tupungato

Worth investing is a difficult service due to the fact that top quality business seldom trade at a discount rate. Nevertheless, particular aspects and market conditions periodically develop engaging chances for creating alpha. And market belief is among the aspects that we have actually consistently made use of to effectively determine worth for many years.

Here at Stratos Capital Partners, we look for business that are trading at depressed assessments due to the fact that they have actually been neglected or done not like by financiers for numerous factors. We then check out those factors thoroughly and objectively to evaluate if market belief sufficiently validates the depressed evaluation on that stock.

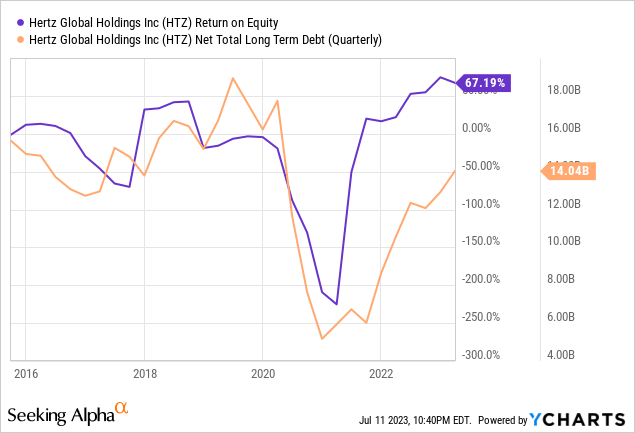

Sometimes, we reveal business like Hertz Global Holdings Inc. ( NASDAQ: HTZ), which trades at simply 7.6 x forward P/E and 2.0 x P/B at the time of composing, however has actually provided an excellent ROE of 67% in Q1 2023 and pre-pandemic ROEs of above 30% (Q4 2017 – Q1 2018).

TradingView.com, Stratos Capital Partners

Additionally, this enhancement in ROE wasn’t accompanied by increased leveraged. As the accompanying chart programs, overall net financial obligation levels have just just recently went back to pre-pandemic levels.

We have actually consistently pointed out pre-pandemic figures when comparing the current efficiency of HTZ for excellent factors. Not just do we anticipate HTZ’s cars and truck leasing service to continue to recuperate in the next 12 to 18 months, however we believe current cost-cutting steps and enhanced functional performances following the restructuring of business will sustain success and high ROEs in the coming years.

Why Financiers Are Overlooking HTZ

HTZ, which owns other brand names such as Thrifty and Dollar, was among the significant business that declared Chapter 11 personal bankruptcy defense in Might 2020 after missing out on payments for a lease for an international fleet of around 660,000 automobiles. Numerous experts would recommend that HTZ’s personal bankruptcy was a repercussion of numerous factors consisting of being greatly indebted, functional ineffectiveness, bad execution of method by management, and even having the incorrect method to start with.

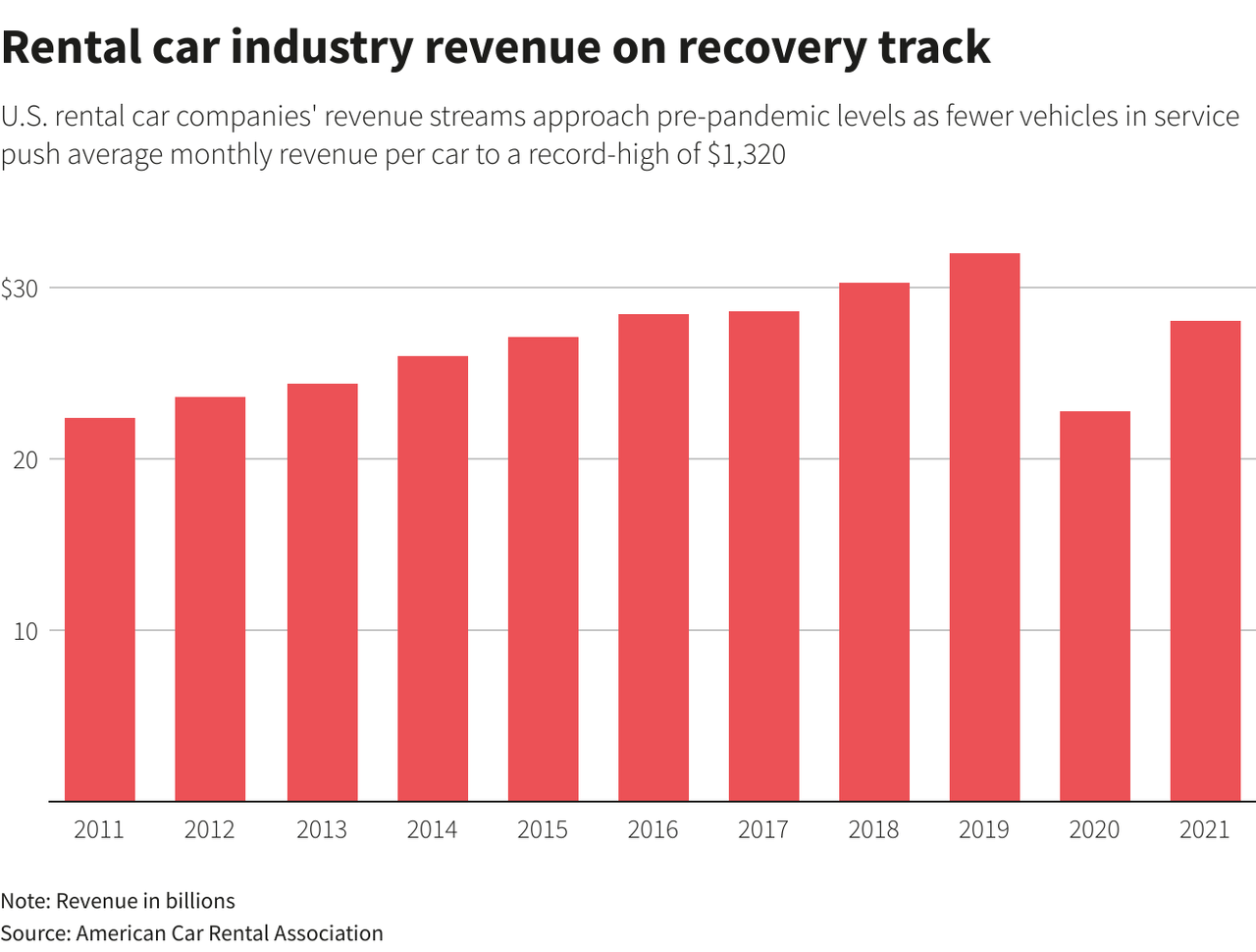

Nevertheless, none can neglect the destructive situations that were produced by the Covid pandemic. Within simply a matter of months, international travel and tourist were stopped, and companies and home entertainment places were likewise shuttered. As the accompanying chart programs, the earnings of U.S. rental cars and truck business plunged by around 20% -25%.

Reuters, American Vehicle Rental Association

International rental cars and truck business in fact fared much even worse considered that the U.S. was less eager to lock down cities throughout the pandemic compared to numerous other European nations.

From a belief viewpoint, it makes good sense that financiers slowly disliked HTZ’s healing as the pandemic dragged out. When HTZ ultimately declared personal bankruptcy, the majority of financiers had actually currently quit on the business.

However should financiers continue to avert?

Restructuring & & Renewal Of HTZ

Basically, HTZ’s international rental cars and truck service is quite uncomplicated and easy to comprehend.

To start with, leisure and service leasings comprise the lion’s share of earnings, with replacement cars and trucks and other short-term usage cases comprising an approximated share of simply 10-15% of the overall. Hence, the efficiency and success of HTZ’s service are totally connected to the international travel and tourist volumes, which HTZ have actually restricted control over.

Second of all, optimising fleet usage is the other piece of the puzzle that figures out HTZ’s functional performance and success. Preferably, management desires fleet usage to be as high as possible without compromising client complete satisfaction, developing supply traffic jams, and lost sales. Standing out at fleet optimization most likely needs a mix of insight, expert need forecasting and preparation, along with active management.

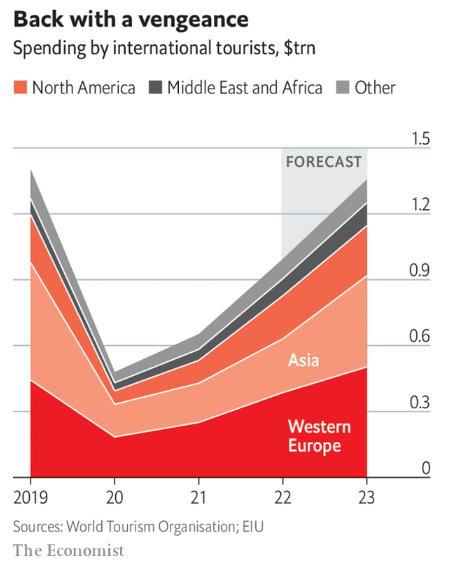

As the international economy continues to recuperate from the pandemic, suppressed need for leisure and service travel must continue to drive healthy volumes for the cars and truck rental service. Appropriately, we anticipate HTZ to provide a constant enhancement in profits over the next 12 to 18 months. Considered that international travel and tourist volumes have yet to completely recuperate to pre-pandemic levels, we see space for continual profits development in the medium term.

The Economic Expert, World Tourist Organisation, EIU

Had HTZ endured and prevented personal bankruptcy in 2020, one may believe that the stock would have rebounded and meaningfully outshined the wider S&P 500 Index ( SPX). On the contrary, we believe the restructuring and renewal of HTZ caused by its personal bankruptcy will ultimately show to be a much better long-lasting result for the stock.

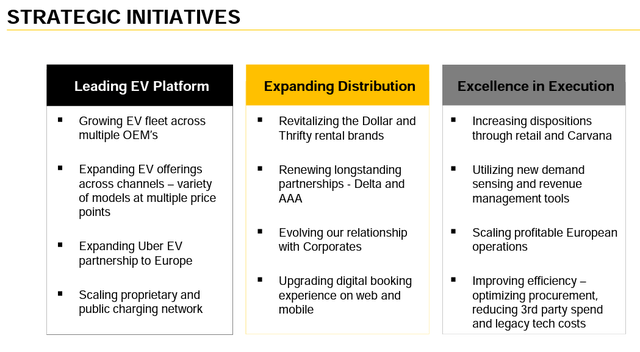

Not just is HTZ a much leaner and more operationally effective business after cost-cutting steps and task cuts, however the fresh management at Hertz will likewise be under pressure to carry out. Which is constantly an advantage for investors. A few of the brand-new tactical efforts focused on enhancing fleet usage, enhancing functional performances, and improving the brand name appear well lined up to completely profit from the international travel and tourist healing in our view.

Hertz Q1 2023 Incomes Discussion

In Conclusion

We see HTZ’s depressed assessments as an engaging chance for financiers seeking to profit from the international travel and tourist rebound.

Not just do we anticipate HTZ’s cars and truck leasing service to continue to recuperate in the next 12 to 18 months, however we believe current cost-cutting steps and enhanced functional performances following the restructuring of business will sustain success and high ROEs in the coming years.

We start our protection of HTZ with a “Strong Buy” score.