2023 has actually been an excellent year for stocks and a variety of other markets, however the variety of winners narrows if you run the tape back to the start of in 2015, right before the Federal Reserve and other significant reserve banks provided a huge rate shock, kept in mind experts at Deutsche Bank in a Friday note.

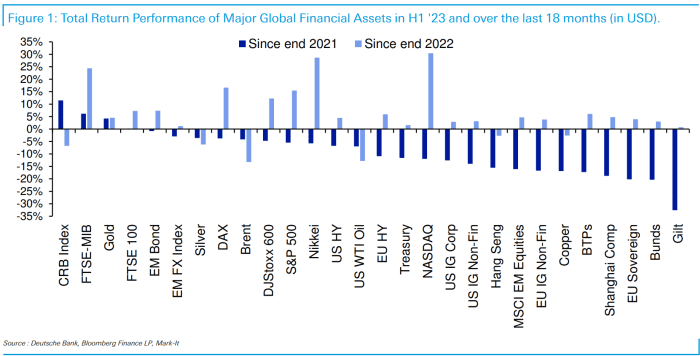

With financiers and traders set to close the books Friday on the 2nd quarter and very first half of 2023, the chart listed below runs down the efficiency of significant monetary possessions in 2023 and over the last 18 months. Efficiency because 2022, in U.S. dollar terms, is represented by the purple bars, with first-half efficiency represented by the light blue bars:

Deutsche Bank.

The period of greater rates began in early 2022, when the yield on the 10-year Treasury note.

TMUBMUSD10Y,.

leapt from 1.5% to 2.5% by the very first week of April and after that leapt to simply listed below 3.5% by the middle of June in 2015, macro strategist Jim Reid kept in mind. The 10-year now trades around 3.86%.

Back at the start of 2022 the yield on the 10-year German bund.

TMBMKDE-10Y,.

was still at -0.18%, then increased to 1.77% by mid-June 2022 and now stands at 2.44%.

The rate shock has actually set the tone over the last 18 months. While U.S. long-lasting rates have actually supported at greater levels over the last 6 to 12 months, the chart reveals that the damage to possessions viewed as dangerous remains “extremely apparent” from the early part of the duration, Reid stated.

” At the start of this year we felt H1 (the very first half) would be okay for danger possessions however that issues would develop as the economic crisis approached later on in H2. H1 has actually amazed on the benefit, mainly due to tech and AI, however if the start of 2022 marked the start of a brand-new greater rates period, then these returns must still be seen because context,” he composed.

That stated, the more favorable analysis “would be that we had a one-off rate shock that the marketplace dramatically gotten used to which we are now in the procedure of stabilizing and can continue to leave the shock behind us as we advance through the quarters ahead,” Reid stated.

The Nasdaq-100.

NDX,.

was on track for its finest first-half efficiency because records started in 1986, while the Nasdaq Composite.

COMPENSATION,.

up almost 30% year to date, was on track for its finest very first half in 4 years. The S&P 500.

SPX,.

was up 14.5% up until now in 2023, while the Dow Jones Industrial Average.

DJIA,.

dragged, up 2.5%.

Do not miss out on: These are the best-performing stocks in the 2023 booming market– and the worst

Reid kept in mind that returning to the start of 2022, the winners are extremely narrow, as the chart reveals, with products, gold.

GC00,.

and Italian equities.

I945,.

separated at the top.

Changed for inflation of around 8%, just products have actually a little surpassed, he kept in mind, while British federal government bonds, or gilts, have actually dropped around 33% in dollar terms and over 40% in genuine terms. That’s the sort of wipeout that “might take a years to make back in small terms and a lot longer in genuine terms,” Reid stated.