Joe Raedle/Getty Images News

A Few Of the most appealing financial investment chances can be had by investing when others will not attempt. This can happen when the business in concern occurs to be extremely questionable. Financiers who can not manage the heat of debate or who are pushed away by the business in concern tend to move far from it. That triggers shares to drop and unlocks for appealing upside. And I believe everyone would concur with me that couple of business were as questionable in 2015 as the manufacturer of Bud Light, Anheuser-Busch InBev SA/NV ( BUD).

By this point, I most likely do not require to review the information of the debate. They were commonly reported and I even discussed them to some level in an short article that I released about the business previously this year. In my newest short article about the business, released in early August, I covered monetary outcomes covering the 2nd quarter of the 2023 . I reveal that, while there were still some indications of weak point in the domestic market brought on by the previously mentioned debate, the business as a whole was doing incredibly well. Domestic market share had actually supported and global development was remarkable. This led me to keep the business ranked a ‘purchase’ and motivated me to declare that the company had beverage the ‘go woke, go broke’ mob under the table.

Now that a lot time has actually passed, I figured it would be an excellent concept to review the scenario. In addition to reporting extra monetary outcomes covering the 3rd quarter of 2023, the business has actually likewise seen its share rate spike 14.4% at a time when the S&P 500 was up a more modest 6.5%. Based upon the most current information readily available, I would argue that, in the long run, Anheuser-Busch is still definitely attractive. Nevertheless, upside from this point is ending up being more restricted. I still believe that the business is appealing enough to rate a ‘purchase’, however just partially so.

Continued development in the middle of weak point

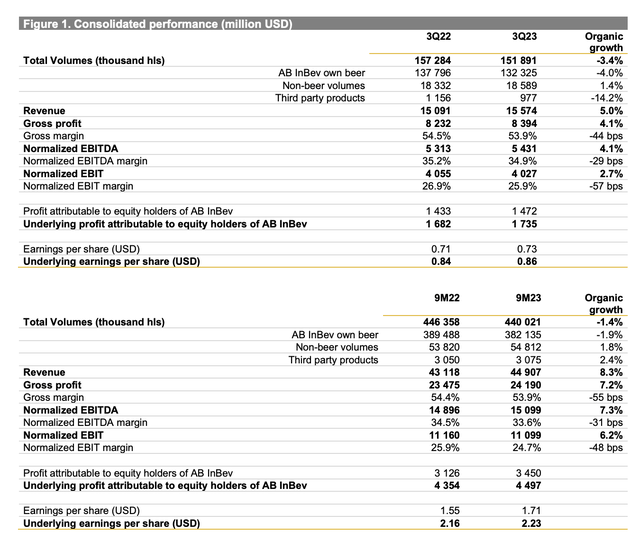

As a foreign company that’s noted for trading in the United States, Anheuser-Busch does not need to expose detailed monetary outcomes each and every quarter. However it does bring out adequate that provides us an excellent image of the total health of the business. To begin with, we need to discuss the favorable side of things. This would include earnings and revenues for the 3rd quarter of the 2023 . Throughout that quarter, sales amounted to $15.57 billion. That’s 5% lower than the $15.09 billion produced one year previously.

As an enormous, international business, there’s a lot to unload here. What enters into the earnings figure is a variety of various things. For example, on the unfavorable side, the business reported a 3.4% decrease in natural volume. Although some may indicate this as an indication that the business is unhealthy, I detailed in among the other short articles that I discussed the business, currently connected to previously in this piece, that volumes have actually been decreasing for many years now. Beer volume has actually been especially affected, with sales down 4% on a natural basis. By contrast, non-beer volumes are in fact up 1.4%. Likewise consisted of in the mix is rates. Year over year, earnings per hl (hectoliter) handled to increase by 9%.

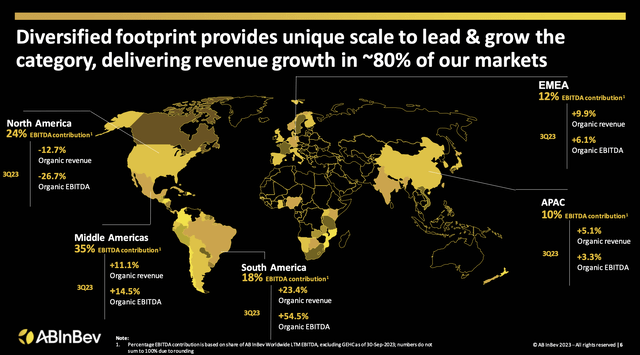

We can take a look at the information in a much more segmented way. If we take a look at the North American market, which management thinks about to be simply the United States and Canada, natural earnings throughout the current quarter was down 12.7%. Continued reaction versus the Bud Light brand name is most likely to blame. However when you move beyond that market, the company has actually experienced fast development. In the Middle Americas, natural earnings leapt 11.1% year over year. In South America, development was a much more remarkable 23.4% on a natural basis. Throughout the EMEA (Europe, Middle East, and Africa) areas, natural earnings leapt 9.9%. And even in the Asia Pacific area, natural earnings handled to climb up a modest 5.1%.

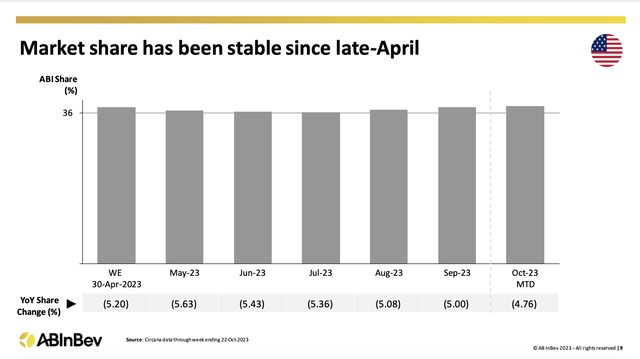

Although the United States market has actually provided discomfort for the business, management asserts that market share here in the house has actually supported considering that late April. Throughout this time, it has actually been hovering around 36% of the total market. Worldwide, the business has some significant leading brand names that are continuing to accomplish fast development. Beyond Mexico, for example, the Corona brand name has actually seen an 18.8% year over year boost in earnings in the 3rd quarter. Beyond the United States, natural earnings related to Budweiser has actually leapt 11.8%. And beyond the United States, Michelob Ultra has actually leapt by 11.5%. The most remarkable, nevertheless, has actually been the Stella Artois brand name, which reported a 20.3% boost in earnings beyond Belgium.

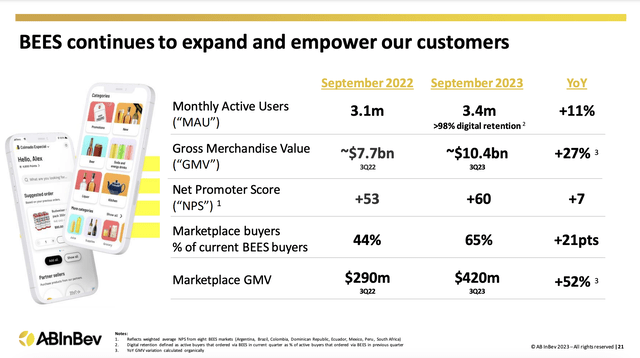

Management is likewise continuing to accomplish development when it concerns a few of the fascinating efforts the business has actually purchased for many years. BEES, a digital purchasing platform that links customers straight to the business, reported 3.4 million MAUs (month-to-month active users) in September of 2023. That’s up from the 3.1 million reported one year previously and it compares positively to the 3.3 million reported for June of in 2015. Gross product worth negotiated on the platform has actually escalated, leaping around 27% year over year from $7.7 billion in the 3rd quarter of 2022 to $10.4 billion at the very same time this year. On the other hand, the gross product worth for the business’s market on the service handled to leap 52% from $290 million to $420 million. Over the very same window of time, earnings related to the business’s digital direct to customer mega brand names has actually leapt around 9% from $110 million in the 3rd quarter to $125 million, with the variety of online purchasings staying the same at 17 million however the variety of active customers leaping from 8.9 million in 2015 to 10 million this year.

This development in earnings brought with it greater revenues and money streams too. Earnings, for example, went from $1.43 billion in the 3rd quarter of 2022 to $1.47 billion in the 3rd quarter of this year. On the other hand, EBITDA has actually grown from $5.31 billion to $5.43 billion. Previously in this short article, I pointed out how specific information is not reported. The most current information that we have for running capital, for example, is from the very first half of 2022. And because window of time, it was down 26.8%. However if we change for modifications in working capital, it is up 12.5%. Likewise, for context, you can see the previously mentioned monetary outcomes for the very first 9 months of the 2023 compared to the very first 9 months of the 2022 , as displayed in the chart below. With this increased success and most likely acknowledging that the stock is underestimated, management started a $1 billion share buyback program. That was authorized on October 30th, which was one day prior to the business authorizing a money tender deal of approximately $3 billion for the acquisition of impressive bonds. From the time the share buyback program was revealed through December 22nd, the business redeemed over 5.66 million shares for around $352.2 million.

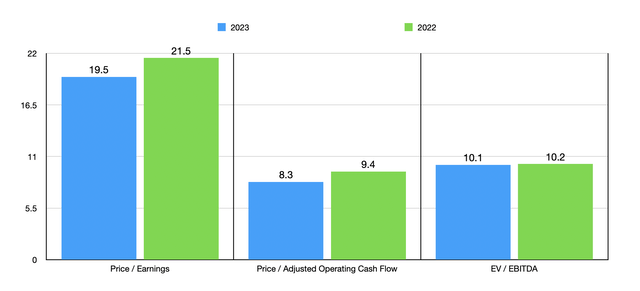

Based upon the present information readily available, I think that net revenues for 2023 will have wound up being around $6.59 billion. Changed running capital need to be someplace around $15.35 billion, while EBITDA needs to be someplace around $20.11 billion. Based upon these quotes, I had the ability to value the business as displayed in the chart above. On a forward basis, shares do look a bit less expensive than if we were to utilize the information from 2022. I then, in the table listed below, compared the company to 5 comparable business. On a cost to profits basis, 2 of the 5 companies were less expensive than it. Utilizing the rate to running capital method, Anheuser-Busch wound up being the most affordable of the group. And last but not least, utilizing the EV to EBITDA method, I discovered that 2 of the 5 business wound up being less expensive than our target.

| Business | Rate/ Profits | Rate/ Running Capital | EV/ EBITDA |

| Anheuser-Busch InBev SA/NV | 19.5 | 8.3 | 10.1 |

| Heineken N.V. ( OTCQX: HEINY) | 21.6 | 16.6 | 12.5 |

| Ambev S.A. ( ABEV) | 14.7 | 9.8 | 9.5 |

| Molson Coors Drink Business ( TAP) | 53.2 | 6.7 | 13.3 |

| Carlsberg A/S ( OTCPK: CABGY) | 16.0 | N/A | 9.3 |

| The Boston Beer Business ( SAM) | 51.1 | 20.5 | 17.9 |

Takeaway

From all that I can see at the minute, there are still some indications of weak point relating to Anheuser-Busch. Nevertheless, for the many part, the essential image is healthy. Earnings, revenues, and money streams continue to increase. Shares are not precisely inexpensive. However they are a little inexpensive relative to comparable companies. So even in spite of the continued weak points and the great boost in rate that shares have actually seen up until now considering that I last discussed the business, I would argue that a soft ‘purchase’ ranking still makes good sense at this time.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.