Matteo Colombo

Intro

It’s time to dive into Air Products and Chemicals ( NYSE: APD), among my preferred chemical business. This stock includes a good yield of 2.4%, 40 successive yearly dividend walkings, and a company design that permits financiers to take advantage of emerging patterns like hydrogen.

Particularly when it concerns hydrogen, I made a huge error by banking on a smaller sized development stock. That error taught me to stay with what works best: purchasing relied on business with fantastic organization designs and the capability to reward investors.

That’s where APD can be found in.

In this short article, I’ll upgrade my bull case and describe why it is among the very best chemical dividend stocks cash can purchase.

So, let’s get to it!

Wide-Moat Energy/Chemical Development

In January, I composed an short article covering Plug Power ( PLUG). I offered the stock a purchase score based upon the strong hydrogen need increase.

I was right on hydrogen, as the bull case keeps establishing well. I was incorrect about PLUG, which is presently 38% down given that I composed that short article.

That a person time I divert from my method, I get burned.

The important lesson I discovered was to stay with what works, which is purchasing top quality business. Even if the possible advantage may be restricted compared to some development stocks, lower dangers make the longer-term risk/reward a lot better.

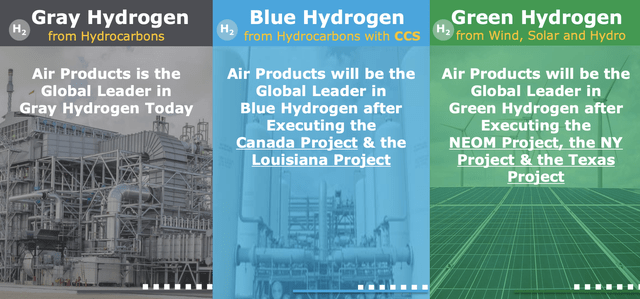

In the location of hydrogen, Air Products is a leader in the production and circulation of commercial applications. The business is actively associated with establishing tidy hydrogen jobs, consisting of blue and green hydrogen production techniques.

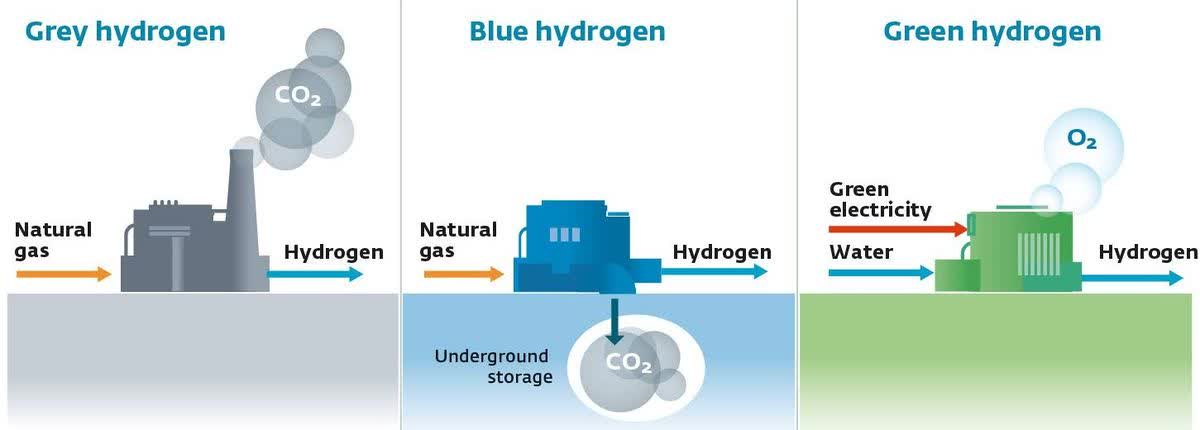

Energy Education

- Blue hydrogen includes catching and saving or using carbon emissions created throughout hydrogen production.

- Green hydrogen is produced utilizing renewable resource sources like wind or solar energy.

These tidy hydrogen efforts line up with worldwide efforts to shift to a low-carbon economy and lower dependence on nonrenewable fuel sources, which offers the business with a strong long-lasting tailwind.

The distinction compared to smaller sized development stocks is that APD is a recognized chemical gamer.

With a market cap of $66 billion, APD serves clients in different markets, consisting of refining, chemicals, metals, electronic devices, production, medical, and food. They likewise establish, engineer, construct, own, and run big commercial gas and carbon-capture jobs.

The business holds leading positions in development markets such as hydrogen, helium, and melted gas (” LNG”) procedure innovation and devices, turbomachinery, membrane systems, and cryogenic containers on an international scale.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Industrial Gases – Americas |

4,168 | 40.4 % | 5,369 | 42.3 % |

|

Commercial Gases – Asia |

2,921 | 28.3 % | 3,143 | 24.8 % |

|

Commercial Gases – Europe |

– | – | 3,086 | 24.3 % |

|

Business and Other |

279 | 2.7 % | 971 | 7.6 % |

|

Commercial Gases – Middle East and India |

– | – | 130 | 1.0 % |

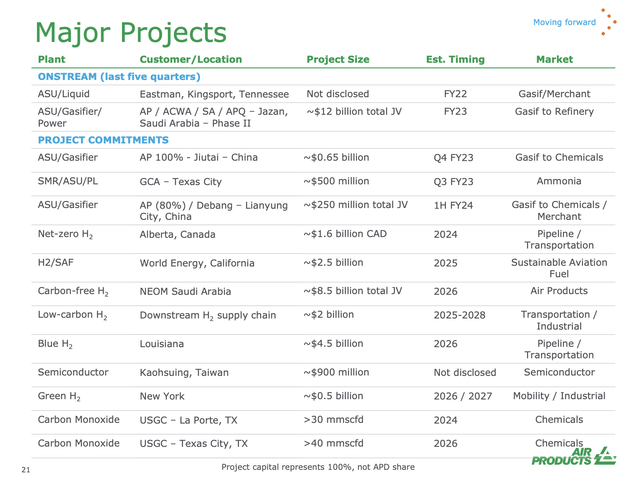

With regard to hydrogen, the business has a variety of significant jobs. For instance, the NEOM green hydrogen job, which was introduced 3 years earlier, taken advantage of renewable resource resources in the Middle East, and it utilizes ammonia as an efficient transportation medium for hydrogen.

Likewise, APD thinks that its Louisiana blue hydrogen job, revealed in 2021, shows its management in carbon capture and sequestration on the United States Gulf Coast.

Air Products stays positive in its first-mover benefit and thinks that its experience, knowledge, and exclusive possessions will protect its position as an international leader in tidy energy and tidy hydrogen advancement for several years to come.

While the business is certainly stating favorable aspects of its operations, I concur with them. APD is a wide-moat business with abilities that others can not take on – a minimum of not without considerable financial investments that are too huge for smaller sized gamers.

This brings me to the next part of this short article: capital costs and investor returns.

APD Shareholders Remain In A Fantastic Area

APD integrates 2 things:

- Investments in sustaining and growing its operations.

- Rewarding investors.

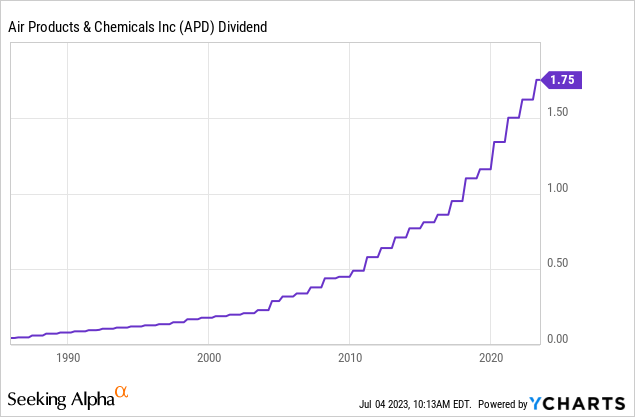

The business has actually treked its dividend for more than 40 successive years, that makes it a dividend aristocrat with less than 10 years till it can be crowned a dividend king.

APD shares presently yield 2.4% with a 5-year typical yearly dividend development rate of 10.5%. The most current walking was on January 26, when the business treked by 8%.

The very best thing is that dividends are sustainable on top of the business’s financial investments in development.

In its 2Q23 incomes call, the business kept in mind that it created considerable distributable capital. Over the previous 4 quarters, distributable capital was $3.2 billion, or more than $14 per share.

From this capital, Air Products paid over 45% and $1.4 billion as dividends to investors while keeping more than $1.7 billion for development financial investments.

The business thinks that its capability to produce capital, particularly in difficult conditions, shows the strength and stability of its organization, allowing the production of investor worth through increased dividends and capital implementation for high-return jobs. As I currently briefly stated, smaller sized business are not likely to be able to take on that.

The possible capital implementation through financial 2027 stayed steady at around $35 billion, consisting of money, extra financial obligation capability, and anticipated schedule by 2027.

Air Products thinks this capability is conservative, thinking about the capacity for extra EBITDA development, which would produce more capital and loaning capability.

Needless to state, handling the financial obligation balance to preserve the targeted A/A2 score stays a top priority. APD isn’t simply a dividend aristocrat, however it likewise has a credit score even less business can take on.

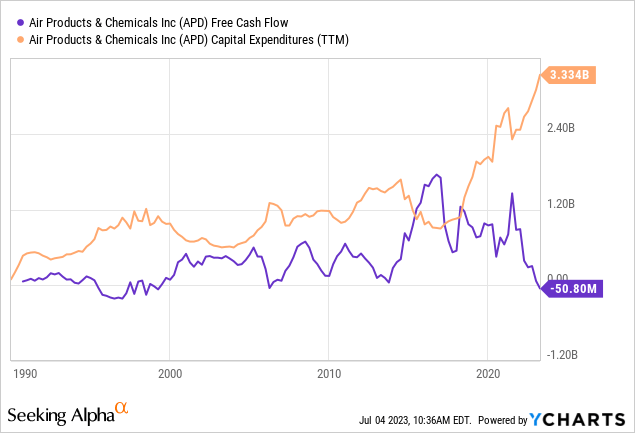

The stockpile of jobs, gotten used to show current advancements, stands at around $16 billion, supplying considerable development capacity. As the introduction listed below programs, the only reason that totally free capital is down is since of a velocity in capital investment. These have actually led to a greater stockpile, which will supply the business with speeding up totally free capital down the roadway.

With that stated, till a minimum of 2025, totally free capital will stay unfavorable. This suggests the business will utilize its balance sheet to support dividend development and financial investments. In 2025, the business is approximated to wind up with $11.9 billion in net financial obligation. That would be a substantial boost from $1.8 billion in 2021.

Nevertheless, this rise is anticipated to improve EBITDA from $3.9 billion to $5.2 billion throughout this duration.

In reality, both sales development and EBITDA development are anticipated to get meaningfully.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | |

| Net sales | 8,930 | 8,919 | 8,856 | 10,323 | 12,699 | 13,332 | 14,222 | 15,553 |

| EBITDA | 3,116 | 3,468 | 3,620 | 3,883 | 4,247 | 4,694 | 5,199 | 5,786 |

| YY Internet sales | -0.1% | -0.7% | 16.6% | 23.0% | 5.0% | 6.7% | 9.4% | |

| YY EBITDA | 11.3% | 4.4% | 7.3% | 9.4% | 10.5% | 10.8% | 11.3% |

Furthermore, $11.9 billion in net financial obligation would be simply 2.1 x EBITDA, which suggests the business stays in a wonderful area to prepare its organization for continual double-digit development on an extended basis.

So, what about the evaluation?

Appraisal

APD does not have favorable totally free capital for the time being. So, I’m not going to utilize totally free capital multiples – that would be meaningless.

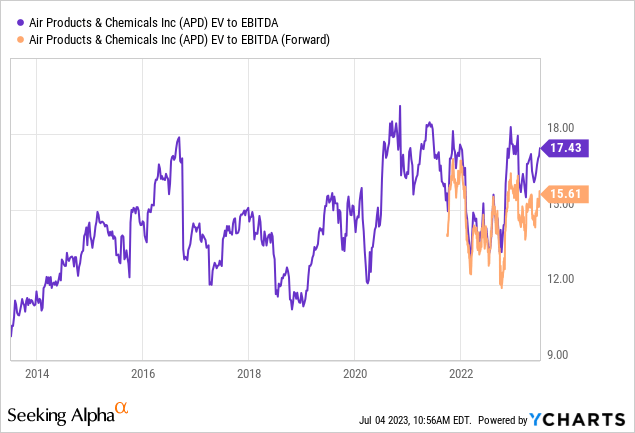

Utilizing 2024E EBITDA, the business is trading at a 12.8 x EV/EBITDA several. This estimation consists of approximately $600 million in minority interest.

That stated, taking a look at the LTM and NTM EBITDA multiples, we see that these numbers completely integrate the business’s anticipated EBITDA velocity.

12.8 x 2024E EBITDA is a bargain – nevertheless, as I’m utilizing 2024 numbers, it requires to be stated that some development has actually been priced in currently.

Based upon that context, APD is presently trading 10% listed below its all-time high after rallying 36% from its 52-week lows. The stock is down 4% year to date.

The agreement cost target is $328, which is 10% above the existing cost.

I believe that’s reasonable – and even a bit too low.

That stated, if I didn’t currently own a lot cyclical direct exposure, I would be on the hunt for an entry.

Provided the degeneration in (worldwide) financial development, I would be a purchaser on 10-15% corrections.

Takeaway

Air Products and Chemicals is a standout chemical business with a concentrate on hydrogen and a great performance history of investor returns.

As a recognized gamer in the market, APD is well-positioned to take advantage of the worldwide shift to a low-carbon economy. While smaller sized development stocks might provide appealing capacity, adhering to top quality business like APD shows to be a better financial investment method, using lower dangers and a much better long-lasting risk/reward.

APD’s wide-moat status, market management, and participation in tidy hydrogen jobs make it an engaging option. The business’s constant dividend development, dividend aristocrat status, and sustainable dividends along with financial investments in development show its dedication to investors.

Regardless of short-term unfavorable totally free capital, APD’s strong balance sheet and predicted EBITDA development set the phase for continual double-digit development.

Trading at a sensible 12.8 x EV/EBITDA several, the stock appears a bit underestimated. For possible financiers, a 10-15% correction might be an appealing entry point.