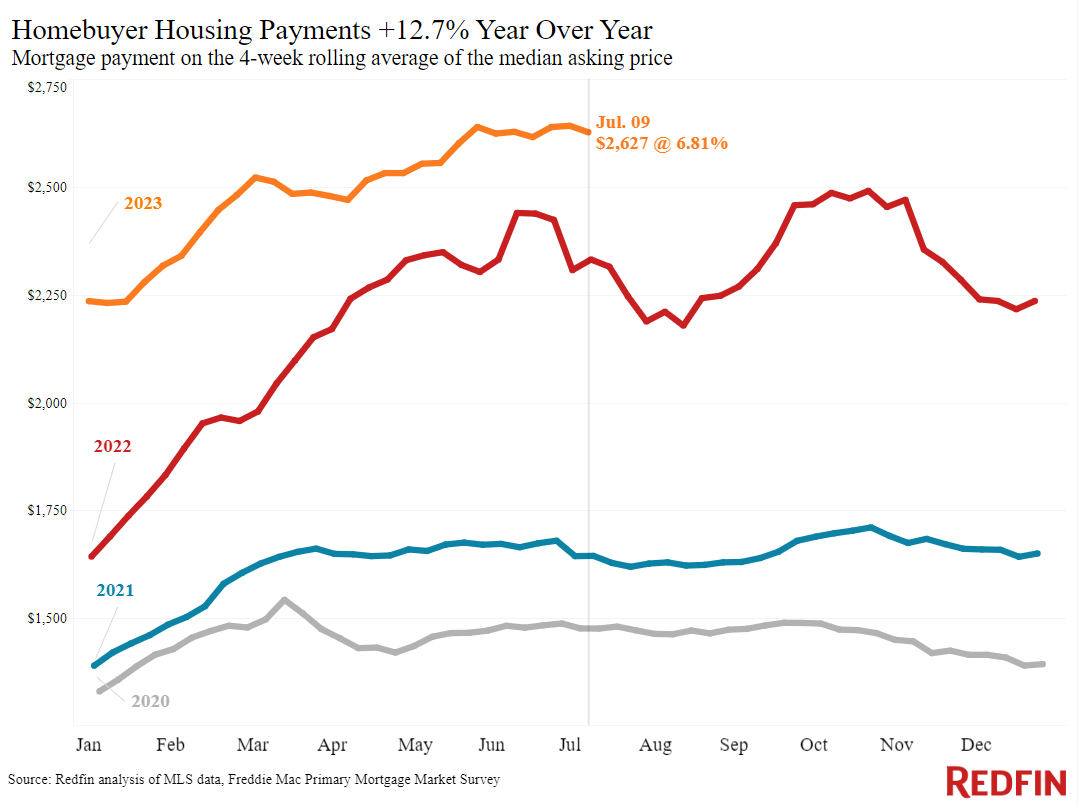

Raised home loan rates are cutting into property buyers’ spending plans; a purchaser on a $3,000 regular monthly real estate spending plan has actually lost $30,000 in buying power over the last 5 months. However today’s inflation report– which reveals that customer rates are cooling rapidly– supplies a twinkle of hope that home loan rates might slowly begin to come down.

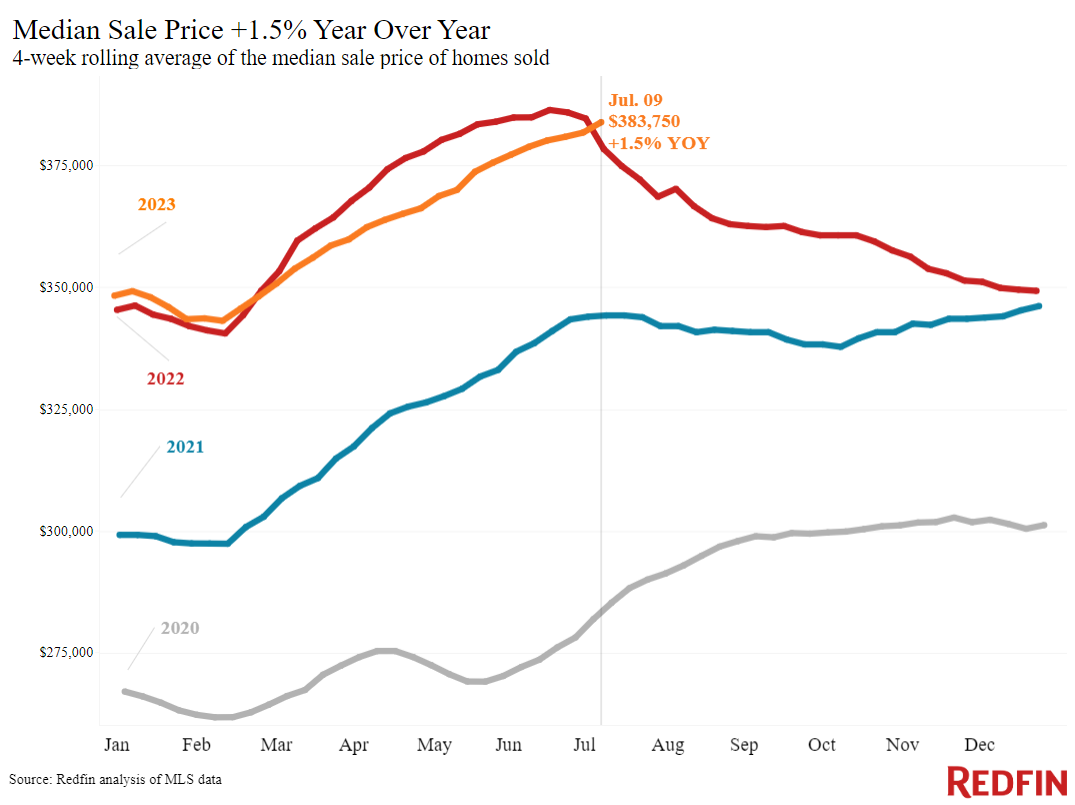

The mean U.S. home-sale rate increased 1.5% from a year previously throughout the 4 weeks ending July 9, the very first boost in almost 5 months. Typical weekly home loan rates are at their greatest level considering that November 2022, bringing the common property buyer’s regular monthly payment to a near-record-high of $2,627.

To take a look at the hit on cost another method, a property buyer on a $3,000 regular monthly spending plan can pay for a $450,000 house with today’s typical rate. That purchaser has actually lost $30,000 in buying power considering that February, when they might have purchased a $480,000 house with that month’s typical rate of around 6%. The drop is more severe when compared to a year back, when a $3,000 regular monthly spending plan would have purchased a $510,000 house at a rate of about 5.3%.

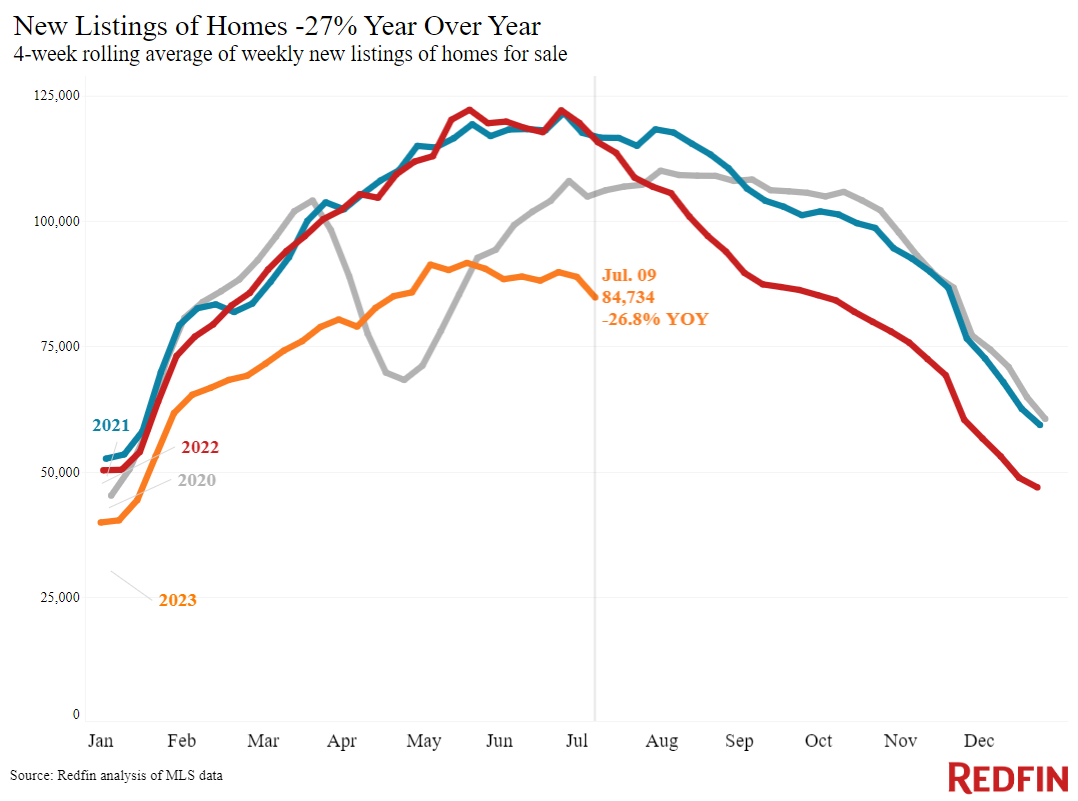

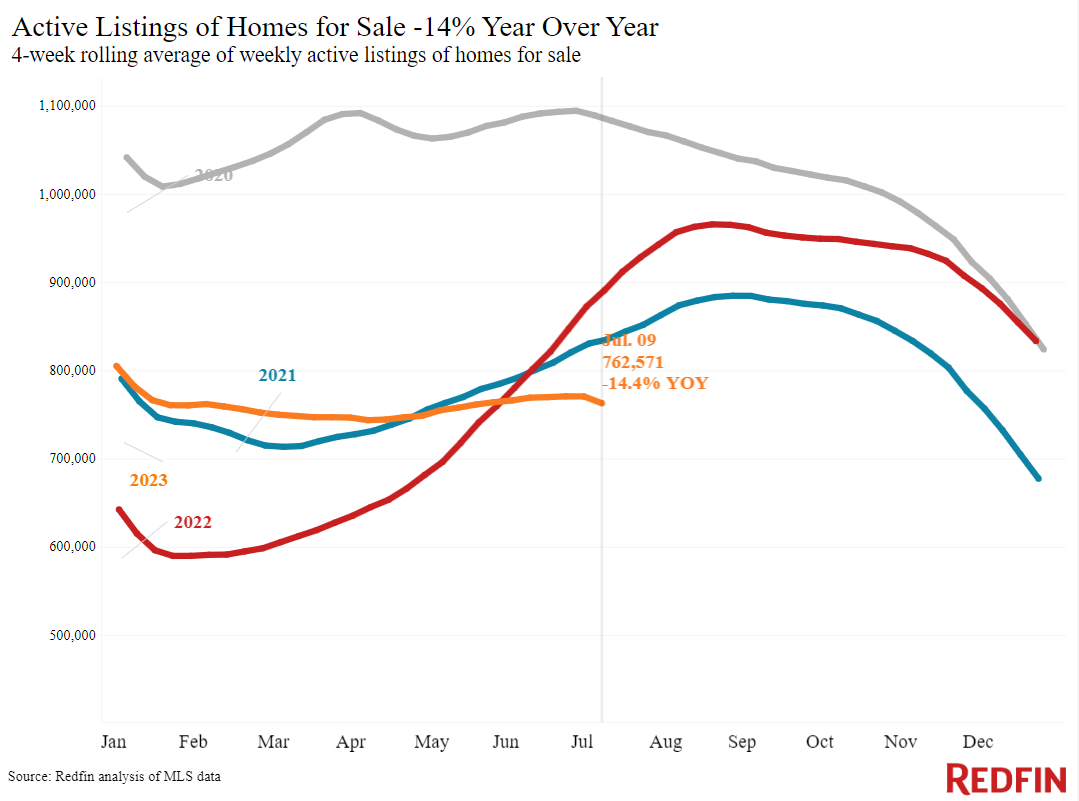

Costs are increasing in spite of reasonably low need since there are so couple of houses for sale. New listings are down 27% year over year, the most significant drop considering that the start of the pandemic, and the overall variety of houses on the marketplace is down 14%, the most significant drop considering that March 2022. That’s mainly since possible sellers are secured by low rates; almost all property owners have a rate listed below 6%.

On the intense side, today’s financial news supplies a twinkle of wish for the real estate market. The most recent consumer-price index report reveals that inflation cooled more than anticipated in June, mostly since it has actually begun showing months of cooling real estate expenses.

” This month’s inflation report is most likely to bring home loan rates down a bit from their current highs. It reveals that the Fed’s interest-rate walkings are working and ups the opportunity they’ll just trek rates one more time this year,” stated Redfin Economic Research study Lead Chen Zhao “Due to the fact that raised home loan rates are accountable for both these days’s significant homebuying difficulties– high regular monthly real estate payments and low stock– any decrease is welcome news for purchasers. However although rates will boil down somewhat, they’ll likely stay well above 6% till the Fed sees numerous more months of inflation readings better to their target.”

Leading signs of homebuying activity:

- The everyday average 30-year set home loan rate was 6.96% on July 12, below a half-year high of 7.22% a week previously. For the week ending July 6, the typical 30-year set home loan rate was 6.81%, the greatest level considering that November.

- Mortgage-purchase applications throughout the week ending July 7 increased 2% from a week previously, seasonally changed. Purchase applications were down 26% from a year previously.

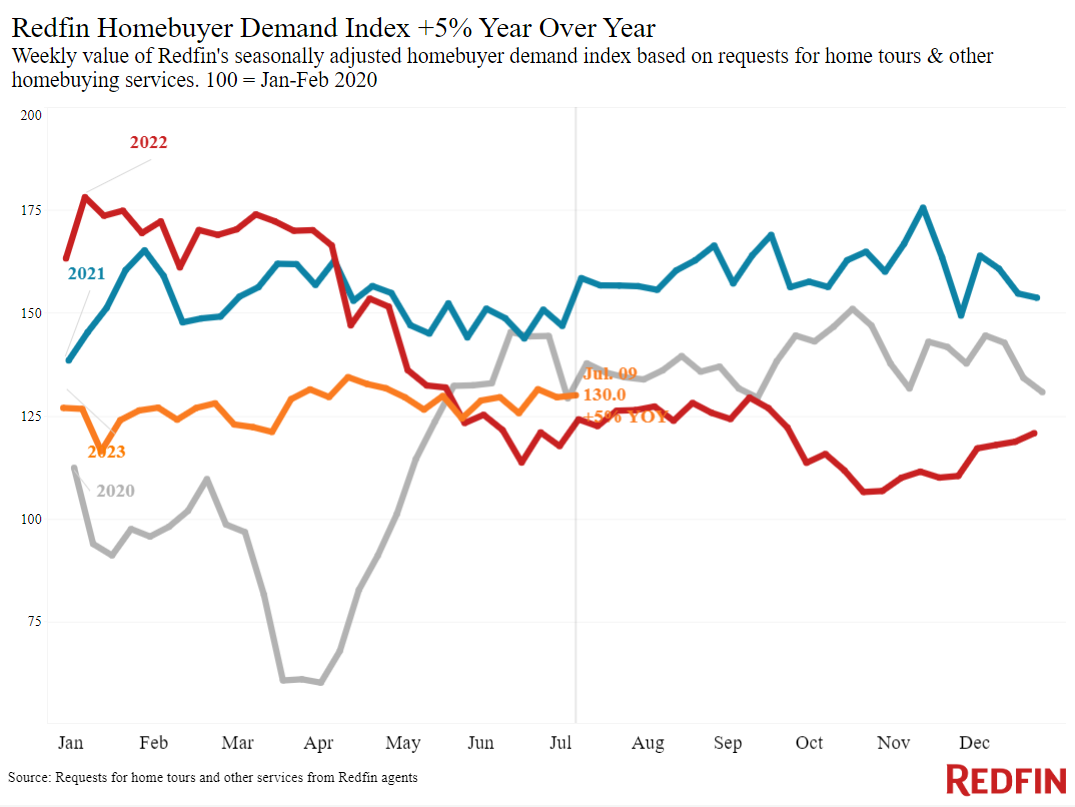

- The seasonally changed Redfin Property buyer Need Index– a step of ask for house trips and other homebuying services from Redfin representatives– was basically flat from the week previously and near its greatest level considering that May 2022 throughout the week ending July 9. It was up 5% from a year previously, the seventh successive yearly boost. Need was dropping at this time in 2022 as home loan rates changed.

- Google look for “ houses for sale” were up basically flat from a month previously throughout the week ending July 8, and down about 15% from a year previously.

- Exploring activity since July 9 was up 4% from the start of the year, compared to a 10% decline at the very same time in 2015, according to house trip innovation business ShowingTime Trips increased gradually throughout this time in 2015 as home loan rates soared.

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending July 9 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

For bullets that consist of metro-level breakdowns, Redfin examined the 50 most populated U.S. cities. Select cities might be left out from time to time to make sure information precision.

- The mean house price was $383,750, up 1.5% from a year previously. That’s the very first year-over-year boost considering that February, and simply $2,500 shy of the record high hit in June 2022.

- Price increased most in Milwaukee (13.5% YoY), Providence, RI (9.2%), Miami (7.8%), Cincinnati (6.7%) and Newark, NJ (6.7%).

- Home-sale rates decreased in 19 cities, with the most significant drops in Austin, TX (-9% YoY), Detroit (-7.4%), Las Vegas (-6%), Phoenix (-5.5%) and Fort Worth, TX (-5.3%).

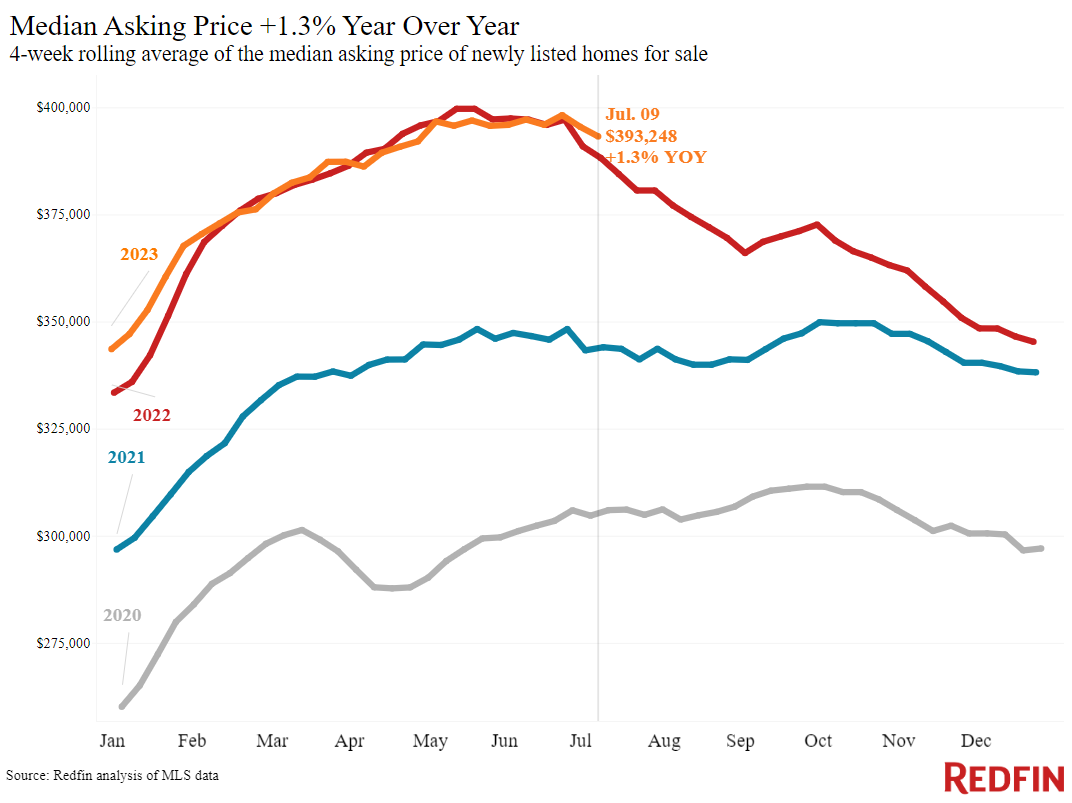

- The mean asking rate of recently noted houses was $393,248, up 1.3% from a year previously. Asking rates have actually been increasing for a month.

- The regular monthly home loan payment on the median-asking-price house was $2,627 at a 6.81% home loan rate, the average for the week ending July 6. That’s on par with the record high struck a week previously, and up 13% ($ 305) from a year previously.

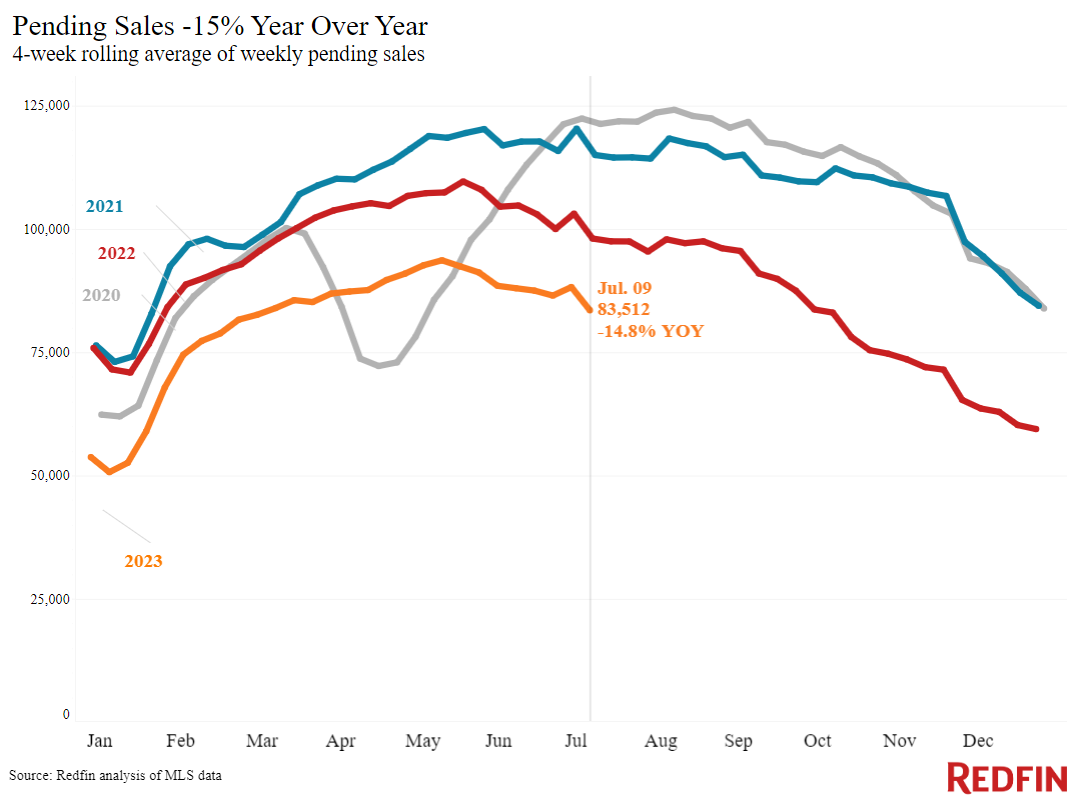

- Pending house sales were down 14.8% year over year, continuing a year-plus streak of double-digit decreases.

- Pending house sales fell in all however among the cities Redfin examined. They decreased most in Cleveland (-34.9% YoY), Newark, NJ (-24.8%), Warren, MI (-24.1%), Milwaukee (-23%) and Cincinnati (-22.5%). They increased 4.6% in Austin.

- New listings of houses for sale fell 26.8% year over year, the most significant decrease considering that May 2020.

- New listings decreased in all cities Redfin examined. They fell most in Las Vegas (-49% YoY), Phoenix (-41.6%), Cleveland (-39.8%), Providence, RI (-39.1%) and Newark, NJ (-36.9%).

- Active listings (the variety of houses noted for sale at any point throughout the duration) dropped 14.4% from a year previously, the most significant drop considering that March 2022. Active listings were down somewhat from a month previously; generally, they publish month-over-month boosts at this time of year.

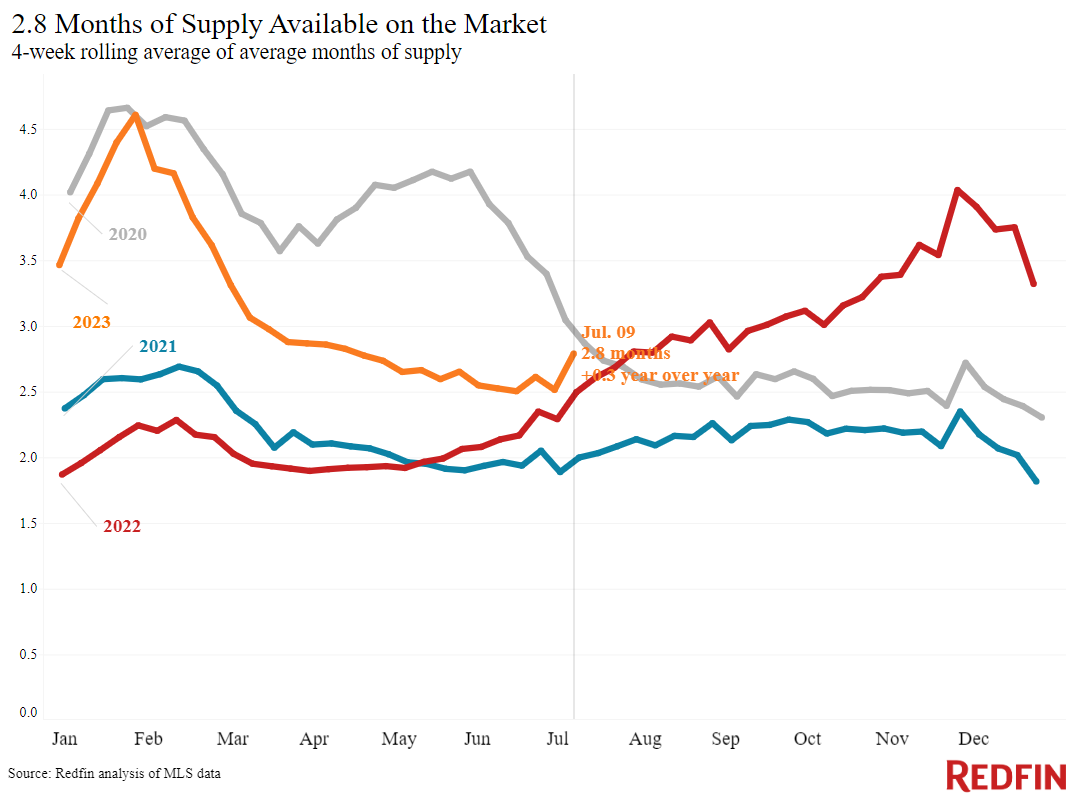

- Months of supply– a step of the balance in between supply and need, computed by the variety of months it would consider the existing stock to cost the existing sales rate– was 2.8 months, the greatest level in almost 3 months. 4 to 5 months of supply is thought about well balanced, with a lower number showing seller’s market conditions.

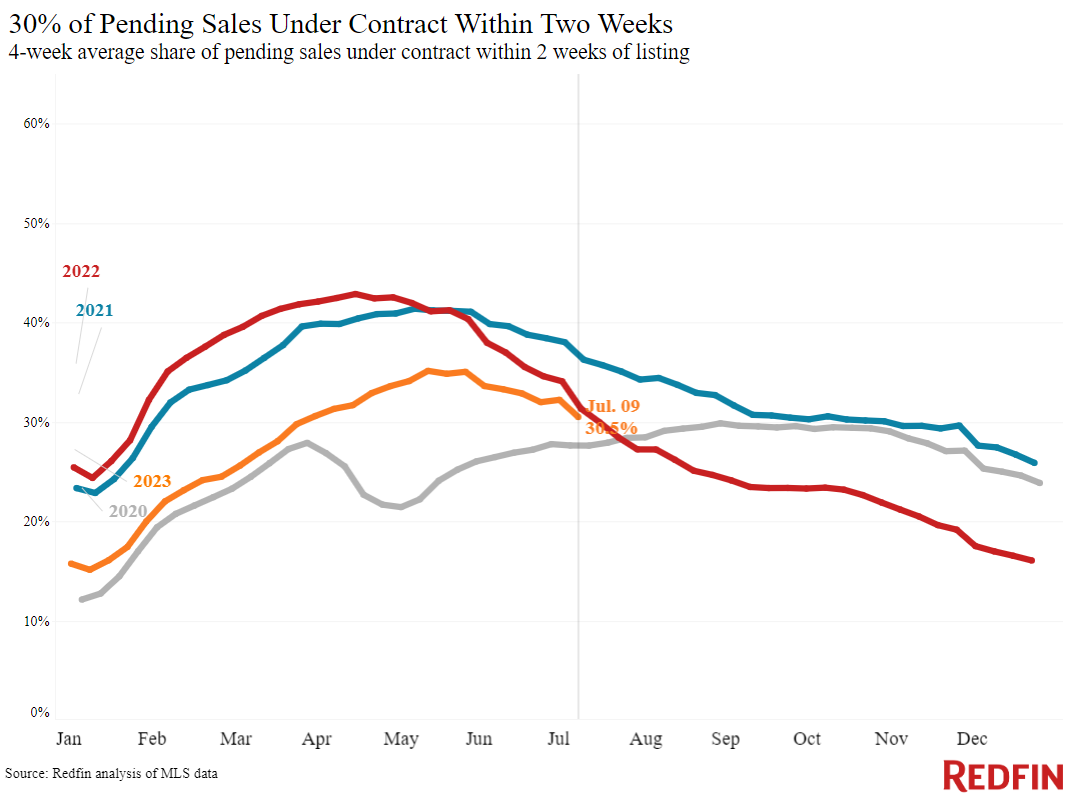

- 30.5% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, on par with the share a year previously.

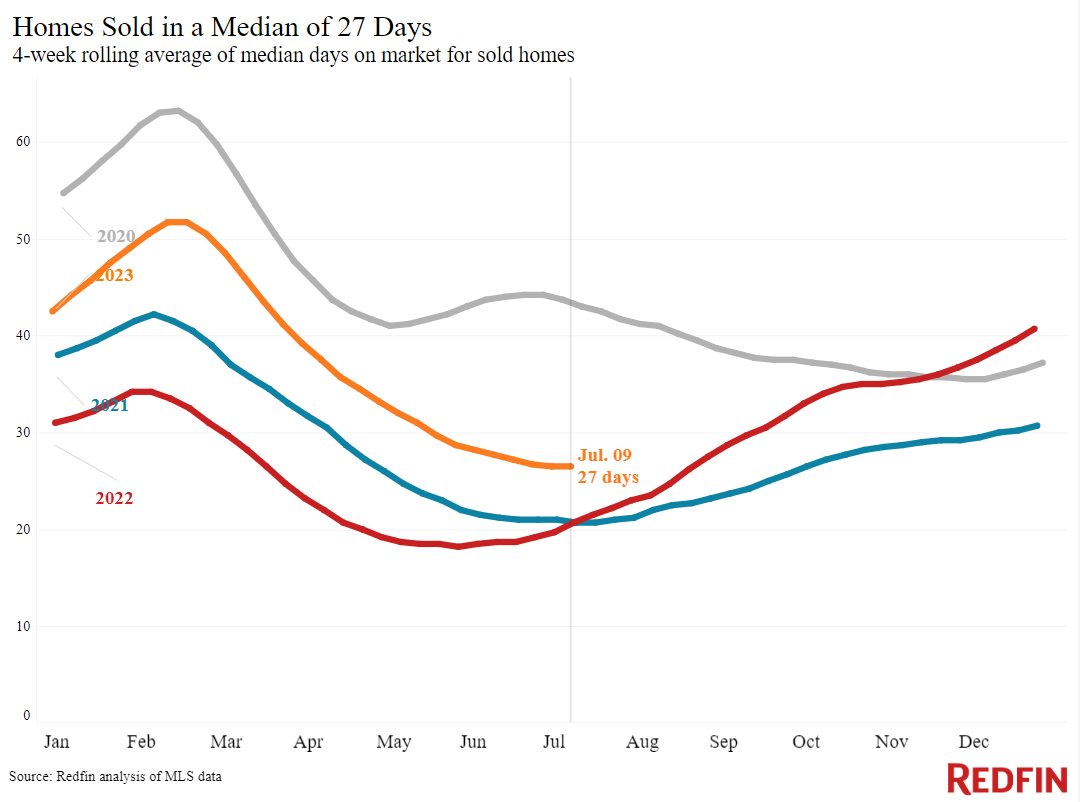

- Residences that offered were on the marketplace for an average of 27 days, the quickest period in 10 months. That’s up from 21 days a year previously.

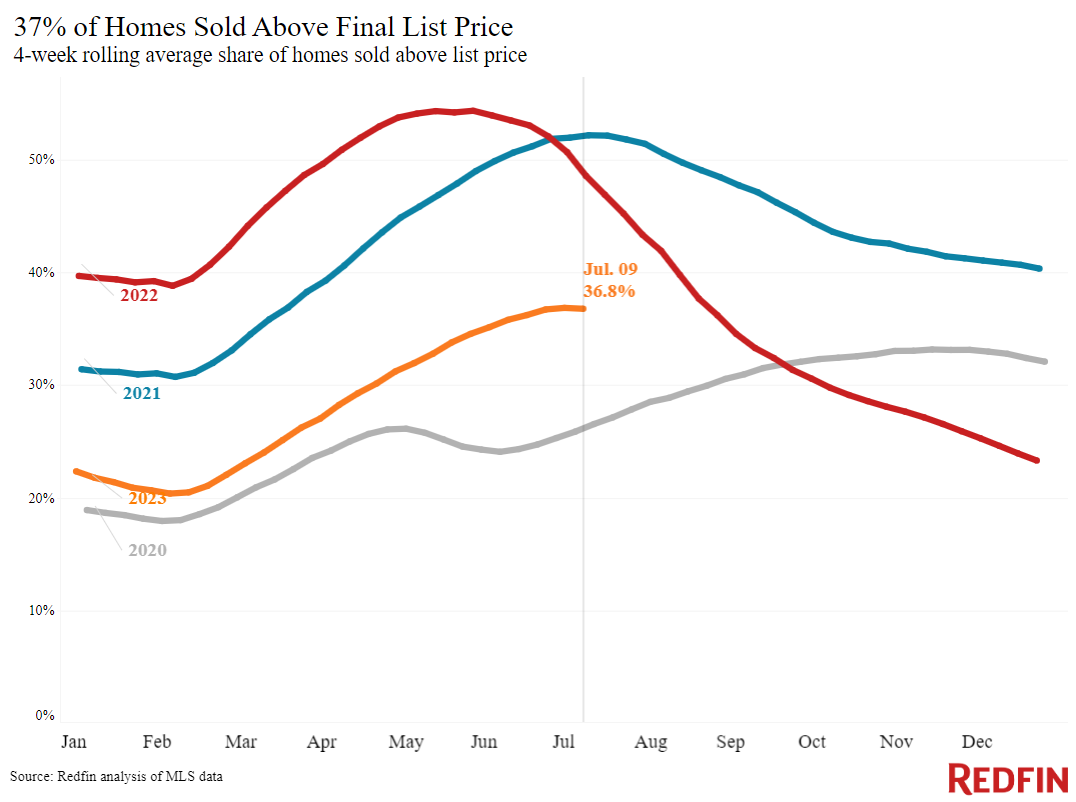

- 36.8% of houses offered above their last market price, below 49% a year previously.

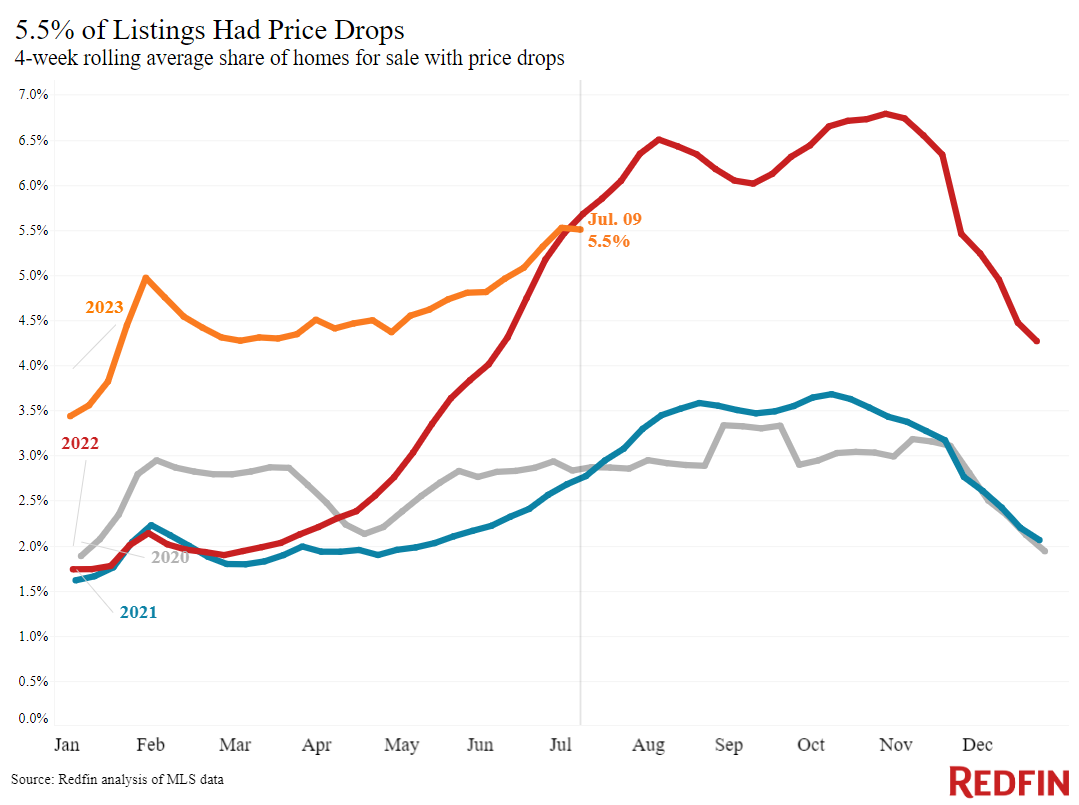

- Usually, 5.5% of houses for sale every week had a cost drop, down simply somewhat from 5.7% a year previously.

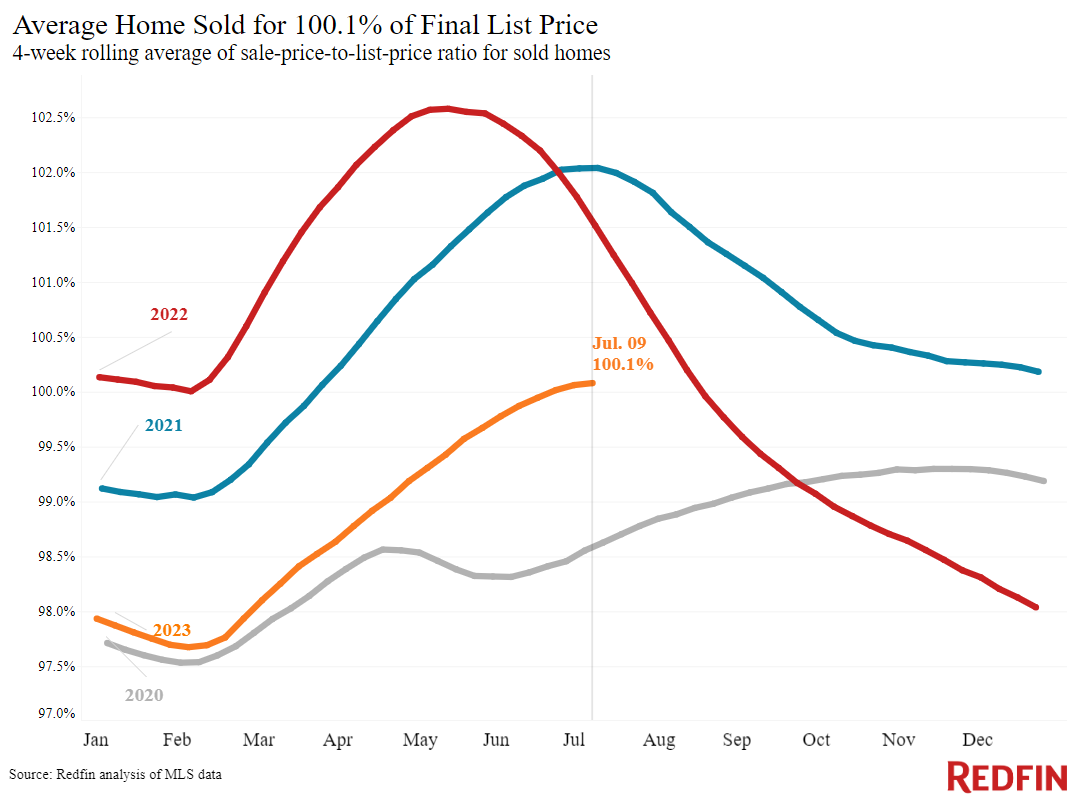

- The typical sale-to-list rate ratio, which determines how close houses are offering to their last asking rates, was 100.1%. That’s the 2nd time in almost a year that the common house is offering above its asking rate, typically. It’s below 101.5% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.