Johnrob/iStock Unreleased by means of Getty Images

Financial Investment Thesis

I wished to have a look at Harley-Davidson’s ( NYSE: HOG) monetary efficiency in the past and see what sort of potential customers it might have in regards to income development for the next years because simply by rapidly taking a look at the business’s PE ratio, it appears to be inexpensive however exists a factor it is inexpensive? In my viewpoint, the development potential customers are not terrific therefore I believe that the PE ratio has to do with right where it ought to be, and I believe that HOG is a worth trap and there may be much better business to buy for the long-lasting.

Outlook

I think that financiers are not pricing the business greater due to the fact that, in the last years, efficiency income went no place. In FY13 the business reported $5.9 B in incomes, quick forward to FY22 and incomes stood at $5.75 B, so in the last ten years the business did not carry out well at all. Exists enough factor to think that this will alter moving forward? I was dissatisfied with how severely the electrical bikes are carrying out in general, and they look good. It appeared like the business is attempting to branch off and adjust to customers, nevertheless, it looks like the business is unable to catch any significant more youthful client base that is more ecologically mindful. It looks like today that the section of bikes is still extremely little and is not experiencing the surge in sales that the business anticipated.

However, the business has some lofty expectations for the LiveWire brand name, reaching stating they will have the ability to offer over 100k systems by 2026. That does sound excellent in theory; nevertheless, I do not see this taking place. For beginners, the bikes are not extremely inexpensive, and the business anticipates that the brand-new S2 Del Mar will be the hero due to the fact that it’ll have to do with $5,000 less expensive than the LiveWire One. The business likewise stated they anticipated to offer 7,000 systems of the brand-new bike, nevertheless, in the most current revenues call, the business stated they anticipate to offer 750-2000 systems, which is a lot less and an extremely large range.

In regards to the primary section that makes the basic Harleys, I do not believe there is much of a driver that will move incomes to brand-new highs in the next years The Hardwire tactical strategy sounds great in theory, nevertheless, in practice, it might be difficult to accomplish this. We can see that the business is not a development business and such low income development makes it extremely unsightly for normal financiers who are trying to find enjoyment.

Financials

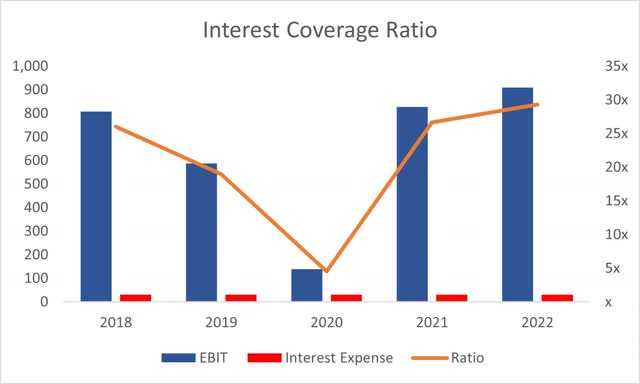

Since Q1 ’23, the business had $1.56 B in money versus $5.2 B in long-lasting financial obligation. The marketplace cap of HOG is around $5B. I would believe a great deal of financiers are not pleased with the quantity of take advantage of the business has and are keeping away from it, which adds to the stock rate going no place. I do not believe that need to be an issue when thinking about where to park your cash. Financial obligation is another tool that a business can utilize to grow, and if it can handle the yearly interest expenditure, then there is no issue in utilizing financial obligation. HOG’s interest protection ratio is extremely healthy, standing at around 29x, implying that running earnings or EBIT can cover yearly interest expenditure 29 times over. Financial obligation is not a concern in my viewpoint.

Interest Protection Ratio ( Author)

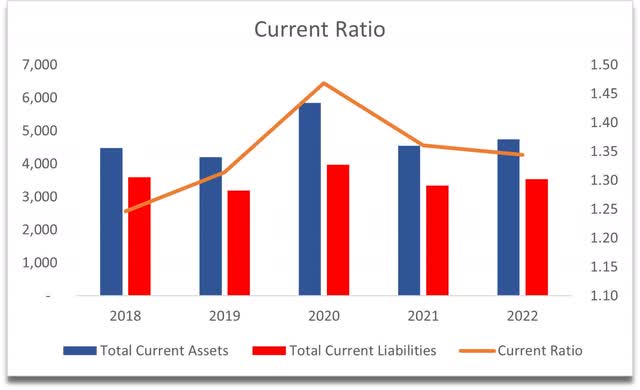

The operating capital ratio or the present ratio has actually been good over the last half a years a minimum of, standing at around 1.34 and keeping stable at this level. This indicates that the business can settle its short-term responsibilities without a concern and still has liquidity left over. On the liquidity side, I see no problems with the business at all.

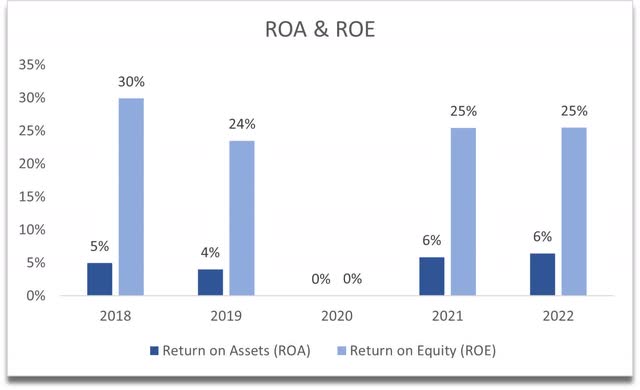

In regards to performance and success, I am likewise pleased with returns on possessions and equity. These numbers are above my minimum of 5% for ROA and 10% for ROE. This informs me that the management is doing a good task of using the business’s possessions and investor capital, which need to develop worth.

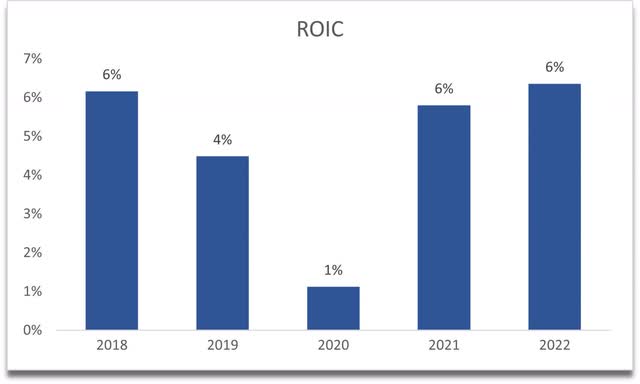

I am not, nevertheless, delighted about the business’s moat and competitive benefit. The business’s return on invested capital is not extremely outstanding in my viewpoint, recommending it has basically no one-upmanship and no moat. I want to see a minimum of 10% here.

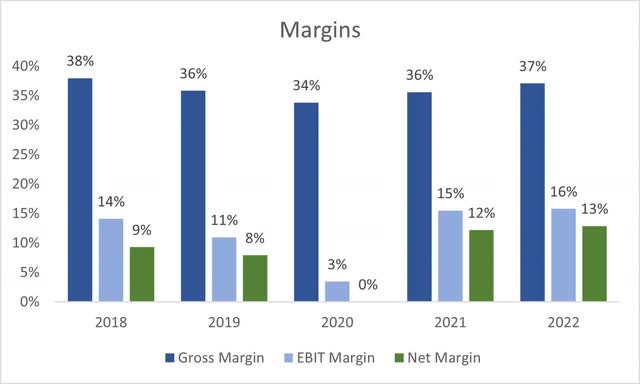

In regards to margins, the business has actually enhanced these from the previous year and are rather good in my viewpoint. The Hardwire technique plan intends to enhance these even more, however just time will inform if the strategy exercises.

It appears like the business has actually been running with these sorts of metrics for rather a long time now and it is difficult to get delighted about them. I wish to see an uptrend in the above metrics continue and reach brand-new highs. Today, I sense that the exact same numbers will continue moving forward which is simply not amazing.

Assessment

It’s difficult to presume greater income development than the business had actually formerly accomplished. Sure, I can see that the business may reach the 4% -7% income development in ’23, I’m simply uncertain if it can sustain it, considered that in the last years, the business lost income

For the base case income presumptions, I opted for a 2% CAGR for the next years, which will bring incomes to $7B by ’32 from $5.7 B in FY22. This is still a much better efficiency than the business’s last years.

For the positive case, I opted for about 6% CAGR, while for the conservative case, I opted for 0% development over the next years, which is extremely possible too.

In regards to margins, I presume that the business will handle to enhance margins extremely a little over the next ten years and net margins will enhance from around 13% in FY22 to 14%. I require to see more quarters of margin enhancements to presume much better performance and success moving forward, so I’ll adhere to this conservative quote.

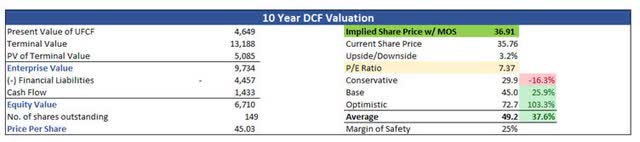

To offer myself some space for mistake, I will include a 25% margin of security to the intrinsic worth estimation. It looks like the business is valued relatively today due to the fact that the intrinsic worth estimation provides me an implied share rate of around $36.91.

Closing Remarks

It is difficult to advise buying the business today, specifically considering that the LiveWire electrical bikes are not offering extremely well. With the income development that I presumed above, the business deserves what it trades at today, and it might remain at these levels longer if its efforts fail. Over the last years, incomes went no place while the share rate is down 36%. I am rooting for this old-timer business to be successful, and I am pleased the people are innovating still, nevertheless, if the business can not accomplish much better lead to the future, there are numerous much better business out there that will reward its investors handsomely.

I will rest on the sidelines and will await the approaching revenues call to see how well the electrical bikes are carrying out. My guess is not well. The business might look inexpensive, however it can be a worth trap in the long run in my viewpoint.