Are you imagining owning a piece of the American Southwest? Arizona, with its lively desert landscapes, warm weather condition, and varied cultural tourist attractions, provides a tempting attraction for those looking for a brand-new location to call house. Nevertheless, prior to starting this amazing journey, it’s important to comprehend the homebuying procedure particular to the Grand Canyon State. From browsing regional guidelines and monetary factors to consider to discovering your ideal house in a downtown Phoenix condominium or a tranquil home in Gilbert, this Redfin short article will work as your thorough guide to purchasing a home in Arizona.

So, secure your seat belts as we check out the actions, complexities, and pointers to make your Arizona homebuying experience smooth and effective.

What’s it like to reside in Arizona?

With its year-round sunlight and warm environment, Arizonans take pleasure in an outdoor-centric way of life by treking, playing golf, and checking out the huge desert landscapes. The state is likewise house to numerous popular national forests and monoliths, consisting of the awesome Grand Canyon and the sensational red rocks of Sedona, supplying limitless chances for experience and expedition. Arizona is likewise understood for its extreme summer season heat, and safeguarding yourself and your residential or commercial property when living there is vital. Take a look at this short article to find out more about the benefits and drawbacks of residing in Arizona

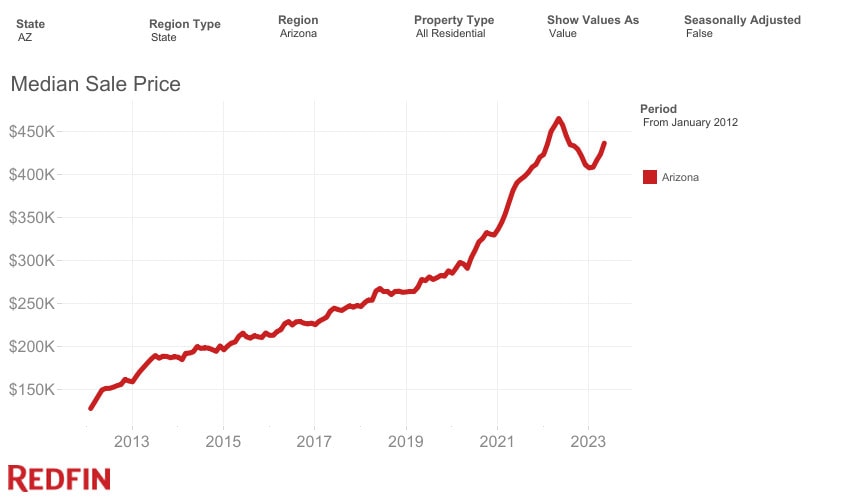

Arizona real estate market insights

The Arizona real estate market is experiencing some noteworthy patterns and shifts. The average price presently stands at $436,100, revealing a 6.2% decline compared to the previous year. A number of cities in Arizona have actually become competitive realty markets, consisting of Pinetop, Flagstaff, and Cottonwood Popular cities in the Phoenix location, such as Scottsdale, Chandler, and Gilbert, are likewise experiencing considerable development and bring in potential property buyers. Nevertheless, the real estate supply in Arizona has actually reduced by 4.7% year-over-year, showing a tightening up market. These information points recommend a vibrant and developing real estate market in Arizona, with varying rates, competitive cities, and restricted supply, all of which have ramifications for purchasers.

Discovering your ideal area in Arizona

For numerous factors, picking the ideal area for purchasing a home in Arizona is important. Primarily, Arizona provides varied landscapes and neighborhoods, each with its special beauty and features. By thoroughly considering your preferred area, you can align your way of life choices with the location’s offerings. Furthermore, the area of your house considerably affects elements such as travelling time, access to vital services, quality of schools, distance to leisure chances, and possible gratitude of residential or commercial property worth gradually.

If you’re not sure where to begin, utilizing tools like a expense of living calculator can assist you identify what cities are within your budget plan. We have actually created a peek of the 5 popular cities, so you can get a concept.

# 1: Tucson, AZ

Typical house cost: $330,000

Tucson, AZ houses for sale

Relocating To Tucson provides a distinct and lively experience that mixes desert charm, cultural richness, and an unwinded environment. Outside lovers can look into the attractive tracks of Saguaro National forest, start stimulating walkings or bike flights in the close-by Catalina Mountains, or enjoy a round of golf on first-rate courses. Accepting its abundant cultural heritage, Tucson boasts a growing arts scene including fascinating museums, art galleries, and the popular Tucson Gem and Mineral Program. While the expense of living in Tucson surpasses the nationwide average by 4%, there are budget friendly Tucson residential areas, making sure a balance in between cost-effectiveness and access to the city’s tourist attractions.

# 2: Mesa, AZ

Typical house cost: $440,000

Mesa, AZ houses for sale

As the third-largest city in Arizona, Mesa is understood for its rural areas, well-kept parks, and outside activities. Relocating To Mesa, you’ll take pleasure in over 300 days of sunlight each year, making it perfect for outside lovers. Check out the close-by Superstitious notion Mountains, go treking or cycling in Usery Mountain Regional Park, or take pleasure in water sports at the close-by Saguaro Lake. Mesa likewise provides an abundant cultural scene, with tourist attractions such as the Mesa Arts Center, which hosts a range of efficiencies, shows, and celebrations throughout the year.

# 3: Phoenix, AZ

Typical house cost: $439,950

Phoenix, AZ houses for sale

Referred To As the Valley of the Sun, Phoenix is a busy city with a flourishing economy, lively culture, and numerous features. With a transfer to Phoenix, locals can take pleasure in an abundance of sunlight throughout the year, enabling a vast array of outside activities such as hiking, playing golf, and checking out the picturesque desert landscapes. Phoenix is house to significant sports groups, consisting of the Phoenix Suns and the Arizona Diamondbacks, using amazing chances for sports lovers. Furthermore, if you’re trying to find budget friendly Phoenix residential areas, numerous choices offer a more affordable real estate market while using access to the city’s features.

# 4: Flagstaff, AZ

Typical house cost: $ 645,000

Flagstaff, AZ houses for sale

Flagstaff takes pleasure in all 4 seasons, bring in locals who delight in the enchanting shades of fall, the snowy winter seasons that provide awesome snowboarding and snowboarding chances at Arizona Snowbowl, and the moderate summer seasons ideal for treking and outdoor camping. If you’re a fan of stars, transferring to Flagstaff will give you the possibility to experience the Lowell Observatory, where locals can look into the marvels of the night sky. It deserves keeping in mind that the expense of living in Flagstaff is 14% greater than the National Average. Still, the city’s special offerings and natural charm make it a rewarding financial investment for those looking for an extraordinary living experience.

# 5: Scottsdale, AZ

Typical house cost: $830,000

Scottsdale, AZ houses for sale

Scottsdale is renowned for its first-rate resorts, day spas, and golf courses, bring in visitors and locals looking for relaxation and extravagance. Scottsdale’s Old Town showcases a captivating mix of historical beauty and contemporary elegance with its stylish stores, art galleries, and popular dining facilities. Relocating To Scottsdale can be pricey, with the expense of living going beyond the nationwide average by 13%. If you wish to remain on a budget plan, there are budget friendly residential areas outside downtown.

The homebuying procedure in Arizona

If the attraction of Arizona has actually swept you away, and you have your heart set on a particular city or area, it’s time to dive into the homebuying procedure.

1. Prioritize your financial resources

Getting your financial resources in order is essential when purchasing a home in Arizona. You can place yourself for a smooth and effective homebuying journey with mindful monetary preparation and preparation. Start by evaluating your credit report and dealing with any problems to guarantee you receive beneficial loan terms. Next, identify your budget plan and compute just how much you can easily manage, thinking about elements like deposit, closing expenses, and month-to-month home loan payments. Utilizing tools like an price calculator can assist you identify your budget plan.

Different programs are offered for newbie property buyers in Arizona, consisting of the Path to Purchase, which can help with approximately $20,000 in deposit and closing expense help.

2. Get pre-approved from a lending institution

Protecting a pre-approval when purchasing a house in Arizona can offer many benefits. By acquiring pre-approval from a trustworthy lending institution, you plainly comprehend your monetary standing and loaning capability. This understanding empowers you to set a reasonable budget plan, guaranteeing you concentrate on houses within your cost variety. Pre-approval likewise boosts your reliability as a purchaser, showing to sellers that you are major and economically certified.

3. Get in touch with a regional representative in Arizona

Dealing with a regional representative throughout the homebuying procedure in Arizona is of utmost significance. Regional representatives have vital understanding and knowledge particular to the Arizona realty market, which can substantially benefit purchasers. They are fluent in the complexities of various areas, market patterns, and prices characteristics throughout the state. So whether you require a realty representative in Tucson or an representative in Phoenix, they’re here to assist.

4. Start visiting houses

When visiting houses in Arizona, keep a critical eye and think about essential elements that can affect your choice. Initially, take note of the house’s area and area. Think about distance to schools, features, and commute times to guarantee it lines up with your way of life. Examine the residential or commercial property’s condition, looking for any indications of wear, structural problems, or possible upkeep requirements. Try to find natural lighting, practical designs, and sufficient storage area that fulfill your requirements.

5. Make the deal

The deal is an important element of the homebuying procedure in Arizona, bring considerable weight in identifying whether your dream house comes true. Crafting a strong deal is important to stick out in a competitive market. Think about the listing cost, residential or commercial property condition, and regional market patterns to identify a reasonable and competitive deal. Your deal ought to consist of the purchase cost, contingencies, and preferred timelines for evaluations, funding, and closing.

6. Close on your home

The closing procedure is a turning point in the homebuying procedure in Arizona, where all the essential documents is completed, and ownership of the residential or commercial property is moved. It’s an important action that needs mindful attention to information and an extensive evaluation of the closing files. Throughout the closing, you will sign numerous legal files, consisting of the home loan, deed, and other essential documents. It’s important to thoroughly examine and comprehend these files prior to signing to guarantee you understand the terms and commitments.

If you’re brand-new to the procedure and still have concerns, Redfin is here to assist. The Newbie Property Buyer Guide enters into more information about each action in the homebuying procedure.

Aspects to think about when purchasing a home in Arizona

Due to Arizona’s geographical area, there stand out elements to think about when purchasing a house.

Environment and weather condition

When purchasing a home in Arizona, it is essential to think about the environment and weather condition, in addition to the effect environment modification is having in the state. Arizona provides a varied variety of environments, with hot summer seasons going beyond 100 degrees Fahrenheit (38 degrees Celsius) in desert locations like Phoenix and Tucson. These cities are likewise understood for their moderate and enjoyable winter seasons, bring in snowbirds and retired people looking for warmer temperature levels. On the other hand, the northern parts of the state, consisting of Flagstaff and Sedona, offer a cooler and more moderate environment, with snowy winter seasons and comfy summer seasons. Property buyers need to consider their choices and tolerance for severe heat or cold when picking an area within Arizona.

Furthermore, the state’s special desert environment provides both benefits and difficulties. Effective cooling systems and appropriate insulation are essential to fight the extreme summer season heat, while the dry weather condition increases the threat of dry spell and wildfires, triggering house owners to think about shade schedule, outside home, and landscaping choices to alleviate the sun’s effect.

Double company

Arizona enables double company in realty deals, which describes a realty representative representing both the purchaser and the seller in the exact same deal. In double company, the representative functions as a neutral intermediary, assisting in the deal and making sure a reasonable procedure for both celebrations. Nevertheless, it is very important to keep in mind that double company needs all celebrations’ notified approval.

Purchasing a home in Arizona: Bottom line

Browsing the homebuying procedure in Arizona needs mindful factor to consider and tactical decision-making. From comprehending the significance of area to getting financial resources in order, protecting pre-approval, and dealing with regional representatives, each action plays a crucial function in attaining an effective and rewarding house purchase. By being knowledgeable, proactive, and versatile, property buyers can with confidence browse the Arizona realty landscape and discover their ideal location to call house in this gorgeous southwestern state.

Purchasing a home in Arizona frequently asked question

What are the requirements for purchasing a house in Arizona?

To begin it off, a deposit is essential, although the particular quantity can differ depending upon elements such as the loan type and lending institution requirements. An excellent credit report is likewise essential, with a minimum rating of around 620 frequently chosen for traditional loans. Earnings and work confirmation is needed to show the capability to pay back the home loan. Lenders examine the debt-to-income ratio to guarantee debtors can handle their month-to-month payments. It is recommended to carry out a residential or commercial property appraisal and house evaluation to identify the worth and condition of the residential or commercial property.

What is a normal deposit on a home in Arizona?

A normal deposit on a home in Arizona can differ depending upon numerous elements. Normally, it varies from 3% to 20% of the purchase cost. The portion frequently depends upon the loan type, lending institution requirements, and the debtor’s monetary circumstance. For traditional loans, a deposit of around 20% is perfect for preventing personal home loan insurance coverage (PMI). Nevertheless, choices are offered for lower deposit portions, such as 3% or 5%, especially for newbie property buyers or through government-backed loan programs like FHA loans.

What credit report do I require to purchase a home in Arizona?

When purchasing a home in Arizona, the credit report requirement can differ depending upon the kind of loan and the lending institution’s requirements. Normally, an excellent credit report is chosen to receive beneficial home loan terms. A minimum credit report of around 620 or greater is usually needed for traditional loans. Nevertheless, loan programs, such as FHA loans, provide more versatility and can accommodate debtors with lower credit rating, often as low as 580. It is very important to keep in mind that a greater credit report normally enhances your opportunities of protecting a home loan with competitive rate of interest and beneficial terms.