CJNattanai/iStock through Getty Images

Korea Fund Chance Summary

The Korea Fund ( NYSE: KF) is among the very best lorries to think about if you wish to acquire direct exposure to South Korea’s stock exchange. July is a great time to continue building up shares, as the discount rate is near a historic low.

The primary threat to think about is that South Korea’s economy might deal with several headwinds this year, as exports have actually been decreasing substantially up until now. Development will likely be dull in 2023 and 2024.

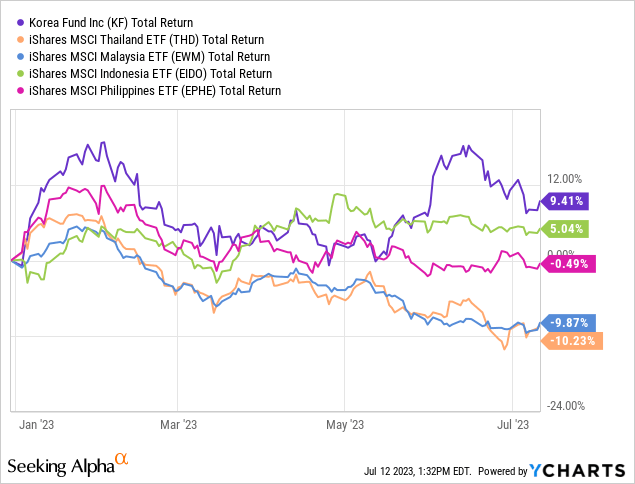

Nevertheless, the equity market is likely due for a rerating from financiers, as South Korea still trades at a discount rate to some smaller sized Asian emerging markets.

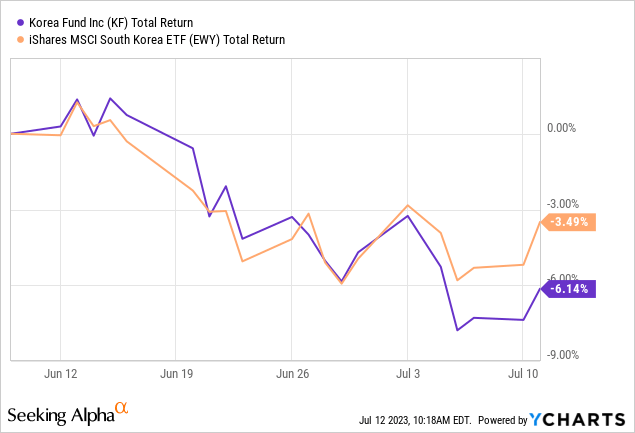

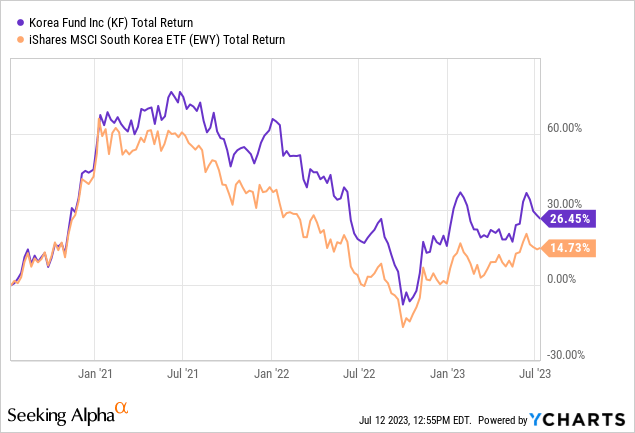

This fund has actually underperformed the iShares MSCI South Korea ETF ( EWY) in the previous month. Nevertheless, the Korea Fund can be a much better automobile throughout booming market, as it exceeded this ETF by over 10 portion points in the previous 3 years.

Benefiting From the Discount Rate

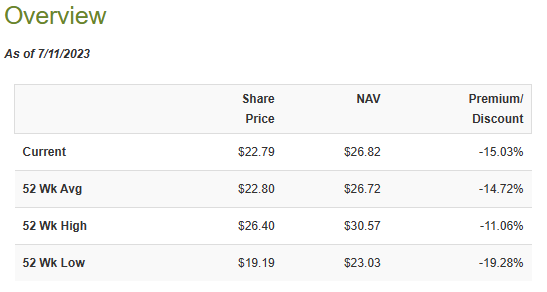

The discount rate of the Korea Fund is still appealing on a historic basis. This fund presently trades at a 15% discount rate to NAV, compared to its 52-week low discount rate of 11.06%.

CEF Link

I likewise formerly kept in mind how this discount rate was reasonably significan t, as other closed end funds generally trade at around a 10% discount rate to NAV.

As you can see, this ETF tends to surpass other ETFs throughout booming market, although it often experiences more powerful drawdowns when the marketplace fixes. As belief recuperates in South Korea and emerging Asian markets, I believe this fund might trade at a 10% discount rate to NAV.

Not So Emerging

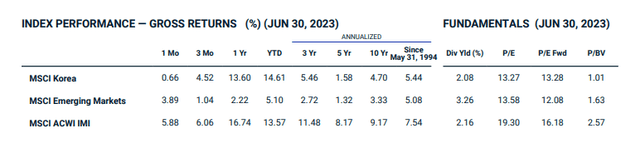

South Korea’s evaluation has actually increased significantly (at around 11x PE in my last protection) because I last covered this fund, yet its evaluation is still in line with MSCI Emerging markets. Other markets like Thailand and Malaysia trade at 16-20x incomes, despite the fact that both nations have smaller sized capital markets and less industrialized economies.

MSCI

South Korea’s economy and capital markets lead other emerging markets in lots of elements. Nevertheless, South Korea still maintained its emerging market classificatio n throughout MSCI’s current semi-annual evaluation.

|

Nation |

Stock Exchange Capitalization |

|

Thailand |

$ 549 billion |

|

Malaysia |

$ 361.7 billion |

|

Indonesia |

$ 663.0 billion |

|

South Korea |

$ 1.9 trillion |

|

Taiwan |

$ 1.6 trillion |

Source: Bloomberg/CEIC/various

Among the primary aspects holding it back from an upgrade include its choice to prohibit the brief selling of specific stocks. South Korea remains in good condition concerning other requirements, such as market size/liquidity and financial advancement.

A current Financial expert short article kept in mind that South Korea is the world’s 12th biggest economy, and the typical income is $35,000, on par with nations like Italy. Additionally, the IMF has actually categorized it as an industrialized nation because 1997.

I maintain the view that South Korean equities ought to trade at a small premium to MSCI Emerging Markets. An upgrade to established market status would be the last piece for a complete upgrade and greater evaluation.

Export Decrease Presses Nation Near an Economic Downturn

South Korean equities are magnificently valued from a relative worth viewpoint, however macro headwinds this year might lead to short-term pullbacks. Favorable points for the economy consist of China’s financial rebound previously this year, and the truth that South Korea has strong direct exposure to Asia and reasonably low direct exposure to Europe.

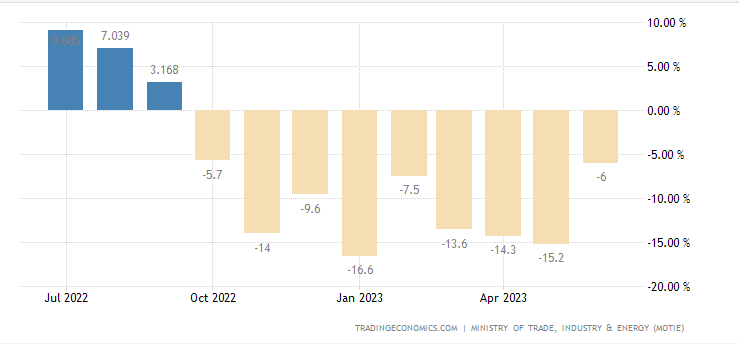

South Korea’s economy just broadened by 0.3% in Q1 2023, following a contraction of -0.4% in the previous quarter. Although South Korea’s exports grew by over 6% in 2022, export development has actually come under pressure in current months.

South Korea’s exports have actually decreased for 9 successive months. Export development might be reasonably flat this year, and it might not be till 2024 till its export development completely recuperates.

South Korea Export Development

Trading Economics

The Majority Of South Korea’s leading trade locations consist of local peers, and it has extremely little direct exposure to Europe’s economy. Vietnam was South Korea’s biggest importer in 2023 Its leading 2 export locations generally consist of the United States and China, and it mainly exports electronic devices.

South Korea’s economy had the ability to evade an economic downturn this quarter, and development will likely be around 1-2% this year. Its Reserve bank has actually effectively reduced inflation to listed below 3% and will not likely need to trek rates this year.

Outlook

Many nations in this area, consisting of Taiwan, will likely deal with slower development this year due to weaker international need for electronic devices and other items these nations export to. For that reason, there will likely be lots of chances later on this year to build up.

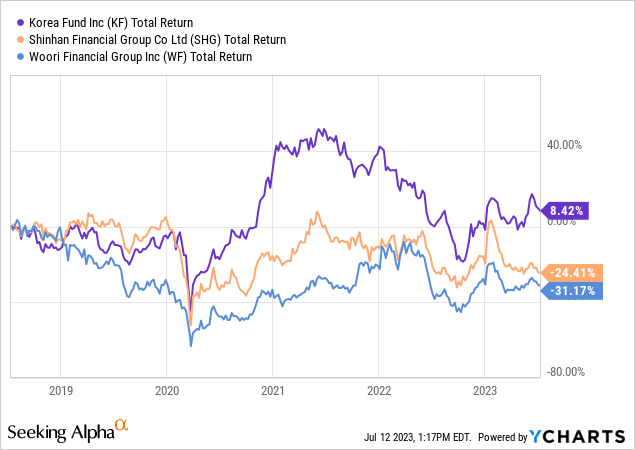

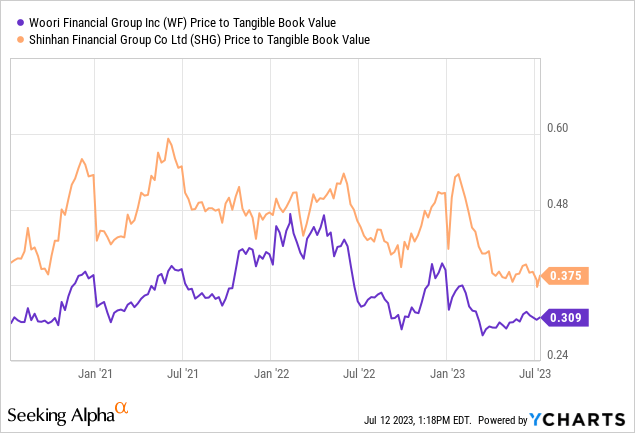

The Korea Fund is a remarkable automobile, as you can access a few of the bigger tech and customer stocks at a discount rate. There is likewise deep worth in other parts of South Korea’s economy, primarily in its banking sector. South Korea likewise prepares to open its banking sector for the very first time in thirty years, permitting brand-new domestic entrants to more quickly go into the market.

South Korean banks have actually underperformed in the long run however are magnificently valued at the minute.

I will likely build up a mix of South Korean banks and this closed end fund in H2 2023. Economic downturn worries are most likely overemphasized, and South Korea has a reasonably exceptional export structure. The international electronic devices has strong development capacity in the long run, and a rebound might assist South Korea’s economy recuperate in 2024.

South Korea’s stock exchange has actually been durable this year, regardless of damaging exports, and the marketplace trades at a discount rate to all of these emerging markets. South Korea likely has space to surpass other markets in the long run if the marketplace starts to trade at a premium to MSCI Emerging Markets.

Till this evaluation space closes, I will continue to choose South Korea over other Asian emerging markets.

Another driver would be the prospective rerating of South Korea’s stock exchange in 2024 or later on. I am monitoring this in case any modifications are made in the market that MSCI notifications in 2024 evaluations.