style-photography

I need to confess that I have actually been amazed by the sensational efficiency of The Trade Desk, Inc. ( NASDAQ: TTD) stock over the previous 6 months considering that my previous upgrade TTD has actually surpassed its interaction sector ( XLC) peers and the S&P 500 ( SPX) ( SPY) considerably considering that forming its bottom in early January 2023.

As such, TTD has actually not recalled after its sensational collapse to form its long-lasting lows from Might to July 2022. Additionally, CEO Jeff Green and his group have actually continued to show skeptics incorrect, with another amazing Q1 incomes release in Might. While the advertisement and media market gamers have actually stammered with macroeconomic unpredictabilities, The Trade Desk’s management in the programmatic advertisement area has actually coped extremely well.

Eager financiers ought to have obtained valuable commentary from management in Might, highlighting its varied earnings direct exposure throughout numerous verticals. The business worried that “ travel invest almost tripled in Q1″ while carrying out well in other locations such as “food and beverage, vehicle, and house and garden.” For that reason, it assisted to reduce weak points in the shopping and service verticals, which underperformed.

As such, The Trade Desk’s capability to publish earnings development of 21.4% in Q1 and directed for about 20% development in Q2 was outstanding. It showed the business’s clear management in the CTV programmatic area and its capability to take advantage of the nascent retail media area. The business likewise highlighted that it “provides an incremental market chance,” recommending another possibly financially rewarding development location.

Additionally, with the United States economy coping fairly well up until now, dip purchasers early this year most likely evaluated that The Trade Desk might handle much better than its peers, enabling it to acquire more share. New CFO Laura Schenkein emphasized that the business’s “disciplined” method has actually settled, enabling The Trade Desk to continue investing while its “peers are drawing back.” As such, the business plans to utilize its momentum to “persevere and grab [more] share.”

I am specific that my downgrade on TTD to Keep In January was method too early, as I ignored the competitiveness of the business’s platform. I was too cautious about whether The Trade Desk might make it through possibly weaker macroeconomic conditions in 2023 while trading at a much greater assessment than its peers.

Regardless Of, that does not always imply that financiers who missed its January lows ought to get on board now, as its assessment has actually risen even more and appears a lot more expensive.

At a forward EBITDA multiple of 47x, it’s method ahead of its media peers with a mean EBITDA multiple of simply 6.3 x. In addition, Looking for Alpha Quant ranked TTD with the worst possible assessment grade of “F,” recommending that financiers ought to work out care.

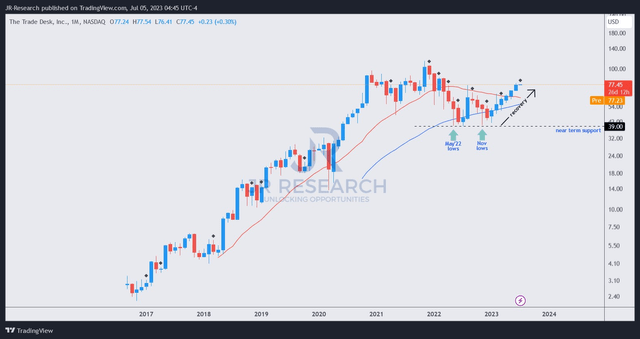

TTD cost chart (month-to-month) ( TradingView)

In Spite Of that, I did not observe a sell signal on TTD recommending long-lasting financiers think about taking profits/cutting direct exposure at the existing levels. While the amazing healing from its January lows has actually damaged just recently, TTD’s momentum might continue, as it assessment stays well listed below its miscalculated zones in late 2020.

In addition, the business is anticipated to continue acquiring running utilize through 2025. As such, based upon its FY25 EBITDA multiple of 29.5 x, the marketplace may not have actually completely shown its prospective development, marking down execution threats from macroeconomic unpredictabilities.

As such, I see TTD’s healing positively and think that financiers can think about profiting from its next pullback, as it has actually resumed its uptrend predisposition decisively.

Ranking: Hold (on the watch for a modification).

Crucial note: Financiers are advised to do their own due diligence and not count on the details supplied as monetary recommendations. The ranking is likewise not planned to time a particular entry/exit at the point of composing unless otherwise defined.

We Wished To Speak With You

Have extra commentary to enhance our thesis? Found a vital space in our thesis? Saw something essential that we didn’t? Concur or disagree? Remark listed below and let us understand why, and assist everybody in the neighborhood to find out much better!