Daniel de la Hoz

Apple Inc. (NASDAQ: NASDAQ: AAPL) has when again crossed a $3 trillion assessment limit, at a greater rate due to share repurchases. The business is a giant, its 2.5% share rate gratitude in a single day represent $75 billion in market cap motion, comparable to the whole worth of giants such as The Progressive Corporation (NYSE: PGR) or Altria Group, Inc. (NYSE: MO).

Nevertheless, with the law of great deals, integrated with increased dangers to the core service, and its assessment, we anticipate Apple to underperform the S&P 500 ( SP500) moving forward.

Evaluation

It may appear like Apple has actually been on a roll, however it is essential to see where the business’s strength is originating from.

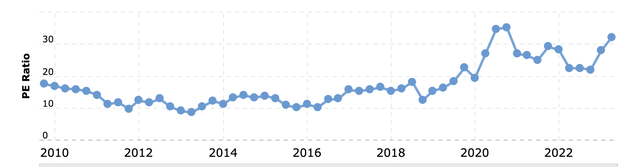

At the end of 2011, the business’s P/E was at 9.8. Today it’s at 32.19. In the meantime, we’ll overlook which assessment you believe is more legitimate. We’ll kindly presume the present assessment is more legitimate. That still indicates that the business’s share rate is 3.28 x, where it would be if it didn’t have the exact same numerous growth.

Another method to take a look at it is the business’s share rate would be ~$ 60/ share otherwise. That’s versus $14.99. That indicates its share rate development over the exact same 12 years would be 400%. That’s 12.2% annualized returns. Okay however much less than the 23.7% that the business has actually seen. So what’s the takeaway here.

The takeaway is that even if Apple can grow profits at the exact same 12.2% substance rate (which as we’ll see later on is not likely), the only method it’ll get the exact same returns is if it keeps the exact same numerous growth and grows to a triple digit P/E into the next years. Otherwise, that 12.2% will be the amount overall of the business’s returns.

Presuming the business’s P/E, on its present high-end, is reasonable, the business requires to match the exceptionally strong profits development of the last years simply to eek out double-digit returns.

Providers

Now let’s move onto the business’s development engine that’s been spoken about, services. It’s the business’s development engine going from $50 billion in 2020 income to an approximated $100 billion this year. It’s likewise high-margin income for the business, which is necessary to have. The business has actually been working to grow this service, making the most of its set up gadget base.

Nevertheless, there are some dangers. The business is seeing pressure for both charging a 15-30% cost on app shop memberships and is preparing to allow side-loading apps. We anticipate that regulative constraint will broaden. Not just will it affect Apple’s novelty versus Android, however it’ll possibly have a huge influence on the business’s service income.

At the exact same time, we anticipate the development rate of the business’s set up gadget base to decrease. It’s just recently struck 2 billion versus 3 billion worldwide for Android. While we do anticipate the % of those with a phone to broaden, we do not anticipate the development rate to grow almost as quick. Currently the development rate for services has actually decreased to the mid-single digits.

The dangers to the business’s existing service income in addition to the downturn in development rate indicates we do not believe this service will keep supplying the double-digit development.

Novelty Disappearing

At the exact same time, novelty disappears. Anecdotally, we have actually observed this in your area, the enjoyment and buzz around buying the current iPhone, Mac and so on has actually decreased significantly. The continued decrease in the center class in addition to record inflation rates affecting spending plans are most likely to be a huge part of the effect here.

We anticipate an increased right to fix will likewise have a larger effect here. Individuals will keep their gadgets for longer and longer. COVID-19 has actually altered patterns, however even prior to COVID-19, replacement cycles were extending.

In our view, the single crucial debate surrounding Apple today is the iPhone replacement cycle– regardless of the iPhone set up base growing +9% in 2015, we now anticipate systems to be down -19% in financial 2019, suggesting a product pushout in upgrade rates. Replacement cycles are lengthening … a lot.

That’s a huge danger for Apple, provided the present size of its set up base and the significance of turnover for HW income.

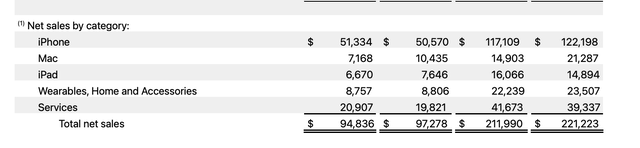

HW income effects are currently being seen in the present market as the business’s 1st 6 month income is down YoY in HW. Mac, among the most convenient items to keep for longer has actually decreased significantly. We anticipate the brand-new 15″ Macbook Air to affect this additional as one of the significant factors for the 16″ Pro design (in our peer group a minimum of) for screen size has actually been gotten rid of.

iPhone and Wearable sales are likewise down YoY. While we do not anticipate the down market to continue permanently, we do anticipate the historical strength not to continue.

The Number Of More Things Can Individuals Use

Included on to this is the absence of brand-new items. A years earlier lets take a look at where Apple was. The iPhone showed up in 2007 however anecdotally didn’t start to pick-up steam up until the 3/4. This can be seen in development rates that increased considerably prior to plateauing in 2015. The iPad didn’t come out up until 2010 and the very first Apple Watch came out in 2015.

Likewise, the very first AirPods came out in 2016. These are items that are now common. Shifts such as the switch to Apple Silicon represent significant one-time bumps in margins. Nevertheless, they likewise comprised a huge part of the business’s development in income over the previous years, throughout the profits development duration we went over above.

That demonstrates how challenging it is to grow profits at 12% annualized as a big business, smash hit items that attain extensive adoption at numerous $ each every couple of years. The business’s pipeline today is now considered as mostly including the Vision Pro and a Vehicle. The business has continually reduced the vehicle

The brand-new Vision Pro, which will release next year, will cost $3000. We believe this item is not likely to end up being a video game changer, specifically at its rate point. Nevertheless, the scale of the business is what harms it here. The business’s present HW margin is ~ 37% (kindly presuming no development in operating costs).

Present yearly revenues are $100 billion in earnings. Even if the Vision Pro ends up being 50% as huge as iPhone at $3000 each, an extremely not likely circumstance in our view, that’s $300 billion in fresh yearly income. Even if the margins are as high as other items, a practically doubling in the business’s earnings, that’s less than 6-years of the business’s 12% profits development.

That demonstrates how much the business requires to make to continue its development.

Little Share Buybacks Can’t Make A Business

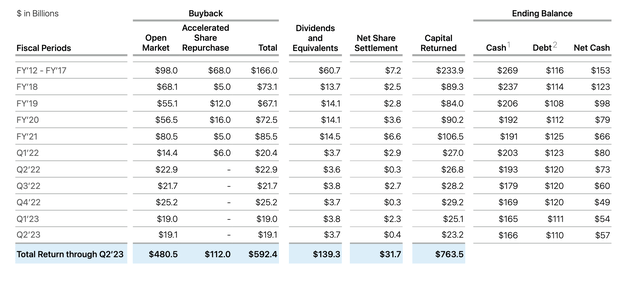

And we get to our next part. The business does not have numerous opportunities at its present level to drive investor returns. Buybacks have actually been a strong part of the business’s EPS development, as the business began with an exceptionally strong net money position. The business is down to a net money position of less than $60 billion from $153 billion at the end of FY’ 17.

The business has a modest dividend of less than 0.5%. Its bought an overall of simply under $600 billion in shares however practically $100 billion of that have actually come kind its net money position. Its quarterly buybacks + dividends are at approximately $25 billion which is increasing its money position by ~$ 3 billion quarterly. The business’s net money generation is ~$ 28 billion/ quarter.

That’s $110 billion in yearly money generation or a capital yield of << 4%. The business invests successfully all of its money on buybacks. The business does have practically $10 billion in stock-based payment each year it requires to offset, which is “close sufficient” to that $3 billion/ quarter. That indicates the business’s present share decrease rate of ~ 3% annualized is its returns.

That plus a 0.5% dividend yield is an exceptionally low return rate for a business that’s seeing all its capital go towards returns. The business’s 2021 and 2022 buyback rates are in-line with what we anticipate to be the business’s long-lasting buyback rate. Those investor returns just aren’t enough to validate the business’s assessment.

Thesis Threat

The biggest danger to our thesis is that Apple Inc. is a business that defies expectations. You do not end up being a $3 trillion tech business by not being one. The business has actually persuaded the typical American to invest countless dollars every couple of years on its items and the advantages that they supply to their everyday lives.

That’s a strong force and other unidentified tasks in the business’s pipeline might rapidly attain extensive adoption driving increased revenues even quicker than anticipated.

Conclusion

Apple is an excellent business. We likewise understand the traditional knowledge is that it is much better to purchase an excellent business at a great rate than a bad business. Nevertheless, assessment still enters into play and Apple, at its present size, is handling the law of great deals as it requires items that would normally specify a business in order to keep moving forward.

At the exact same time, even if the business handles to keep profits associated an exceptionally strong duration, its returns will not be almost as high. That’s because much of Apple Inc.’s development over the last years has actually been numerous growth. Even if you believe its present assessment is more reasonable than its last one, it’s exceptionally not likely in our view for the business to grow to a triple digit P/E.

In general, that makes Apple Inc. a bad financial investment. Let us understand your ideas in the remarks listed below.

.