Lemon_tm

Intro

I have actually composed an overall of 3 short articles on SA about Perseverance Gold ( OTCQB: FTCO), the most current of which remained in April 2023 when I stated that state-of-the-art reserves were down to listed below 40,000 ounces of gold and that all-in sustaining expenses (AISC) might increase significantly in 2024 or 2025.

On January 18, Perseverance Gold launched its production results for 2023 and I believe this might be a great time to review this business. While Perseverance Gold handled to accomplish its production target for the year, I believe that the Q4 production was underwhelming, and the Isabella Pearl cash cow will run dry. I’m keeping my score on the stock at strong sell. Let’s evaluate.

Introduction of the current advancements

If you’re not acquainted with the business or my earlier protection, here’s a short description of business. Perseverance Gold owns the Isabella Pearl open pit stack leach cash cow in Nevada and is amongst the couple of high-yield gold miners today. The business is noted on the OTC Market, and it has a regular monthly dividend of $0.04 per share, which equates into a dividend yield of 8.03% since the time of composing. Perseverance Gold was drawn out from Gold Resource ( GORO) in December 2020 and it has had a regular monthly dividend considering that April 2021. I have actually covered the latter in January 2023 here and its share cost has actually come by over 80% ever since.

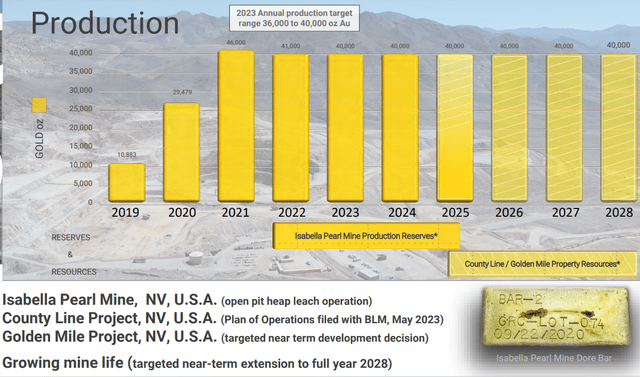

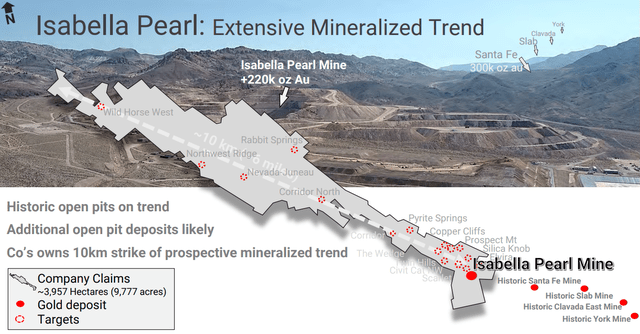

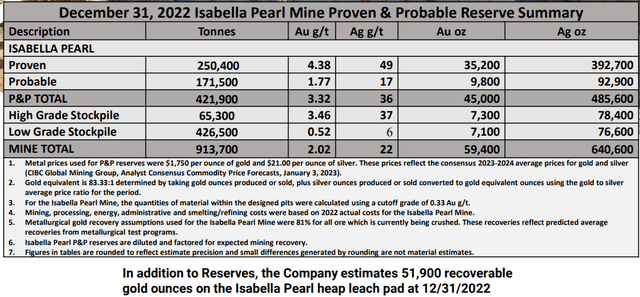

Turning our attention to Isabella Pearl, this is a little cash cow in the Walker Lane Mineral Belt with a yearly production of around 40,000 ounces. What makes it stick out are the low AISC which stand at listed below $700 per ounce thanks to the high grades of reserves. While the business discussion of Perseverance Gold points out reserves of 220 koz two times (slides 14 and 15), it is necessary to keep in mind that this is the figure for completion of 2019 and the most recent reserve quote is for 2022 (slide 35).

Perseverance Gold Perseverance Gold

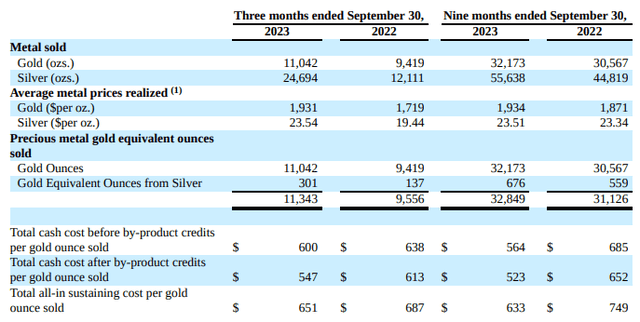

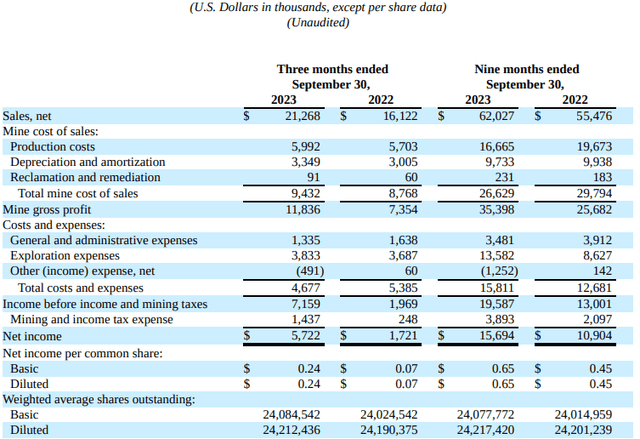

Taking a look at the most recent offered monetary outcomes, we can see that net sales increased by 11.8% year on year for the very first 9 months of 2023 to $62 million. The enhancement is attributable to a 5% development in sales volumes and a 3% boost in the typical list prices. The business produced an overall of 32,293 ounces of gold and offered 32,173 ounces at AISC of simply $633 per ounce. The greater sales caused an enhancement in the mine gross earnings margin to 57.1% from 46.3% a year previously.

Perseverance Gold Perseverance Gold

Complimentary capital for the very first 9 months of 2023 can be found in at $16.6 million and this assisted Perseverance Gold improve its net money position to $52 million from $45.1 million in December 2022 regardless of paying $9.6 million in dividends.

In the beginning look, Perseverance Gold looks underestimated based upon principles thanks to its low AISC, high dividend yield, and strong money position. Nevertheless, the concern here is the low state-of-the-art reserves and I believe the output of Isabella Pearl might drop considerably in 2024. Perseverance gold stated that the mine produced 37,996 ounces of gold in 2023 which remained in line with the targeted 36,000 to 40,000 ounce production variety.

Yet, this suggests that production in Q4 2023 can be found in at 5,703 ounces, which represents a 52.4% downturn from a year previously. In my view, Isabella Pearl is most likely lacking state-of-the-art ore as grade of ore mined in Q3 2023 was simply 2.04 g/t and most likely went listed below 2 g/t in Q4. The mine had 45,000 ounces of high grade gold reserves in addition to 7,300 ounces in a high grade stockpile at the end of 2022. In order to streamline computations, if we presume that all gold mined in 2023 was from the high grade reserves, this leaves tested and likely reserves of about 7,000 ounces of gold in December.

In order to keep its mining operations running, Perseverance Gold prepares to utilize a number of satellite deposits. I have actually covered this in my previous short article – the deposits with resource quotes at the minute consist of County Line with 37,400 ounces of determined and shown resources at 0.97 g/t, and Golden Mile with 78,500 ounces of determined and shown resources at 1.13 g/t. The concept is to put these 2 tasks into production before Isabella Pearl lacks ore and keep mining performing at least till 2028.

Perseverance Gold is targeting County Line as its next cash cow, however the concern here is that it still hasn’t got the needed licenses to start building and construction. In addition, I believe AISC from this task are most likely to be above $1,500 per ounce due to the much lower grades. In my view, Perseverance Gold will likely need to close down its mining operations in a couple of months as Isabella Pearl runs dry and the regular monthly dividend is most likely to be suspended.

I believe there is an excellent short-selling chance here as the marketplace does not appear to have actually priced in the low output for Q4 yet thinking about the share cost has actually been hovering around $6 considering that August. Perseverance Gold must launch its Q4 2023 monetary lead to late February and I anticipate to see AISC increasing to above $1,000 per ounce for the quarter. With Isabella Pearl lacking high grade ore, I anticipate the production and monetary outcomes to weaken throughout 2024 and the marketplace assessment to drop to a level near the money balance of Perseverance Gold. According to information from Fintel, the brief obtain charge rate is simply 1.69%. In addition, the brief capture danger appears low as the brief interest is just 0.1% of the circulation and takes less than a 3rd of a day to cover. Nevertheless, there is no possibility to hedge the danger through call alternatives as the business is noted on the OTCQB. In view of this, I believe it might be best for risk-averse financiers to prevent this stock.

Taking a look at the upside dangers, I believe there are 2 significant ones. Initially, the share rates of microcap business can skyrocket for spurious and unidentified factors. Second, the marketplace assessment of Perseverance Gold can get an increase from the development of gold rates. The cost of the metal has actually stayed above $2,000 per ounce over the previous a number of months due to worldwide macroeconomic unpredictability and geopolitical dangers, and there might be more upside prospective left.

Financier takeaway

Perseverance Gold produced less than 6,000 ounce of gold at Isabella Pearl in Q4 2023 and I believe the mine is beginning to lack state-of-the-art gold. With none of the satellite deposits near production, I believe the business may need to close down mining operations in the coming months and suspend its regular monthly dividend. In my view, there is an excellent brief selling chance here as the marketplace appears to be disregarding the dangers at the minute. That being stated, there are no alternatives offered to hedge the danger and I believe that risk-averse financiers must prevent Perseverance Gold stock.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.