elenaleonova/E+ through Getty Images

Financial Investment Thesis

Primo Water ( NYSE: PRMW) is a leading pure play water provider after having actually effectively changed itself over the last 5 years. Following the acquisition of Tradition Primo within water and the divestiture of its S&D Tea and Coffee company and subsequent rebranding, it transitioned itself into a pure play water provider after struggling its tactical focus for several years. It has actually been at the crosshairs with activist Legion Partners and lastly reached an friendly option with a brand-new CEO and revamped board Our company believe the whole episode with the activist, focused outlook and development and success and continued strides that the business is making operationally bodes well in the long term. PRMW trades at a discount rate to its peers regardless of strong functional efficiency and economic crisis resistant company design. Start at Buy.

Revenues Outlook

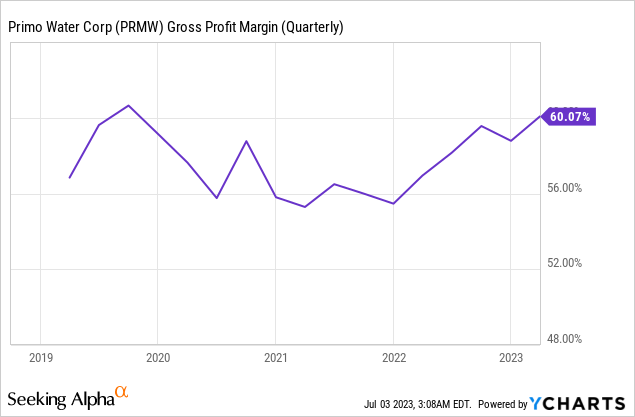

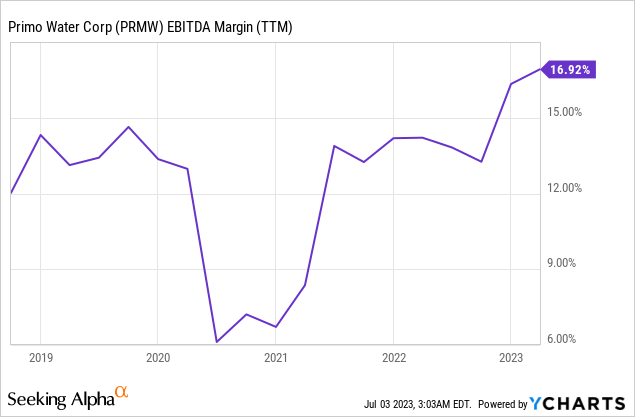

PRMW reported an outstanding Q1 with beat on both earnings and incomes. Earnings increased 4% YoY (consisting of -2% Fx impact) driven by 11% development in Water Direct and 21% development in Water Refill partly balanced out by exit from Russia and exit from single usage mineral water in the United States. It reported robust gross margins at 60.1% (up 300+ bps YoY), greatest considering that it started its change, driven by prices, and exit of low-margin single-use retail in The United States and Canada.

Changed EBITDA margin broadened 70 bps YoY to 17.4% as strong gains in gross margins were partly balanced out by deleverage in SG&A costs as an outcome of greater wage expenses in addition to raised freight costs.

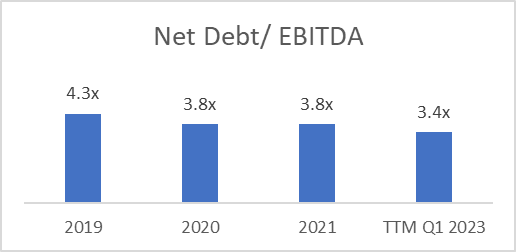

Balance sheet position continues to enhance with Net Financial obligation/ EBITDA under 3.5 x, no maturities up until 2028-2029 and money balance of ~$ 100 mn.

It assisted for Q2 earnings growing at 5% (at mid point) and restating FY23 guide of 5% earnings development and EBITDA margin at 19.8%. Our company believe the prices advantages would ease off as it laps harder compensations moving forward (10% prices development in 2H22 and 15% in Q2 2022) and would need to depend on volume development which our company believe would be attainable provided broadening of its unique Costco collaboration, increased frequency of cubicle programs and April pattern following Q1 patterns. Free Capital assistance stayed unfavorable mostly as an outcome of the $20 mn headwind in working capital, nevertheless, it stayed dedicated to returning money to investors having actually bought an extra $17 mn in stock (on top of $24 mn in 2022) with additional space for $59 mn in share purchases and raising its dividend by 14% to $0.08 with 2023E dividend projection at $0.32.

Why are we Bullish on the Stock?

Strong Operating Patterns

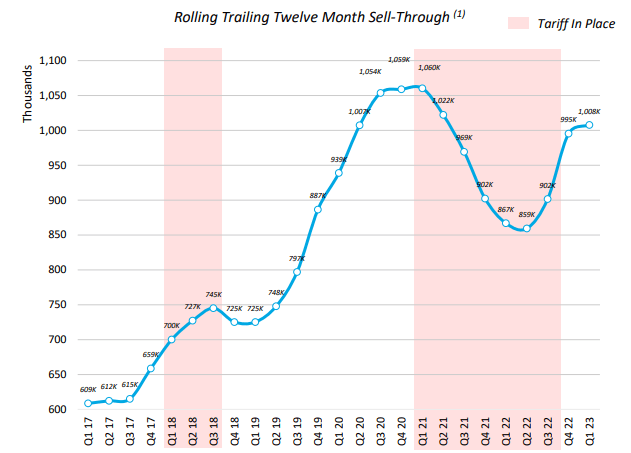

While the PRMW’s cost flexibility stays strong as evidenced by robust and broadening gross margins, it’s sell-through has actually revealed an ongoing uptrend on the back of digital efforts and collaboration with Costco which in turn causes an enhanced refill rate. Automatic path optimization has actually caused a boost in functional effectiveness within water exchange/ purification as an outcome of boost in shipment frequencies (213 systems/ path day-to-day vs 210 in Q1 2022)

Business Discussion

Digital Efforts

Its strong concentrate on digital efforts throughout the pandemic and beyond has actually led them to increase the digital penetration as % of overall sales from 27% in 2017 to over 44% presently. App is presently ranked 4.8+ on both Android and Apple play shops.

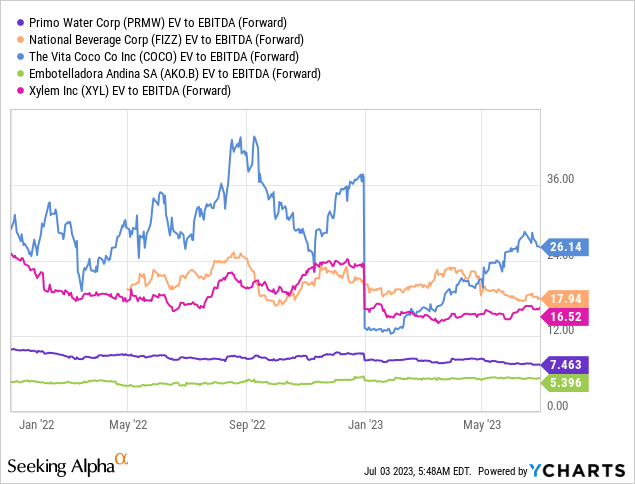

Evaluation

PRMW trades inexpensively at 7.5 x EV/ Fwd EBITDA compared to its peers and its historic average. Our company believe provided the strong operating performance history in addition to current enhancement in the efficiency would cause a several rerating.

Improving Take Advantage Of and Capital

PRMW’s financial obligation position has actually regularly enhanced with net take advantage of lowering from 4.3 x to 3.4 x in last 3 years with the objective to be under 3.0 x by 2023. Strong operating capital (regardless of a headwind of $20 mn in the year) together with worth accretive capital allotment in M&A and capex with a concentrate on lowering financial obligation and returning money to investors through dividends (2.5% dividend yield) and buybacks.

Business filings

Threats to Score

Threats to score consist of 1) Undesirable relocations in FX would drag down earnings and success, as seen throughout Q1 where unfavorable Fx motion caused slashing off 2% development in earnings 2) Substantial intake downturn as an outcome of macroeconomic difficulties would push gross margins as the PMRW would not be acting on cost boosts in the middle of a weakening belief and 3) Execution challenges as an outcome of lower clients per path and greater logistical expenses would squeeze the operating margins.

Conclusion

PRMW has actually changed itself into a pure play water company with strong functional efficiency driven by constant earnings development and broadening margins. With an enhanced monetary profile, activist ruckus in the rear view, assessment convenience as it trades at discount rate to its peers and long term average, 2.5% dividend yield, our company believe the danger benefit agrees with on the benefit. Start at Buy.