Fanliso

Hermès ( OTCPK: HESAY) ( OTCPK: HESAF) has actually been among the very best financial investments in the market over the previous 5 years, returning 273% to financiers through cost gratitude, dividends, and unique dividends.

Unlike its closest high-end peer in LVMH ( OTCPK: LVMHF), Hermès is deeply focused on the really luxury of high-end, particularly with its leather items items. The business accommodates the exceptionally abundant, the type of consumer that does not appreciate an economic downturn and isn’t conscious cost boosts.

Trading at a 53.3 P/E several on 2023’s forecasted incomes, it’s clear the marketplace has really high expectations for the business and values it at a considerable premium compared to LVMH, the just real similar.

So, let’s discover if that premium is warranted.

—

With July approaching, practically every high-end home on the planet is set to report its monetary outcomes for the very first half of 2023. For those thinking about checking out previous posts I blogged about business in the market, here are the links:

- LVMH: 2023 Ought To Be Another Excellent Year, It’s A Buy

- LVMH: Q1 Numbers Program No Indication Of Decreasing

- Capri Holdings: It’s A Worth Trap, However A Most Likely Takeover Prospect

- Tapestry: It’s Not High-end, However It Is An Appealing Financial Investment

I prepare to compose a pre and post-earnings post on every high-end home. Stay tuned.

Business Summary

Hermès mainly runs as a mono-brand around the world. In addition to the Hermès brand name, the group offers items under the John Lobb, Bucol, Crystal Saint-Louis, Puiforcat, LeGrin, Mètaphores, and Verel de Belval brand names.

Your house was established in 1837 by Thierry Hermès, who offered high-end harnesses and saddles. 6 generations later on, the group is still run by members of the creator’s household, led by Axel Dumas.

Today, Hermès utilizes 19,686 individuals, of which 7,000 are trained and licensed artisans who make the business’s items in a vertically incorporated operation. There is no mass production here, Hermès produces its items classified under 16 métiers (line of work), with 76% of the production situated in France. The majority of the items are dispersed through 300 shops owned and run by Hermès, and the rest is offered through wholesale partners.

Geographical Existence

Hermès 2022 Yearly Report

Of the group’s 300 shops, 133 shops lie in Asia-Pacific, where Hermès created practically 58.0% of its sales in 2022. For contrast, LVMH runs an overall of 5,664 shops, 2,325 of which lie in Asia Pacific, where LVMH created 37% of its sales in 2022.

Considering the reality that 2022 sales were impacted by lockdowns in China, we comprehend that regular Asia direct exposure for both business is much more considerable, however for Hermès it is materially bigger. For the near term, it suggests we ought to anticipate Hermès to be a somewhat bigger recipient of the China resuming. Nevertheless, having a much smaller sized and far more focused group of consumers, Hermès wasn’t as impacted by the China lockdowns as LVMH, so that’s why I just anticipate small outperformance because location.

Item Mix

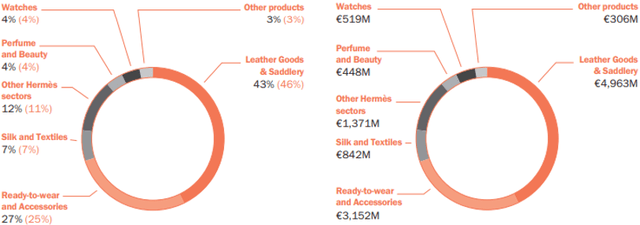

Hermès disaggregates its profits into 7 classifications. The main classification is Leather Product & & Saddlery, including the well-known Birkin and Kelly bags, which are basically ungettable to “regular” individuals. To get a perspective on simply how tough it is to get a bag, here’s a guide composed by Style.

The 2nd biggest classification is Ready-to-Wear and Devices, which includes males’s and ladies’s clothing and devices consisting of shoes, belts, hats, gloves, devices, and wearable fashion jewelry.

Then we have smaller sized classifications in Silk and Textiles, which consist primarily of headscarfs; Other Hermès Sectors which mainly make up tableware and fashion jewelry that isn’t used; Fragrance & & Charm; Watches and-; Other Products, which are items offered by the non-Hermès brand names.

Hermès 2022 yearly report

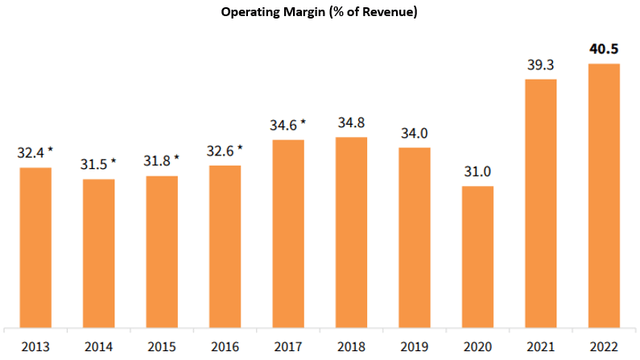

Sadly, Hermès does not offer us with an earnings breakdown per item classification. Nevertheless, we do understand that for LVMH, Style & & Leather Product is the most lucrative section, with a 40.5% operating margin in 2022. For LVMH, this section is just 49.0% of sales, whereas for Hermès it’s around 70.0% (depending upon just how much of the 27.0% in Ready-to-Wear and Add-on is credited to fashion jewelry). This discusses most of the distinction in between Hermès’ industry-leading operating margins of 40.5%, compared to LVMH’s 26.7%.

Monetary Efficiency

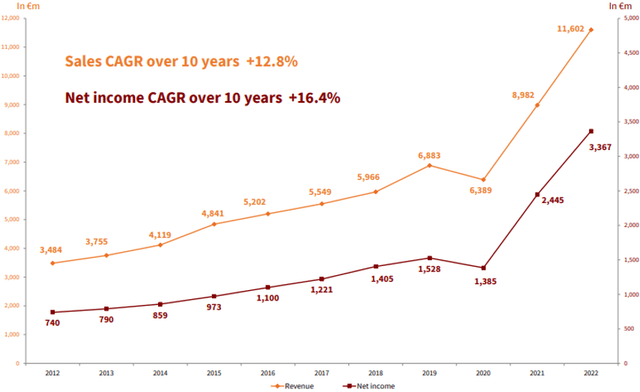

Hermès 2022 Financier Discussion

A chart that basically informs the entire story. In between 2012-2022, earnings increased 4.5 x, and unsurprisingly, the stock more than followed, increasing by 6.9 x. Development in earnings was mainly an outcome of earnings development, integrated with a considerable margin growth.

Hermès 2022 Financier Discussion

Hermès Vs. LVMH

Covering the majority of the market, you’ll quite rapidly understand that there’s Hermès, then there’s LVMH, and after that there are others like Kering ( OTCPK: PPRUY) and Richemont ( OTCPK: CFRUY). While those others trade at substantially lower appraisals, they are matchless to the 2 royals of high-end. Not in regards to development, not in regards to margins, not in regards to future potential customers, and not in regards to management quality.

In my view, there are just 2 options for a financier who wishes to get direct exposure to the real benefits of buying high-end style, and those are, as you can comprehend by now, Hermès and LVMH. The only concern that stays is which one is the much better financial investment.

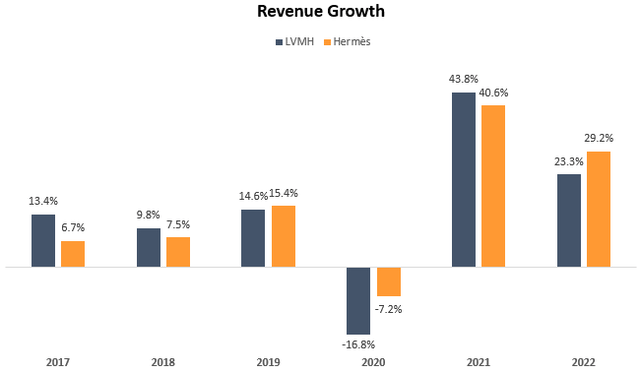

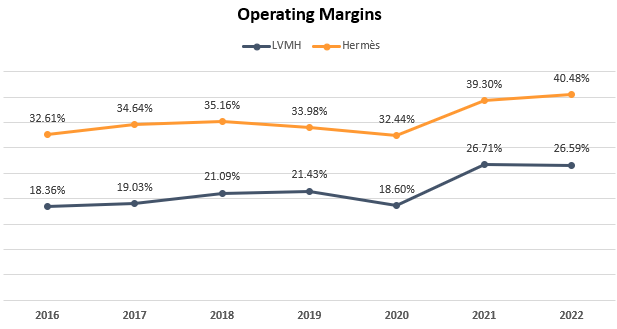

Developed and determined by the author utilizing information from the business’ monetary reports; Information since July 1st, 2023.

Starting with earnings development, Hermès is just partially greater with a 14.3% CAGR in between 2016-2022, compared to LVMH’s 13.2%. Nevertheless, LVMH grew out of Hermès in 3 out of those 7 years and came quite near to Hermès in every year besides 2020. As I explained in my LVMH posts, the business has far more direct exposure to Covid lockdowns due to its selective selling (particularly Sephora) and travel organizations, so I would not check out excessive into the 2020 efficiency.

Developed and determined by the author utilizing information from the business’ monetary reports; Information since July 1st, 2023.

Continuing with running margins, it’s clear which is the more lucrative company, with a typical space of 13.9% in favor of Hermès. In my view, this does not state much about the performance of business, due to the fact that as we talked about, LVMH obtains 50% of its sales from less lucrative classifications. That being stated, it suggests the space isn’t closing whenever quickly, and hence, each incremental Euro Hermès produces is better.

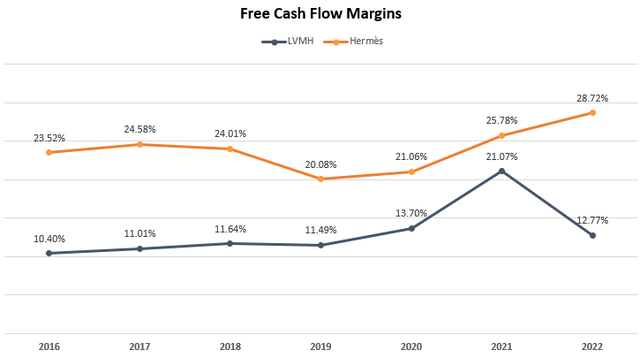

Developed and determined by the author utilizing information from the business’ monetary reports; Information since July 1st, 2023.

A comparable story is informed by the totally free capital margins of the 2, with a typical space of 10.8% in favor of Hermès. As you can see, the typical considers 2022, a year in which LVMH had a one-time drop in OCF margins due to stock accumulation and non-recurring tax installations, along with increased capex costs for running homes which are yet to yield return.

Prior To that, LVMH has actually been regularly narrowing the space, and we can anticipate that as quickly as this year, we’ll see the space return into the 4% -6% variety. Gradually, I believe it’s not unlikely that LVMH will have the ability to utilize its scale into going beyond Hermès’s FCF margins. Not in the future, however absolutely possible in the 5-year horizon.

Is Hermès’ Premium Justified?

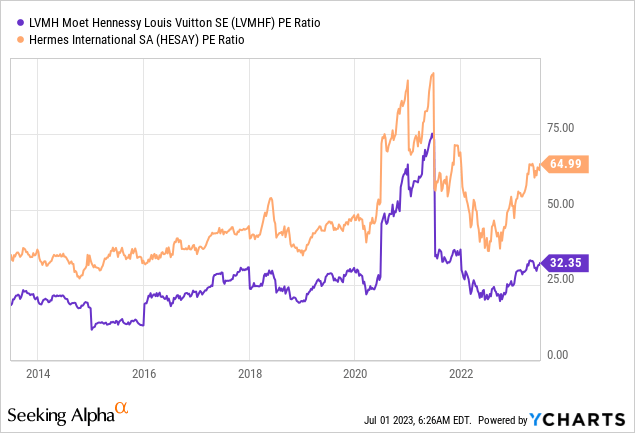

In the past, Hermès has actually constantly traded for a substantially greater several than LVMH, with the previous’s mean multiple at 42.1 compared to the latter’s 24.7. So by their particular means, Hermès was traditionally valued at a 70% premium. Today, the space is much larger.

Taking A Look At their GAAP P/Es (2022 ), Hermès is at 62.4 compared to LVMH at 29.6 (disregard the chart above, which is impacted by the USD/EUR currency exchange rate, it’s here to show the total pattern). Based upon present agreement price quotes for 2023, LVMH is trading at a P/E of 26.0 and Hermès is at 53.3. Based upon my price quotes for 2023, LVMH is at 25.2 and Hermès is at 51.6.

The bottom line is Hermès is getting a 100% premium compared to the historic 70% premium. As I stated, both I and the marketplace anticipate Hermès to continue to exceed LVMH in 2023, however I do not believe that validates extra 30 portion points over the historic premium.

For the near term, Hermès ought to gain from its focused item mix and greater direct exposure to Asia Pacific, however in time, I believe LVMH will offer steadier development and might exceed Hermès in FCF margins. Hence, I discover the present traditionally high premium unjustified.

Assessment

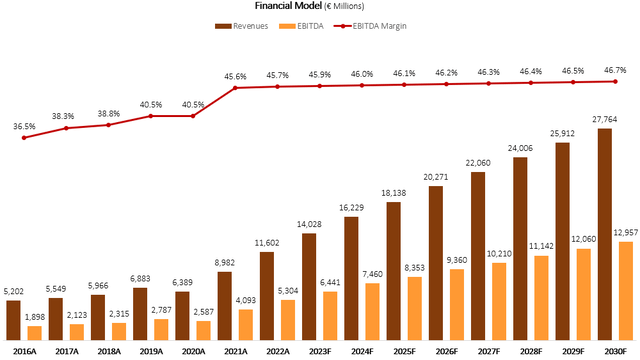

I utilized an affordable capital approach to examine Hermès’ reasonable worth. I anticipate Hermès will grow profits at a 10.2% CAGR in between 2023-2030. I approximate profits will grow at this rate due to continuous cost boosts, continued shop openings, entry into brand-new sectors, healing in China, and stable natural development.

I forecast EBITDA margins will increase incrementally approximately 46.7% in 2030. In my view, this is an affordable forecast as the business is continuously able to enhance margins, however on the other hand, it’s broadening line of work that are less lucrative.

Developed and determined by the author utilizing information from Hermès monetary reports.

Taking a WACC of 7.3% and including its net money position, I approximate Hermès’ reasonable worth at EUR1,544 per share, which totals up to $1,675 per HESAF ADR based upon the present USD/EUR ratio. This represents a 22.4% drawback compared to the marketplace cost at the time of composing.

While this is a considerable drawback, I do not rate Hermès a sell, as the business is of such high quality that it appears each time financiers believe it’s misestimated it will amaze them to the benefit. Furthermore, as we talked about in my previous LVMH posts, agreement price quotes are usually method off when it pertains to European business, and I absolutely task Hermès will beat expectations in the near term.

With enormous dividend development, no financial obligation, and big space for growth, I approximate financiers who continue to hold will be simply great.

Conclusion

Hermès is most likely among the very best organizations on the planet, attracting the most resistant consumer mate there is. From royal households to around the world celebs, the need for its high-end status-signaling items is unlimited, with complete waiting lists years beforehand.

Sadly, the business trades at a premium that I can’t disregard. Usually, I do not mind purchasing business at what is an objectively high several, as remarkable quality does not come cheap, and I look for to purchase business for the long term. Nevertheless, Hermès is presently too abundant even for my taste. When I compare it to LVMH, probably a business with a comparable or close-to-similar quality, I consider the premium unjustified and discover LVMH as extremely most likely to exceed in the foreseeable future.

Hence, I rank Hermès stock a Hold and repeat a Buy score for LVMH.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.