffs, and PAGP’s strong position in market, I believe it’s safe to presume that the business is underestimated.

Conclusion

The business’s current efficiency was affected by the unfavorable weather. Nevertheless, it has a strong development possibility as the market is flourishing quickly and to accommodate the growing need the business has actually substantially concentrated on acquisition in the Delaware Basin which can increase its services and offerings to draw in brand-new clients and increase its capital. Just recently the company revealed that it is increasing its dividend payment by 19% as an outcome of its growth activities. This makes the business appealing stock to include the portfolio to make constant payments. Nevertheless, it is exposed to risk of supply chain interruptions which can lower its success. The stock is presently underestimated and it can benefit the financiers to make constant dividend payment which can likewise possibly grow in future as outcome of strong market characteristics and its growth activities. After thinking about all the above aspects, I designate a buy ranking to PAGP.