anusorn nakdee/iStock through Getty Images

Financial Investment Introduction

Vericel Corporation ( NASDAQ: VCEL) is showing constant development within the business’s core line of product which are exclusive and more reliable than conventional completing options. VCEL is bringing brand-new items to market and continues to get show existing items, with both elements set to drive more growth in the coming years. Although not without threats, VCEL is a service with competitive benefits and barriers to entry and these elements will assist drive substantial returns over the next 2 years.

Business Introduction

Vericel is a biotechnology company that mostly targets the sports medication and extreme burn markets with development remedies and treatments. VCEL’s 2 primary items are Epicel, a long-term skin replacement alternative for individuals with extreme burns who have deep dermal or complete density burns, and MACI, a corrective cartilage repair work service planned to treat cartilage irregularities of the knee.

MACI is the very first tissue-engineered autologous cellularized scaffold item to get FDA approval. In non-medical terms, MACI establishes a repair work tissue that allows clients to resume an active way of living. The artificial tissue brings back knee and joint function by fixing damage to the knee (such as cartilage chips and fractures). While doing not have the corrective benefits of MACI, completing treatments have actually traditionally focused more on repair work and discomfort control.

For substantial overall area burns in both adult and pediatric clients, Epicel is the only autologous skin item with FDA approval. When there isn’t much natural skin readily available for autografts, Epicel offers an important option to cover and recover harmed tissue.

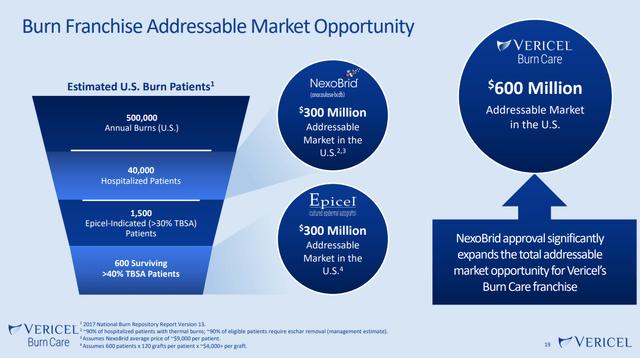

VCEL’s NexoBrid service for the elimination of scar tissue from burns has actually finished stage 3 trials and was authorized by the FDA in December of 2022. NexoBrid is a biological item administered topically that eliminates nonviable burn tissue, or eschar, from clients with extreme partial and full-thickness thermal burns.

Update Strategic Financial Investment Case & & Development Outlook

Vericel is a service with product competitive benefits. VCEL’s items are extremely exclusive and a lot more reliable than completing and conventional techniques. The option to MACI, for instance, is normally microfracture surgical treatment. Although a complete conversation of microfracture surgical treatment is beyond the scope of this short article, it is an intrusive treatment with a a lot longer healing time than MACI. Microfracture surgical treatment likewise does not bring back joint function, therefore provided MACI a substantial leg-up vs. conventional techniques. A comparable story emerges when taking a look at NexoBrid’s competitive benefits. Per the business’s yearly report

” The present requirement of look after eschar elimination of deep partial-thickness and complete density burns in the U.S. is surgical excision, which can lead to both feasible and non-viable tissue being gotten rid of. Surgical excision includes making use of sharp instruments or hydrosurgery” Source: Business Yearly Report

As a topical service that can be used straight to the burn location, NexoBrid is far less intrusive and more reliable than conventional surgeries.

Beyond VCEL’s item efficiency, financiers require to think about that rivals deal with really high barriers to entry when targeting the core markets served by VCEL. MACI, Epicel and NexoBrid are items that all took years to establish and after that invested a number of more years going thru the extensive regulative approvals procedure in both the United States and worldwide markets. This is especially crucial, as it’s not likely a rival might can be found in and take market share over night.

While our previous protection of VCEL has actually highlighted the overall addressable market chances for the business’s items, there are some brand-new favorable advancements for prospective financiers to factor into the financial investment thesis. To start with, the business is placing MACI to deal with cartilage problems of the ankle. If authorized, broadening MACI’s protection to the ankle might increase MACI’s TAM by $1 billion to $4 billion total. A stage 3 research study for MACI’s treatment of ankle problems is pending. VCEL is likewise actively increase marketing efforts to land more consumers for MACI in the knee repair/restoration area.

Likewise, NexoBrid represents a significant growth of the TAM for the business’s burn care franchise. With NexoBrid sales and marketing efforts still in the really early phases, it’s sensible to think that VCEL might catch a minimum of 10% of the addressable market with time provided NexoBrid’s tested capabilities to assist recover and bring back burn harmed skin in a non-invasive way. $30M of run rate NexoBrid sales would be a material boost to VCEL’s leading line which was available in at $164M in 2022.

Business Financier Discussion

According to the business’s yearly report, all 3 core items have substantial runway staying. Management keeps in mind that VCEL is seeking to increase MACI profits by increasing the variety of cosmetic surgeons implanting MACI and the typical variety of implants per cosmetic surgeon. Furthermore, there’s the possibility that MACI might be provided arthroscopically in the future, which would even more boost the worth proposal of this offering. Relying on Epicel, management is actively targeting extra burn centers and cosmetic surgeons to more broaden market share. Lastly, for NexoBrid, the business thinks it can utilize a lot of its existing relationships in the burn care location to make inroads in landing consumers for its most recent item.

The last location of the financial investment case to emphasize is that VCEL’s item offerings are requirement based and exempt to market patterns or trends. This will likely result in substantial “remaining power” for VCEL’s offerings, as those in requirement will likely choose the alternative that’s understood to be more reliable than conventional techniques.

Updated Financial Outlook

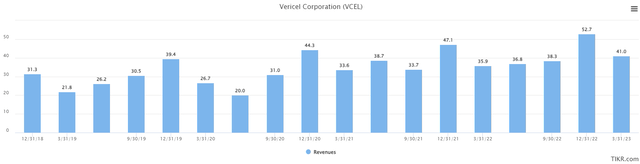

Throughout the years, VCEL has actually gradually grown its earnings. The chart listed below programs quarterly earnings and over the last 5-years, profits has actually grown regularly beyond a decline throughout the 2020 pandemic. Q1 2023 profits of $41.0 M was up $5.1 M YoY vs. Q2 2022 profits of $35.9 M. Compared to the chart below, profits development might begin to speed up as more cosmetic surgeons end up being knowledgeable about MACI and as the business NexoBrid commercialization efforts ramp-up.

TIKR

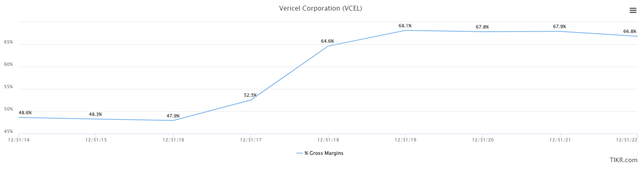

VCEL’s gross margins have actually likewise trended up with time and this seems a leading indication of the business’s capability to keep its prices power throughout core line of product. Aiming to the longer-term, management has actually consistently highlighted on quarterly incomes calls that they think a 70%+ gross margin is sustainable.

TIKR

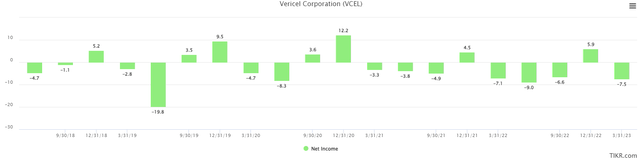

One knock on VCEL economically is that the business hasn’t had the ability to accomplish constant net success right now. In the most current quarter, VCEL lost $7.5 M. If the business can accomplish its targeted 70% gross margins and likewise level out sales financial investments, it’s most likely that VCEL will begin to see regularly net success with the next 12-18 months.

TIKR

VCEL continues to show investor friendly qualities too. Weighted typical Diluted Shares Exceptional have actually remained right around 47 million over the last 3 years. Likewise, Money and Short-Term Investments was $119M in the most current quarter, however has actually likewise remained above $100M because Dec 2021. VCEL has actually been financial obligation complimentary because Dec 2018, another indication that management is fiscally conservating leading everyday operations.

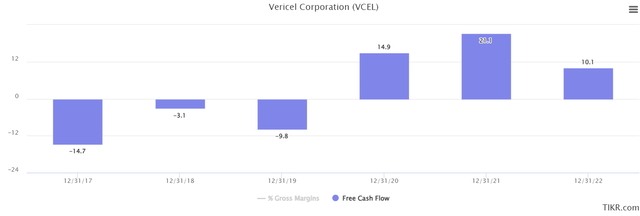

As evidenced in the chart below, complimentary capital has actually likewise noticeably enhanced over the last 5 years. This provides more credence to the case that VCEL will ultimately reach net success too.

TIKR

Looking ahead, the Wall Street agreement is that VCEL will reach $233M of profits next year and likewise turn to a net revenue of $5.3 M. If attained, this would be a velocity of sales development to 23% each year. Experts are likewise predicting that VCEL will see a sharp boost in success in 2025, going to a 10.3% earnings margin off of $274M in sales. In general, VCEL is well placed from a monetary viewpoint.

Financial Investment Dangers

Although both the monetary and tactical financial investment cases appear strong for VCEL, there are some threats for prospective financiers to examine. Although the business presently has 3 strong line of product which appear to have growing moats, financiers require to consider what lies beyond these 3 items. Development will ultimately slow, and at the minute, management has actually not clarified what efforts are in-flight today as associated to brand-new item advancement. This absence of an item pipeline will require to be dealt with in the coming years in order to guarantee more development.

Mentioning development, VCEL is likely a service with natural development limitations. The marketplace for treatment of extreme burns is mainly defined by constant need. Likewise, while aging worldwide populations are looking for more corrective cartilage treatments, there are not strong drivers that are most likely to press yearly need substantially beyond today’s present requirements.

At the minute, direct competitors for VCEL is reasonably very little. For MACI, prospective financiers will wish to keep viewing the outcomes of Aesculap Biologics, LLC’s Stage 3 trial of NOVOCART ® 3D. VCEL management thinks that this item is the just other item in advancement in the United States that utilizes the ACI technique. For NexoBrid, the business kept in mind the following on competitors in its yearly report-

” Other non-surgical treatments consist of clostridial collagenase lotion (CCO/Santyl ®) (Smith & & Nephew, plc.), antimicrobial representatives (silver sulfadiazine), or hydrogels. Although less intrusive than surgical excision, prior to NexoBrid, non-surgical debridement representatives have actually frequently been thought about ineffective, can lead to a prolonged sloughing duration, and have the capacity for the advancement of granulation tissue and increased infection and scarring. Aside from NexoBrid, CCO is the only FDA-approved item for enzymatic eschar elimination in the U.S.” Source: Business Yearly Report

More basic threats for VCEL consist of undergoing an intricate variety of medical and health policies all over the world. This dynamic is not likely to alter whenever quickly and the business will require to continue to browse the progressing regulative environment. VCEL is likewise based on an intricate worldwide supply chain for its items. Sometimes, this supply chain can be subjected to disruptive forces. Although this is not an issue special to VCEL, supply chain interruption might damage quarterly financials.

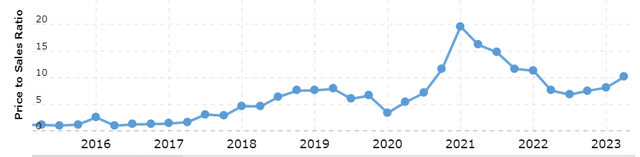

Base, Bull & & Bear Outlooks

Considering that VCEL stays unprofitable at the minute and continues to show strong development, we’ll think about evaluation situations utilizing the P/S several. Presently, the business is trading at several of 10.1 x, though this evaluation has actually varied regularly over the last few years.

Macrotrends

The bear case for VCEL most likely includes an absence of adoption for NexoBrid, in mix with development slowing for MACI. In this situation, sales development slows to 5% each year after reaching $190M this year, suggesting 2025 sales for $210M. The outcome here is most likely substantial several compression for VCEL to 4.0-5.0 x sales variety. VCEL’s market would drop from $1.75 B today to $800M+ in the bear situation.

The base situation focuses on VCEL continuing to grow gradually at 15% each year. Here sales pop to $250M by 2025, however net margins can be found in closer to 5% vs. the 10% Wall Street had actually designed. As an outcome of slower development and lower margins, the P/S several boils down to 8.5 x, offering VCEL a forecasted market cap of $2.1 billion.

The bull case takes place if management has the ability to direct VCEL to 20% development over the next 2 years. Overall sales in this situation dive to $274M and management strikes Wall Street’s targeted 10% margins in 2025. In this situation, there’s a case for small several growth to 11.0 x sales, bringing VCEL’s market cap to $3.0 billion, a 76% overall boost.

Our view is that VCEL most likely lands someplace in the middle of the base and bull situations, and for that reason attains an evaluation in the $2.3 B – $2.5 B variety. Considering that VCEL’s item offerings are best-in-class, management has actually shown a capability to run and scale business and since substantial development chances stay, VCEL is appointed a buy score. Provided present market conditions, it would not be unexpected to see a much better entry point in the coming months. For financiers looking for a bigger margin of security, a targeted entry point would be around $30 per share or a market cap of less than $1.5 billion.