Jeremy Poland

Disclaimer: I’m not a geopolitical professional and this is all speculation on my part. The info provided is simply a workout of idea and need to be taken with a grain of salt. All viewpoints revealed are my own based upon press release that might or might not include all product info associating with the matter.

President Maduro of Venezuela appeared to more intensified the circumstance in Guyana, declaring that:

Venezuela deserves to protect itself, to harmony, to peace.

In retaliation to the British military sending out Guyana a warship, President Maduro released 5,000 soldiers to Guyana as stress increase in between the 2 countries. Though numerous would recommend this is simply a border disagreement, I highly think this is the outcome of the 11Bboe discover in the Stabroek block and President Maduro completely means on nationalizing this block. This can have big ramifications for Exxon ( XOM) straight and Chevron ( NYSE: CVX) and its acquisition of Hess ( NYSE: HES). I have actually covered both Exxon/Pioneer Natural Resources ( PXD) and Chevron/Hess associating with the preliminary referendum and what might be the outcome of an intrusion. Looking for that, talks have actually become release; I think the tipping point looms. I think any escalation in the area will put Chevron’s acquisition of Hess at danger offered the company’s 30% stake in the properties. I had actually initially reported a positive perspective that the border talks would not intensify. Provided the current upgrade over the vacations, I am slowly ending up being more worried that escalation might take place, leading to the offer being cancelled. I am devaluing my suggestion on HES to an offer and keep my offer suggestion for Chevron, keeping my cost target of $136/share for CVX. As determined in my preliminary report covering Exxon & & Leader Natural Resources, I stay bullish on the company and the handle location. I will keep my BUY suggestion for XOM & & PXD with a cost target of $107.55/ share for XOM.

Operating Summary

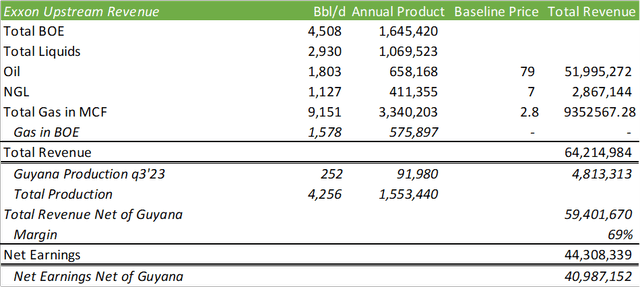

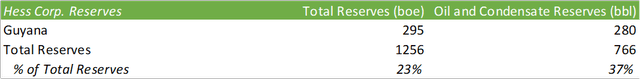

Exxon has actually made over 25 considerable discoveries offshore Guyana in the Stabroek, Canje, and Kaieteur Blocks. With the current conclusion of Payara, overall production in the Stabroek Block now sits at 620Mboe/d. The Stabroek Block’s equity ownership consists of Exxon at 45%, Hess at 30%, and China’s CNOOC Nexen Petroleum at the staying 25%. In general, Exxon expects to almost double production to 1.2 MMboe/d by 2027

Aside from the oil play, Exxon declares that specialists have actually invested more than $83b with more than 1,500 Guyanese services in 2022 alone and $180b given that 2015. Not just is the oil discovery useful to the international energy economy, it has actually highly benefited the regional economy of Guyana that has actually supercharged their financial advancement. Appropriately, GDP projections, for the little country of 800,000 individuals, grew by 62.3% in 2022, is forecasted to have actually grown 38% in 2023, and will grow an extra 115% over the next 5 years.

According to Guyana Chronicle,

The 2023 spending plan saw huge boosts in funds for essential infrastructural upgrades, such as roadways and bridges, real estate, and power generation.

The short article goes on to recommend the spending plan increased from $11.8 b in 2019 to $131.5 b in 2023 for facilities advancement. $53.1 b will be invested in real estate advancement alone. The abrupt increase of cash has likewise driven the hospitality sector with a rise in worldwide branded hotels being built around the country’s capital, Georgetown. I think much of this financial development is what drove President Maduro to pay an unique interest to the little country.

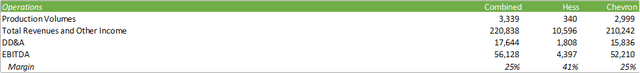

As I had actually formerly covered in my report on Chevron/Hess, Guyana represent almost 40% of Hess’s overall production for q3′ 23. In the short article, I had actually recommended that any escalation might prevent the $53b offer as I think the main target of Chevron isn’t always Hess’s domestic properties. Provided the current escalation in Guyana, I have factor to think that this isn’t going to end anytime quickly and might intensify into an intrusion. I highly think that if the circumstance were to intensify in Guyana and if the United States backsteps from Chevron’s capability to produce with Venezuela, the acquisition of Hess will be at danger.

On the flipside, if the skirmish were to deescalate, I do think the offer, though fairly pricey per the used appraisal, will highly benefit Chevron. Guyana, in addition to the short-cycle domestic properties, will use Chevron a large range of production versatility and will be margin accretive.

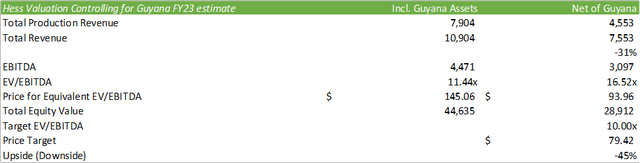

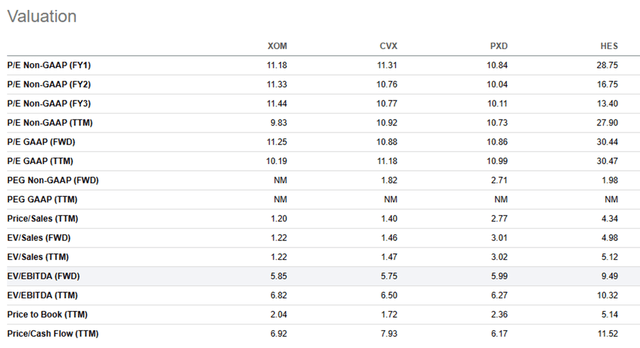

Evaluation

Though the geopolitical danger does not always suggest a loss of properties, I do think it deserves thinking about as an extremely genuine possibility and how it might impact both the company itself and the offer that’s at stake. Without the Guyana properties, I think HES’s appraisal would look closer to 16.52 x EV/EBITDA at its existing cost. If Hess were to lose their Guyana properties and if Chevron were to either take out of the offer or change their cost, I think HES shares would deserve closer to $79.42/ share, a -45% drawback danger to the existing cost level.

Provided HES’s robust appraisal, I think the company’s shares will be at biggest danger if production were to however cut off at the Stabroek block and if the handle Chevron were to fail. One can not understand for specific if this will take place; nevertheless, I’m recommending this as a possible threat as the geopolitical dangers in the area establish.

To repeat, I supply XOM/PXD a BUY suggestion with a cost target of $107.55/ share for XOM without any cost target attended to PXD as shares will trace XOM upon closing, and CVX/HES offer suggestions with a cost target of $136/share for CVX without any cost target for HES for the exact same factor as PXD.