TERADAT SANTIVIVUT

By FS Personnel

The following is based upon our Might 19, 2023 Smart Macro podcast, Big Cluster of Hindenburg Prophecies as LEIs See Additional Decrease, with Financial Sense Wealth Management CIO Chris Puplava.

Summary: Leading financial indications (LEIs) are still indicating a most likely economic downturn in the United States. You would not understand it by the habits of the stock exchange, nevertheless, offered the huge bull run in tech stocks up until now this year.

Regrettably, most of business comprising the broad market indices are getting left with the present level of concentration into pricey innovation stocks, not a healthy indication for the present rally.

As such, we now see a cluster of ‘Hindenburg Prophecy’ sell signals appearing throughout the significant averages, comparable to what took place in late 2021. In general, offered the information examined listed below, our company believe this lines up with a cautious/defensive posture on the outlook for equities.

Chris, when we talked to you a number of weeks back, you had actually pointed out how the ‘Offer in Might, disappear’ unfavorable seasonal pattern for the stock exchange has a much greater event when the leading financial indications are refusing, which is what we’re seeing now. Nevertheless, when you take a look at the stock exchange, we simply broke out to a brand-new year-to-date high above 4200 on the S&P 500.

Even with the decrease in leading financial indications and a great deal of the bearishness out there on the economy, it appears that there is a fair bit of favorable belief streaming into the tech sector – in specific, Nvidia ( NVDA), Google/Alphabet ( GOOG) ( GOOGL), Microsoft ( MSFT), you call it, all up quite highly – with a great deal of the advancements in expert system and generative AI. So, offered what we went over a number of weeks back, and the leading financial indications continuing to decrease, has your view or evaluation of the marketplaces altered considering that?

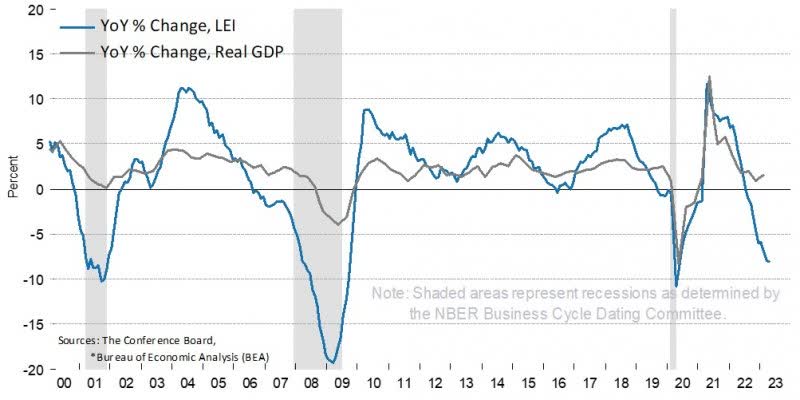

Chris Puplava: Not. The LEIs are still pointing down. In truth, we just recently simply got the Conference Board’s LEI for April, which has actually now decreased for the 13th successive month (revealed listed below). Based upon the wide variety of information they track, they think the economy is going to contract this quarter and are anticipating an economic crisis to begin in the middle of this year.

I believe the issue is, when you take a look at the S&P 500, it’s powering greater and the tech stocks appear like they’re succeeding, whatever looks great. However the concern I need to keep asking myself, what has altered in regards to the outlook?

We still see the Fed raising rates or keeping rates at present levels, which is putting pressure on the economy, the Fed is still diminishing its balance sheet and pulling liquidity out of the marketplaces, and the economy continues to slow. So, all of the significant headwinds are still present and, I think, will continue to put pressure on business earnings margins and the more comprehensive market in basic.

Source: The Conference Board

Could the Conference Board LEI be offering an incorrect signal about economic downturn or exist other designs flashing indication for the financial outlook?

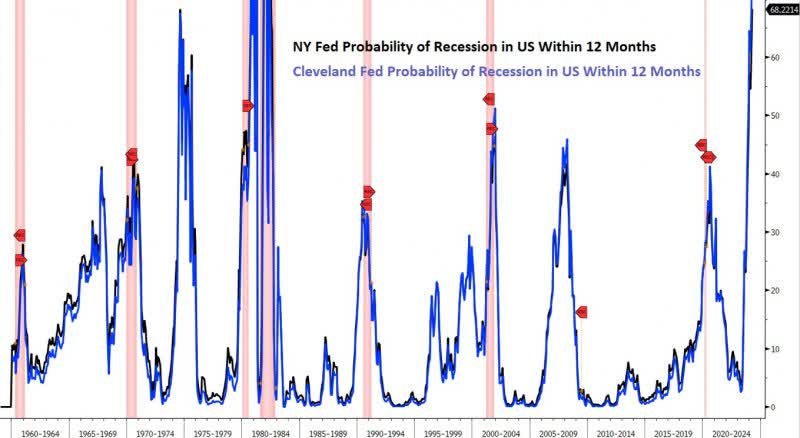

Chris Puplava: It’s not simply the Conference Board, however even main information supplied by numerous local Federal Reserves are flashing high chances of an economic crisis. For instance, both the New York City Fed and the Cleveland Fed have their own economic downturn designs approximating the chances of economic downturn within the next 12 months (revealed listed below).

And the readings that we are seeing from their designs are north of 68%. Now to offer you a concept of 2020, when we were undoubtedly in economic downturn, they got up to about a 40% opportunity.

Even in the Great Financial Crisis, the inmost economic downturn we have actually had considering that the Great Anxiety, their chances just got to around 45%. And today we’re at 68%. So, exceptionally raised relative to previous readings where economic crises took place, and I believe you would need to bury your head in the sand to not believe the chances of economic downturn are high.

Source: Bloomberg, Financial Sense Wealth Management

So, there’s a variety of things that are lining up for additional weak point, despite the fact that, once again, tech stocks are rallying quite highly and moving greater while the more comprehensive market is not getting involved. What are a few of the other things that you’re taking a look at under the hood that line up with this concept that we could be taking a look at an essential juncture?

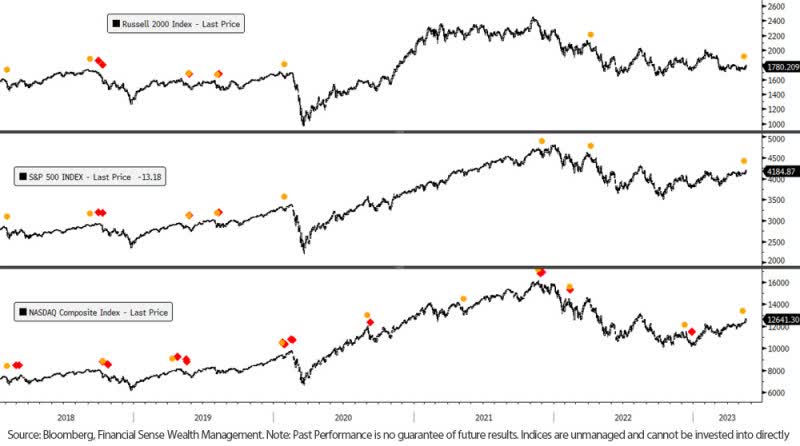

Chris Puplava: I track a vast array of technical buy and offer signals on the significant averages and, simply recently, we have actually now seen a cluster of what traders and service technicians describe as Hindenburg Prophecies (revealed listed below), which you can either consider prospective sell signals or warnings for a market peak.

However basically, the Hindenburg Prophecy signals when the marketplace is going through an id where you have a high variety of brand-new 52-week highs in addition to a high variety of brand-new 52-week lows.

That’s not a healthy market. And, in basic, that tends to hint weak returns moving forward. So, taking a look at a few of the significant indices, we have sell signals now standing for the Russell 2000 little cap index, the S&P 500, and the NASDAQ Composite. This is possibly a bad indication for the marketplace, in my viewpoint.

Taking a look at the larger photo, when we continue to see returns controlled by a little handful of tech stocks and the stock exchange averages showing little issue over financial threats, I need to ask myself what has altered? And when I do that, absolutely nothing has actually altered.

Rate of interest – that is, obtaining expenses – are still at raised levels, which is putting in pressure on the economy and larger monetary system; monetary liquidity is still being withdrawn by the Fed as they continue to carry out quantitative tightening up by diminishing their balance sheet; the ‘walk’ on business banks has actually not ended and individuals continue to pull cash from banks, which suggests banks need to either liquidate their securities holdings to fulfill deposit outflows or utilize developing loans to do that; and banks are continuing to tighten up on loaning.

So, entirely, these are not the examples you see throughout a strong financial growth to move stocks greater. The one intense area just recently has actually been a healing in real estate activity however, once again, unless rate of interest materially fall from present levels, I believe this is simply a short-term healing.

And if the Conference Board and Federal Reserve designs for economic downturn – not to discuss, Bloomberg’s economic downturn design too, who we have actually consulted with on our program (see Bloomberg Chief United States Financial Expert Anna Wong Goes Over Increasing Indications of Economic Crisis) – are right about the outlook, we need to anticipate to see more task losses in the months ahead.

So, once again, at this point, I’m still mindful on the outlook for the economy and the stock exchange and think a protective posture is the most sensible course.

Editor’s Note: The summary bullets for this post were selected by Looking for Alpha editors.