RobsonPL

French banks, which usually run varied lending/asset management service designs, are excellent locations to be ahead of a financial policy pivot. Of the 3 majors, Credit Agricole ( OTCPK: CRARY) screens most positively due to its outsized insurance coverage and asset-gathering charge earnings contribution vs. net interest earnings from retail and business banking. However the upside capacity for Credit Agricole is impeded by its leaner capital position; this keeps the return on concrete equity reasonably high however likewise lowers the scope for buyback-driven EPS upside. Credit Agricole has actually likewise preferred releasing excess capital into M&A over investor returns traditionally, though its combined performance history has actually weighed on financiers’ desire to appoint a greater assessment several.

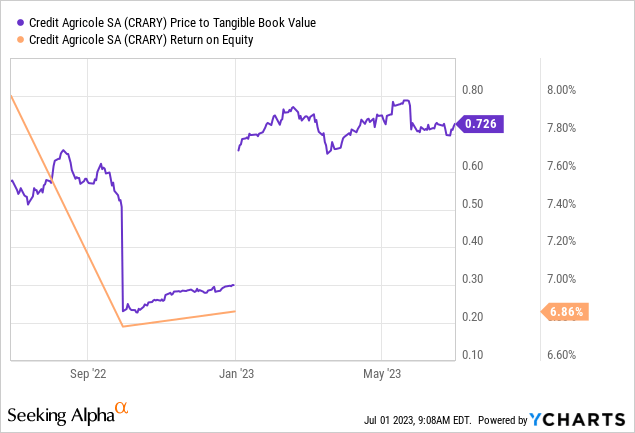

The domestic regulative background is barely beneficial either– in addition to rate walkings on managed cost savings items (e.g., the 100bps Livret A walking in January), legislators’ push for bank windfall taxes or ‘environment financial investment’ requireds might weigh on investor worth development. And provided the structurally greater expense of equity environment for EU banks post-Credit Suisse ( CS) AT1 default, Credit Agricole most likely will not be running much of an equity spread (i.e., the distinction in between its return and expense of equity) for the foreseeable future. Internet, the equity appears relatively priced at the existing ~ 30% discount rate to concrete book; I see no engaging factor to own the stock ahead of Q2 outcomes.

Distinct Company Design Underpins Robust Through-Cycle Basics

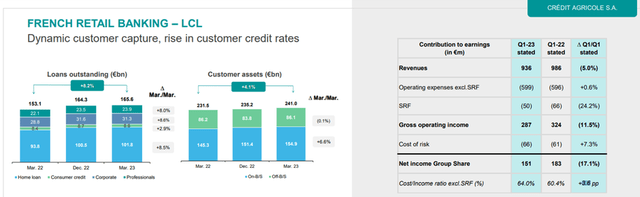

Of the 3 significant French banks (the others being BNP Paribas ( OTCQX: BNPQY) and Societe Generale ( OTCPK: SCGLY)), Credit Agricole has actually seen the greatest development in essential metrics such as loan development and deposits at its French retail banking system LCL. On the other hand, its net interest margin has actually underperformed YoY, showing its concentrate on development through consumer acquisition (+100 k brand-new consumers and +4% YoY consumer property development in Q1 2023). Provided its bigger property event and insurance coverage existence, enhancing for cross-selling chances over retail banking NIMs makes good sense. Management likewise is worthy of credit for its operating expense discipline, as the bank’s industry-leading retail jaws efficiency (i.e., the ratio of earnings increases to matching cost development) has actually kept the P&L robust through the turbulence of current months.

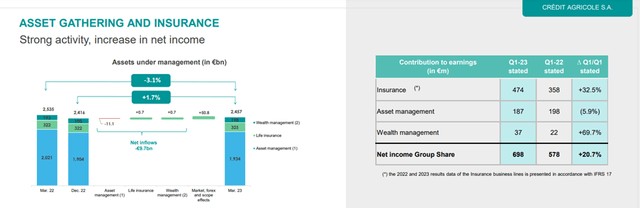

Possibly more notably, Credit Agricole’s asset-gathering and insurance coverage earnings has actually supplied an important balanced out to any net interest margin pressure. While properties under management were somewhat down YoY (however up sequentially) due to market conditions, retail charge development (primarily payment and services) has actually shined through low-margin institutional outflows. As the rate cycle turns and enhances the more comprehensive markets, Credit Agricole ought to likewise take advantage of inflows to a higher level vs. its peers. However even with the concrete book placed for constant development over the next year, the capital return capacity is restricted here. For one, the dividend payment is currently at the ceiling of ~ 50%. And though there is a strong case for buyback accretion with shares trading at a discount rate to concrete book, Credit Agricole’s leaner equity base implies there isn’t a great deal of excess capital readily available to release.

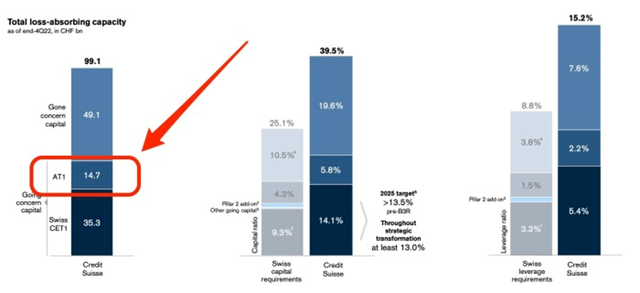

CS AT1 Wipeout Leads The Way for a Greater Expense of Capital Program

On the one hand, the landmark Credit Suisse offer this year highlighted the implicit regulative ‘put alternative’ underlying EU banks (recall the SNB used UBS ( UBS) liquidity help and a Swiss federal government warranty to presume possible losses from CS properties post-merger), efficiently topping the banking sector’s equity danger premia. More substantial, nevertheless, was the long-lasting ramification of documenting CS AT1s (i.e., ‘extra tier 1’ contingent convertible claims) in spite of the equity restoring worth from the deal.

Provided the scale of AT1s impressive from European banks and the progressively vital function these securities have actually played in their financing structures throughout the years (Credit Agricole consisted of), financiers requiring greater yields would have extensive ramifications for wholesale financing expenses. Credit Agricole has actually usually put its AT1s well listed below its expense of equity in the high-single-digit % variety (e.g., its EUR1.25 bn issuance in March came at a preliminary 7.25% rate), so yields closer to the low-teens might substantially weigh on the group’s general expense of capital and by extension, its capability to develop investor worth.

Extra Financing Pressure Ahead at the French Retail Bank

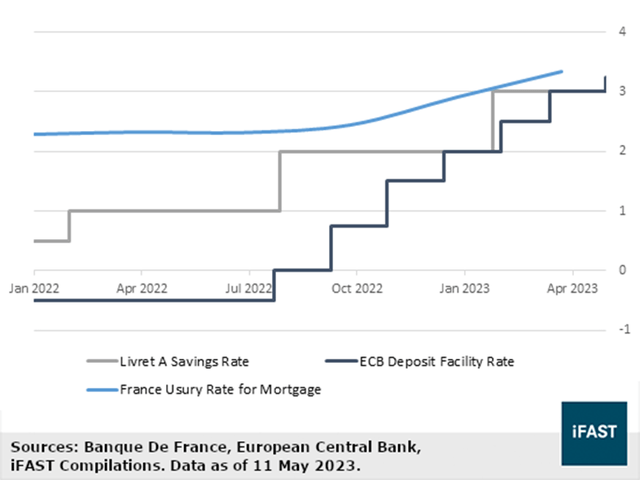

Intensifying the possibility of a greater EU-wide financing expense routine are possible headwinds from high walkings on French-regulated cost savings items in the coming months. Retail banks are currently competing with 2 succeeding 100bp rate boosts for Livret A or ‘instantaneous gain access to cost savings accounts’ (now at 3% or the greatest rate in fifteen years). With inflation still raised in France and not likely to alleviate prior to the next modification due in July this year, anticipate more walkings down the line. In the most likely occasion that greater regulated rates equate into greater uncontrolled item yields also, French banks look set for a product headwind to their net interest earnings development course. Of the 3 significant banks, Credit Agricole might come off worst provided its reasonably lower net interest margins and restricted scope for expense cuts to balance out the effect.

Not Low-cost Enough

As appealing as Credit Agricole’s reasonably lower rate level of sensitivity may appear ahead of a neutral/looser financial policy environment, there are just a lot of possible headwinds on the horizon. Besides its lower investor return headroom, an outcome of its leaner capital base, the bank’s performance history of worth development (naturally and inorganically) hasn’t been especially excellent. With restricted upside possible to the high-single-digits % structural ROTE in a greater expense of capital environment post-banking problems in the US/EU, the bank might see its equity spread even more compress (if not turn unfavorable). Possible regulative headwinds are an included source of disadvantage, most significantly from the more walkings to managed domestic cost savings items like Livret A. Include tail dangers like a possible French bank windfall tax, and the apparently low-cost ~ 0.7 x concrete book assessment does not evaluate so inexpensively any longer.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers connected with these stocks.