Luis Alvarez

Invesco Solar ETF ( NYSEARCA: TAN) is a solar ETF.

Although the solar market has actually grown significantly in the previous couple of years, shares of Invesco Solar ETF have actually been underwhelming over the very same duration as oversupply and high rate of interest have been quite strong headwinds.

As we get even more into 2024, this year might be a fight in between a number of patterns such as the start of stabilizing rate of interest, oversupply of solar modules, and speculation on the 2024 election. As an outcome, there’s a possibility that Invesco Solar ETF might be unpredictable.

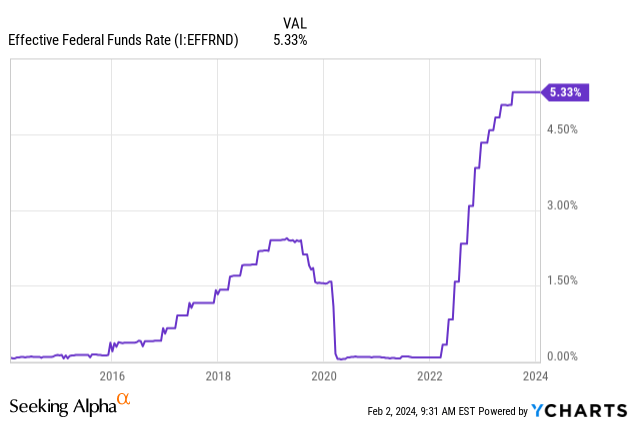

Rates Of Interest

Starting on a favorable note, there’s the possibly helpful pattern of the start of stabilizing rate of interest.

While the Federal Reserve held its essential federal funds target rate consistent at 5.25% to 5.5% this January, numerous think the U.S. reserve bank will start reducing rate of interest at some point later on this year as inflation has actually reduced significantly from its peak.

According to the IEA, a 5% boost in rate of interest results in an around 33% increase in the levelized expense of electrical power from solar and wind.

If rate of interest decrease enough, there might be more need than anticipated for solar, and this might possibly assist numerous business a minimum of in the near term.

Oversupply

A prospective headwind for the solar market is oversupply in some sectors.

According to the IEA, there are around 45 gigawatts of solar modules in the U.S. and 90 gigawatts of solar modules in the EU that remain in stockpiles since completion of 2023, which has to do with two times the approximated setups for 2024.

As an outcome of oversupply, worldwide solar module costs decreased 50% in 2023.

On the other hand, production is anticipated to increase and possibly go beyond need. The IEA states:

Based upon the production jobs pipeline, it will broaden to over 1,100 GW in 2024 and 1,300 GW in 2028, remaining at more than double yearly PV setups over the projection duration

Need might likewise not grow as rapidly as it has in previous years as the grid in some locations has actually not had the ability to maintain.

China, for example, set up a record 216.9 gigawatts of solar in 2023, versus 87.4 gigawatts in 2022. Of that quantity, a considerable part of the development is because of dispersed solar, likewise called roof solar. Although there isn’t a particular number for the specific quantity of dispersed solar set up in 2023, a March 2023 Bloomberg post stated around 40% of China’s overall solar capability is from roofs and yards.

Offered the significant development in dispersed solar in 2023, the regional power facilities in some Chinese cities has actually been not able to manage more dispersed solar additions up until the facilities is updated, which spends some time.

In Shandong province, for example, over 70% of the province’s cities and counties deal with a degree of restrictions when it concerns linking to brand-new solar jobs according to a December declaration made by the provincial federal government.

Offered the anticipated boost in solar module supply in China in 2024, the failure of the grid to manage more solar in some parts of the nation, and possibly weaker than anticipated need provided a slowing Chinese economy, there might be more solar oversupply in China.

Additionally, provided the United States and India have in current years enforced tariffs on Chinese solar imports, the oversupply in some markets might be even worse.

If there suffices oversupply in China and somewhere else, solar module costs might decrease more than anticipated.

Speculation on Election

Offered tariffs on Chinese solar imports, the U.S. solar market is various from much of the remainder of the world (with India being another exception) as helpful policies such as the Inflation Decrease Act (INDIVIDUAL RETIREMENT ACCOUNT) have benefited some business in the sector such as Very first Solar.

With the U.S. election this year, there might be more speculation on whether the Inflation Decrease Act will continue as some Republican politicians have actually tried to repeal parts of it Regarding whether parts of the individual retirement account can be reversed will depend upon which branches of federal government the Republicans win. Regarding what parts will be reversed will depend upon what the Republican leaders choose if they win the appropriate branches.

If the Democrats win your home, the Senate, and the Presidency, the Inflation Decrease Act will likely stay in impact.

The speculation, in my viewpoint, might cause more volatility in the Invesco Solar ETF.

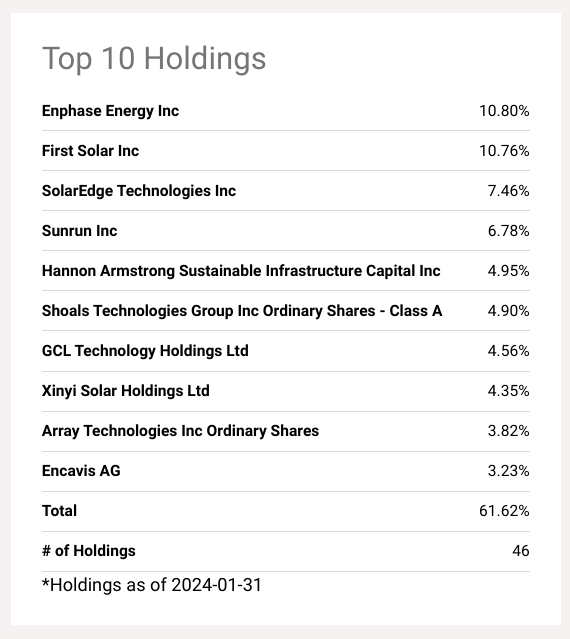

Structure of Invesco Solar ETF

In regards to its structure, Chinese business do not make up as much weight in the Invesco Solar ETF as Chinese business add to the whole solar sector.

Internationally, Chinese business control the solar sector as China is both the biggest customer and biggest manufacturer of numerous solar items.

In regards to its structure, nevertheless, 4 of Invesco Solar ETF’s leading 5 holdings are U.S. business such as Enphase Energy, First Solar, Sunrun, and Hannon Armstrong Sustainable Facilities Capital. Another top-five business, SolarEdge, has its head office in Israel.

Additionally, the main market of First Solar, Sunrun, and Enphase Energy is the United States, which secures versus Chinese oversupply to differing degrees depending upon market section and tariffs.

Offered much of the biggest business remain in the United States, a few of those business such as Very first Solar take advantage of tariffs on Chinese solar imports and likewise the Inflation Decrease Act, which sort of assists safeguard a minimum of some part of Invesco Solar ETF from Chinese oversupply.

On The Other Hand, a few of the leading 5 holdings of Invesco Solar ETF are likewise not in the solar module organization where worldwide costs decreased 50% in 2023. So deflation is less of a headwind.

Business like Enphase Energy are more into micro-inverters and industrial solar storage options, for example. On The Other Hand Hannon Armstrong Sustainable Facilities Capital handles energy associated possessions instead of producing solar items.

In regards to the leading 5 holdings since 1/31/2024, Enphase Energy represented 10.8%, First Solar represented 10.76%, SolarEdge Technologies represented 7.46%, Sunrun represented 6.78%, and Hannon Armstrong Sustainable Facilities Capital represented 4.95% of Invesco Solar ETF’s holdings according to Looking for Alpha.

Looking For Alpha

According to Invesco, business in the United States comprise 55.58% of Invesco Solar ETF’s portfolio since 1/31/2024 and business in China comprise around 15.33%. Offered the solar market is worldwide, numerous business in other countries are impacted by oversupply in China.

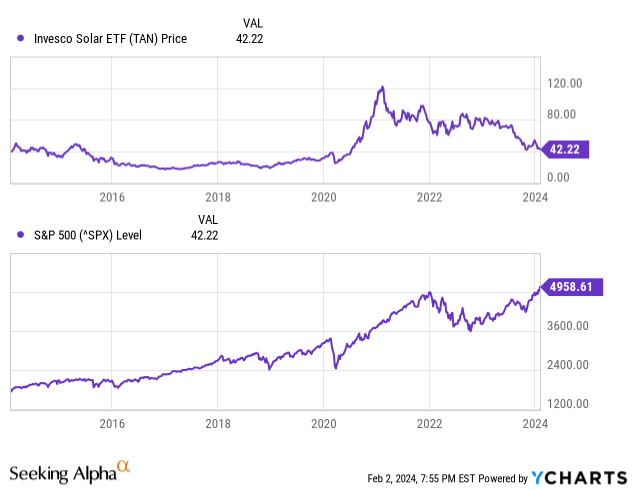

Conclusion

Invesco Solar ETF has actually underperformed the S&P 500 provided oversupply and deflation in the market over the last ten years. While the S&P 500 has more than doubled, the Invesco Solar ETF has to do with where it was ten years earlier.

One factor is that China’s federal government has actually made it a top priority to establish and increase solar production in the past to decrease emissions and expense.

Offered helpful policies, the IEA anticipates China to attain its nationwide 2030 target for solar PV setups and wind in 2024, 6 years ahead of schedule.

While the customer and the environment have actually gained from the deflation, it has actually made it challenging for solar business to make a growing earnings as the deflation is a headwind for numerous business.

If the rate of a solar module decreases 50% for example as it did in 2015 worldwide, a solar module-only business would require to double its solar module capability to simply keep its earnings. It would require to invest capex and perhaps offer into a market with thin margins as an outcome.

While the very best business can still earn a profit from this environment provided numerous competitive benefits and deflation has actually been less in the past, it is still a difficult sector to grow.

Likewise, while tariffs and helpful policies support some leading U.S. solar business, the business depend upon the individual retirement account, and tariffs stay active. The oversupply in the market likewise restricts the marketplaces outside the United States to a degree.

Solar assessments show to a degree the capacity for oversupply as numerous solar stocks trade for reasonably low forward EV/EBITDA ratios. Nonetheless, if there is more oversupply than anticipated, assessments might reduce even more.

Eventually solar business are not restricted to simply standard solar devices, and they might provide other nearby items. Enphase Energy has, for example, provided in addition to standard inverters, batteries, battery chargers, and other items to grow its prospective overall market

Numerous solar business such as Enphase Energy likewise produce other solar items that deal with less deflation than what solar module business are dealing with.

Nonetheless, in the long term, deflation is a headwind and Invesco Solar ETF has an overall cost ratio of 0.67% which is quite substantial for an ETF.

In the near term, business like Enphase Energy and Sunrun which remain in the leading 5 holdings of Invesco Solar ETF might deal with headwinds this year if the domestic solar market in the U.S. is weaker than in 2015 as Wood Mackenzie anticipates.

Another top-five holding, First Solar, might be more unpredictable provided speculation on the election this year.

As such, I rank Invesco Solar ETF a ‘Hold’ as in ‘sideline’ provided the election unpredictability and the capacity for more oversupply of solar this year.

If I were to own Invesco Solar ETF, I would own it in a portfolio with the Stunning 7 to take advantage of development.