oatawa/iStock by means of Getty Images

Thesis Summary

Petrobras ( NYSE: PBR) ( PBR.A) has actually been among the best-performing energy stocks in the last couple of months, even in the face of decreasing energy costs.

PBR is a worth financier’s dream, as it is valued inexpensively compared to a number of its peers. This is since this is a partially state-owned Brazilian business, which financiers view as an unfavorable. Nevertheless, I would argue that these viewed headwinds are, in reality tailwinds for PBR.

This business still has a great deal of long-lasting development ahead, and it will continue to reward financiers with dividend payments and capital gratitude.

PBR vs. The Rest

PBR has actually been on a tear because I last reported on it, offering us an overall return of +44%, thanks to capital gratitude and juicy dividend payments.

Expert ranking (SA)

PBR’s return is equivalent to the extremely valued after AI Mega Cap stocks. (Maybe they are resting on some innovative oil drilling AI innovation).

However Petrobras’s efficiency is a lot more magnificent if we compare it to its peers in the energy sector.

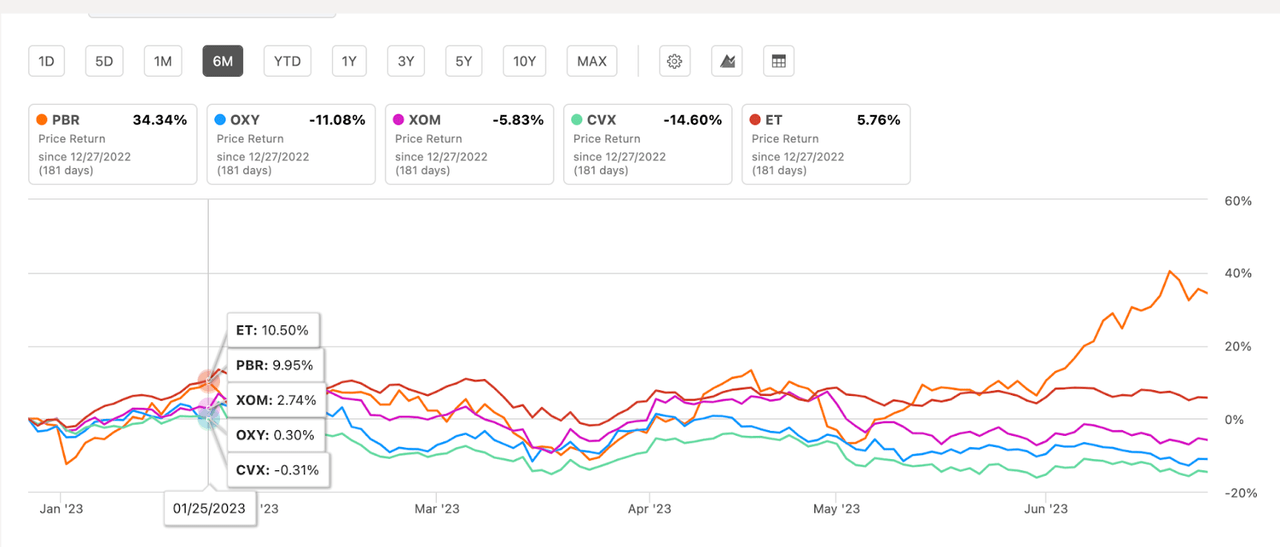

PBR vs peers rate efficiency (SA)

PBR is up 34.34& & in the last 6 months, while its best-performing United States rivals like, Occidental Petroleum ( OXY) and Exxon Mobil ( XOM) are just up 11% and 5.8%, respectively.

With the stock rate up over 25% in the last month, some financiers may start to believe that PBR is ending up being misestimated which it may be wise to turn into other stocks. Absolutely nothing might be even more from the reality.

|

PBR |

OXY |

XOM |

CVX |

ET |

|

|

P/E GAAP (fwd) |

4,04 |

13,12 |

10,96 |

11,66 |

8,92 |

|

Price/Sales (ttm) |

0,65 |

1,48 |

1,09 |

1,26 |

0,44 |

|

Price/Cash Circulation (ttm) |

1,63 |

3,11 |

5,38 |

5,99 |

3,95 |

|

Income 5 Year (CAGR) |

20,28% |

21,68% |

10,11% |

11,88% |

15,64% |

|

EBITDA 3 Year (CAGR) |

39,21% |

22,32% |

49,40% |

26,92% |

7,00% |

|

Levered FCF Margin |

33,23% |

25,98% |

11,31% |

12,95% |

5,79% |

|

Return on Equity |

43,44% |

35,13% |

33,25% |

23,37% |

14,22% |

The table above compares appraisal, development and success metrics in between PBR and a few of its peers. The currently discussed OXY and XOM, and likewise Chevron ( CVX) and Energy Transfer ( ET).

As I discussed above, PBR is a worth financier’s dream, even after the current rate rise. An easy take a look at the appraisal metrics will reveal as much. PBR trades at a forward P/E of 4, while its least expensive rival, ET, has a PE of practically 9.

PBR’s rate to sales is listed below 1, although it holds true that in this metric, ET is less expensive. Finally, we can see that by Price/cash circulation, PBR is exceptionally inexpensive, trading at just 1.6 x its existing capital.

How can this be? Generally such a discount rate would be attributable to lower development and or success, however that is certainly not the case here.

PBR has actually grown incomes by over 20% CAGR in the last 5 years, beaten just a little by Occidental Petroleum. Ebitda 3-year CAGR is simply listed below 40%, in this case, beaten just by XOM.

The business does win with a comfy margin when it pertains to FCF margin and Return on Equity. And, let’s not forget that PBR pays a substantial dividend. The next payment will be $0.34 per share on Aug 24, 2023.

You might have purchased this stock for $13.5 on June 9th, and you ‘d currently be up 6.8% in capital gratitude and would be getting 2.5% in dividend payments.

PBR is still inexpensive, and I do not believe it needs to be. The factor behind this heavy discount rate can be credited to the reality that PBR is mainly state-owned. It would appear that financiers do not have faith in Brazil and the Brazilian federal government.

In my viewpoint, these worries are overblown and on some accounts, might be flat-out incorrect.

Headwinds End Up Being Tailwinds

Because Lula ended up being president once again, at the start of 2023, there has actually been a dark cloud hanging over PRB. The concept is that, with a left-wing federal government in power, the requirements of investors will come 2nd to the requirements of the nation.

While this seems like a strong argument, can’t these requirements be lined up? Does not the federal government take advantage of having a well-regarded and effective oil business? Besides, history does not support this thesis. Price-wise, Petrobras did extremely well under Lula’s previous presidency. That’s not to state there is a connection, just that even if we accept the argument, PBR can still be successful in spite of Lula.

Just recently, Goldman turned bullish on PBR, stating basically what I stated a month earlier; that the regulative danger is overemphasized. Now, we do have some additional proof:

Petrobras last month ended a market-based policy for pricing its fuel and diesel in Brazil in favour of higher versatility to smooth rate swings, however executives vowed not to offer fuel listed below rewarding levels; Goldman stated the brand-new policy “is not simple however indicate Petrobras still following worldwide rate patterns.

Source: Looking For Alpha

On top of that, PBR scored a win today, as the Supreme court agreed the business in a 2018 multi-billion labour disagreement

Things appear to be working out for PBR.

Now, the other huge objection individuals need to PBR is the reality that it is a foreign business. Nevertheless, I see this as a big win, provided the worldwide macro patterns we are observing. Brazil has actually been doing extremely well, with inflation under control, and the Brazilian genuine has actually been rallying hard in 2023.

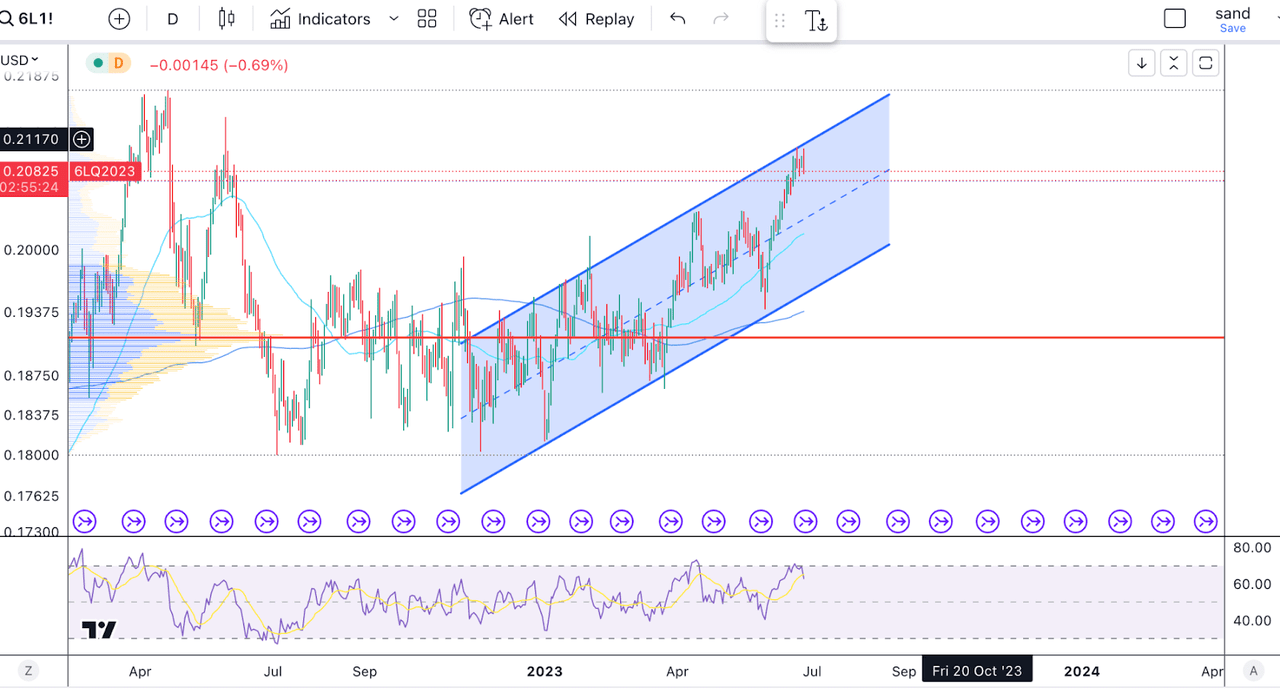

Brazilian genuine futures (TradingView)

In general, I think there is a lot to like about emerging economies, and Brazil is definitely a standout, with excellent resources, a big population, and a favorable GDP outlook.

Threats

There are still some dangers with a business like PBR. For something, I will state the chart above of the Brazilian genuine appearances overbought, and we may boil down in the short-term to evaluate the trendline.

In regards to the oil outlook, I do believe, in the more instant term, we might be heading a bit lower prior to a bigger rally takes place. My recommendations is to collect gradually at these levels.

Last But Not Least, the Lula aspect is constantly a looming danger, and although PBR is extremely underestimated, financiers need to comprehend this will continue to hold true. Although, I anticipate this appraisal space to continue to close.

Last Ideas

In conclusion, PBR continues to be a fantastic buy, even after the current rally. I am extremely bullish on the outlook for this business, oil, and Brazil. Any sell-off from here would be a fantastic chance to purchase or increase your position.