cemagraphics

The 4325-37 assistance location in the S&P 500 ( SPY) has actually been highlighted for a number of weeks now and was lastly checked today. Monday’s session closed right on 4328 and this marked the low of the correction. Remarkably, there was no genuine capitulation to eliminate the last of the bulls, and the 4325 significant assistance was never ever breached. Nevertheless, that’s not to state the purchasing chance was ‘simple’ – either you purchased a weak close at the lows, or chased after a space greater on Tuesday. Undoubtedly, it was simpler to purchase 4362 (a level likewise highlighted in recently’s short article) later on in the week.

New 2023 highs were made on Friday, which provides a bullish predisposition early next week. Nevertheless, Self-reliance Day might disrupt the circulation. A brand-new month and brand-new quarter will get underway, and trading is normally quieter after the July fourth vacation. So what to anticipate over summer season? Exists an opportunity of another turnaround and even a top?

To respond to these concerns, a range of technical analysis methods will be used to the S&P 500 in numerous timeframes. The goal is to supply an actionable guide with directional predisposition, essential levels and expectations for rate action. I will then utilize the proof to telephone for the week ahead.

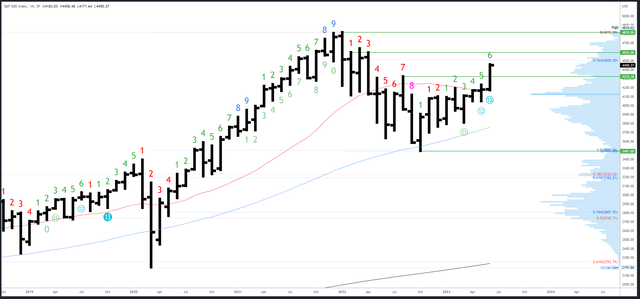

S&P 500 Regular Monthly

As anticipated, the June bar liquidated Q2 on Friday with a ‘window dressing’ rally. A strong close near the highs bodes well for Q3, a minimum of in the start, and resistance at 4593 ought to be reached at some time.

SPX Regular Monthly ( TradingView)

There is small resistance at the 76.4% Fib at 4505, followed by month-to-month referrals beginning at 4593.

4325 is possible assistance, then 4230 at May’s high, with 4195-200 a significant level simply below.

An upside Demark fatigue count will be on bar 7 (of 9) in July. We can anticipate a response on either bar 8 or 9 ought to brand-new highs be made (compared to the other bars in the count) so it might be over 2 months till we see greater timeframe fatigue.

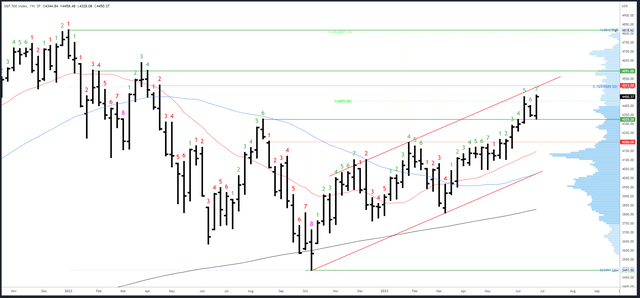

S&P 500 Weekly

Today’s action produced an ‘outdoors bar,’ totally swallowing up the variety of the previous week. Combined with the brand-new 2023 high and strong close, this is a bullish pattern. Extension to brand-new highs is anticipated early next week.

One possible obstacle originates from the weekly benefit fatigue (Demark) count which will be on bar 8 (of 9) next week. As pointed out in the previous area, we typically see a response on bar 8 or 9, either a dip/ time out (more than likely), or complete turnaround. It isn’t always a factor to offer, however it does suggest resistance levels have a much better opportunity of holding.

4505-4513 is the next resistance at the 76.4% Fib and weekly pivot high. This will likewise associate the channel highs ought to it be reached.

4325-28 is now preliminary assistance, and there is a weekly space fill at 4298.

As pointed out previously, an advantage (Demark) fatigue count will be on bar 8 (of 9) next week.

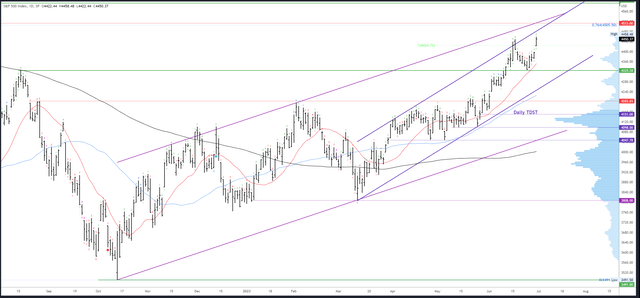

S&P 500 Daily

Friday’s space greater functions as a near-term inflection. Monday’s half session and Wednesday’s re-opening ought to truly hold above 4422 for the momentum to continue.

An everyday channel assembles with the weekly one in the low 4500s and these remain in confluence with the weekly resistance location of 4505-13. The rally ought to truly continue to check this location with only small dips of around 20-30 points.

Just a sharp turnaround and weak close listed below 4422 would turn the view bearish for 4362, even 4325 once again.

Possible assistance is at the 4422 space, 4396 space fill and 4362.

An upside fatigue (Demark) count will be on bar 3 (of 9) on Monday There is likewise an establishing 9-13 consecutive count which might finish towards completion of the week. These counts have actually blended lead to strong patterns, however combined with the weekly fatigue, it is something to consider ought to there be a bearish response at resistance

Occasions Next Week

Markets close at 1pm on Monday and are shut all the time Tuesday for the Self-reliance Day vacation. ISM Production PMI information is launched on Monday while Solutions PMI is on Thursday. FOMC Minutes are out on Wednesday, and the emphasize of the week is NFP on Friday.

Current information has actually been strong and yields are increasing, as are the chances of a 2nd additional walking from the Fed, which now stand at 40%. The S&P 500 has actually been rallying recently on excellent information with apparently little issue for what the Fed does. This might alter at some time, possibly when the 10Y yield crosses above 4% or hot information makes a 2nd walking practically specific.

Probable Relocations Next Week

The rally looks set to continue, however this Friday’s ramp ought to have marked the greatest stage (the extension space) and momentum might slow as it makes its method towards 4500.

4422 and the space window need to hold for the pattern to stay reliable. A weak close listed below that point would recommend the S&P 500 is still in correction mode and can fall back near today’s lows.

If and when 4505-12 resistance is reached, I will search for a turnaround and any indications of weak point. This might result in a 50-100 point drop, however I do not anticipate a leading to be formed, yet.